HOUSTON—The future may be uncertain, but within the industry, the consensus seems to be that natural gas is a “bridge” fuel that helps meet emissions goals.

Speaking during a plenary session at the Unconventional Resources Technology Conference (URTeC) on June 20, executives emphasized the need for continued investment for producing natural gas and highlighted its role as an enabler in achieving net-zero emissions goals by 2050.

“It’s important to approach thinking about the future with a sense of humility,” said Mark Finley, energy and global oil fellow at Rice University’s Baker Institute. “The future is uncertain.”

“The market shares for different forms of energy do change, but they change over decades-long processes.”—Mark Finley, Fellow in Energy and Global Oil, Rice University's Baker Institute

One of the things that makes planning for the future so tough, he said, is that energy demand outlooks to 2050 can vary wildly depending on which set of policy assumptions are considered.

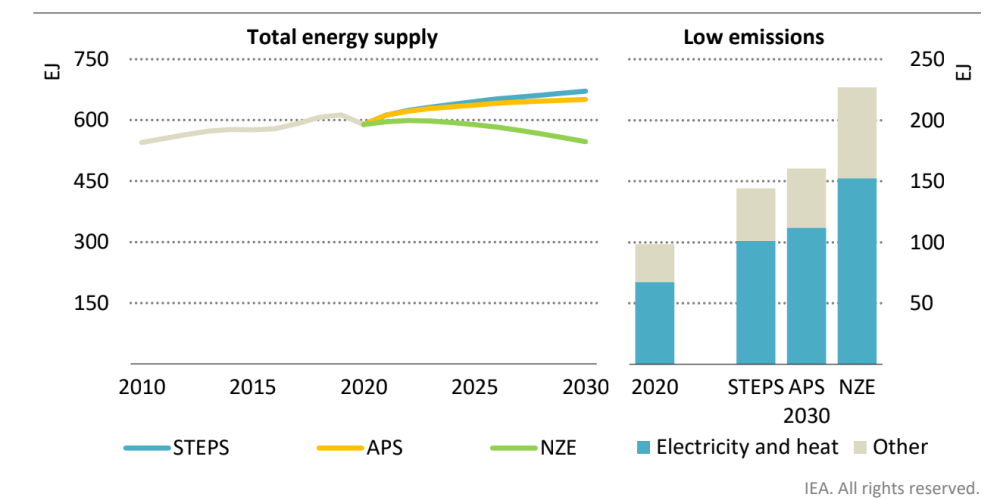

The International Energy Agency’s 2021 World Energy Outlook projects energy supply through 2030 under three different policy scenarios with supply varying by more than 100 exajoules by 2030 depending on the policy in play.

With that kind of uncertainty range, Finley asked, “How do you plan your business?”

Instead of focusing on the unknowns, he said, energy companies should think about what is known.

The first of those, he said, is that “the world is going to need more energy” especially as 80% of the world’s population aspires to better and more access to energy to raise their quality of life.

The second, he said, is that trillions of dollars of investment in oil and gas will be needed, “no matter what the future holds.”

Continued investment is crucial because existing production declines so rapidly without additional investment. Finally, it’s important for the world to remember that transitions take time.

“The market shares for different forms of energy do change, but they change over decades-long processes,” he said.

“Gas is critical to a transition to that type of world where we can lower emissions. The focus has to be on lower emissions, not on eliminating fossil fuels.”—Deborah Byers, EY Americas Industry Leader

As the sector focuses on the energy transition, Deborah Byers, Americas Industry Leader for Ernst & Young, said the oil and gas industry must focus on finding a safe and efficient way to “keep the lights on.”

“Gas is a bridge fuel. Gas is critical to a transition to that type of world where we can lower emissions,” Byers told URTeC attendees. “The focus has to be on lower emissions, not on eliminating fossil fuels.”

One of those reasons, she said, is because developing markets will demand access to energy. The world will be home to between 9 billion and 10 billion people by 2050, she said.

“None of them are going to say, ‘I don’t need refrigeration,’ or ‘I don’t need a smart phone’ or ‘I don’t need transportation.’ We need to give that to them,” she said. “The developing markets will drive the transition more so than what we’re going to do here in developed countries.”

When it comes to the energy transition, Byers also noted macro drivers such as the future consumer, new alternative energies, transportation revolution and governance.

Preferences can change when price tags are associated with goals.

“Start asking the questions, ‘How much are you willing to pay for that’ and ‘Are you going to pay for someone else’s decarbonization? And the amounts people are willing to pay is much smaller than you think,” Byers said.

There are many other ways to help reduce emissions, she said.

“Climate change is a global problem but solutions are going to have to be regional and not every solution is going to work in every place,” she said.

She also emphasized the need for efficient operations.

“Efficiency is a good form of supply,” Byers said.

“We went from the paradigm where we thought we couldn’t extract hydrocarbons from shale commercially to all the different ways to try and produce it, and … zero in on what works.”—Greg Leveille, former CTO, ConocoPhillips Co.

Greg Leveille, the former CTO ConocoPhillips who is now retired, said energy companies should concentrate on favorable innovation niches in order to drive the biggest impact in meeting demand.

In particular, Leveille noted six factors that contributed to the high rate of innovation that drove the unconventional revolution. They were low cost of experimentation, rapid experimentation speed, a large number of players, a high level of scalability and patentability, and a low regulatory burden.

Comparatively, Leveille said, innovations in ultra-deepwater, where there are only a handful of players, take longer.

“The more people participating, the more likely it is that somebody’s going to find a breakthrough,” he told URTec attendees. “No one knows which things are going to work. But once you see something that works, you can replicate it fairly quickly.”

And some of that learning came from “looking over the fence line,” such as attending URTeC presentations, he said.

“We went from the paradigm where we thought we couldn’t extract hydrocarbons from shale commercially to all the different ways to try and produce it, and … zero in on what works,” Leveille said.

Recommended Reading

How Diversified Already Surpassed its 2030 Emissions Goals

2024-04-12 - Through Diversified Energy’s “aggressive” voluntary leak detection and repair program, the company has already hit its 2030 emission goal and is en route to 2040 targets, the company says.

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.