Drilling crew in the San Andres Play in Yoakum County, Texas, in the summer of 2017. (Source: Hart Energy)

Exploration and production companies focused on lowering their capex and generating more free cash flow during the fourth quarter as oil prices remained range bound at $50 to $55 a barrel.

“While this strategy shift has been the primary demand from investors, the stock price reaction to these new plans was widely dispersed,” said William Featherston, an analyst with Credit Suisse, in a research report. “This is because [generally] lower spending results in slower production growth, which decreases NAV and expands EBITDX multiples [bad for the current E&P investor], while it only minimally improves near-term free cash flow.”

The quarter produced disappointing results overall with less than half of E&Ps that beat consensus for the total production, but most exceeded oil volume expectations, he wrote.

RELATED:

E&P Earnings Recap Part II: Lower Oil Prices Dampen Results

E&P Earnings Recap: Mixed Results From Anadarko Petroleum, Oxy, Others

“We’d also note another 10 E&Ps missed Street production expectations, while nine E&Ps delivered fourth quarter volumes in line with consensus,” Featherston wrote. “But 16 oil-focused E&Ps [out of 29 total] beat consensus on oil production with just five missing Street oil estimates. Perhaps most notably, within our group of nine Permian E&Ps only three beat consensus oil volume forecasts [five were in line] and six came up short on EBITDX expectations.”

The fourth-quarter cash flow per share Houston-based natural gas producer Cabot Oil & Gas Corp. (NYSE: COG) reported was “in line as production was 1% above consensus, but gas prices were better,” wrote Leo Mariani, equity research analyst at KeyBanc Capital Markets. The company’s net income was $275 million or $0.64 per share, compared to net loss of $44.4 million or $0.10 per share in the prior-year period.

Cabot Oil & Gas lowered its 2019 capex guidance by 3% and reduced its production guidance by 2.5%. The new first quarter 2019 production guidance was 6% below consensus, he wrote.

“We are maintaining a sector weight rating on [Cabot] due to our expectation that natural gas prices stay flattish in 2019,” Mariani said.

Cabot, which has core operations in the Marcellus Shale within the Appalachian Basin, will have a solid year assuming a 2019 Henry Hub gas price of $3.10 with shares trading at a fair value range of $23 to $26, he added.

“Cabot’s greatest risk going forward is a weakening of commodity prices, exclusively on the natural gas side,” he said. “This would reduce [Cabot’s] returns on its drilling program, impact cash flow, and might slow its future production growth rates. [Cabot] has reasonable hedge protection with respect to natural gas, which exposes it to slightly less variability.”

Carrizo Oil & Gas Inc. (NASDAQ: CRZO), a Houston-based producer with positions in the Eagle Ford Shale and the Permian’s Delaware Basin, reported net income of $255.1 million or $2.75 per diluted share and net cash provided by operating activities of $188.3 million.

“[Carrizo] reported slightly weaker fourth quarter cash flow per share on lower pricing,” Mariani said.

With first-quarter 2019 production guidance 6% below consensus, Carrizo’s stock will maintain its overweight “due to its slightly discounted valuation versus peers and its likely high-beta reaction to an upside move in oil prices, which we expect to see,” he added.

The price target is $14.50 with an assumption of 2019 West Texas Intermediate (WTI) oil price of $55 and a Brent oil price of $64, Mariani said.

The “greatest risk” to the price target is a weakening of commodity prices, especially on the oil side, he said.

“This would impair [Carrizo’s] returns on its drilling inventory and put some added strain on the

company’s balance sheet,” Mariani said. “[Carrizo’s] current leverage is slightly above peers, though we expect the company to spend close to cash flow in 2019.”

One advantage for the producer is that it is very well hedged in 2019 and has less potential oil weakness compared to its peers. However, Mariani noted that Carrizo faces operational and execution risks which could prevent the company’s shares from reaching the price target, especially in the Delaware Basin where there is concentrated industry activity.

“The Delaware Basin where [Carrizo] operates is one of the most active areas of drilling in the U.S. and any difficulty in obtaining services and supplies as well as any potential infrastructure bottle-necks could negatively affect the company,” he said. “Lastly, [Carrizo] is also subject to reservoir risk in the Eagle Ford Shale as the play has been heavily drilled over time, making future well and overall field performance a bit more uncertain.

Denver-based Jagged Peak Energy Inc. (NYSE: JAG) reported revenue for the fourth quarter of $138.5 million, compared to $104.4 million in fourth-quarter 2017. The increase in revenue was a result of the 60% increase in production volumes. The company also reported net income of $186.3 million or $0.87 per diluted common share.

2018 Earnings: February 2019)

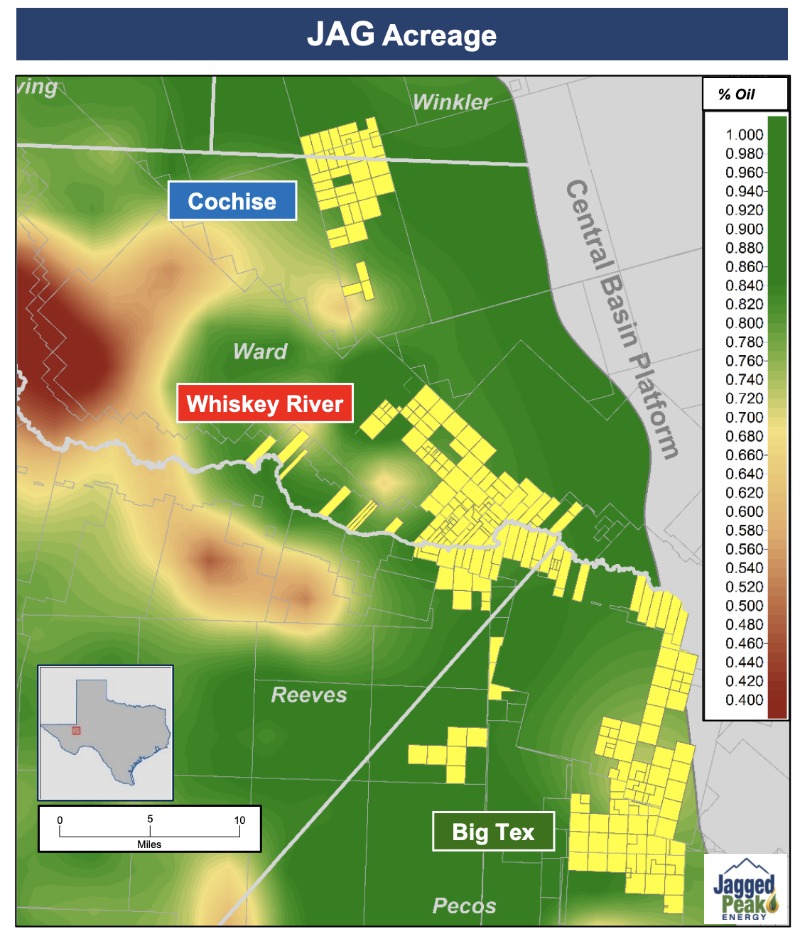

The pure-play Permian Basin company with a core position in the Southern Delaware Basin has a sector weight rating based on its outsized capital outspend in an uncertain oil market, Mariani said. Plus, uncertainty surrounds drilling results of Jagged Peak’s Big Tex acreage in 2019. The company plans to bring five wells in the Big Tex area online, one of which will target the Woodford with the remaining targeting the Wolfcamp A Formation.

Jagged Peak’s cash flow per share was 8% below consensus. Meanwhile, the company’s production of 38,413 barrels of oil equivalent per day was 1.4% above consensus and oil production of 29,050 barrels per day was 1.5% below consensus. The fourth-quarter adjusted cash flow per share of $0.47 was $0.04 below consensus due to slightly lower realized oil and gas pricing, the report said.

Jagged Peak’s “financial leverage is in line with peers, though we expect cash flow outspends through 2019,” Mariani said. “[Jagged Peak’s] leverage is in line with peers, with 2019 net debt/EBITDA of 1.1x. Additionally, [Jagged Peak] has good liquidity with $540 million of revolver capacity and $35 million of cash. However, we expect [Jagged Peak] to outspend cash flow in 2019 by around $205 million with WTI at $55, which will erode a lot of this liquidity.”

Recommended Reading

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.

Marketed: Stone Hill Minerals Holdings 95 Well Package in Colorado

2024-02-28 - Stone Hill Minerals Holdings has retained EnergyNet for the sale of a D-J Basin 95 well package in Weld County, Colorado.