The decision by OPEC+ on Dec. 4 to keep oil production quotas unchanged represents a pivot from the proactive stance the cartel has assumed in recent months, a leading expert said.

Pointing to the group’s decision to meet on the Sunday before the EU’s embargo of seaborne Russian oil was set to take effect, Mark Finley, fellow in energy and global oil at Rice University’s Baker Institute for Public Policy, said that, at least for now, OPEC appears to be willing to wait and see how things play out in an uncertain global economic environment.

The decision to stand pat was also made a day after G7 countries and Australia imposed a $60/bbl price cap on Russian crude oil.

“That’s not where the group has been in recent months,” Finley said during a recent Baker Institute webinar. “In fact, as recently as October, the big cut at that meeting was with the intent of being proactively anticipating a potential weakening of the market and heading it off.”

RELATED

Oil Prices Rise After OPEC+ Keeps Output Steady, Russian Price Cap Imposed

OPEC+ is keeping a close watch on several fronts, including consequences of COVID-related lockdowns in China and the risk of a global recession in 2023, all of which could threaten oil demand in the U.S. and Europe, as well as the G7’s price cap.

The near-month price for international benchmark Brent crude climbed above $88/bbl early on Dec. 5 before falling to the low $80s. S&P Global Commodity analysts, who estimate Saudi Arabia’s price target at $90/bbl, expect that to be enough to keep Saudi supply at 10.4 MMbbl/d-10.5 MMbbl/d, which is near the top of its historical range.

OPEC+ announced a production cut of about 2 MMbbl/d in early October, but a Piper Sandler analysis shows a reduction of only about 1 MMbbl/d so far. If Middle East producers match Piper Sandler’s expectations, the cartel’s spare capacity would grow to about 2 MMbbl/d, which is more than it was in October, although low by historical standards.

Toril Bosoni, head of the International Energy Agency’s (IEA) oil industry and markets division, had a similar take.

“We don’t know OPEC spare capacity and inventories—that’s the balance,” Bosoni said. “With both being relatively low, the buffers remain quite thin in such an uncertain environment.”

Tension over Asian markets?

Russia’s material response to the price cap and EU embargo is, so far, not entirely clear. An RBC Capital Markets research note said “it remains uncertain whether it will ensure the smooth flow of Russian barrels to Asian markets or if there will be a material disruption.”

An indication that Russia is prepared to cut off oil exports could cause prices to spike in the coming days, RBC said.

Russia’s response was vague enough to allow it some flexibility.

“We will sell oil and oil products to those countries which will work with us on market conditions, even if we have to somewhat cut production,” Russian Deputy Prime Minister Alexander Novak said over the weekend.

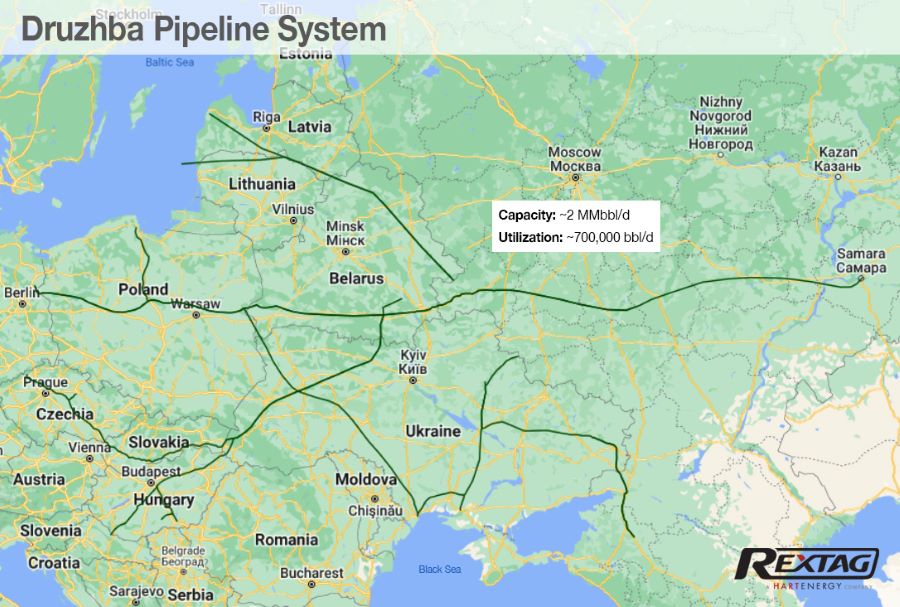

The IEA estimates that Russia has exported about 1.5 MMbbl/d to EU countries in recent months ahead of the embargo, of which 800,000 bbl/d is seaborne. The EU has reduced its dependence on Russian crude imports by 1 MMbbl/d in 2022, Bosoni said during the Baker Institute webinar. However, that figure still accounts for about one-third of all Russian exports. Russian oil flows to Europe via the 2 MMbbl/d Druzhba pipeline, which links Samara, Russia, to various points in Europe but has been shut down several times since the start of Russia’s invasion of Ukraine.

embargo on seaborne Russian crude oil, but Russia says it will not sell to countries adhering to the G7 price cap. (Source: Rextag)

Were Russia to move away from Europe and aggressively pursue Asian markets to sell its crude, the potential exists for friction to develop with Saudi Arabia, Finley and two other scholars wrote in a recent report.

“Riyadh and Moscow are simultaneously pivoting to Asia and competing for market share in a region that has long been a stronghold for Saudi exports,” the report said. “Saudi shares in the Indian and Chinese markets are being lost to Russia. Given the greater long-term attractiveness of market share in Asia versus Europe, tensions could arise over Saudi losses.”

The IEA forecasts a fourth-quarter contraction in global oil demand compared to the same period in 2021, Bosoni said. She added that slow growth will likely continue into early 2023. For the entire year, the IEA expects a recovery in global oil demand. That forecast is dependent on a recovery in China’s economy.

“We are assuming a gradual reopening of China” that will result in increased demand for 1.6 MMbbl/d in 2023, Bosoni said. China, however, is carrying the weight of increased global demand by itself.

“That is underlying our demand growth forecasts where you’re seeing major developed economies and transport fuels contracting to slower economic growth and higher prices for the forecast period,” she said.

But even if Russia is able to effectively navigate the new restrictions, the next step in the sanctions regime will complicate its efforts. On Feb. 5, the EU’s import ban on Russian refined products goes into effect.

This measure will affect more than 1 MMbbl/d of Russian products that flow into Europe. Alternative markets are not as easily accessible as they are for crude oil. Europe has already moved to purchase more distillates from Middle Eastern providers, and U.S. refiners have shown an ability to more than meet demand.

Russian refiners lack high levels of storage capacity, so when markets dry up, they must curtail their runs, Bosoni said. Russia’s non-EU customers would have to triple the volumes of their imported refined products to compensate for the loss of that market, she said. The IEA’s assumption is that Russia will have to cut production of those products.

Recommended Reading

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

Air Liquide Eyes More Investments as Backlog Grows to $4.8B

2024-02-22 - Air Liquide reported a net profit of €3.08 billion ($US3.33 billion) for 2023, up more than 11% compared to 2022.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.