A drilling rig and pumpjacks are shown in a West Texas oil field. (Source: G.B. Hart/Shutterstock.com)

Near-term market woes caused U.S.-based majors Exxon Mobil Corp. and Chevron Corp. to slow activity in the Permian Basin, dropping rigs and taking other steps to preserve cash flow. However, the two are staying focused on key goals in the top U.S. oil field.

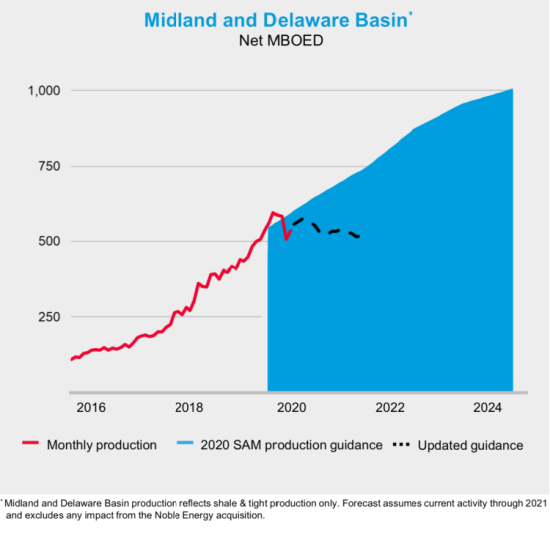

Exxon Mobil is sticking to its plan to grow Permian production to more than 1 million barrels of oil equivalent per day (boe/d) by 2024, despite second-quarter volatility brought by the global COVID-19 pandemic and oil supplies slowing spend and drilling.

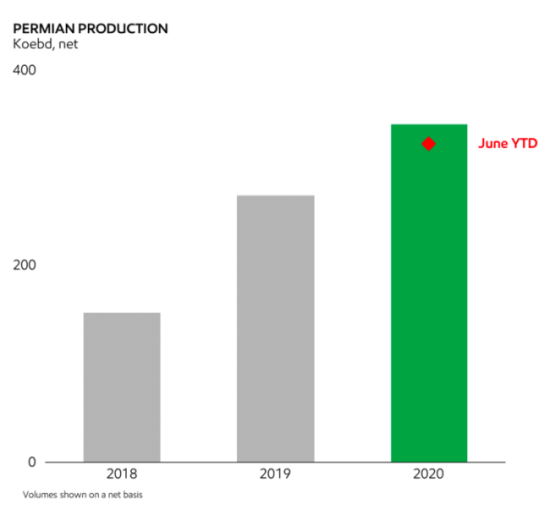

The company, which holds more than 1.6 million acres in the Permian, reported July 31 its Permian production increased 9% during the second quarter, compared to a year ago.

Neil Chapman, senior vice president for Exxon, said 2020 Permian production is expected to be about 345,000 boe/d. That is down only about 15,000 boe/d from the company’s March outlook and more than 700,000 boe/d above 2019 output.

“That really reflects the way we are developing the Permian with these large-scale developments and large cube developments,” he said. “The capital you invest last year has a material impact on the results this year.”

RELATED: Exxon Mobil Posts Second Straight Quarterly Loss on Demand, Price Plunge

In all, Exxon reported about 330,000 boe/d in total production curtailments during the second quarter, including about 75,000 boe/d at its unconventional assets. Most of the latter was back online in July to what Chapman later described as the same position on the type curve.

“The short-cycle nature of our Permian assets also provides flexibility to pace development, reduce spend and preserve cash in the current environment,” Chapman said.

However, low oil prices—which sank into negative territory in April before rising to the $40s—halted some projects.

Exxon pushed out the flowback of its 27-well cube development in the Midland sub-basin to the third quarter. The company also cut its rig count in half to 30 rigs. The rig count is expected to drop again by year-end to between 10 and 15. Chapman called the move a “short-term” one to manage capital.

“Our activities for the rest of the year will be focused on Poker Lake [in Eddy County, N.M.] where we will continue to leverage our development scale advantage and utilize the above surface investments that we have pursued in the last 18 months, including Cowboy,” Chapman said, referring to the Delaware sub-basin central processing and exporting facilities the company started up in the second quarter.

The facility “enhances our integrated position in the basin through collection and processing of production from our Delaware Basin assets and enables efficient lower cost delivery to Gulf Coast markets,” said Stephen Littleton, vice president and secretary for Exxon.

Chevron

With a position of about 2.2 million net acres in the Permian, Chevron is also focused on growing production in the basin. However, like its peers, the company was also forced to make some tough decisions during the second quarter.

RELATED: Chevron Posts $8.3 Billion Q2 Loss on Writedowns, Job Cuts

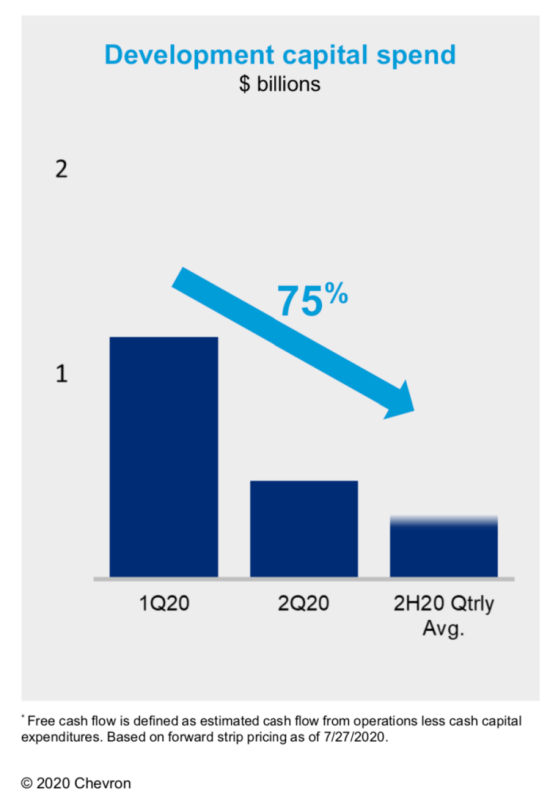

“In the Permian, [we] expect quarterly capital spend in the second half of the year to be about 75% lower than the first quarter,” Jay Johnson, executive vice president for Chevron’s upstream operations, said on the company’s earnings call July 31. “As of July, we’ve reduced our operated rig count to four with one completion crew.”

Less spending will impact production in the near term along with proved undeveloped reserves. Expectations are for current activity levels in the Permian to fall by 6% to 7% in 2021, he said.

“The near-term production profile for the Permian has changed, but our long-term view of the assets’ attractiveness has not,” Johnson said. “With our scale efficient factory drilling and royalty advantage, we believe we’re well-positioned to maximize returns and deliver value.”

Meanwhile, Chevron is striving to become more efficient. Among its goals: doubling the lateral feet drilled per rig and staying free cash positive at today’s strip prices.

Looking Forward

Neither Exxon nor Chevron gave specifics on 2021 capital spend for the Permian Basin.

“We’re in the middle of our planning process,” Chevron CFO Pierre Breber said. Details on next year’s capex are expected in December. “There is a lot of time between now and then. … It’ll depend on what the economic recovery is, what inventory levels (are). A number of factors will determine what our activity level in the Permian will be going forward.”

Exxon’s Chapman said wells decline rapidly if there is no investment. He also pointed out the substantial number of DUCs.

“You’re also aware [that] it’s a much higher cost to frac than it is to drill,” Chapman said. “That’s really important. So just looking at drilling rigs alone doesn’t tell you the full story.”

He doesn’t expect Exxon’s Permian volumes to fall next year. Plans will be shared during Exxon’s investor day in first-quarter 2021.

Littleton shared sentiments similar as Breber.

“It’ll also depend on what the business environment looks like and that’s the beauty of the Permian,” Littleton added. “We’ll be able to flex up or down depending on what we see in terms of the market.”

Recommended Reading

Benchmark Closes Anadarko Deal, Hunts for More M&A

2024-04-17 - Benchmark Energy II closed a $145 million acquisition of western Anadarko Basin assets—and the company is hunting for more low-decline, mature assets to acquire.

‘Monster’ Gas: Aethon’s 16,000-foot Dive in Haynesville West

2024-04-09 - Aethon Energy’s COO described challenges in the far western Haynesville stepout, while other operators opened their books on the latest in the legacy Haynesville at Hart Energy’s DUG GAS+ Conference and Expo in Shreveport, Louisiana.

Mighty Midland Still Beckons Dealmakers

2024-04-05 - The Midland Basin is the center of U.S. oil drilling activity. But only those with the biggest balance sheets can afford to buy in the basin's core, following a historic consolidation trend.

Mesa III Reloads in Haynesville with Mineral, Royalty Acquisition

2024-04-03 - After Mesa II sold its Haynesville Shale portfolio to Franco-Nevada for $125 million late last year, Mesa Royalties III is jumping back into Louisiana and East Texas, as well as the Permian Basin.