New E&P regulations wouldn’t only significantly affect production in the Permian, but other basins as well, Scott Field, president and owner of Field Geo Services Inc., told Hart Energy. (Source: A picture of the EPA building in Washington DC by DanielJohn / Shutterstock.com)

A move by the EPA to redesign portions of the Permian Basin for violating federal air quality standards is drawing heavy criticism across the energy sector.

The action, currently being considered by the Biden administration, would force state regulators in both Texas and New Mexico to develop plans for cracking down on high ozone levels, which could lead to stricter regulations and scrutiny of drilling operations.

Texas Gov. Greg Abbott said EPA’s discretionary re-designation of the Permian Basin could threaten a quarter of the nation’s gas supply from the most prolific oil field in the U.S.

“The EPA’s process could interfere in the production of oil in Texas which could lead to skyrocketing prices at the pump by reducing production, increase the cost of that production, or do both.”—Texas Gov. Greg Abbott

“While you express concern about out-of-control gas prices, your Environmental Protection Agency is threatening to increase them even further,” Abbott wrote in a letter to President Joe Biden.

“The EPA’s process could interfere in the production of oil in Texas which could lead to skyrocketing prices at the pump by reducing production, increase the cost of that production, or do both,” he added.

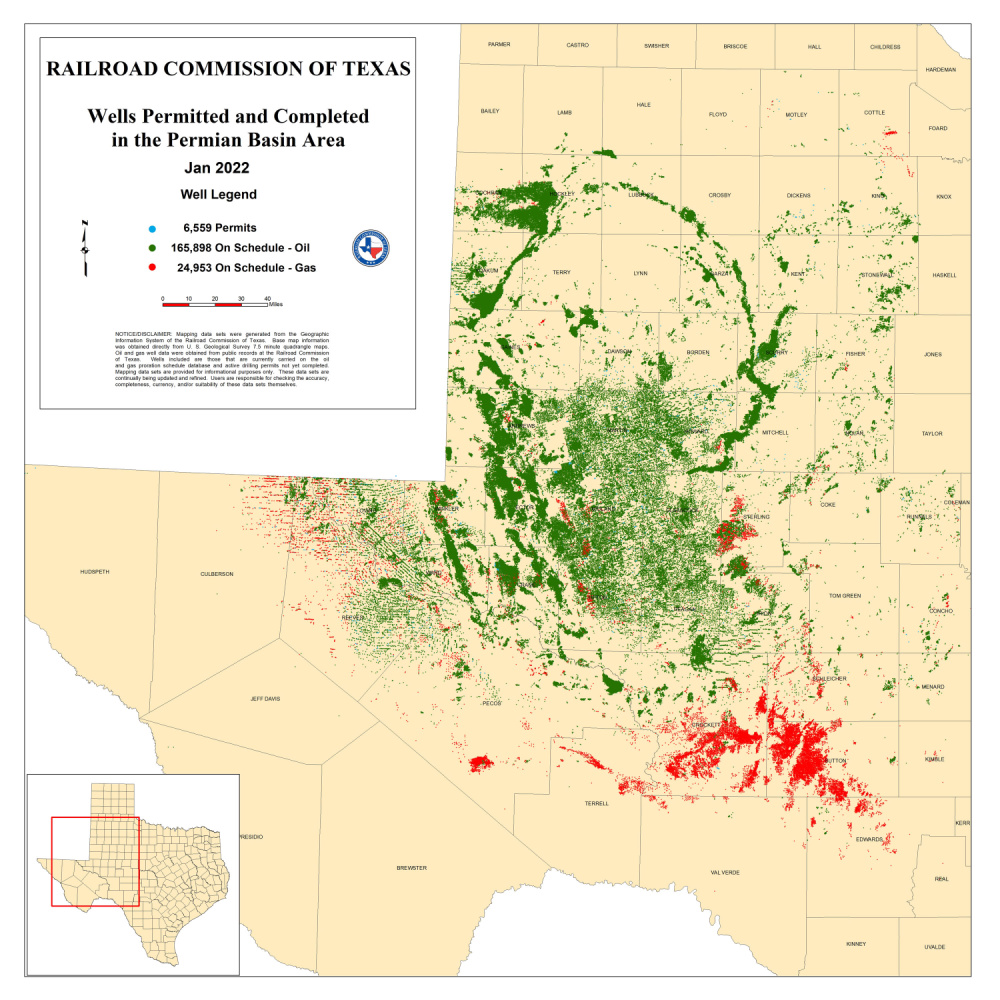

The Permian Basin in West Texas and southeastern New Mexico produces about 5.2 million bbl/d of oil, according to the Energy Information Administration, that can be processed into about 95 million gallons of gasoline a day. Per the Texas Railroad Commission, the greater Permian Basin accounts for nearly 40% of all oil production in the U.S. and nearly 15% of its natural gas production.

In its notice, EPA warned that if the ozone levels in the basin are too high, state regulators would have three years to submit an implementation plan for lowering ozone levels that are in accordance with the national ambient air quality standards.

Scott Field, president and owner of Field Geo Services Inc., told Hart Energy that the new E&P regulations wouldn’t only significantly affect production in the Permian, but other basins as well.

“Permitting could become dependent on showing low values methane leakage and investors may become nervous to put their money into companies that do not show any internal knowledge of their air quality emissions,” Field noted.

Air quality monitoring, he advised, with continuous methane monitors around each facility, is an inexpensive way to prevent action from regulators and groups that look to punish the oil and gas industry.

EPA’s actions could also be “extremely detrimental” to the nation’s energy security, warned Leslie Beyer, CEO of the Energy Workforce & Technology Council, which represents more than 450 energy technology and services companies across the U.S.

“At a time of increased global demand, extremely high energy costs and record inflation, taking actions which could increase the cost of domestic energy resources will only exacerbate inflation, increase prices on consumers and jeopardize American energy security,” Beyer said in a statement.

To effectively reduce emissions, she said the U.S. needs to encourage investment in new technologies that are increasingly lowering emissions and increase LNG exports to replace coal fired power production around the globe.

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.