Warren Buffett’s Berkshire Hathaway has invested more than $40 billion in the oil and gas sector. The sector rewarded him and other investors with a stellar year. (Source: Hart Energy; Kent Sievers, PHOTOCREO Michal Bednarek, huyangshu, Jirapong Manustrong/Shutterstock.com)

An energy supercycle bull market has just begun, an investment expert told Hart Energy, citing a global supply/demand imbalance and pointing to the outlook of legendary investor Warren Buffett.

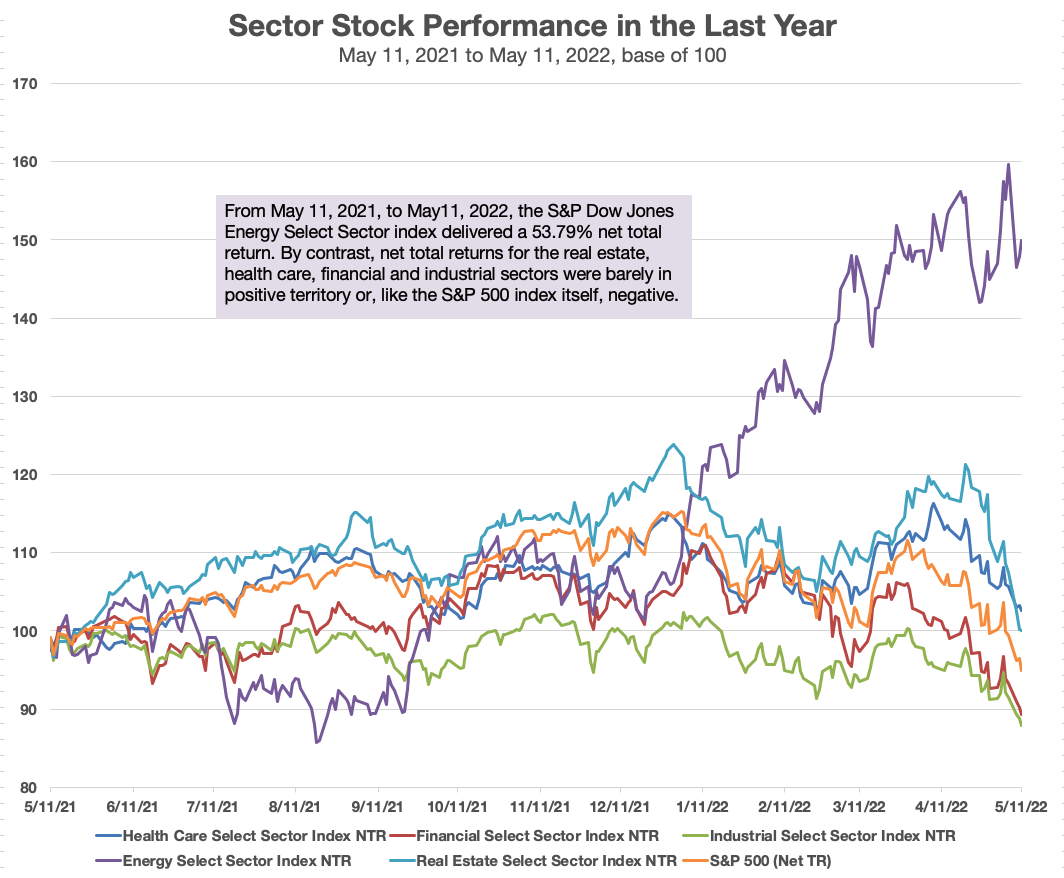

This forecast from Matthew Iak, executive vice president of U.S. Energy Development Corp., comes as S&P Dow Jones sector indexes show energy enjoying a boom over the last year while the bulk of the market struggles.

From the start of the year through the end of the first quarter, Buffett’s Berkshire Hathaway’s stake in Chevron Corp. soared from about $4.5 billion to almost $26 billion.

True, Chevron’s stock price hitched a ride on elevating crude oil prices to rise more than 30% in the quarter, but that wouldn’t account for the increase in value of Berkshire’s stake. Buffett saw the trend and invested many billions. He also pumped about $7 billion into Occidental Petroleum Corp. stock.

Altogether Buffett’s holdings in the oil and gas sector surpass $40 billion, Edward Jones analyst James Shanahan told CNBC.

And what’s not to like about oil and gas stocks? In the 12 months ending May 11, the S&P Dow Jones Energy Select Sector index boasted a giddy 53.8% net total return. By comparison, the health care and financial sectors delivered anemic returns, the financial (-9.2%) and industrial (-10.8%) sectors suffered setbacks, and the S&P 500 index shed 4.3%.

‘Ultra-long-term supercycle’

But what about mere mortals who lack the stature of the Oracle of Omaha? Is the run-up over? Too late to get in? Time to get out of energy stocks?

“Quite to the contrary,” Iak said. “If anything, we’re in the opening innings of an ultra-long-term energy supercycle bull market. Many investors are confusing the current short-term volatility in energy prices, attributable to geopolitical issues, with the longer term, upward trend of commodity prices caused by a global supply and demand imbalance.”

If anything, Iak believes there needs to be increased awareness of a massive imbalance now forming for fossil fuels.

“Regardless of an investor’s view on renewable versus traditional energy, it’s becoming more apparent every day that we need substantially more fossil fuel and renewable production, as neither can meet the growing energy demand alone,” he said.

Savvy investors have to consider the divergent valuations of fossil fuel and renewable companies, Iak said.

“Fossil fuel stocks are traditionally more mature and based on current cash flow, whereas renewable energy investments are a bit more speculative and unknown, with a value based on future cash flow and potential,” he said. “Prudent investors and stakeholders stick with what they know and understand.”

In addition to his enthusiasm for oil and gas, Buffett also has an eye on renewable opportunities. By year-end 2021, Berkshire Hathaway Energy had invested about $6.7 billion in solar energy projects.

Distorted markets

Of course, the returns are not compelling to all. Remember the movement to divest holdings in fossil fuel companies? It’s still there. So are investors who are dogmatic about supporting fossil fuels.

“One faction will continue to divest and argue that the spike in energy prices is a reason to invest more in renewables,” Iak said. “The other faction will continue to invest in fossil fuels and contend that we need to invest more for security and help insulate the economy from geopolitics. Both viewpoints have confirmation bias and will cite these points to support their claim.”

When considerations other than economics govern investment decisions, the free market can become distorted. Pressure on publicly traded companies to have capital discipline has resulted in what many call it the most unfair advantage in private company history, he said.

“Consequently, this movement results in inherent losers, including publicly traded companies who would have been best positioned to benefit from this opportunity under free market conditions,” Iak said. Long-term, fossil fuel firms will continue to practice capital discipline, while developing transformative business models that balance the need for renewable energy goals.

“In fact,” he said, “as demand grows and supply shrinks, we believe traditional energy offers the greatest generational opportunity from an investment perspective.”

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.