In March, the U.S. Securities and Exchange Commission (SEC) proposed new rules that would require registrants to include certain climate-related and ESG disclosures in their SEC statements and reports.

According to the SEC, the proposed disclosed information would include, in addition to other things, information regarding registrant’s direct greenhouse-gas (GHG) emissions (Scope 1) and indirect emissions from purchased electricity or other forms of energy (Scope 2). Additionally, a registrant would be required to disclose GHG emissions from upstream and downstream activities in its value chain (Scope 3), if material or if the registrant has set a GHG emissions target or goal that includes Scope 3 emissions.

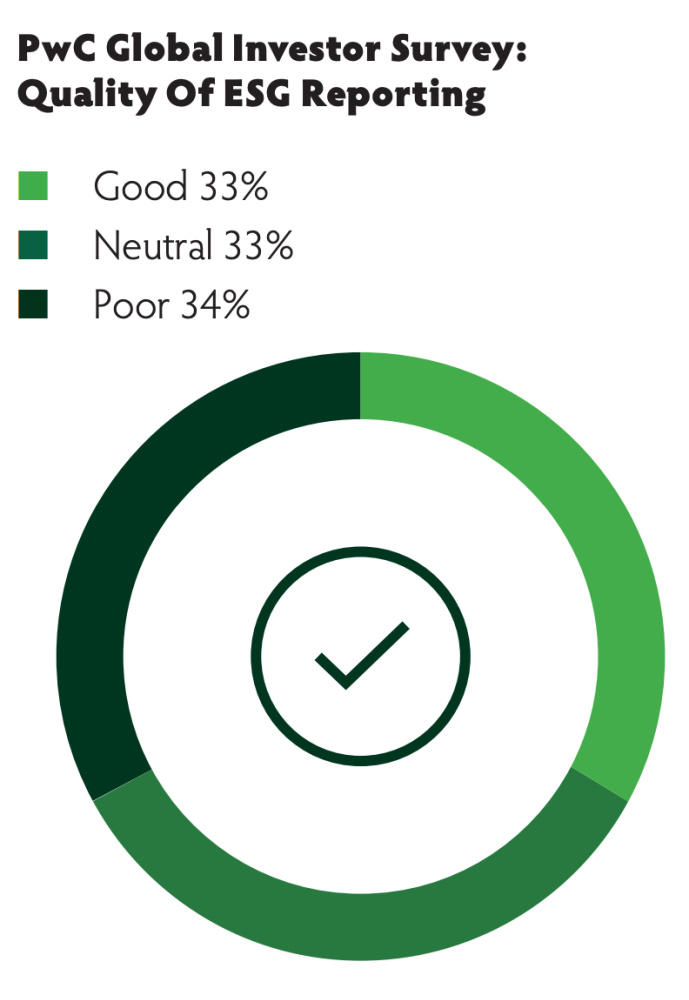

“Investors are looking to companies to explain the meaning, relevance and effect of ESG issues on their business,” said Reid Morrison, a principal with PwC. “In a fall 2021 PwC global survey of investors, only 19% believed current reporting of this information is of good quality. We believe standardized climate disclosures would aid investors in better understanding the impact of climate on a company’s operations and financial performance and support comparability.”

The rule changes are a step toward standardizing that reporting.

“Regardless of the final form of the rules, companies need to start preparing for more disclosure now as investors and other stakeholders continue to ask for more transparent disclosure in this area.”—Reid Morrison, PwC

“There is a long history of voluntary frameworks,” Morrison said. “The recent activity focuses on potential required disclosures.”

These potential standards are in the proposal stage, he explained. “The SEC has received over 14,000 comment letters, including almost 1,000 letters from investors, registrants, industry organizations, public policy groups and the like,” he said. “The feedback loop is likely to result in changes to the proposals before final rules are issued.”

Investor needs

The recent push for increased ESG efforts in the industry have been market-driven.

“I think everyone is responding to the needs of investors,” Morrison said. “Investors believe ESG disclosures are decision-useful but in multiple surveys have commented that the information being provided on a voluntary basis may not be in sufficient detail or may not be consistent company to company.”

Whether or not the newly proposed rules will help to standardize the information provided to investors is yet to be seen. Regardless, those investors recognize the value of standardization, and the global debate has turned its spotlight on organizations’ ESG policies and disclosures, Morrison explained.

“There are growing calls from investors, regulators and other stakeholders for better information on how businesses are considering these issues, particularly climate change,” he said. “So, ESG issues are playing a more prominent role in how companies are valued.”

The proposed climate-related disclosures do not exclusively affect the oil and gas industry; they could potentially affect all industries impacted by climate-related risks.

“We advise companies not to view the SEC’s proposal as a compliance exercise,” Morrison said. “This is a great opportunity for companies to challenge themselves. These disclosures provide an opportunity to share their unique story and point of view on climate-related matters, including how prominently these topics play in their overall business, strategy, risk management and governance practices.”

The proposed disclosure rules give producers a chance to control their ESG story, Morrison said.

“I think it’s a win-win if companies approach their disclosures this way,” he continued. “Companies can better control their own narrative, and investors will get the more fulsome information they’ve been asking for.”

Start the prepping

As of July, the SEC is still considering public input on the proposal. Once that is completed, the SEC will adopt a final rule before any new disclosures would be required, Morrison said.

“Regardless of the final form of the rules, companies need to start preparing for more disclosure now as investors and other stakeholders continue to ask for more transparent disclosure in this area,” he added.

Morrison provided advice for how companies can start preparing for disclosures before they go into effect.

“We recommend starting with a gap analysis—understand what is in the proposal, what information the company may already be collecting or disclosing and the timing of those activities,” Morrison said. “Companies can then begin to understand where they have the most work to do and think about what controls and processes would need to be implemented to close any gaps.”

Regardless of what final form the SEC proposal takes and how it affects regulations and reporting, preparing standardized reporting ahead of time will provide producers and investors with a valuable toolset.

“Given strong investor interest in ESG information,” Morrison said, “efforts to understand and start to operationalize potential disclosures will not be wasted.”

Recommended Reading

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

Exxon Versus Chevron: The Fight for Hess’ 30% Guyana Interest

2024-03-04 - Chevron's plan to buy Hess Corp. and assume a 30% foothold in Guyana has been complicated by Exxon Mobil and CNOOC's claims that they have the right of first refusal for the interest.

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

2024-04-11 - Continental Resources is adding leases in Midland and Ector counties, Texas, as the private E&P hunts for drilling locations to explore. Continental is also testing deeper Barnett and Woodford intervals across its Permian footprint, CEO Doug Lawler said in an exclusive interview.

Pitts: Heavyweight Battle Brewing Between US Supermajors in South America

2024-04-09 - Exxon Mobil took the first swing in defense of its right of first refusal for Hess' interest in Guyana's Stabroek Block, but Chevron isn't backing down.

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.