(Source: Hart Energy/Shutterstock.com)

The growth in gas production from the U.S. in recent years has occurred as Asian markets transition their energy consumption toward gas. Those two fundamentals are expected to continue over the medium term, making the U.S. the world’s largest liguefied natural gas (LNG) exporter and China the largest importer by 2025.

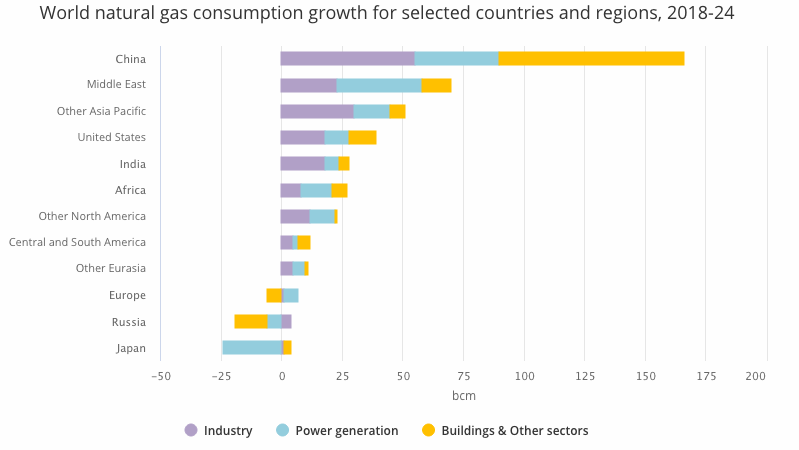

The world has shown a growing demand for gas, and by extension, LNG. Demand for gas grew 4.6% in 2018, the fastest rate in more than eight years, the International Energy Agency (IEA) reported. China is the largest component of that demand growth as the country pursues environmental policies designed to reduce air pollution by switching away from coal-fired plants to gas-fired plants. That demand is expected to grow more than 10% over the next five years to more than 4.3 trillion cubic meters (Tcf) in 2024. Additional demand is also expected to come from Bangladesh, India and Pakistan over the next five years.

As demand for both gas and LNG surges, producers are building additional LNG liquefaction facilities. One recent study showed current global LNG capacity is ~350 mtpa, with another ~50 mtpa under construction and scheduled to come online by 2025. Data from the U.S. energy information administration (EIA) showed that LNG exports reached a record high of 1,083 billion cubic feet (Bcf) to 37 countries, including South Korea (23%), Mexico (17%) and Japan (12%).

RELATED ARTICLES:

- Gas-Fired PowerGen: Natgas & The Renewables

- API, IOGP Calls For Increased US, EU LNG Trade

- Japan To Lose Top LNG Importer Position To China By 2022: Report

- FERC Reorganizes To Create New LNG Division, Open Houston Regional Office

By the end of the year, the EIA expects U.S. export capacity to reach 8.9 Bcf/d (~68 mtpa), the third largest in the world behind Australia and Qatar. As additional supply from the U.S. and growing demand from China continue, analysts say the geopolitical trade disputes between the two countries will not interfere with the fundamentals for growth.

Suppliers and consumers recognize natural gas and LNG as one of the fuels of the future because it is among the most environmentally friendly fossil fuels. In many places, it is the most viable fuel alternative to coal-fired power, said Stratas Advisors director George Popps. It's increasingly plentiful, with huge discoveries made in the Mediterranean and East Africa in recent years, in addition to cheap and plentiful U.S. shale gas. Further, Russia has huge amounts of gas, the ability to export is both by pipes and by LNG, and great proximity to both European and Asian demand centers.

And although there are huge doubts about Iran because of the effect of international sanctions, the country has the second largest natural gas reserves in the world. If it is able to ever seriously develop its export capabilities, it could flood the market with massive volumes of gas, Popps said.

RELATED VIDEOS:

While demand will continue to grow—Stratas Advisors expects global demand to hit 450 mtpa around 2030—the plentiful resources of gas around the world have the ability to keep pace with demand. Of course, this requires that liquefaction is built in a timely manner including planning, permitting and construction. Greenfield plants can often take more than five years to become operational, so as long as the industry has the foresight, there shouldn't be a shortage of supply any time soon.

Evolving Market

The world's market for LNG is evolving as new sources of supply and demand enter. The new players bring additional transparency, more liquidity, new pricing mechanisms and more spot trading to the market.

"Clearly, the market is maturing," said Charles Palmer, managing director, power and gas at Opportune LLP. "It's becoming more like other commodities, with more liquidity and transparency."

Historically, the LNG market has been relatively illiquid, with long-term contracts that supported the capital spending of LNG producers. As the market has matured, it is seeing new pricing mechanisms and new pricing contracts emerge. Previously, LNG was linked to crude, indexed to Brent, JCC, or to gas prices at Henry Hub or NBP. Today, a growing number of contracts are using new indexes, such as the JKM LNG benchmark. In addition, there is a growing array of derivative instruments that producers and consumers can use to hedge price risk.

As another indication of the evolution of the market, commodity trading houses are increasingly participating in the LNG market.

"If traders are in the market, there are arbitrage opportunities," Palmer said.

In addition, many traditional suppliers are beefing up their trading desks to take advantage of new opportunities.

There is increasing activity using shorter-term LNG contracts. Previously, typically LNG contracts were for 20 years or more. But more contracts have terms that have fallen to three to five years. As a result, the spot market for LNG has become increasingly liquid. One recent study showed that as much as 25% of the world's market for LNG trades on a spot basis.

"That could be a bit overstated, but is still a significant increase," Palmer said.

Data from the IEA shows here has been a recent convergence in market prices in major world regions, an indication of the increasing globalization of the natural gas market. Despite that, there are still plenty of arbitrage opportunities for companies that have the capital to invest in production and import facilities, as well as commodity trading companies.

"New sources of gas are coming into the market and the US shale gas is probably the best known example of that," Palmer said.

These new sources of supply occur simultaneously with ongoing LNG growth in demand in Asia and throughout the world.

There is some strategic advantage to being the first mover in the LNG industry, given that there is a fixed amount of supply available, at least in the near-term relative to the large volumes consumed by the liquefaction plants. In addition, as pipeline capacity is largely fixed, starting operations before a competitor allows a company to secure capacity. It also allows suppliers to secure sales contracts first for the emerging LNG demand.

"You take some uncertainties out of the equation," he said.

The market has seen the erosion of arbitrage opportunities between the Atlantic and Pacific basins at various times throughout the year. As more LNG is traded on a spot basis and more contracts are unlinked from oil prices, the price points for LNG will become increasingly more similar. However, Stratas Advisors does not expect a single worldwide crude-type price like Brent to take hold any time soon, Popps said.

The gradual evolution of these market fundamentals, including the growth of natural gas production from unconventional sources in the U.S., have created unique opportunities for companies like Tellurian, which is working to build a 27.6 mtpa LNG liquefaction plant south of Lake Charles, La.

Tellurian will retain a 49% stake in a JV that will manage the plant and its associated infrastructure. It is working to finalize ~$20 billion in project finance debt and hopes to secure an additional ~$7 billion in equity financing from other its JV partners, who will have a 51% stake in the partnership. This structure allows Tellurian to better control costs across the value chain.

Construction is expected to start later this year. The plant will produce ~11 mtpa when production starts in 2023, and will ramp up to 27.6 mtpa in 2026. Tellurian believes the world LNG market will need an additional 100 mtpa to 250 mtpa of liquefaction capacity to keep pace with demand through 2025.

Recommended Reading

Chesapeake Slashing Drilling Activity, Output Amid Low NatGas Prices

2024-02-20 - With natural gas markets still oversupplied and commodity prices low, gas producer Chesapeake Energy plans to start cutting rigs and frac crews in March.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Greenbacker Names New CFO, Adds Heads of Infrastructure, Capital Markets

2024-02-02 - Christopher Smith will serve as Greenbacker’s new CFO, and the power and renewable energy asset manager also added positions to head its infrastructure and capital markets efforts.

Stockholder Groups to Sell 48.5MM of Permian Resources’ Stock

2024-03-06 - A number of private equity firms will sell about 48.5 million shares of Permian Resources Corp.’s Class A common stock valued at about $764 million.