EP Energy Corp. is set to transform into a two-basin operator following the recent announced sale that will mark the Houston-based company’s exit from the Permian.

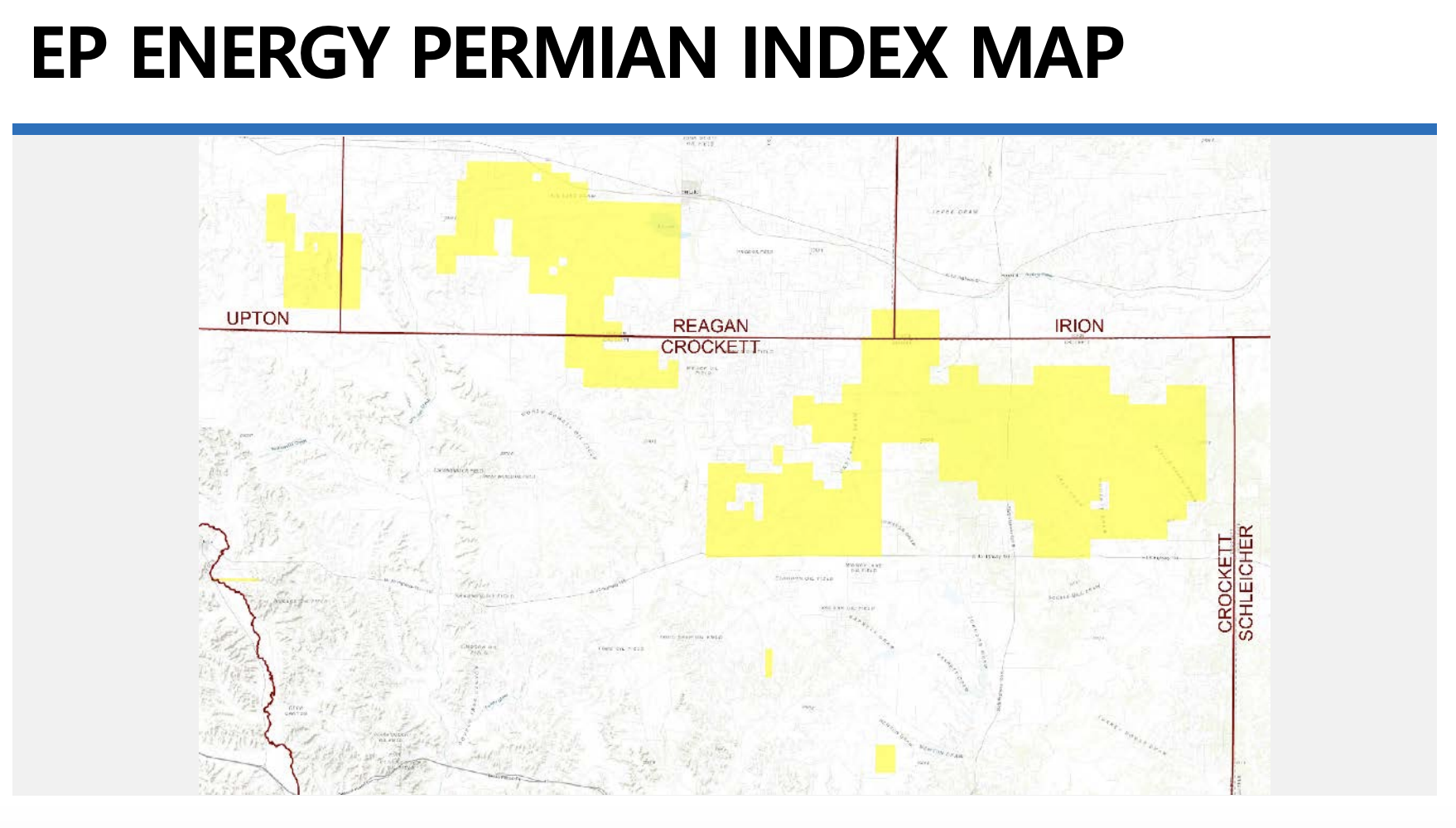

In a Dec. 11 company release, EP Energy said it had entered a purchase and sale agreement with an undisclosed buyer to divest its assets located in the southern Midland Basin. The company holds a large contiguous acreage position in the basin currently focused on the Wolfcamp Shale in Crocket, Irion, Reagan and Upton counties, Texas, according to its website.

Following closing of the Permian divestiture expected by the end of January, EP Energy will become a two-basin operator with positions in northeastern Utah and the Eagle Ford Shale.

“We are very pleased to announce this transaction that enables EP Energy to core up its portfolio and significantly reduce debt,” Russell Parker, president and CEO of EP Energy, said in a statement on Dec. 11.

EP Energy didn’t disclose the terms of the transaction. However, the company said it intends to use proceeds from the sale to reduce borrowings under its reserve-based loan facility.

In early October, EP Energy emerged from Chapter 11 bankruptcy, successfully completing a financial restructuring that it said reduced its pre-petition debt by approximately $4.4 billion.

As part of the reorganization, EP Energy closed on a new $629 million RBL facility from the company’s existing revolving loan lenders. At the time, the company had over $200 million of available liquidity and approximately $400 million of debt net of unrestricted cash, according to an Oct. 1 release.

Pro forma for the Permian divestiture, the company expects to end 2020 with roughly $100 million of net debt and a net debt to adjusted EBITDAX at approximately 0.3x.

“Post the divestiture, EP Energy will have minimal leverage, a strong liquidity position and an asset base that can generate attractive returns and free cash flow in the current price environment,” Parker continued in his statement.

Pro forma for the divestiture, EP Energy will own approximately 410,000 gross (275,000 net) acres in Northeastern Utah and the Eagle Ford. Average daily net production for third-quarter 2020 pro-forma for the transaction was 48,400 boe/d comprised of 31,600 bbl/d of oil.

Recommended Reading

Exclusive: Tenaris’ Zanotti: Pipes are a ‘Matter of National Security’

2024-04-12 - COVID-19 showed the world that long supply chains are not reliable, and that if oil is a matter of U.S. national security, then in turn, so is pipe, said Luca Zanotti, U.S. president for steel pipe manufacturer Tenaris at CERAWeek by S&P Global.

Exclusive: Sabine CEO says 'Anything's Possible' on Haynesville M&A

2024-04-09 - Sabine Oil & Gas CEO Carl Isaac said it will be interesting to see what transpires with Chevron’s 72,000-net-acre Haynesville property that the company may sell.

Exclusive: Liberty CEO Says World Needs to Get 'Energy Sober'

2024-04-02 - More money for the energy transition isn’t meaningfully moving how energy is being produced and fossile fuels will continue to dominate, Liberty Energy Chairman and CEO Christ Wright said.

Chesapeake, Awaiting FTC's OK, Plots Southwestern Integration

2024-04-01 - While the Federal Trade Commission reviews Chesapeake Energy's $7.4 billion deal for Southwestern Energy, the two companies are already aligning organizational design, work practices and processes and data infrastructure while waiting for federal approvals, COO Josh Viets told Hart Energy.

Exclusive: Calling on Automation to Help with Handling Produced Water

2024-03-10 - Water testing and real-time data can help automate decisions to handle produced water.