The Noble Tom Madden drillship began drilling one of the new discoveries, the Tilapia-1 well, on Jan. 7 and will next drill the Yellowtail-1 well located west of Tilapia-1 in the Turbot area. (Source: Hess Corp.)

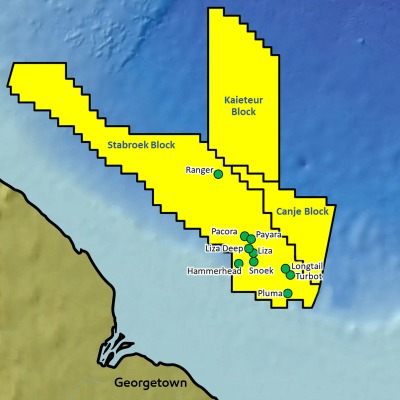

Exxon Mobil Corp. (NYSE: XOM) made two additional discoveries offshore Guyana, the company said Feb. 6, bringing the total number of discoveries on the Stabroek Block to 12.

The discoveries at the Tilapia-1 and Haimara-1 wells build on the previously announced estimated recoverable resource of more than 5 billion barrels of oil equivalent on the Stabroek block operated by Exxon Mobil with partners Hess Corp. (NYSE: HES) and CNOOC Ltd. (NYSE: CEO).

The Tilapia-1 well encountered about 93 m (305 ft) of high-quality oil-bearing sandstone reservoir. The well was drilled to a depth of 5,726 m (18,786 ft) in 1,783 m (5,850 ft) of water.

Tilapia-1 is the fourth discovery in the Turbot area that includes the Turbot, Longtail and Pluma discoveries. The well is located roughly 5.5 km (3.4 miles) west of the Longtail-1 well.

The Noble Tom Madden drillship began drilling the well on Jan. 7 and will next drill the Yellowtail-1 well, located roughly 10 km (six miles) west of the Tilapia-1 well in the Turbot area. Baseline 4-D seismic data acquisition is underway, Exxon Mobil said.

“We see a lot of development potential in the Turbot area and continue to prioritize exploration of high-potential prospects here,” Steve Greenlee, president of ExxonMobil Exploration Co., said in a statement. “We expect this area to progress to a major development hub providing substantial value to Guyana, our partners and Exxon Mobil.”

The other discovery was at the Haimara-1 well, which encountered about 63 m (207 ft) of high-quality, gas-condensate bearing sandstone reservoir. The well was drilled to a depth of 5,575 m (18,289 ft) in 1,399 m (4,590 ft) of water.

Haimara-1 is located roughly 31 km (19 miles) east of the Pluma-1 discovery and is a potential new area for development. The Stena Carron drillship began drilling the well on Jan. 3 and will next return to the Longtail discovery to complete a well test.

RELATED: Hess Shares Insight On Guyana Oil Discoveries, Plans

Hess said in a separate release that the previous 10 discoveries on the Stabroek Block established the potential for at least five FPSO vessels producing more than 750,000 barrels per day (bbl/d) of oil by 2025.

“These two discoveries demonstrate the continuing exploration potential on the prolific Stabroek Block and add to the previously announced gross discovered recoverable resource estimate of more than 5 billion barrels of oil equivalent,” Hess CEO John Hess said in a statement.

‘Most Impressive’

The Stabroek Block is 26,800 sq km (6.6 million acres). Exxon Mobil affiliate Esso Exploration and Production Guyana Ltd. is operator and holds 45% interest in the Stabroek Block. Hess Guyana Exploration Ltd. holds 30% interest and CNOOC Petroleum Guyana Ltd., a wholly-owned subsidiary of CNOOC Ltd., holds 25% interest.

Following news of the 10th discovery on the Stabroek Block in December, Wood Mackenzie research analyst Luiz Hayum called the Stabroek discoveries “one of the most impressive exploration campaigns in recent times.”

“The giant, low breakeven discoveries are key to the partners,” Hayum added. “At peak, the project accounts for a third of Hess’ future production. For Exxon Mobil, Guyana strengthens its growing deepwater portfolio, while for CNOOC it addresses efforts to offset domestic declines.”

Work progresses on development of Liza Phase 1, the play-opening discovery. Sanctioned in June 2017, Liza Phase 1 is expected to mark first oil by early 2020, producing up to 120,000 bbl/d of oil from the Liza Destiny FPSO.

The larger Liza Phase 2 development will use a second FPSO designed to produce up to 220,000 bbl/d and is expected to startup by mid 2022.

A third development, Payara, is also on the horizon. If sanctioned, a decision for which is expected next year, production could begin in 2023. The Payara Field is located about 12 miles northwest of Liza.

Liza Phase 1 has a breakeven cost of $35 per barrel (Brent) and Phase 2 has a breakeven of $25 per barrel, Richard Lynch, senior vice president of technology and services at Hess, told investors in December. Low rig rates, combined with the standardization approach of design one and build many, also lowers costs and improves schedule.

“SURF standardization and the FPSO approach will accelerate first oil by nearly 12 months,” Lynch said.

Drilling costs for development wells have also fallen as partners have gained knowledge. The average well cost has dropped from $85 million with Liza Phase 1 to $58 million for Liza Phase 2, according to Hess.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.