Low crude prices have disrupted Africa’s oil and gas industry and put a strain on several major E&P projects. (Source: Lukasz Z/Shutterstock.com)

[Editor's note: A version of this story appears in the July 2020 edition of E&P. Subscribe to the magazine here.]

As the oil and gas industry grapples with the downturn, Africa’s oil-producing countries—which depend on crude oil exports for a large portion of state revenue—face a dismal situation. Despite recurrent steps taken by governments over the past decade to diversify their economies, enough hasn’t been done. Low crude prices could cause double digit recessions in African oil-producing countries this year, according to experts.

“By far, the biggest impact of low oil [and gas] prices has been on government budgets and capital investment of oil companies,” said Keith Myers, president of research with Westwood Global Energy Group. “Post pandemic, about 1.1 MMbbl/d of OPEC production cuts have been allocated to African OPEC members, although Nigeria’s compliance with its 417,000 barrels per day cut was only 50% in May.”

Despite the partial recovery of oil prices, E&P projects in Africa may continue facing uncertainty because the top upcoming final investment decisions (FIDs) in Africa have a breakeven crude price of more than $45/bbl, with some even close to $60/bbl, according to Rystad Energy.

Operators in Africa—similar to their global counterparts—have entered survival mode by deploying short-term cost-saving strategies that include spending cuts, halting nonessential activities, furloughing or laying off of workers and delaying E&P projects. In Nigeria, for instance, most oil majors have suspended capex spending and are only maintaining minimal operational activities.

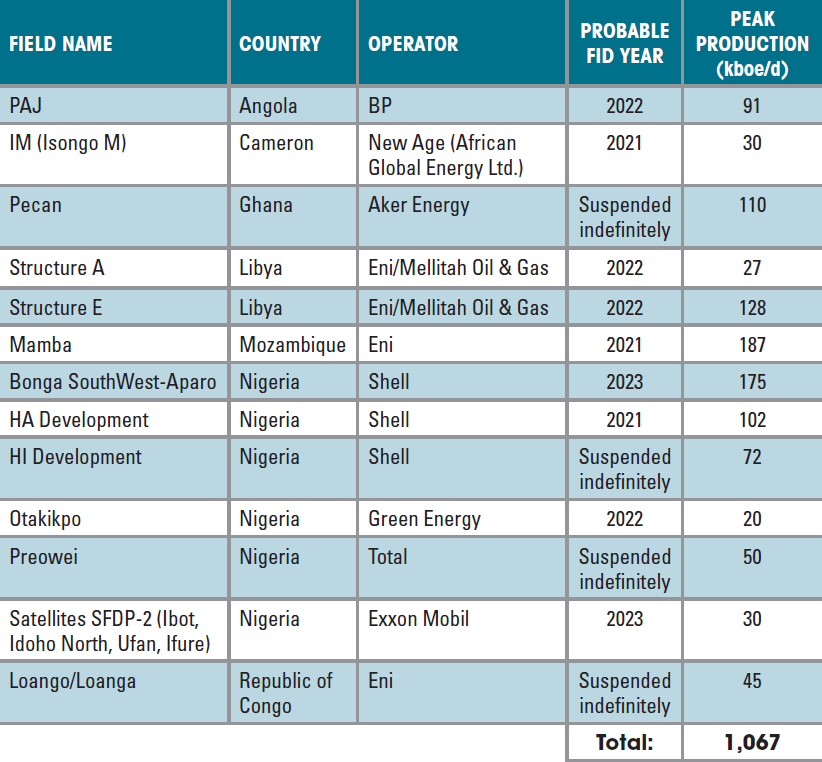

“As oil companies rush to cut spending, roughly 1 MMboe/d in development projects, which could have been sanctioned in 2020, has been deferred,” Myers explained, adding that if oil prices stay low, some of these projects may never be sanctioned.

For instance, a one-year delay was announced for the BP-operated LNG project in Senegal. Also, Tullow Oil announced force majeure at the Lokichar oil development in Kenya.

Myer also pointed out that exploration drilling, which had only just started to recover from a sharp fall after the 2014 price crash, will be down by more than 50% in 2020.

“So far, three high-impact exploration wells have completed offshore Egypt, and Westwood expects only three to four more wells to be completed during the rest of the year,” he said.

Licensing rounds

Rystad Energy estimated that 54% of the world’s planned licensing rounds might be canceled this year due to the oil price drop, job cuts and work disruptions due to COVID-19.

Major oil-producing countries in Africa have seen delays in FIDs while new licensing rounds have been canceled or postponed, Harriet A. Okwi, consultant and director with Okwi & Partners, told E&P.

“With the exception of Liberia, which launched a digital licensing round in April 2020, all other licensing rounds in Mozambique and Tanzania are on hold, while Senegal has extended application deadlines,” she explained.

In addition, virtually all oil and gas projects and licensing rounds in Equatorial Guinea are on hold as the country braces for an extended oil downturn because of the pandemic, according to a recent statement by Gabriel Obiang Lima, minister of hydrocarbons. To keep investments flowing into the nation’s energy industry, Lima also has granted oil and gas companies two-year extensions on their exploration programs.

Project delays

Project delays or cancellations not only pose a challenge to established oil- and gas-producing countries such as Nigeria and Angola, which have been counting on new development projects to offset declining production of mature fields, but also the new players including Senegal, Mauritania, Uganda and Mozambique, which had plans to monetize large discoveries within the next few years, according to a report by Africa Oil and Power.

Several high-profile African projects could be canceled or postponed indefinitely such as Shell’s Bonga South West, BP’s Palas-Astraea-Juno in the Gulf of Guinea and Eni’s Mamba gas project offshore Mozambique, according to a report by Westwood Global Energy Group. Total also has suspended the development of its short-cycle satellite field projects in Angola, located near the operator’s large offshore installations.

It’s worth noting that the substantial reduction in capex budgets of Eni and Total have had a significant impact on African oil production since the two oil majors are the leading hydrocarbon producers of the region.

In Mozambique, Exxon Mobil has delayed its FID on its natural gas project in the Rovuma Basin.

“Due to the pandemic, upstream projects are being delayed due to capex constraints or physical impediments, prompted by movement or other restrictions,” Okwi said. “A notable delay that is directly linked to capex constraint is Exxon Mobil’s $30 billion project in northern Mozambique. FID was expected in March 2020 but has now been moved to sometime next year.”

The report by Africa Oil and Power noted, “While the outcome of many large-scale projects remains unknown as companies continue to review their portfolios, several projects remain on track, either because they are considered low cost due to the size of the fields involved or because capital-intensive infrastructure has already been laid.”

In February Total announced that its Mozambique LNG project is still projected to come online before 2025. Meanwhile, Equatorial Guinea’s Gas Mega Hub project continues onward, with first gas from the Alen Field to backfill the LNG plant projected to come online by November, which would be ahead of schedule and initial projections for the first quarter of 2021.

Recovery path

Given the current operational and cash flow challenges, governments of African nations should be flexible about license terms for recovery in the short term, Myers said. He added that stable policies and effective regulations, transparency and good governance are necessary to attract capital.

“In the medium term, major producers should focus on maximizing economic recovery, incentivizing infrastructure-led exploration, shortening cycle times, [and] driving down costs and greenhouse-gas emissions from operations, which will all be significant factors in sustaining investment and arresting falling production,” he explained.

Africa’s oil and gas future is more tied to gas, Myers said, adding that two out of the top three plays globally in the last five years were in Africa, both of which were gas plays—the Zohr play in Egypt and the Tortue play in the MSGBC Basin. However, no new billion-barrel-plus oil play has emerged in Africa for 13 years despite 132 frontier play tests.

“Globally 36 Bboe of discoveries are stalled at the appraisal stage, half of which are in Africa. Discovery-to-production cycle times are longer, and minimum economic field sizes are bigger in Africa than other regions. Working out how to commercialize [underdeveloped gas] will be key to Africa’s energy future,” he added.

For recovery in the current low crude oil price environment, Okwi said international oil companies must reassess their spending plans, make radical cuts and be extremely selective on where to deploy capex.

However, for the longer term, a conducive investment environment will attract investors.

“A clear and transparent legal framework, along with a track record of upholding contract sanctity can aid recovery,” Okwi said.

Recommended Reading

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.