Natural gas flares between two rigs in a West Texas oil field. (Source: GB Hart/Shutterstock.com)

As interest in sustainability grows, investors are paying greater attention to ESG issues across sectors, especially in the energy industry. They have called for increased disclosure of ESG performance metrics, alongside financial reports. Oil and gas producers are scrambling to compile that information. But investors and producers aren’t the only interested parties. Land owners, regulators, insurers and others need ESG data to make decisions regarding their properties and portfolios.

“Access to energy security equates to economic well-being, and oil and gas will be in the global energy mix for the long term. At the same time, the industry must decarbonize and eliminate fugitive emissions. We need transparency of data about performance,” said Gani Sagingaliyev, co-founder of data and analytics firm ESG Dynamics.

Launched in March 2021, the ESG Dynamics tools initially focused on environmental data material to the oil and gas business including emissions, flaring, inactive wells and more. The platform is growing quickly to incorporate social and governance metrics too.

“There are good players and not-so-good players in the oil patch. We need to learn to differentiate them,” Sagingaliyev explained. “If we give the power of data to a wide variety of stakeholders, they can make ESG-friendly decisions to push the entire industry’s performance forward.”

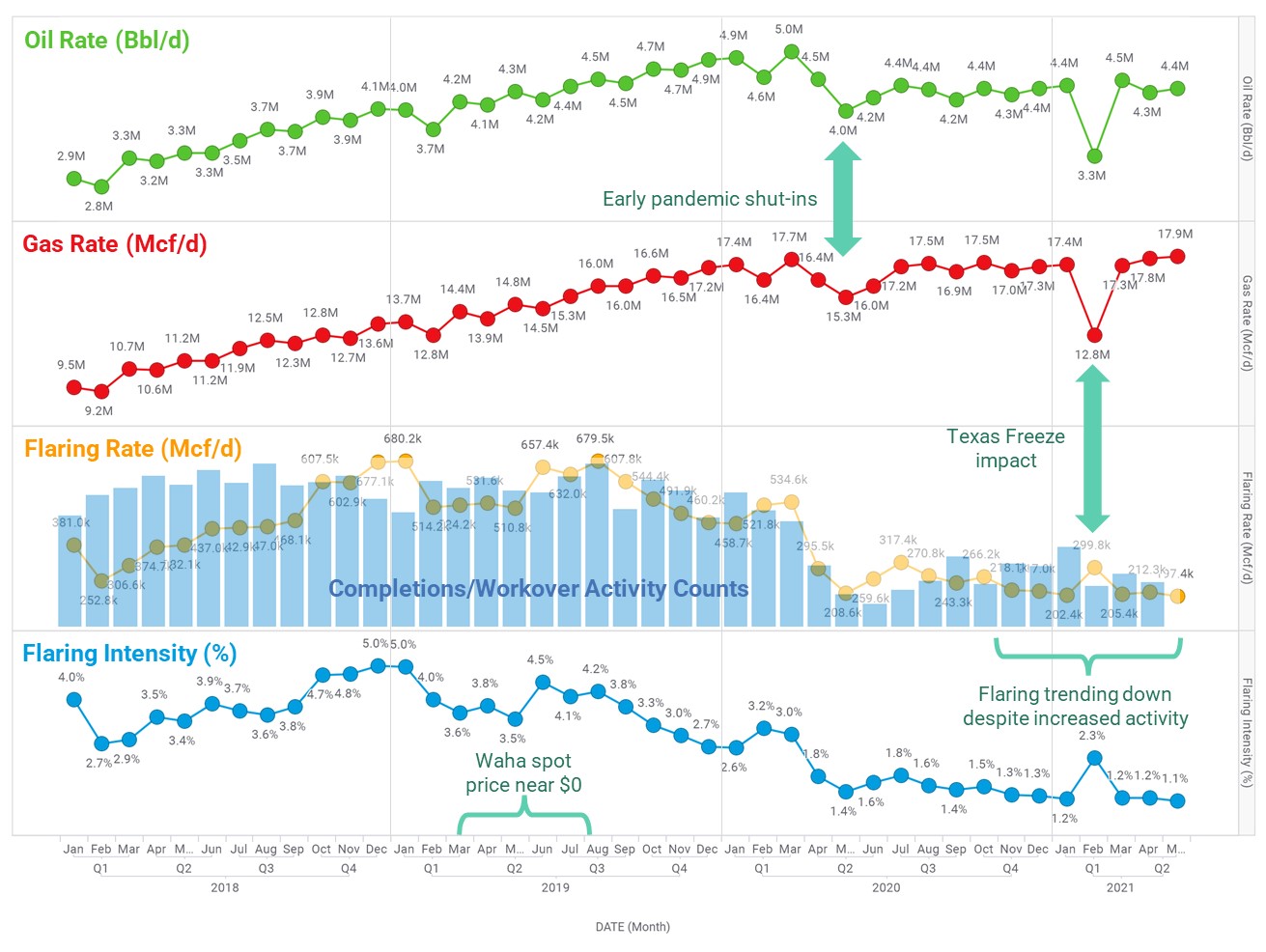

Permian Basin gas flaring rates over the past few years demonstrate that pressure to change. In 2018 and 2019, flaring doubled across the basin as drilling and completions activity soared. Gas pipelines filled and near-zero Waha gas prices made routine flaring more economic than production. Flaring slowed with new takeaway capacity in 2019 followed by pandemic-induced drilling cuts. As the ESG focus gained momentum, flaring rates and intensity continue to fall despite climbing completions since late 2020.

Aggregated information reveals the trends in ESG metrics, uncovering problems that the oil and gas industry should tackle, as well as the progress. ESG Dynamics datasets show that many operators are significantly improving, and embracing this essential data will allow them to illustrate results that better represent the industry.

Action plans or portfolio decisions require more granular data at the company, lease and well level. For example, ranch owners want to understand the environmental risks on their land. ESG Dynamics provides tools to map the location and age of inactive wells that could present leak hazards.

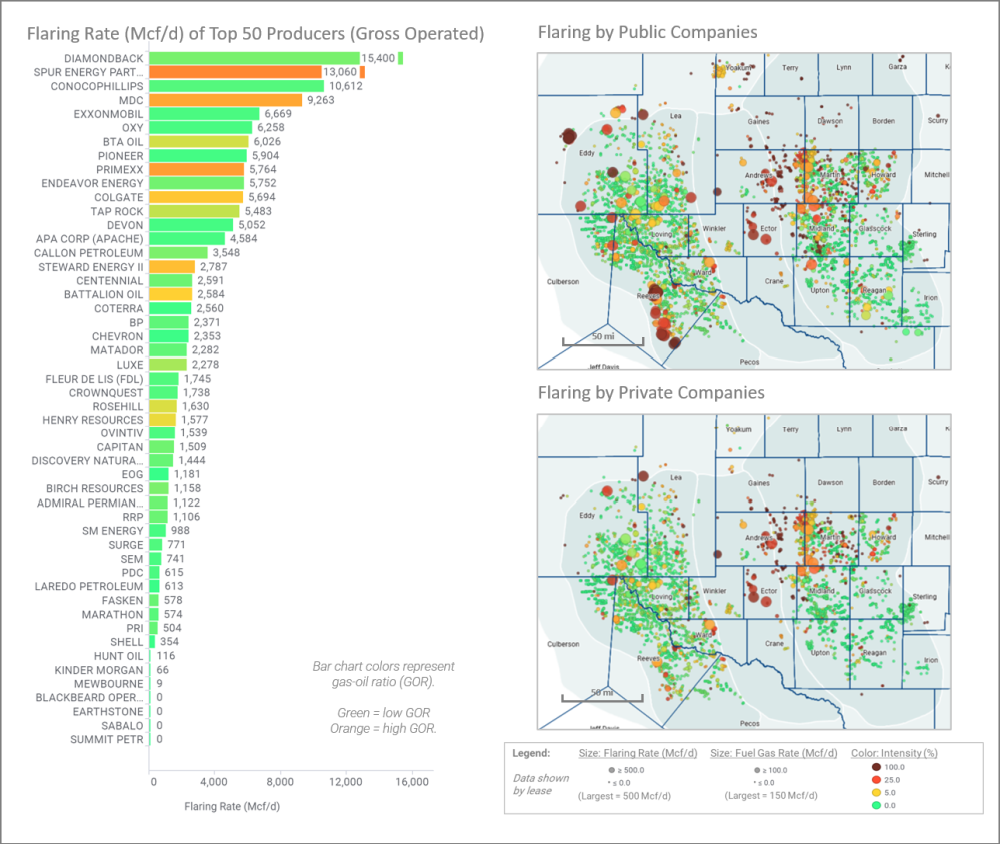

Detailed Permian Basin benchmarking shows that the top 10 producers, all of which are public companies, have the highest flaring and fuel gas use rates, unsurprising given the scale of operation. These companies contribute 91% of production but only 76% of flared gas basin wide.

In 2020, Permian gas combustion emissions totaled over 20 million metric tons of CO2 emissions, about half from fuel gas consumption. Some stand out with better performance, though. EOG and Cimarex are among the lowest relative to peers for flaring and fuel gas intensity (rate per gas volume produced).

Smaller private companies produce 20 to 30 times less with lower flare volumes, but rank among the highest in flaring and fuel gas intensity.

Efforts to cut CO2, methane and other greenhouse gas emissions will require different tactics. Larger operators would need widespread flare reduction programs, while smaller players can focus on high flaring intensity assets to maximize progress. Both could electrify field operations to replace fuel gas.

The ESG Dynamics platform gives many types of stakeholders the data and analytics to make strategic decisions for their own assets and portfolios.

“We’re not trying to score companies, though we provide data that can enable that, with no judgment. We give our clients the tools to draw conclusions on their own quickly, easily and affordably," Sagingaliyev said.

About the Author:

Grant Swartzwelder is a co-founder and partner of ESG Dynamics, with over 35 years in the energy industry as investment banker, owner/investor, operator and engineer. He is also the founder and president of OTA Environmental Solutions, a full-service environmental firm focused on the energy industry. ESG Dynamics provides ESG data analytics, enhancement, visualization, insights and access to groups and sectors interested in the environmental performance of oil and gas companies.

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.