The departure reflects a wider move by major oil producers to reduce crude production in West Africa and shift investments elsewhere. (Source: Shutterstock.com)

Exxon Mobil Corp. will wind down oil production in Equatorial Guinea and leave the West African country after its license expires in 2026, two sources close to the matter told Reuters.

The departure reflects a wider move by major oil producers to reduce crude production in West Africa and shift investments to lower-carbon natural gas development on the continent, and to more lucrative projects in the Americas.

“It is a high-cost region where carbon emissions are a problem as well,” said Gail Anderson, research director for Sub-Saharan Africa at energy consultants Wood Mackenzie.

Exxon Mobil has cut its output in the country to less than 15,000 bbl/d of oil through existing production unit Serpentina, one of the sources said on Nov. 28 on condition of anonymity to discuss nonpublic information. It evacuated staff from the offshore production platform Zafiro this year due to water entering the aging vessel.

Europe, which has been looking for alternative oil suppliers after sanctions were imposed against Russia this year, is the main destination for Equatorial Guinea’s oil exports.

Aging Oil Fields

Exxon Mobil’s oil output in Equatorial Guinea, a member of OPEC, peaked at more than 300,000 bbl/d eight years ago and has been declining since. Exxon Mobil has been trying to sell its Zafiro operation since 2020. The company last year pumped about 45,000 bbl/d in Equatorial Guinea, out of the country’s total production of 93,000 bbl/d.

Africa is struggling to meet OPEC quotas due to the lack of investments in crude production. Output from its top two producers—OPEC-members Angola and Nigeria—sank by a third to 2.1 million bbl/d in October from 3.2 million bbl/d in 2019. Since 2013, it has declined 41%.

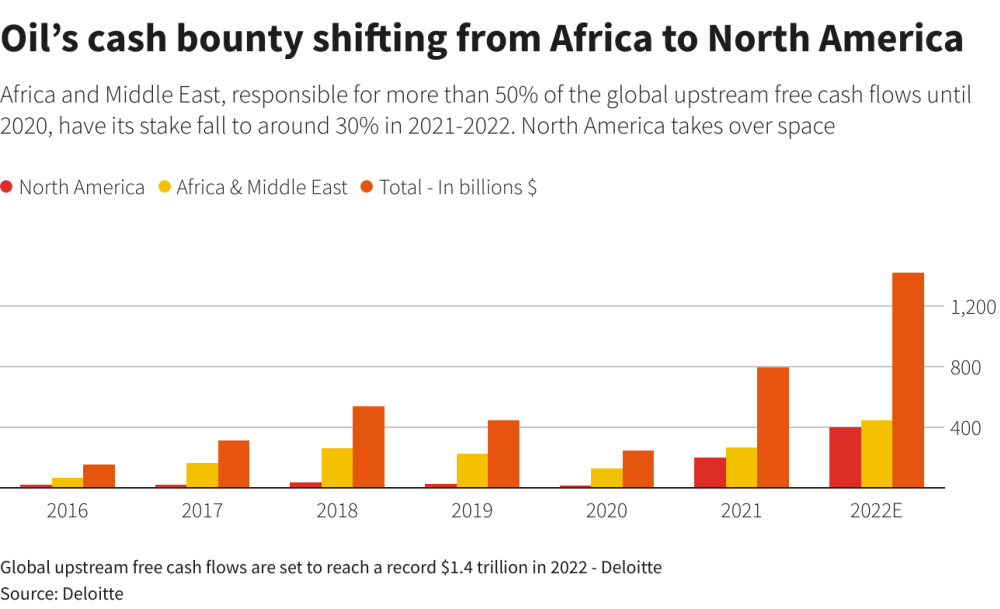

The region's share of oil cash flows also is falling, a study by consultancy Deloitte found. For Middle East and African oil producers, cash has dwindled to 30% of global flows in the last two years, from 50% between 2010 and 2020.

Foreign oil producers Chevron Corp., Shell Plc and Exxon Mobil have retreated from Nigeria due to rampant levels of oil theft, selling their assets mostly to local companies.

Nigeria’s output is at a 32-year low and the country this year slipped behind Angola as Africa’s largest exporter. TotalEnergies SE also exited Angola earlier this year.

Shift to Americas

As crude output in West Africa shrinks, production in the Americas is expected to grow to 28 million bbl/d next year, up 2.3 million bbl/d from pre-pandemic levels, OPEC estimates show. Much of the increase comes from the U.S., Canada, Guyana and Brazil, some of the places where Exxon Mobil has increased spending on oil output.

Exxon Mobil has decided to decommission Zafiro and tow the platform away, possibly next month, one of the people said. Future revenue from Zafiro would not have covered the cost of repairs, the person said.

Exxon Mobil could recover some of Zafiro's production and reach about 25,000-30,000 bbl/d by adding a third platform called Jade, pending government and company approvals, one of the people said.

Namibia and Natural Gas

While crude oil production wanes in West Africa, the continent’s LNG future is on the rise and fossil fuel output could grow elsewhere in Africa. Major producers are investing in gas and LNG as Europe looks to replace supply from sanction-blocked Russia.

Rising demand globally could result in a 30% rise in gas production in Africa by the end of the decade, Deloitte said.

Mozambique exported its first LNG cargo earlier this month from the $8 billion Coral South floating LNG consortium led by Italian oil firm Eni SpA and Exxon Mobil. Chevron last year exported the first LNG cargo from the Alen gas project it operates in Equatorial Guinea.

Libya and Algeria produce oil at lower cost levels and could keep attracting investments if they take measures to reduce carbon emissions from current operations, a study by McKinsey and Company consultancy found.

Promising reserves of oil and gas have been discovered in Namibia, with appraisal wells expected to be drilled in the first half of next year, Wood Mackenzie’s Anderson said.

“It could be the next Guyana,” she said, referring to the South African nation that is home to the world's largest oil discovery in the past decade. “The signals are very positive.”

Recommended Reading

Exxon Mobil Green-lights $12.7B Whiptail Project Offshore Guyana

2024-04-12 - Exxon Mobil’s sixth development in the Stabroek Block will add 250,000 bbl/d capacity when it starts production in 2027.

Exxon Ups Mammoth Offshore Guyana Production by Another 100,000 bbl/d

2024-04-15 - Exxon Mobil, which took a final investment decision on its Whiptail development on April 12, now estimates its six offshore Guyana projects will average gross production of 1.3 MMbbl/d by 2027.

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.

Pitts: Heavyweight Battle Brewing Between US Supermajors in South America

2024-04-09 - Exxon Mobil took the first swing in defense of its right of first refusal for Hess' interest in Guyana's Stabroek Block, but Chevron isn't backing down.