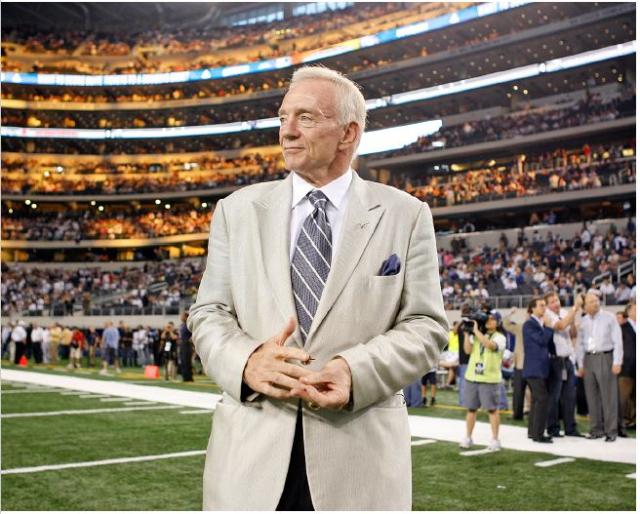

Jerry Jones has been drilling oil and gas wells since 1970, long before he became globally known as the owner of the Dallas Cowboys.

[Editor's note: A version of this story appears in the May 2019 edition of Oil and Gas Investor. Subscribe to the magazine here.]

Jerry Jones has been drilling oil and gas wells since 1970, long before he became globally known as the owner of the Dallas Cowboys. Just 28 at the time, he was drilling bright spots in Oklahoma.

With his oil and gas success, he bought the Cowboys for $140 million in 1989; it’s now estimated to be worth $5 billion. And, while growing the Cowboys into the world’s most valuable sports franchise—the September 2018 Forbes tally had the Cowboys as No. 1 for a 12th consecutive year—he kept drilling, including exploratory wells in South Texas.

In 2012, he joined the shale revolution, taking nonoperated interests in the Williston Basin and participating in wells operated by Hess Corp., Whiting Petroleum Corp. and other play leaders.

In 2018, Jones rolled his and his family’s interests in the 424 Bakken-producing wells into Haynesville gas producer Comstock Resources Inc. in exchange for 88.6 million—that is, 84%—of outstanding shares.

As a result of the cash-flow injection, Comstock’s fourth-quarter EBITDAX grew 117% to $112.5 million from the year-earlier $56 million. Operating cash flow year-over-year: up 154% to $95.6 million from $37.6 million.

The Jones assets also came without debt; Comstock’s leverage ratio fell from 6 to 2.8 in the fourth quarter. Companywide proved reserves are 2.4 trillion cubic feet equivalent, 94% gas, with a PV-10 value of $1.8 billion.

Fourth-quarter 2018 net income was $50.3 million (48 cents per share) compared with a fourth-quarter 2017 net loss of $42.3 million (per share, $2.86).

Oil and Gas Investor visited with Jones, who’d been “hollering at football players all morning,” about his start in the oil and gas business, his vision for Frisco, Texas-based Comstock and the Haynesville, and his bet on U.S. natural gas. A native of Arkansas, Jones gained his lifelong love for sports when playing for the University of Arkansas Razorbacks under Coach Frank Broyles, who led the team to a national championship Jones’ senior year.

“In winning a national championship, I saw what could happen to you as an individual. That inspired me so much. It had everything to do with me spending this life I have in sports and owning the Dallas Cowboys.” (That 1964 title was won in the Cotton Bowl Classic, which is played today at AT&T Stadium, home of the Cowboys.)

Jones’ grandson, John Stephen Jones, is a third-generation Razorback, as quarterback (No. 9) this past season, his freshman year. He had his best game ever in a scrimmage in late March, his coach told Jones. “He only played in three games this past season,” Jones told Investor. “So he has full eligibility left. And he had his best day ever. That’s my grandson.”

Jones’ lifelong business plan includes some mentoring by Sam Walton, too. He talks about it here.

“I’m very sold on the economics of [natural] gas in this country,” said Jerry Jones, owner of the Dallas Cowboys and 84% of Comstock Resources Inc.

Investor: In 1970, when you were getting started, what were you drilling?

Jones: My business and operations were in the Anadarko Basin in north-central Oklahoma, principally in the Red Fork River Sand. The wells were between about 5,000 and 6,000 feet. The goal at the time was to find the old river channels and drill on the edges of them. That’s how I got started.

Investor: Later, in the Arkoma Basin, what were you drilling there?

Jones: That was about eight or 10 years later. It was principally for gas in the Arkoma Basin. And, for the most part, it was all gas in the Red Fork play as well. After I bought the Cowboys, I just drilled wells in and around both those areas.

Investor: When did you enter the Williston Basin?

Jones: I did not get into shale until about 2012. In about 2015, that’s when I really got involved in the Bakken Shale. The interest was a product of recognizing that a lot of operators in the Bakken were offering an opportunity to participate in their wells, usually due to budgetary constraints.

These opportunities became available through my Arkoma Drilling LP group, which consists of Mike McCoy and Bob Roth and their staffs. We invested over $700 million, principally in nonoperated projects, primarily in the Bakken. We would directly participate in projects that were ready to drill.

Investor: Were you not interested in shale earlier?

Jones: There was better definition in 2012 than there was earlier. To me, you really had de-risked the shale investment opportunity. It was a good plan. It did not require operations on our part and that was an integral part of our strategy.

Investor: You’ve re-entered natgas via the Haynesville. What do you see for gas in the future and, in particular, for the Haynesville?

Jones: We made a conscious effort to seek out natural gas opportunities. I had made my money principally in natural gas over a 40-year period. And I’m also very sold on the economics of gas in this country—buoyed, if you will, by the export policies, the LNG possibilities, as well as just the use of it as a clean fuel.

We principally saw more high-quality prospects in gas than were available to us in oil, so we looked up Comstock, sought them out and initially tried to do a joint-drilling venture with them. That wasn’t of serious interest to them, but, in doing so, we became really interested in the quality of operations of the company.

We weren’t operators, so we had to pass on a lot of opportunities. And Comstock offered excellent operations.

But, more important than all of it, they were strategically located in the best, I think, hydrocarbon business proposition in the country—and for that matter, any place. It has to do with the market—the transportation, the fact that the fundamental infrastructure was put in place as far back as 15 or so years ago, and now it has excess capacity.

And the rocks were outstanding by our definition. So Comstock was really an effective proposition for us, and it let us marry up the cash flow that I had developed in the Bakken with an entity that had great operations as well as great drilling locations.

We viewed it as an ideal opportunity. I basically made the equivalent of a $620-million investment in Comstock by exchanging my properties and revenue. I had no debt, so it immediately served to deleverage Comstock’s balance sheet and allowed Comstock to have the cash flow to expand their drilling program, while still drilling within cash flow.

I don’t make any money from this investment unless the value that Comstock is creating in the Haynesville is also reflected in the stock price.

“You will have the highest return on your investment if you shorten the time between when you spend your dollars and start receiving revenues.”

Investor: Speaking of stock price, it’s been confounding that the market isn’t giving full value to gas producers’ reserves. Clearly, you see the value of it. When might the market come around or what might it take?

Jones: I don’t know any individual investor that you can talk to who has put more cash into the basic proposition of drilling shale oil and gas wells in recent years. An investment in Comstock is equivalent to investing directly in a Haynesville well in my view: The cash flow that the company generates goes right into creating value by drilling its large inventory of prospects.

They also have the lowest cost of getting the Btu [British thermal unit] right to the end game of selling it into the best gas market in the country.

What attracts me is that Comstock stock gives you the closest touch to the dollar as it relates to natural gas. It has the best timing: It has the shortest period of time from spending that dollar to when it turns into money.

Investor: Comstock is a neighbor there in Frisco. Just a coincidence?

Jones: It’s not a coincidence. I have known Jay Allison, Comstock chairman and CEO, and the company for more than 30 years. They’re great Cowboy fans, and they’re involved in the support of the team.

But, importantly, Jay had come to me with an investment opportunity about 30 years ago. And I passed on it. It was in the $30-million range. I had the money and didn’t invest. I could have made more than $600 million in a matter of a handful of years on that investment.

And I have always been pretty good at hindsight, especially the good ones you miss. [Laughs.] I had always kept up with “what might have been.”

Also, I have known Jay to be, No. 1, honest and the company to be honestly managed. And the team to be “intense workers.” All of that is good, if you’ve got the rocks and you can sell your product. Obviously, I think that’s the case with Comstock in the Haynesville.

My bet is the market will recognize the value—the quality of these reserves—and developing and producing at these low costs.

We will operate within our cash flow and do everything we can to create appreciation in the stock value.

I know the returns we have on drilling these wells and have confidence that will translate to value in the shares. This is the only public company I’m involved in or have been involved in. So the only way to partner with me in any of my businesses is to buy a share of Comstock.

Investor: Would you like to see Comstock expand in the basin via acquisition or any another manner?

Jones: I would want to insure that any acquisition that Comstock does improves our balance sheet. I’m not in favor of incurring debt or for diverting cash flow that can go into the drilling program to fund acquisitions.

Comstock has a number of drilling locations that will convert into a revenue stream over the next five and 10 years. So a new deal would have to be highly accretive to the asset value I already have.

Investor: What else would you share with other operators and with investors?

Jones: You will have the highest return on your investment if you shorten the time between when you spend your dollars and start receiving revenues. My success in recent years has been to invest in projects that get turned to sales quickly. That is what we can do at Comstock.

I asked [fellow Arkansan] Sam Walton one time, personally, “If you had a sentence to give me—a recommendation for me, as a young guy.” I was younger then, when I was talking to him. He said, “If you are not undermanned, you’re overstaffed; you will never see your heroes.”

In drilling shale, you should focus on cash-on-cash returns and not focus on accumulating reserves that will not be produced for many years.

That’s what I intend to insist on in how Comstock operates.

Nissa Darbonne can be reached at ndarbonne@hartenergy.com.

Recommended Reading

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.

Exclusive: Carbo Sees Strong Future Amid Changing Energy Landscape

2024-03-15 - As Carbo Ceramics celebrates its 45th anniversary as a solutions provider, Senior Vice President Max Nikolaev details the company's five year plan and how it is handling the changing energy landscape in this Hart Energy Exclusive.

The Need for Speed in Oil, Gas Operations

2024-03-22 - NobleAI uses “science-based AI” to improve operator decision making and speed up oil and gas developments.

ShearFRAC, Drill2Frac, Corva Collaborating on Fracs

2024-03-05 - Collaboration aims to standardize decision-making for frac operations.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.