(Source: Chevron Corp.)

EQT Corp. agreed to acquire Chevron Corp.’s Appalachian position for $735 million on Oct. 27 marking the oil major’s exit from the region.

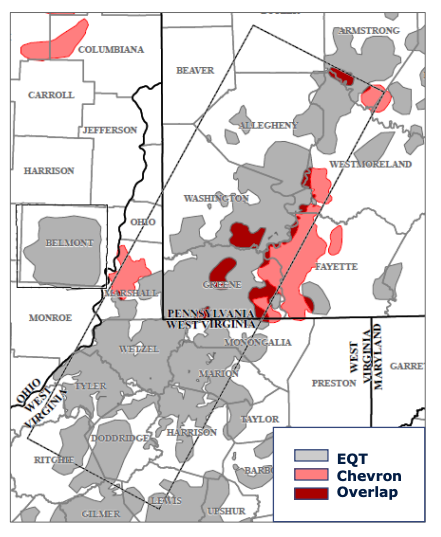

Pittsburgh-based EQT, which focuses on natural gas production, said in a release it had entered into a definitive purchase and sale agreement with Chevron U.S.A. Inc. under which EQT will acquire Chevron’s upstream and midstream assets located in the Appalachian Basin. The transaction includes 335,000 total net acres in the Marcellus Shale with current net production of about 450 MMcfe/d.

Toby Rice, president and CEO of EQT, described the acquisition as a natural bolt-on extension of EQT’s dominant position in the core of the southwest Marcellus where the company currently holds about 630,000 net acres.

“Our unique knowledge of these assets, coupled with our superior operating model, puts these assets in the right hands to maximize the embedded value,” Rice said in a statement on Oct. 27.

The deal marks Chevron’s exit from the Appalachia region. Last year, the oil major said it was considering the sale of the properties after taking an $8.17 billion charge to earnings to write down their value and an unrelated U.S. offshore project.

EQT intends to finance the multimillion-dollar acquisition with cash on hand, drawings under its revolving credit facility and/or one or more capital markets transactions. Concurrent with the announcement of the deal, EQT also launched a public equity offering with proceeds earmarked to partially fund the purchase.

Rice added in his statement that the “favorable financial impacts” of the deal will benefit both equity and debt holders.

“With the purchase price underpinned by PDP value, the extensive work-in-progress well inventory, core undeveloped acreage and water assets provide material value upside,” he said.

The Chevron acquisition includes 31% ownership interest in Laurel Mountain Midstream plus two water systems and associated infrastructure located in Pennsylvania and West Virginia.

Jefferies LLC was financial adviser to EQT on the transaction. Citigroup, Credit Suisse, BofA Securities and Barclays are joint book-running managers for EQT’ proposed public offering of common stock.

EQT said it expects to close the transaction late in the fourth quarter. The deal has an effective date of July 1.

Recommended Reading

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.

Paisie: Crude Prices Rising Faster Than Expected

2024-04-19 - Supply cuts by OPEC+, tensions in Ukraine and Gaza drive the increases.

Report: Freeport LNG Hits Sixth Day of Dwindling Gas Consumption

2024-04-17 - With Freeport LNG operating at a fraction of its full capacity, natural gas futures have fallen following a short rally the week before.

Permian NatGas Hits 15-month Low as Negative Prices Linger

2024-04-16 - Prices at the Waha Hub in West Texas closed at negative $2.99/MMBtu on April 15, its lowest since December 2022.

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.