(Source: Have a nice day Photo/Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

[Editor's note: This article originally appeared in the January issue of E&P Plus. It was originally published on Jan. 4, 2021. Subscribe to the digital publication here.]

The U.S. oil, gas and chemicals (OG&C) industry brought the country to an era of energy security on the back of its nearly 1.5 million-strong workforce. This talent enabled the upstream shale boom and downstream energy renaissance in the country, and the industry in turn rewarded its workforce generously with large paychecks. In fact, the U.S. energy and utility sector had the highest median salary of any industry in the S&P 500 in 2018.

However, supply from this boom started running ahead of oil demand. The result? Oil started its longest and deepest downturn in 2014, and the growth narrative changed into mass layoffs of about 200,000 employees between 2014 and 2016. The COVID-19-led lockdowns and the resulting oil price crash to negative levels exacerbated the situation, leading to the fastest layoffs in the industry: about 107,000 workers were laid off between March and August 2020.

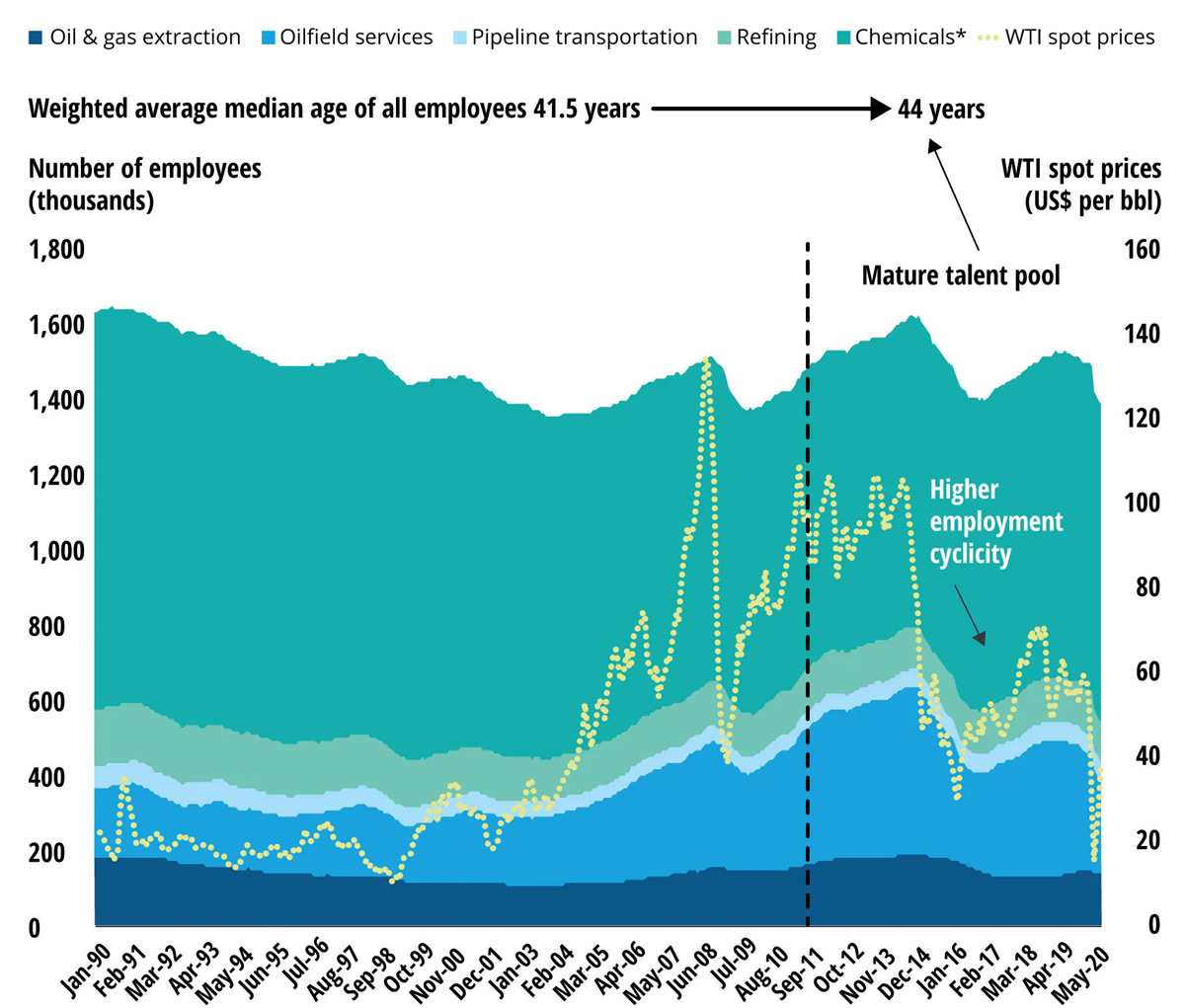

Put simply, the industry’s reputation as a reliable long-term employer could be damaged by rising cyclicality in its employment due to the short-cycled nature of shales and higher sensitivity of employment to oil prices. During 2014 to 2019, every dollar change in oil prices affected 3,000 upstream and oilfield service jobs, as against 1,500 in the 1990s. Although the industry is not in a hiring mode currently, retaining its existing top employees and tackling the challenge of an aging workforce (median age of above 44 years) will likely be among its prime concerns in 2021 (Figure 1).

Disruption beyond workforce

The OG&C industry is in a great compression where companies’ room to maneuver is restricted by multi-decade low prices, unforeseen demand destruction and changes in end-use consumption due to mass telecommuting, mounting debt loads and a renewed focus on health from COVID-19. The compression is not challenging the talent landscape alone, but it is impacting three deeply interconnected dimensions of organizations—the nature of the core hydrocarbon work (the work), who is best suited to do the work (workforce) and where the work can be done in a highly efficient way even in a remote working arrangement (the workplace).

Work: In addition to shifting roles from human-operated to digitally powered remote operations centers, COVID-19 has accelerated the prospect of peak oil demand, degraded investor appetite for fossil fuels, renewed focus on the energy transition and permanently altered mobility trends. Although nations are easing COVID-19-led lockdowns, oil transportation demand associated with local office commute and international travel is expected to remain below pandemic levels in 2021.

Workforce: With 53% of oil and gas workers highlighting job security as a concern and COVID-19 shifting toward the health and well-being of people, the flow of incoming young talent desiring flexible working conditions and a green footprint could drop significantly. Moreover, strict on-field presence of some roles and limited career mobility for highly specialized roles could put the OG&C workforce at a disadvantage. This raises a deep-seated question: How can the industry stop organizational challenges from snowballing into acute business problems?

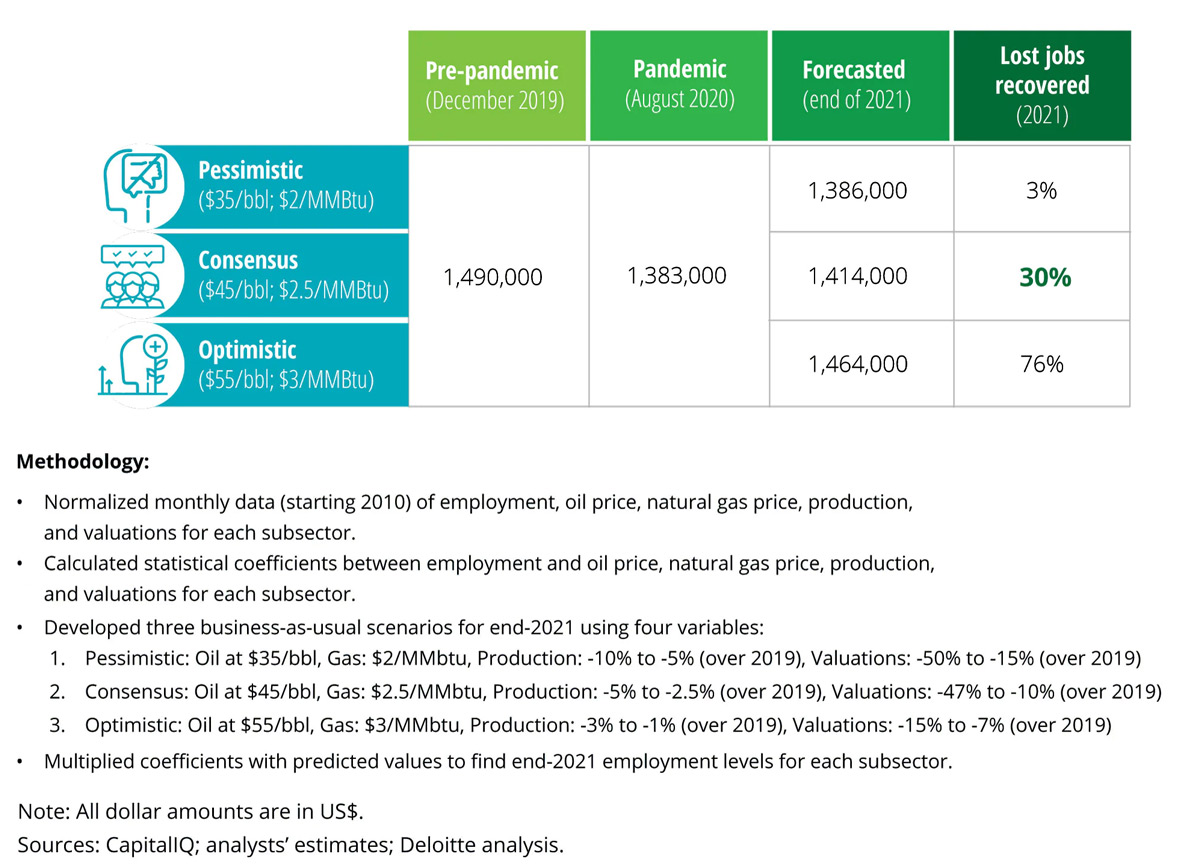

Workplace: Despite the focus on workplace safety, the industry’s fatality rate is substantially higher than in other industries. With a majority of the workforce off-field due to the pandemic, mitigating risks (including regulatory compliance and cyber) and ensuring continuity of key tasks become challenging. One of the critical areas, for example, is regular inspection and maintenance of wells and plants, which typically require personnel and technicians on site. Similarly, processing petabytes of data from home screens without a secure remote environment isn’t easy. In fact, less than 1% of U.S. OG&C employers offered flexible workplace arrangements before the pandemic. The new trend of home-based workers shouldn’t be seen as transitory—as it impacts behavior and may become an expectation in the post-COVID-19 world. The cost of waiting out this downturn could be very high for the industry. If the industry continues to chase price cycles and follow the traditional work-workforce-workplace strategy, about 70% of jobs lost in the pandemic may not come back by the end of 2021 in a $45/bbl business-as-usual scenario (Figure 2). Are there any bright spots then?

The four levers of transformation

COVID-19 has given organizations the much-needed push to transform themselves and find new ways to reclaim their earlier appeal. How? The four levers of transformation: energy transition, integrated human-machine collaboration, recoded careers and organizational agility. These could push OG&C organizations into the future.

Sustainability as a way of business: With the return on invested capital of oil and gas companies (6% to 8%) now at par with top renewable energy companies, organizations can craft a new carbon-free energy agenda. But that requires a structured pathway—from adhering to the bare minimums (foundational HSE requirements) to laying building blocks (advanced electrification, emissions and efficiency measures) to developing new blueprints (portfolio of low-carbon fuel mix, energy sources, green and service-oriented businesses like carbon capture) to finally winning the future (a license to operate and lead in a clean-energy economy, and influence net-zero paths of consumers). A net-zero pathway, with tangible medium-term targets, is essential for the industry’s current and future workforce to gain the social and economic license to work in this industry.

Digital to transform the way of working: While advanced technologies brought higher efficiencies in the industry, many companies still struggle to choose from myriad technologies or quantify their return on investment. COVID-19 presented a new mandate-cum-challenge to put people along with operations at the core of digitalization efforts. Though projects virtualizing on-field assets and data were underway before COVID-19, the pandemic accelerated the need to mitigate HSE risk by leveraging more cloud-based platforms without disrupting operations. Nevertheless, the final stage of digitalization entails educating partners and the workforce through immersive platforms and ultimately virtualizing the business through technology-enabled, human-driven decision-making using the technology-as-a-service model.

Recoded careers to build the workforce of the future: There is a dichotomy for the OG&C industry: big layoffs amid the great crew change. Negative image, HSE concerns, rigid demographics, excessive specialization and possible knowledge drain are some of the challenges along the career life cycle that are fueling this gap. Organizations need to promote sustainability, offer new digital and remote ways of working, add a distributed workforce to the mix, pair millennials and perennials, and build a sense of pride among its workforce. Also, traditional hierarchical structures need to be broken to hire and engage the workforce of the future. Like organizations, employees have to do their bit. Employees need to reequip themselves with the right mix of technical, professional and digital skills to do the work of tomorrow and co-lead the change for the industry.

Organizational agility for new business models: Usual operational performance levers are either plateauing or giving dwindling gains due to limited room to reduce costs further. Thus organizational—and not operational—agility is the way forward. This may be achieved in four ways:

- Redraft organization-wide operational vision by driving down costs and programs that are not aligned with new ways of working;

- Variabilize fixed cost structures by outsourcing and offshoring intelligent process automation on cloud and by structurally reducing SG&A costs;

- Explore flexible and scalable resource models by shifting task-based, on-demand, transactional roles to off-balance sheet resource models that lower fixed costs; and

- Embrace open energy systems by forging a multisided platform of operators, suppliers and potential talent to streamline the ecosystem through timely estimation and management of material and services.

Building an organization of the future

Expecting blanket transformation across the industry or even an organization is unwise. But piecemeal transformation and solutions (i.e., tweaking existing processes and throwing in a few cyclical solutions) could yield suboptimal results in the post-COVID-19 environment.

The coming years are likely to be pivotal in determining the path of the OG&C industry at large. Naysayers may call the new normal part of the industry’s cyclicality. However, organizations that see the coming decade as an opportunity for transformation will likely outlive this compression and may even lead the industry into the future of work. But for that, fundamental changes and a new mandate must come from the top. Leaders will have to constantly probe their plans, take hard business decisions and course correct to deliver added value. Such continual self-assessment will likely go a long way in generating a resilient company.

After all, the end goal in building successful OG&C organizations of tomorrow and tackling these questions is simple: making bold choices today to make sustainable energy the core work of tomorrow, expanding job canvases of the workforce by creating redesigned, cyber-physical teams and fungible roles, and embracing a digital workplace culture that remains open to future innovations. Can this happen? Why not? The industry has transformed itself in the past and may do it again in the next decade.

Editor’s note: References available. Article was written in late October 2020.

Recommended Reading

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

First Solar’s 14 GW of Operational Capacity to Support 30,000 Jobs by 2026

2024-02-26 - First Solar commissioned a study to analyze the economic impact of its vertically integrated solar manufacturing value chain.

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.

SunPower Begins Search for New CEO

2024-02-27 - Former CEO Peter Faricy departed SunPower Corp. on Feb. 26, according to the company.