The Liza Phase 2 project development involves a second FPSO vessel, Liza Unity, that is designed to produce up to 220,000 bbl/d of oil. (Source: Exxon Mobil Corp.)

[Editor's note: This article originally appeared in the October issue of E&P Plus. Subscribe to the digital publication here.]

As the oil and gas industry continues to weather the storm of the downturn, South America’s upstream sector is preparing for a wave of new growth and opportunity.

Across the globe, operators have slashed capex and reduced activity after the worst price crash in decades wreaked havoc on the sector. The current state of the market has put the U.S., Europe and Africa in a dire state, offsetting a potential 2021 recovery by two or more years.

Although the outlook for the sector remains uncertain, South America is expected to lead the recovery among regions given its attractive onshore and offshore prospects, the political resolve in Guyana and Argentina’s hydrocarbon production, according to Wood Mackenzie analysts.

In all, South America’s resilience during distressed times signals a positive recovery. The country’s progress could prove to be a useful blueprint for the strategies across the globe as E&P companies begin to emerge from the downturn.

Guyana

Following a monthslong political dispute over the election results, Guyana swore in Mohamed Irfaan Ali as president in August. The resolve of the political crisis has allowed delayed projects and Guyana’s oil and gas industry as a whole to begin to move forward.

“On the development side, we saw some delays from the government on project approval,” said Luiz Hayum, Wood Mackenzie’s upstream research senior analyst for Latin America. “But, finally the situation with the election has been resolved. This should allow the government entities to work on moving the oil industry and the decision process for project approval forward.”

Although Exxon Mobil Corp. has acknowledged that the political conflict and coronavirus outbreak will cause a six- to 12-month delay on the development of certain projects, Hayum noted both the company and its partner Hess Corp. have resumed normal operations with four active drilling rigs.

Exxon Mobil also recently added to its oil discovery tally offshore Guyana with the Redtail-1 well in early September. The discovery marked the 18th find on the Stabroek Block made by the Exxon-led consortium that also includes Hess and China’s CNOOC Ltd.

In a statement, John Hess, CEO of the U.S.-based independent, said the Redtail-1 discovery will add to the gross discovered recoverable resource estimate for the block of more than 8 Bboe.

“Redtail is the ninth discovery in the southeast area of the block, which we expect will underpin future development,” Hess added.

While Guyana remains a priority region for companies like Exxon and Hess, Hayum said the company’s success at the Stabroek Block and Tanager-1 exploration well in the Kaieteur Block are significantly raising the attractiveness of the small country.

“Guyana is an area of focus for development for both Exxon and Hess, despite the investment reductions elsewhere, including in the U.S.,” he said. “In particular, Tanager-1 is one of the exploration wells that we are waiting for the results and is probably one of the most exciting prospects for the year. If this well is successful, it will help prove that the petroleum system expands even further from the coast and that could open up an exploration licensing round in a couple of years.”

In addition, results from Tanager-1, which is located in the block adjacent to Stabroek, will prove that exploration success can be replicated outside of the current cluster of development by Exxon.

“It will help de-risk some of these blocks in deeper waters and open a new horizon of investments and possible developments for years to come,” Hayum said.

The impact of discoveries on the Stabroek Block, the pending success of the Tanager-1 exploration and alluring offshore prospects will make Guyana a new entrant this decade, according to a Rystad Energy report released in February.

With more than 8 Bbbl of recoverable oil discovered in Stabroek and recent discoveries in the Guyana-Suriname Basin proving a wider petroleum system, companies will boost their capex in the area, the report said.

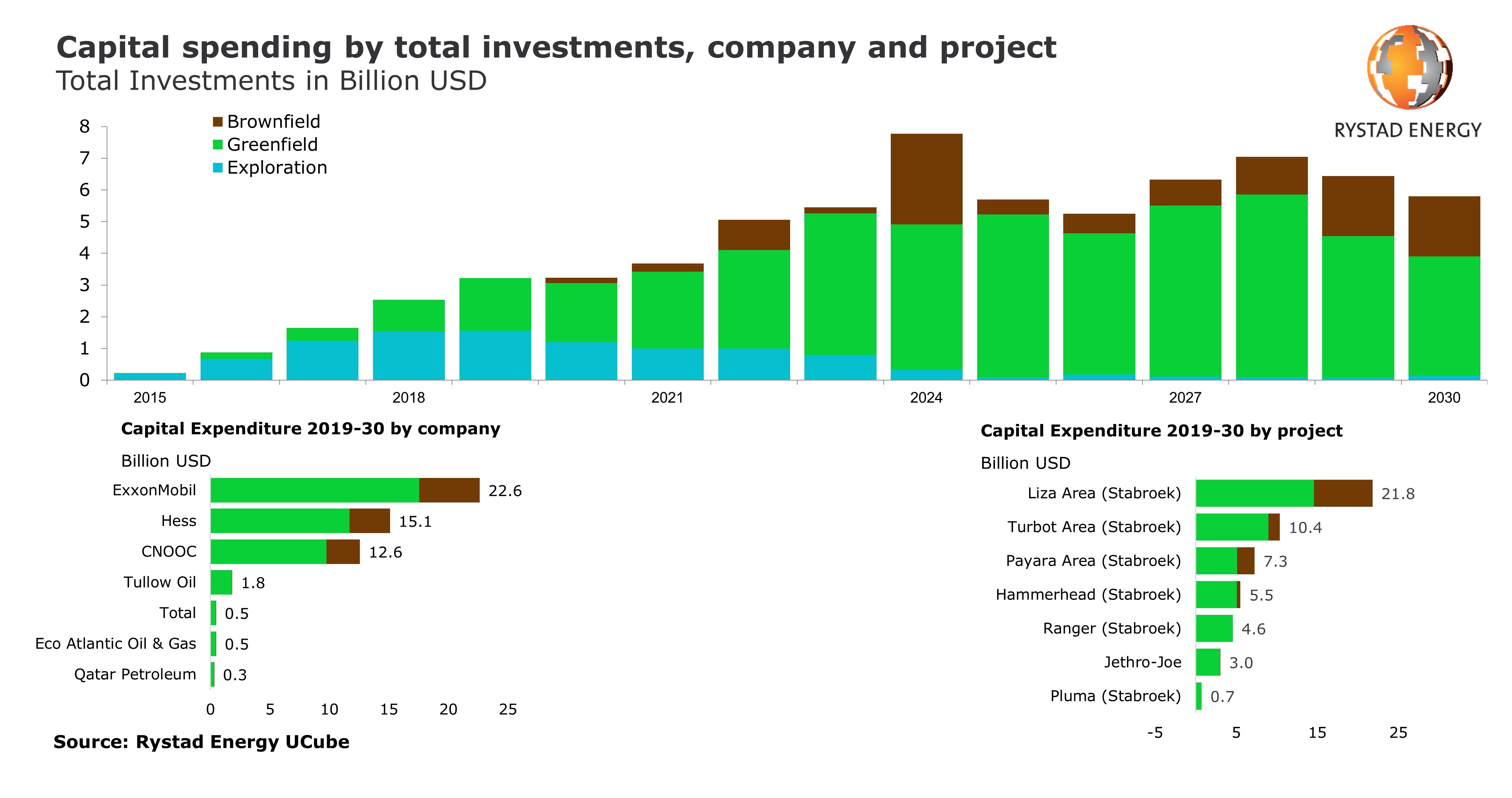

Rystad expects the Guyana’s coveted Stabroek Block to bring in billions in investment from oil firms. The firm anticipates global oil firms are preparing to spend more than $53 billion in the block with Exxon Mobil leading the way at $22.6 billion. Following Exxon, the analysts project roughly $15.1 billion in spending by Hess and CNOOC at $12.6 billion.

The Liza Field will attract most of the capital, with the Turbot Field and the Payara Field expected to round out the top three, according to the report.

Additionally, offshore prospects will increase the appetite of energy companies in Guyana. In particular, the appeal of lower breakevens and competitive payback times will make oil projects offshore South America more attractive versus similar projects in other parts of the world.

“Offshore activity in Latin America is expected to recover from 2021 with more than 3 million barrels per day of peak production estimated to be sanctioned in Brazil and Guyana alone by 2025,” the Rystad report stated. “Of this, more than 80% of the capacity has breakeven prices of less than $45 per barrel and is expected to get sanctioned despite the current market environment.”

Together Brazil and Guyana will account for more than one-third of the offshore investments over the next five years, and roughly 30 offshore oil projects will be given the green light across the continent in the next three years, according to recent findings by Rystad.

Guyana Capital Spending

Vaca Muerta: ‘Argentina’s Permian Basin’

Onshore South America, the Vaca Muerta Formation has become more relevant for hydrocarbon production in Argentina, adding to the promise and potential of the shale play.

Production from the play accounted for roughly 25% of the total hydrocarbon production in the country in 2020, according to Wood Mackenzie principal research analyst Ignacio Rooney.

Liquids production halted across the country in April and May, but Rooney said production began to recover by June and July. The same blocks that had decreased in production at the beginning of the pandemic in Argentina are now the ones that are driving liquids production recovery.

“[Argentina’s] oil production is not at the same levels as it was before the pandemic,” he said. “But we’re seeing that the liquids output numbers from the Vaca Muerta are above what we saw during April and May. Right now, the liquids part of the play is what is most attractive for companies.”

Furthermore, Rooney said the Vaca Muerta’s liquids production growth will steadily increase and recover faster than gas, possibly returning to pre-pandemic levels by next year.

The light is a bit dimmer on the gas side given the price environment, he noted. However, the Argentinian government is discussing a potential low-price incentive scheme for offshore companies. The incentive is designed toward ensuring that gas production does not decline going forward and will incentivize upstream activity. If implemented, the incentive will apply to all basins within the country and signal opportunity for offshore producers, Rooney said.

Recommended Reading

EIG’s MidOcean Energy Acquires 20% interest in Peru LNG

2024-02-08 - On top of acquiring a 20% interest in Peru LNG, MidOcean Energy is also in the process of acquiring interests in four Australian LNG projects.

Clean Harbors Closes $400MM Acquisition of HEPACO

2024-03-25 - Clean Harbors acquired HEPACO for $400 million, adding complementary services for environmental remediation and emergency response in the Eastern U.S.

Marketed: Anschutz Exploration Corp. WI Opportunity in Converse County, Wyoming

2024-01-26 - Anschutz Exploration Corp. retained EnergyNet for the sale of its WI participation option in Converse County, Wyoming.

Excelerate Energy, Qatar Sign 15-year LNG Agreement

2024-01-29 - Excelerate agreed to purchase up to 1 million tonnes per anumm of LNG in Bangladesh from QatarEnergy.

UK’s Union Jack Oil to Expand into the Permian

2024-01-29 - In addition to its three mineral royalty acquisitions in the Permian, Union Jack Oil is also looking to expand into Oklahoma via joint ventures with Reach Oil & Gas Inc.