A seismic vessel in the North Sea. (Source: Shutterstock.com)

[Editor's note: A version of this story appears in the September 2020 edition of E&P Plus. It was originally published Aug. 31, 2020. Subscribe to the magazine here.]

Over the last decade, more oil and gas was discovered in stratigraphic traps than any other trap type, and excelling in stratigraphic trap exploration is now the key to top quartile exploration performance. Historically, hydrocarbon prospects in clastic stratigraphic traps have been considered difficult to identify and high risk to explore, but success rates have been improving with better geological models and use of geophysical direct hydrocarbon indicators (DHIs).

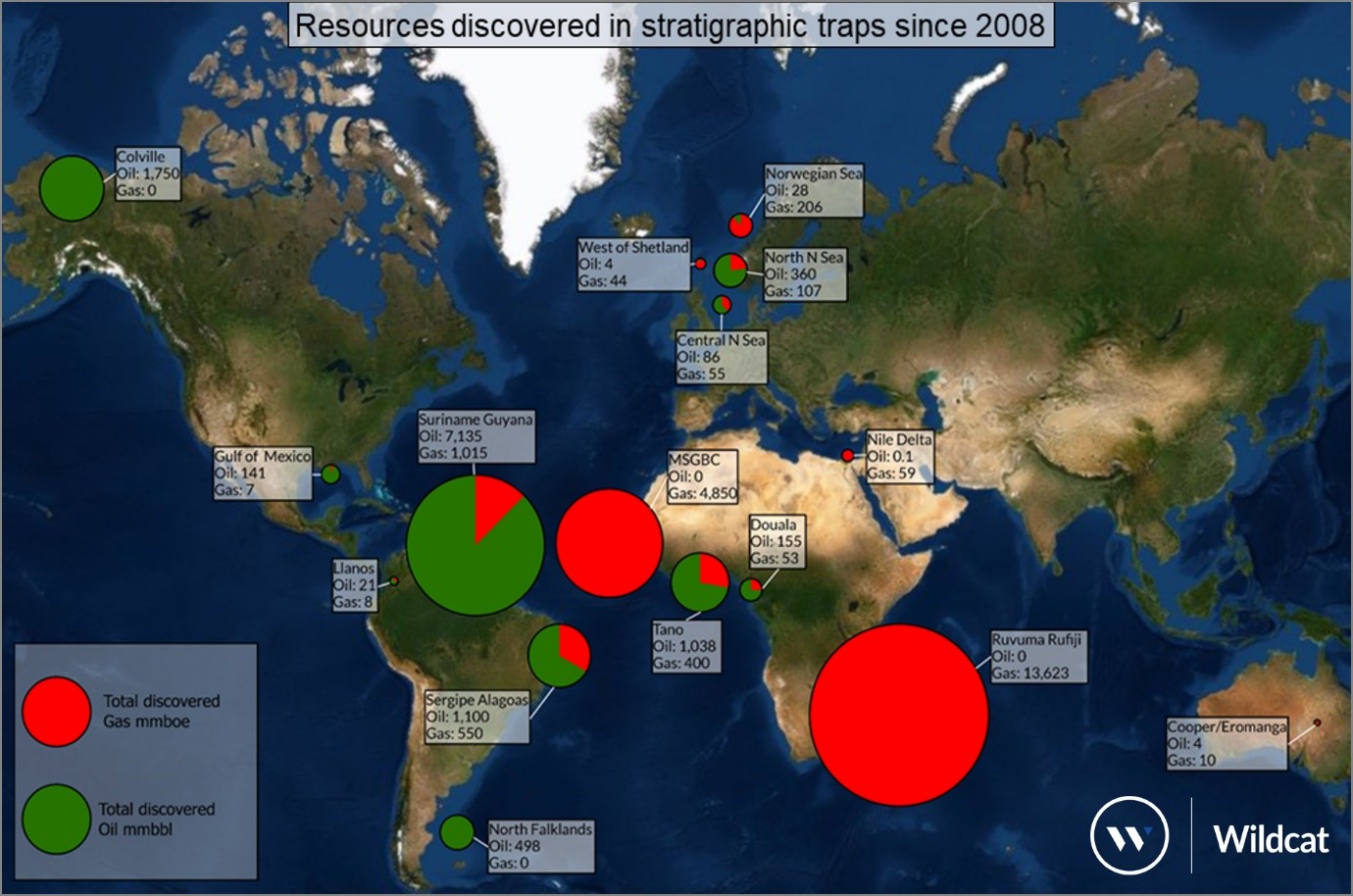

Westwood analyzed stratigraphic trap exploration between 2008 and 2019 in 66 basins and in 113 different plays. It found that the pro- portion of exploration targets reported as involving stratigraphic traps increased from 12% in 2008 to 30% in 2019. Commercial success rates (CSRs) also have increased, with the average CSR of 50% achieved between 2017 and 2019, double that of the previous nine years. Strati- graphic traps had a larger average discovery size of 280 MMboe, and a lower drilling finding cost of 0.5 $/boe, compared to other trap types during this period. The evidence shows they are not higher risk than other traps, contrary to many explorers’ preconceptions.

Defining stratigraphic traps

Stratigraphic traps in clastic sediments are formed when reservoir sands are encased in sealing mudstones. Pinch-out traps are the most targeted clastic stratigraphic traps and involve the lateral and updip pinch-out of channels and lobes, or pinch-out of sand bodies by onlap onto an under- lying unconformity. Stratigraphic traps also can be formed by erosional truncation, where the reservoir is sealed by younger mudstones infilling an erosional topography. Another kind of stratigraphic trap is formed by injectites, where unconsolidated sands are injected, post-deposition, into overlying mudstones forming dykes and sills.

Stratigraphic traps in clastic sediments can be formed in different tectonic settings and in different parts of the systems tract from fluvial to deep water, where there is a rapid transition from permeable sand- stone to an impermeable facies. The major focus of stratigraphic trap exploration in the 2008-2019 period was Cretaceous- and Tertiary-aged deepwater turbidite complexes located in passive margin settings, which have delivered 31 Bboe of discovered commercial resources.

In the last 10 years, about 80 Tcf of gas (13 Bboe) has been discovered in stratigraphic traps in the Rovuma-Rufiji Basin offshore Tanzania and Mozambique, while another 24 Tcf of gas has been found across the continent in the MSGBC Basin. Stratigraphic traps contain more than 6 Bbbl of oil in the Suriname-Guyana Basin and over 2 Bbbl of oil in the Colville Basin in Alaska. Other prolific basins with significant numbers of stratigraphic traps include the Nile delta, Sarawak, Sergipe-Alagoas and the Tano basins. There have been notable failed stratigraphic trap campaigns as well in the Carnarvon, Sierra Leone-Liberia and Central North Sea basins from which important lessons have been learned.

Lessons learned

Westwood’s analysis has shown that there are two key factors that have led to an increase in the success rate of stratigraphic traps. The first is a better understanding of the geological setting where stratigraphic traps form.

Within turbidite systems, the location of the stratigraphic trap on the depositional slope and the detailed architecture of the slope can have impact on the chance of commercial success. Traps located on the lower slope to basin floor had the highest success rates in the 2008-2019 period and delivered the largest discovered volumes. Additionally, slopes that were graded with little little preexisting topography performed better. Lower slope settings are conducive to the stacking of multiple stratigraphic traps vertically offering a higher resource density, resulting in the need for fewer development wells, lower costs and a greater chance of commercial success.

In the Cretaceous Nanushuk play of the Colville Basin in Alaska, stratigraphic traps have been formed in a series of low-stand wedges, where high-quality marginal marine sandstones and sealed by overlying shales deposited with next transgression.

The second key factor that has led to improved performance of stratigraphic traps is the role of geophysical DHIs, which have long been the Holy Grail for explorers, providing a means to predict discoveries ahead of the drill bit using information obtained solely from seismic data.

Seismic reflections are created at the boundaries between layers in the earth where the physical properties of the rocks and the fluids contained within those rocks change. The seismic response can be different, depending on whether the pore space in a rock is filled with water, oil or gas. The change in the observed response may be used to infer the presence of hydrocarbons rather than water in some instances. Stratigraphic traps are often very subtle and may be difficult to observe on seismic data. In some cases, the first indication of a potential stratigraphic trap prospect is the presence of a seismic anomaly, which can be a DHI.

Westwood has analyzed the success rates of exploration prospects reported to have DHIs interpreted pre-drill globally since 2010. Thirty-five percent of stratigraphic and combination traps (i.e., those traps that contain both structural and stratigraphic elements) recorded by Westwood were reported as being DHI-supported, compared to only 11% of purely structural traps. In stratigraphic trap prospects, amplitude anomalies and amplitude-versus-offset anomalies were the most frequently reported DHIs, contributing 55% and 32% of the number reported respectively, with amplitude conformance comprising only 9% of the reported DHI types and flat spots just 2%.

Over the entire 10-year period reviewed, the average commercial success rate for stratigraphic traps reported to be supported by the presence of a DHI was 28%, less than the commercial success rate for all stratigraphic traps, with or without DHIs. The DHI-supported prospect success rate was particularly poor in the 2011 to 2014 high oil price period suggesting that many seismic anomalies were mistakenly interpreted as DHIs.

The overall commercial success rate for stratigraphic traps increased from about 26% in 2013 to 47% in 2019, but the turnaround in performance has been even better for those supported by DHIs. The success rates for stratigraphic traps with DHIs reached a nadir in 2013 with a CSR of just 7%. It has since shown a dramatic improvement, reaching a peak in 2018 of 64% with successes in Alaska, Romania, Norway, Colombia and Guyana.

Stratigraphic traps are not inherently more risky than other trap types. The key is for explorers to recognize whether they have the right tools and processes to explore effectively for commercial finds. This requires a sound geological model integrating the trapping element into the entire petroleum system analysis, supported by reliable geophysical calibration and the effective use of analogue data.

Recommended Reading

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.