[Editor’s note: This interview was recorded during Hart Energy’s DUG Bakken & Rockies Conference & Exhibition held Feb. 19 in Denver.]

Hart Energy:

The Powder River Basin is sometimes referred to as the Rockies’ answer to the Permian Basin, in that it has a lot of potential. What is your take on that?

Joe Mills:

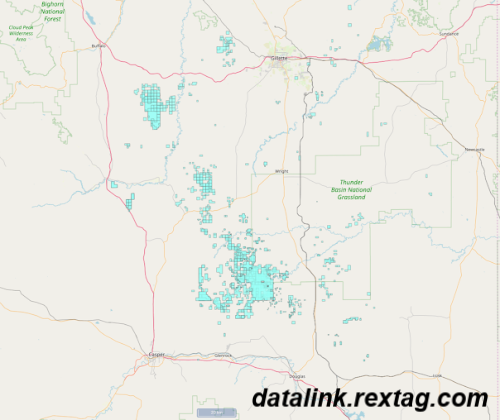

We are very excited about the Powder River Basin. We have been at it almost a couple of years drilling wells. Results have really exceeded our expectations. What makes the Powder unique is that it is very similar to the Permian, very thick 5000 feet of hydrocarbon bearings sand. You’ve got a number of conventional type reservoirs as well as two major shale plays. The source rocks being the Niobrara and the Mowry. We along with other operators are really testing horizons. Results have been really good. We love the fact that it’s very oily. So most formations are 80%-90% oil. There is a lot of infrastructure in the basin so the economics are quite robust. We are really pleased to be in the Powder River Basin.

Hart Energy:

You’ve called the Powder River Basin Samson’s last stand, meaning you’ve already exited the Permian, Williston, and the Anadarko. Why is the Powder River Basin the place for that last stand?

Joe Mills:

Samson is a proud company. We obviously went through a difficult time through bankruptcy. During bankruptcy that is when we had to sell a lot of our assets mainly the Bakken, the San Juan, Permian, the Midcon. So when we came out of bankruptcy, we really had three assets left. East Texas, which was really a core asset for us, the Green River and the Powder. We made a very strategic decision to pivot away from natural gas. The company had always been a natural gas company from its very foundation. 90% of our reserves and production was natural gas. So we made the decision to monetize our East Texas assets. That pivoted us to being more of a Rockies focused company. The more we studied the Powder, the more excited we got about its potential. We developed our Green River assets also. We monetized those last year. Today we are a pure-play Powder River Basin company. We are very excited that we chose the basin to make our last stand. It is a very economic basin. Rates of returns are quite high. We will see what the future holds, but so far our strategy has really worked well for us to pivot away from being natural gas and much more of an oil company.

Click here for more data on Samson Resources II’s operations.

Hart Energy:

What have you learned in those basins that you can apply in the Powder River, or not apply as the case may be?

Joe Mills:

Samson has a long history in a lot of basins. Obviously with the advent of horizontal drilling and fracking technology specifically, the Haynesville really was a great learning application for us. So while we had this great position in East Texas, we were drilling Haynesville wells; horizontal Cotton Valley wells. We really took that knowledge that we had learned there and took it to the Powder River Basin. Obviously, the Haynesville is more gassy, this is more oily. We have been really able to utilize our frack technology in terms of helping develop what we think are exceptional reservoirs in the Powder. So far, so good. We are really seeing results that we like. We are seeing cost structure come down meaningfully. Which is going to be important in order to drive the economics for the basin.

Hart Energy:

Samson, like other E&Ps has been pivoting toward the Powder River Niobrara. In your opinion, is that the next big play?

Joe Mills:

I have said before. I think the Niobrara is really the key formation that will catapult the Powder River Basin into greatness. The tight sand formations. The Shannon, the Frontier, the Turner are quite good. But, the inventory is limited. Today there are roughly 18 rigs running in the basin. For us to get to 50 rigs running in the Powder River Basin, it’s going to be all about the Niobrara. We have drilled one Niobrara well. This year we have a number of Niobrara wells planned. Our offset competitors are all testing the Niobrara. We are seeing really good results in high degree of repeatability in terms of results. That gives us confidence that the play itself will mature. It’s very early stages. I kind of put the Niobrara in the first quarter of a football game. A lot of running room is still left. That is not to take away from the Mowry. The Mowry is the other unconventional shale. It’s deeper, it tends to be a little bit more gassy. So given where gas prices are today, it’s all about the Niobrara and that’s where we are focusing.

Hart Energy:

Let’s talk about the rock. In Wyoming, it’s pretty distinctive with reportedly up to 5,000 feet of stacked pay potential. What have you seen in the rock here that is different from other basins that offer so much optimism?

Joe Mills:

It’s an oil prone basin. A pretty big chunk of the basin tends to be over-pressured which is good. So, higher deliverability wells, it costs a little bit more but you get bigger EURs and higher IPs. That, of course, helps drive the rate of return. What we do like is the stack pay. So, you obviously have the shallow formations. For us, we really have focused on the Shannon, the Frontier, the Turner, the Niobrara and the Mowry. Those are the big five formations that we have focused on. But that really doesn’t even talk about the deeper potential. You get into the muddies, the Dakotas which quite frankly there's been a lot of vertical control. Which really helps with our geosteering. We really don't need seismic nearly as much in this basin in order to drive our wells because there is so much vertical penetration. We think the upside potential is really robust and we are just now starting to scratch the surface in the basin.

Hart Energy:

How much has the Colorado regulatory environment contributed to the surge in interest in the Powder River versus the Denver-Julesburg (D-J) Basin?

Joe Mills:

We have definitely seen a growing interest in the basin, in particular from D-J players. No doubt that the regulatory environment in Colorado is evolving. In Wyoming, the good news is the regulatory environment is very stable. It’s been an oil-producing state for 80 years. We like the fact that there is a lot of federal land up there. Federal land does a couple of things. Long-term leases, 10 years plus. High net revenues. From an economic standpoint, you get higher rates of return. The federal lands also allow you to form federal units. It allows you to really more orderly develop assets over time. We think that is a unique characteristic of the basin.

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.