Presented by:

In an era where few privates are finding exits for IPOs, one Permian Basin operator bucked the trends and entered the public markets through an approach rarely seen in the industry. In February, Riley Permian completed a reverse merger with Tengasco Inc. in an all-stock transaction that provided the Oklahoma City-based Riley Permian the IPO it had sought for years and without much fanfare.

In March, the new company began trading on the New York Stock Exchange under the symbol, “REPX.”

“Starting in January 2020, we got introduced to Tengasco as a reverse merger candidate,” said Riley Permian president Kevin Riley. “We’d seen other reverse merger candidates along the way, but everyone seemed to have a little bit of hair on them, or we couldn’t get evaluations done right, or they had assets which clouded the picture. So, we were never really able to move very far along with other opportunities. But once we saw Tengasco—a pretty clean company with a very small asset base in Kansas—we thought it probably made sense.”

Once the merger was complete, Riley Permian offloaded the Kansas assets and established its board. Its members now consist of chairman and CEO Bobby Riley, independent director Bryan Lawrence, director and CFO Michael Rugen, independent director Brent Arriaga and independent director E. Wayne Nordberg.

ROTH Capital Partners served as financial advisor for Tengasco, while Truist Securities represented Riley Permian. di Santo Law and Thompson & Knight served as legal counsel on the deal.

Under the terms of the merger agreement, Tengasco issued about 203 million shares of Tengasco common stock to Riley members at the closing of the transaction. At closing, Tengasco conducted a 1-for-12 reverse stock split, resulting in a reduction of outstanding shares of the combined company to about 18.7 million shares of common stock.

Riley Permian announced in its fiscal second-quarter financial report (ending March 31, 2021) that it had raised its dividend, which it has been paying—as a private company—for 10 consecutive quarters, to $0.28 per share.

Making a move

The go-public move for Riley Permian was the culmination of two years of start-and-stop IPO flirtations.

“Riley was formed with the intent of eventually becoming a public company, and that was back in 2017,” Kevin Riley said. “And as we grew the company, we attempted the IPO route a couple of times over that period, and just a traditional IPO never really was available or materialized for the company just because the markets weren’t there.”

In 2018, Riley Permian, whose equity sponsors included Yorktown Partners, Bluescape Energy Partners and Boomer Petroleum, launched a $115 million IPO with more than 6.6 million shares of common stock, but ultimately pulled that back because of unfavorable market conditions. “Riley attempted to do an initial public offering in a traditional way in 2018, but the market turned on them,” said Alex Montano, managing director, investment banking at ROTH Capital Partners and advisor to Tengasco on the deal. “After that, we were engaged to do a modified IPO for them in late spring of 2019. We went out, we tested the waters, we had feedback. The decision was made for Riley to commence paying a quarterly dividend.”

ROTH believed that strategy would transform the story a bit, but eventually deferred on the IPO.

“But what we knew from that experience was that Riley was ready to go public,” Montano said. “We knew that Riley was a good public company candidate. On the flip side, we’ve been developing a relationship with Tengasco over a number of years.”

Montano said that Tengasco was a “very tiny” E&P company, but “very clean” with no concerning liabilities.

“They were basically not bleeding money,” he said. “So it was a good public platform. We knew that the [Tengasco] board had looked at a number of deals over the years. None of them really checked all the boxes. So we were engaged by [Tengasco] in late 2019 to do a formal strategic review process.”

That process kicked off for Tengasco in early 2020, and one of their first calls was to Riley Permian.

“We knew that they wanted to be public, and they were ready to be public,” Montano said. “I think it took a bit of convincing from Yorktown and Bluescape, the public equity backers, that this was a viable way for them to accomplish their going-public goals.”

The parties reached a preliminary agreement in early 2020 and then COVID-19 hit. At that point, everything went on hold. According to Securities and Exchange Commission filings, negotiations between the two paused between March and June. The motivations for Tengasco to pursue the merger meant additional capital, additional exploration opportunities and benefits to the company’s stockholders, among several other issues.

For Riley Permian, in addition to the IPO Tengasco offered, there existed the opportunity to take on very few assets.

“[Tengasco] was relatively clean,” said Philip Riley, executive vice president of strategy and of no familial relationship to other Riley executives. “It was a clean entity without a lot of legacy liabilities, a clean balance sheet and a small set of assets in Kansas, which we subsequently divested in April. Not a large number of employees to integrate, not a lot of corporate leases and headquarters. It allowed for a cleaner merger that wasn’t as costly.”

Riley Permian was initially formed as a wholly owned subsidiary of Riley Exploration Group (REG) in June 2016, which was backed by Yorktown Partners. During 2017, a series of transactions were consummated in which working interests in oil and gas properties and related real property assets in Yoakum County, Texas, were contributed by several parties in exchange for corporate ownership in the newly formed Riley Permian.

Initially, REG and Boomer Petroleum, a family office group in Calgary, contributed their assets in January 2017. Then, in March 2017, Bluescape and DR/CM contributed the remaining working interests on the same set of assets. The 2017 transactions—essentially a merger itself—brought together these disparate interests, which had been governed under standard joint operating agreements among unaffiliated parties, to a cohesive corporate organization, which allowed for more efficient development of the field.

“Simultaneous with the March 2017 merger, the three primary owners—Yorktown, Bluescape and Boomer—invested $40 million of preferred equity to fund the initial development of this asset.” Philip Riley said. “In September 2017, we did a little follow-on of $10 million with the same group.” At the time, Philip Riley was a managing director for Bluescape and led the investment in Riley Permian, serving as a director of the company until joining as an executive in March of 2021.

He said the new company saw the potential for capital discipline and to combine that with a dividend as the new model that just recently came into favor in the industry.

“One of the original objectives was to form a company that could find and develop reserves for less than $10 a barrel,” Philip Riley said. “Fortunately, we met and improved upon that objective. The capital discipline that’s now prevalent in the industry was becoming our standard almost two years ago. As is customary with most startups, we invested more than our cash flow during the first few years to build a production base. But then starting in late 2019, we began investing less than our cash flow, as many companies did during the pandemic, but we were still able to grow meaningfully, unlike most companies.”

Third-generation oilman

Having served as CEO at REG, Bobby Riley was appointed CEO of the new company, as well as chairman of its board of directors and president, in June 2016. Over the course of nearly four decades, he has worked in the oil and gas industry in North America, South America, Europe, Africa and Asia.

Bobby Riley began his career in oil and gas on the service side of the business with Cameron Iron Works in Houston in 1974. Starting in 1991, he served as president of a service company that specialized in well design and reservoir data acquisition. The technologies were deployed in Nigeria, Venezuela and Norway. He founded his first independent E&P, Durango Energy, in 1984. That company operated as many as 150 wells in Oklahoma.

“I was third generation,” Bobby Riley said. “My father was in the drilling business, my grandfather was in the drilling business. And I’m the first one that stepped aside from the service sector and moved into E&P, and I have been doing that for the last 20 years.”

He said he learned early on the ups and downs of the oil and gas business and how to sustain through the times.

“Having grown up in the service sector in the drilling business, this business goes through very extreme cycles, and the service sector especially when the drilling rig is laid down,” Bobby Riley said. “You’re relying upon the rig running and having a customer to work for. And when oil prices are good, the rigs are busy, everybody’s happy, but when oil price takes a dip and everybody lays the rigs down, it’s a layoff.

“But one thing I figured out being on the E&P side is that once you establish production, even though the price of the product may be depressed, you still have a source of revenue coming in, and you can survive to fight another day. I was looking for slower growth and being able to live through the cycles—that was the main reason I went from the service side to the E&P side,” he said.

Permian footprint

Riley Permian’s core assets focus on developing conventional non-shale assets on 65,000 net acres in the Northwest Shelf, with horizontal development in the San Andres. According to its second-quarter 2021 financial report, the company believes the San Andres’ moderate depth leads to lower drilling costs compared with much of the Permian Basin, including the Wolfcamp.

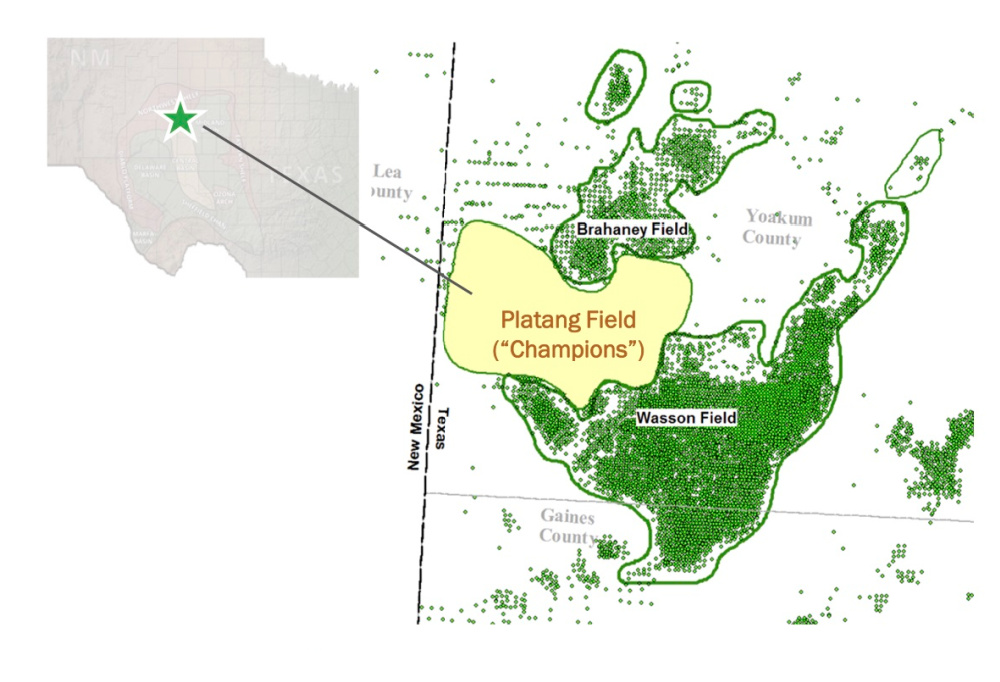

“We don’t consider ourselves to be just any other horizontal San Andres play, which saw a flurry of private equity activity in 2015 with a lot of failures,” Philip Riley said. “We see our asset as an extension of a giant field. We’re sandwiched between the Wasson and Brahaney fields. We’ve got relatively similar subsurface properties as those [fields] with permeability, porosity and oil saturation.”

Second-quarter production for the year averaged about 6,000 bbl/d, with full-year oil production guidance estimated to average 6,300 bbl/d to 6,500 bbl/d. Capex guidance for 2021 was estimated to range from $54 million to $56 million.

Among the allocations for that capital was a seven-well drilling and completion program and investment of $9.1 million in drilling and completion capex, which resulted in drilling five gross wells and the completion of two gross wells.

Riley Permian’s decline profiles compare favorably to vintage wells in the Permian Basin with initial production beginning in 2018. According to Riley Permian’s second-quarter financial report, the company’s 2018 vintage wells were producing at about 50% of their peak month production after 30 months, three times the rate of other Permian Basin shale wells, which after 30 months were producing at less than 20% of their peak month production.

“That’s through primary production,” Philip Riley said. “The reservoirs have excellent natural permeability and porosity. It allows large volumes of fluids to move through the rock to the borehole. They allow for a lighter frac, which is both lower in cost and easier on the environment.”

The company estimates its drilling and completion costs are roughly half the cost of a typical Permian shale well.

Riley Permian management is forecasting the company can grow production by about 20% year-over-year and spend about 65% of its EBITDAX allocation on reinvestment for production growth, Philip Riley said.

“We’re really just trying to reinvest two-thirds of our EBITDA and yet still grow meaningfully compared to others,” he said. “I recognize other large caps face pushback from investors for tempered growth or no growth. We’re small enough where we can still benefit from increased scale. We’re not pushing the needle on the global macro supply picture.”

For the remainder of its EBITDAX allocation, Riley Permian will put about 20% of its capital allocation toward paying its dividend, and up to 15% to interest and debt reduction and working capital.

EOR program

Following the merger with Tengasco, Riley Permian commenced operations on a new EOR program in Yoakum County. The company is forecasting ultimate recovery of up to three times primary recovery methods.

“We find ourselves in a very interesting geography and geology,” Philip Riley said. “We’re in a region of the country with the most concentrated area of CO₂ pipeline infrastructure directly adjacent to our asset. We’re directly adjacent to several of the largest EOR projects in America.”

The company has collected extensive cores, logs and 3-D seismic data over Champions Field, which is located between the Brahaney and Wasson fields in Yoakum County, to evaluate resource potential. According to Riley Permian, its assets there feature similar reservoir rock characteristics to Wasson Field, where several of the largest and most successful EOR projects in North America have been established.

“We knew that they wanted to be public, and they were ready to be public.” —Alex Montano, ROTH Capital Partners

In addition, Riley Permian is benefitting from substantial existing infrastructure in the region, including a CO₂ pipeline hub at Denver City and Kinder Morgan’s Cortez CO₂ pipeline running directly through the company’s property. The company is aiming to ultimately utilize anthropogenic sources for CO₂, or ACO₂, which helps Riley Permian achieve both its production goals and its CO₂-reduction efforts.

Beginning in May 2018, the company kicked off an EOR pilot project on a 980-acre project area that will utilize vertical injection wells in combination with horizontal producers. Three horizontal wells have been drilled and are producing—one in May 2018 and the second in May 2019—with combined cumulative production of 869,000 bbl as of May 2021. Two new horizontal wells were drilled in April and May and will be completed later this summer. Water injection is scheduled to begin during 2022 and a combination of water and CO₂ injection is estimated to begin after the reservoir is sufficiently repressurized.

Kevin Riley said the company’s full-scale EOR project will commence this fall. In late June, Riley Permian announced a $50 million follow-on offering of 1.6 million shares priced at $30 per share, which generated $47 million of net proceeds.

“A large portion of that raised was earmarked for our EOR project,” he said. “We’re already moving quickly on the execution, beginning soon with drilling 12 injection wells, as well as starting the process to get CO₂ supply. The other half of it is for additional working capital for other opportunities.”

Philip Riley explained that the project is being applied to undeveloped fields with the intent to accelerate the life cycle of the field.

“On the economics, we’ve run various different scenarios, and we acknowledge that it can be capital-intensive,” he said. “We’re trying to find the right balance of measured pace and combining it with our primary production. We’re not switching the entire company to this. We’re starting off with a pilot, and I can imagine doing a mix of the two. From the beginning we’ve always envisioned [EOR] as the next phase in the evolution of this asset.”

Recommended Reading

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

CEO: Magnolia Hunting Giddings Bolt-ons that ‘Pack a Punch’ in ‘24

2024-02-16 - Magnolia Oil & Gas plans to boost production volumes in the single digits this year, with the majority of the growth coming from the Giddings Field.

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.