Source: Hart Energy

The first U.S. E&P company to successfully launch an IPO in two years defied expectations, not just with its strong first day in the markets but its focus area—the Denver-Julesburg (D-J) Basin.

Extraction Oil & Gas, Inc. (NASDAQ: XOG) launched an IPO Oct. 12, escalating its offer price to $19 per share from $15 to $18

Despite a reported first half net loss of about $173 million, investors apparently liked what they saw in the company. At the opening bell, Extraction Oil & Gas jumped 20% above its offering price to $22.75. Its market cap, based on its Oct. 21 price at close, is about $3.15 billion.

The company’s Oct. 13 Securities and Exchange Commission (SEC) IPO filing planned to raise $100 million on about 33.3 million shares. Instead, its closing price put the offering’s value at $728 million.

Because of the strong valuations that the Permian Basin has demanded in A&D transactions this year, many observers expected the first successful IPO would come out of the Midland or Delaware basins. However, such is the appetite for acreage there that after Centennial Resource Production LLC filed an IPO for its southern Delaware assets in June, Silver Run Acquisition Corp. (NASDAQ: SRAQ) bought it for roughly $1.5 billion.

In September, the Marcellus Shale’s Vantage Energy Inc. filed for an IPO, only to sell to Rice Energy Inc. (NYSE: RICE) in a deal worth $2.7 billion.

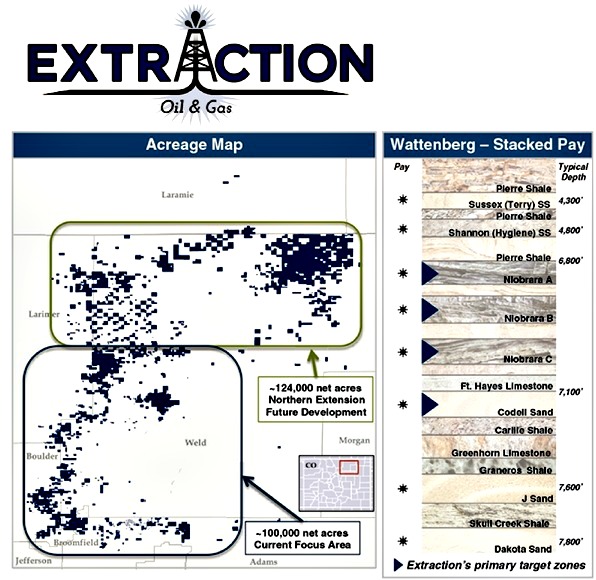

Extraction Oil & Gas is a pure play company focusing on the Wattenberg Basin. The company holds 224,000 net acres and produces of 37,300 barrels of oil equivalent per day (boe/d). In July, the company purchased Bayswater Exploration & Production LLC and affiliates in the Wattenberg for $420 million cash.

Insertion

Matt Owens, one of the founders of Extraction Oil & gas, said he created the company after noticing differences in performance in wells.

Owens, then in his mid 20s, discussed the idea with a friend in 2012. After mentioning the idea to a mentor, he was introduced to investors at Yorktown Partners in New York, which immediately funded the company.

“That was really the birth of Extraction,” Owens told Hart Energy earlier this year.

Less than two months later, the company was drilling its first well.

Owens is a Hart Energy Thirty Under 40 honoree.

RELATED: Matt Owens, 29 Founder & President, Extraction Oil & Gas LLC, Denver

EXFIL

Extraction Oil & Gas is running a two-rig program with flexibility to adjust its rig count based on the commodity price environment, according to its SEC filings.

The company managed a four-rig drilling program in first-quarter 2015.

“Due to significant improvements in our drilling efficiency since late 2014, each of our rigs is currently able to drill over twice as many wells per year as we were previously able to drill,” the company said.

Since its NASDAQ debut, Extraction Oil & Gas has been gearing up with new talent and plans to drill. The company said it plans to add a third drilling rig in the first quarter of 2017, earlier than the anticipated mid-year 2017 timeframe.

An extra rig will be deployed subject to market conditions, prevailing commodity prices and oilfield services and equipment availability.

Extraction Oil & Gas has also named Eric S. Jacobsen as senior vice president of operations. Jacobsen joins the company from Noble Energy Inc. where he served in various senior operations leadership positions, most recently as director of planning and development for Noble Energy’s D-J Basin business unit.

In the first half of 2016, the company’s capex was $137.8 million, excluding acquisitions and about $365 million for the year, compared to $398.4 million for all of 2015.

“Due to significant improvements in our drilling efficiency since late-2014, each of our rigs is currently able to drill over twice as many wells per year as we were previously able to drill,” the company said.

In 2017, Extraction Oil & Gas’ capital budget is anticipated to be about $590 million, substantially all of which is intended to go toward Wattenberg Field development.

“We intend to allocate approximately $535 million of our 2017 capital budget to the drilling of 138 gross (102 net) operated wells and the completion of 120 gross (102 net) operated wells,” the company said.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.

Tethys Oil Releases March Production Results

2024-04-17 - Tethys Oil said the official selling price of its Oman Export Blend oil was $78.75/bbl.

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.