(Source: Willyam Bradberry/Shutterstock.com)

[Editor's note: A version of this story appears in the July 2020 edition of E&P. It was originally published July 1, 2020. Subscribe to the magazine here.]

The offshore wind industry is maturing, and the low-hanging fruit of easily accessible shallow-water sites have been developed. Sites now under consideration are deeper and farther from shore.

In water depths up to about 30 m, monopiles are the most suitable and widely installed type of foundation. Beyond this, it is generally accepted that the limiting water depth for the commercial viability of bulkier jacket foundations is about 50 m to 60 m. Going deeper, floating foundations should become technically viable options.

However, the potential for greater wind speeds farther out at sea could balance the increased installation costs of projects in deeper waters. The U.K. government’s Department for Business, Energy and Industrial Strategy recently announced changes to the contracts for difference scheme to allow a separate strike price for floating wind projects at water depths greater than 60 m. This shows that U.K. policymakers are committed to supporting floating wind and deem 60 m as the turning point for fixed to floating structures.

There are currently several large leasing areas known as Scotwind sites that are located in deeper waters around Scotland, which go beyond the generally accepted limit for jacket foundations. Therefore, it can be tempting to assume floating structures will play a key role in the next leasing round, expected to be announced near 2021. However, techno-economic modeling is fundamental to realize the true economic balance of deeper water.

Techno-economic modeling

With only a few demonstrator projects in the water, floating offshore wind technology is still in its infancy. While there is a huge appetite for floating platforms, the costs remain high. Uncertainty also exists in defining the optimum installation and maintenance strategies and related costs.

However, as larger projects are erected, it is expected that supply chains will become streamlined and economies of scale will reduce floating costs. The Carbon Trust, for instance, states that a 48% reduction in capex could be possible as technologies mature from demonstrators to commercial scale.

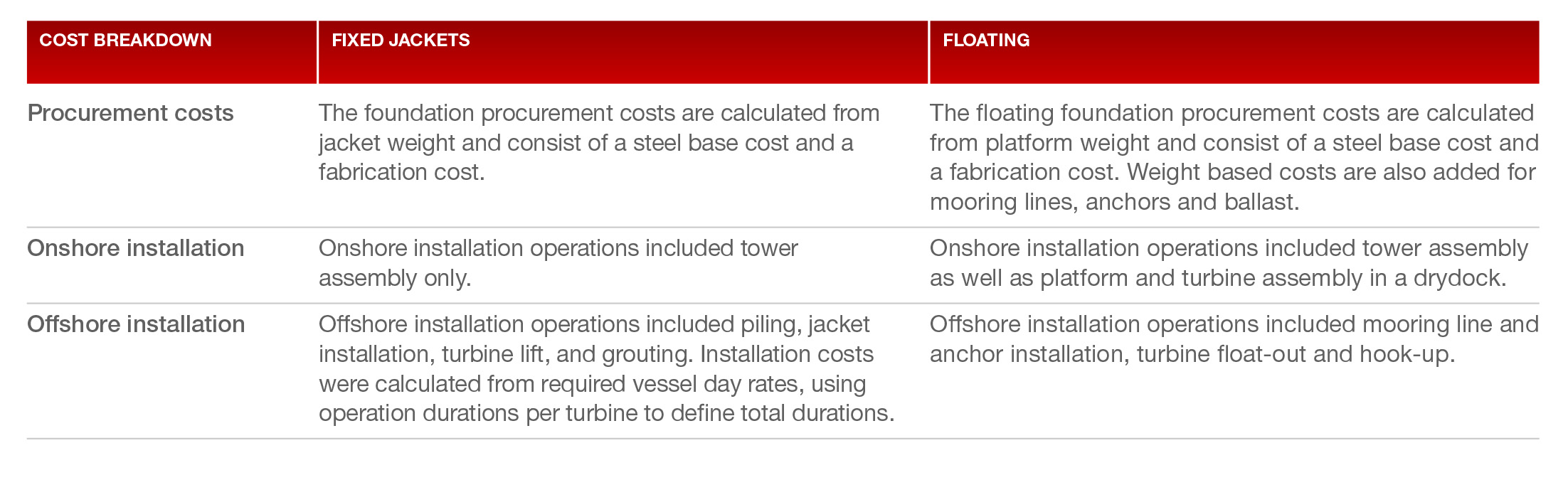

Xodus Group conducted internal modeling of offshore wind projects in sites of varying bathymetry, exploring the economic viability of jackets and floating foundations at water depths beyond 60 m. In the analysis, a semisubmersible platform was compared to jacket foundations, both sized for the same site using corresponding metocean and geotechnical data. The turbine size considered was 12 MW and the project capacity 1 GW. For the sites in question, only offshore installation was more expensive for jackets than floating. As the purpose of the modeling was comparative, identifying costs that differentiate fixed from floating was key (Figure 1).

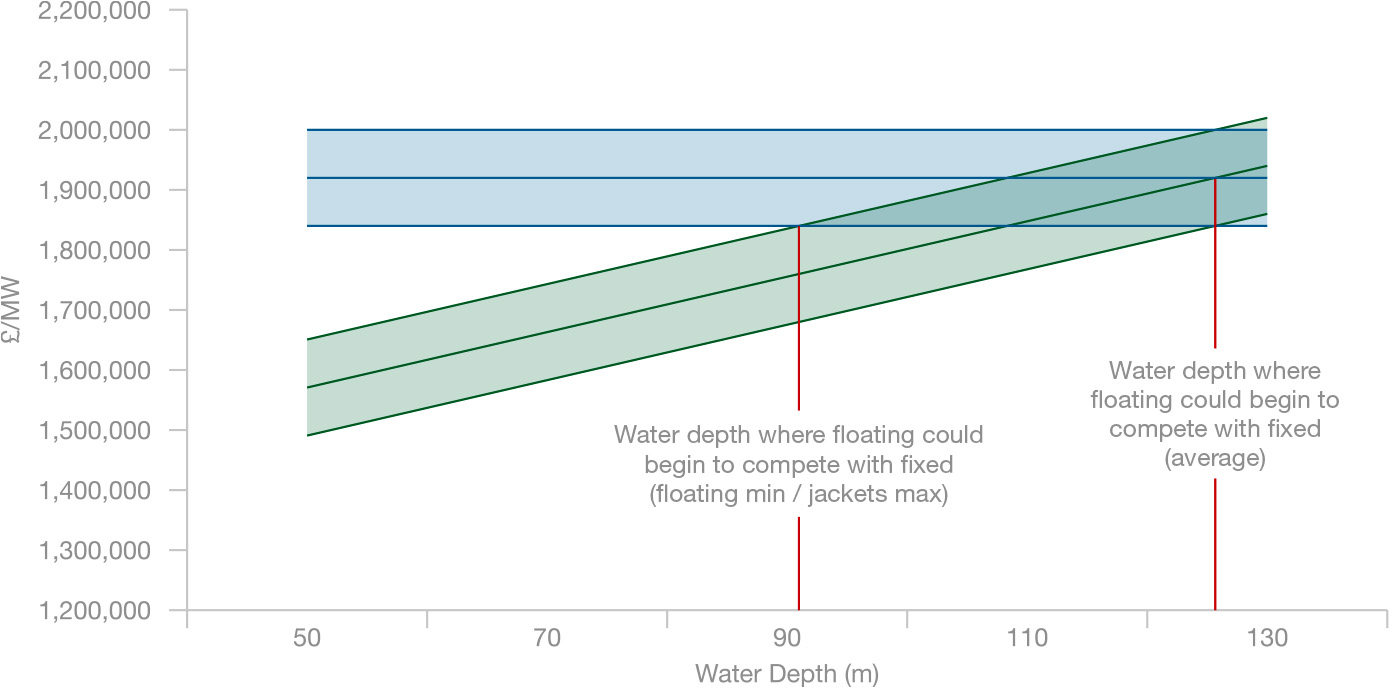

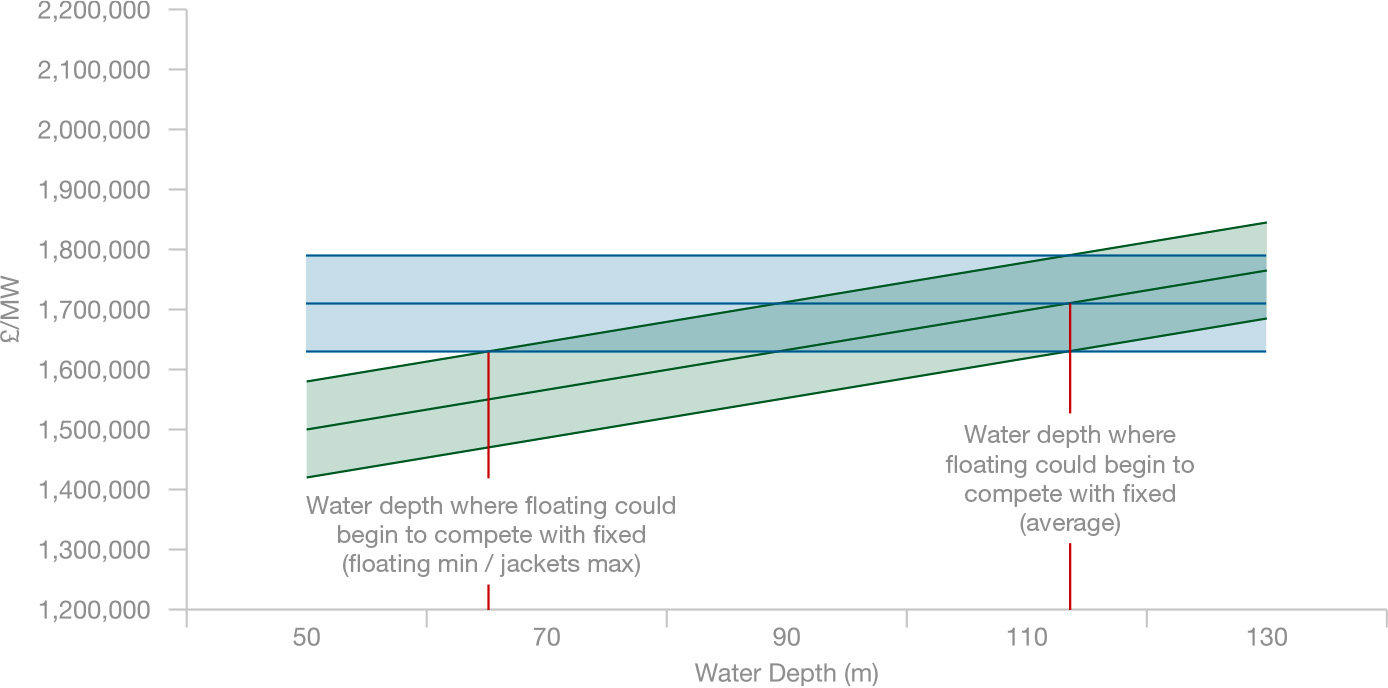

The analysis focused on generic sites on the east and west coast of Scotland and considered water depths from 40 m to 90 m. The analysis was performed with current costs and predicted cost reductions for 2030. The results of the analysis are shown in Figure 2 as capex/MW against water depth.

The high-level comparison energy yield was widely similar for the two technologies, but the greatest cost differences arise from installation and procurement. Conversely, opex costs are highly dependent on site conditions, distance to the port and the type of floating foundation considered. Hence, capex is visualized in Figure 3 to provide a more transparent and general comparison of the two foundation types.

Overall, the results for the leveled cost of energy were reasonably consistent with capex trends. Notably, jacket and floating platform sizing were only carried out at a high level and no detailed design was undertaken at this point.

The results show fixed foundation capex increases almost linearly with depth, whereas floating costs remain quasi-static. This means that floating structures remain significantly more expensive even at water depths considerably beyond the 60-m threshold.

The 2020 plot shows the uncertainty ranges first crossing at about 90 m, implying that this is the minimum water depth floating could start competing on a purely cost basis with fixed. In the 2030 graph, this minimum threshold has decreased to 65 m. The average value lines cross only at 115 m, and the extreme ranges beyond the scale of the graph, indicating a large range for the actual location of the crossover point. The uncertainty range in the 2030 graph is wider because of the greater ambiguity in learning rates used in the analysis. Running the model for both floating and fixed cases for several different sites supported this trend.

The steep learning curve expected for floating technology was examined, as this is likely to bring down installation, operation and procurement costs. For a fair comparison, in the 2030 case, a learning rate was applied to both floating and jacket foundations. As jackets are considerably more established than floating, the learning rate applied to jackets was only a third of that applied for floating. This accounts for research and innovations in novel maintenance strategies, improved design and development of supply chains.

A more detailed analysis of the cost drivers also was investigated. Even with the expected cost reductions applied, 60 m appears low for the generally accepted transition point.

Cost drivers

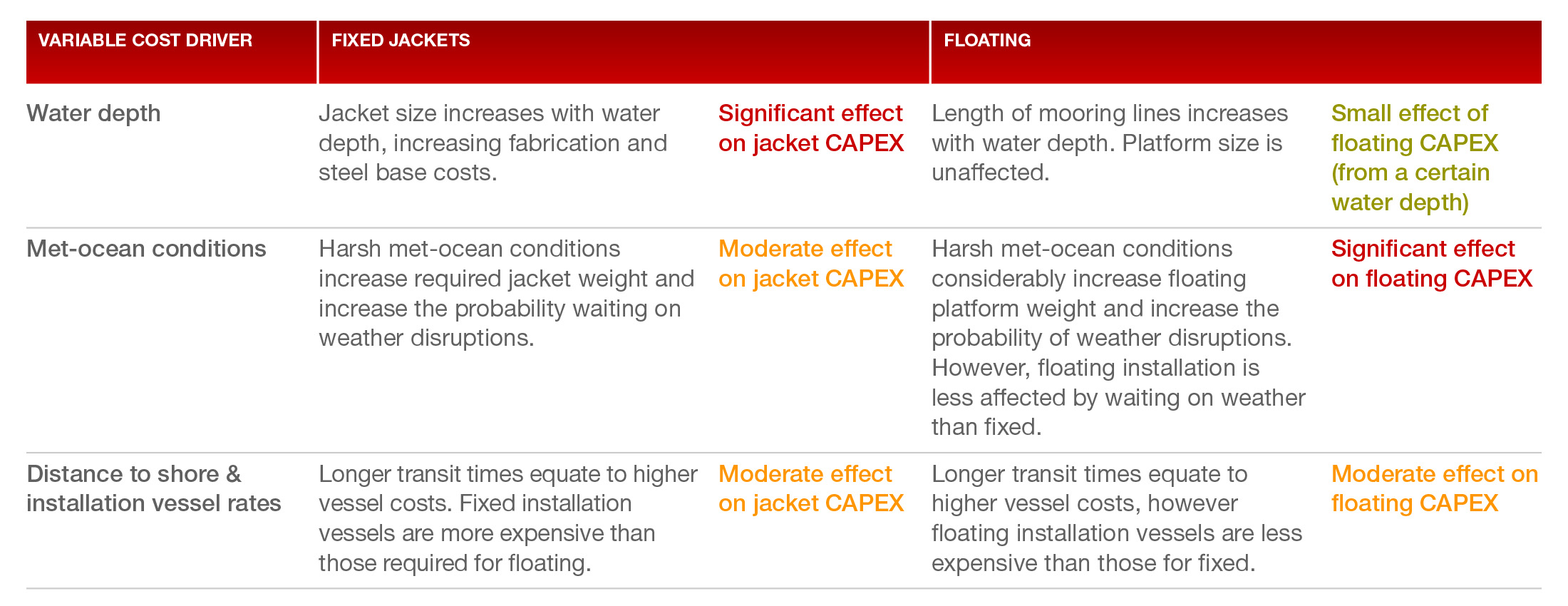

The key parameter in the cost driver analysis is foundation weight. It dominates over all other criteria, and the crossover depth is only achieved when the weight of the fixed jackets equates to that of the floating platform (Figure 4).

For fixed foundations, the jacket weight is defined by the water depth, wind, wave and current loading. Floating platform weight is unaffected by water depth, except for a relatively small change in mooring line length. Instead, metocean conditions define the size of the floating platform required to maintain tower tilt, natural period and loading within acceptable limits. Two conclusions relating to the crossover water depth can be drawn from this.

First, the crossover water depth is likely to be lower for a platform design lighter than the semisubmersible, such as a tension-leg platform. Second, the crossover water depth will vary depending on metocean conditions at the site.

Other challenges that are not quantified in the analysis can have a significant impact on installation costs. For example, construction port selection and availability and, due to limited experience, costs are likely to arise as the technology moves from concept to commercialization. Extreme water depths also create new problems for jacket installation such as storage space constraints, limited crane life capacity and increased installation duration.

Conclusions

The results should not be taken to mean that floating will only ever be competitive with fixed at extreme depths. Indeed, it is expected that changes to the contracts for a difference scheme will likely accelerate development, and learning rates will be at the higher end of previous predictions.

Xodus consultants believes the commercialization of floating offshore wind will be a case of when rather than if. The gradient of the learning curve will depend on the progress of research, successes of demonstrator projects and the amount of investment into required infrastructure.

The results reveal that the tipping point between commercial viability of fixed and floating foundations could be at a greater water depth than previously expected. Furthermore, the decision between floating and fixed is not dictated merely by water depth but by a combination of factors.

Identifying the most suitable project concept option should be done through detailed techno-economic analysis, and fixed jackets could potentially be seen in unexpectedly deep waters.

Recommended Reading

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.

BP: Gimi FLNG Vessel Arrival Marks GTA Project Milestone

2024-02-15 - The BP-operated Greater Tortue Ahmeyim project on the Mauritania and Senegal maritime border is expected to produce 2.3 million tonnes per annum during it’s initial phase.

Equinor Receives Significant Discovery License from C-NLOPB

2024-02-02 - C-NLOPB estimates recoverable reserves from Equinor’s Cambriol discovery at 340 MMbbl.

CNOOC Makes 100 MMton Oilfield Discovery in Bohai Sea

2024-03-18 - CNOOC said the Qinhuangdao 27-3 oilfield has been tested to produce approximately 742 bbl/d of oil from a single well.