[Editor's note: This article originally appeared in the October issue of E&P Plus. It was originally published on Oct. 1, 2020. Subscribe to the digital publication here.]

As the world grapples with the dreadful human cost of COVID-19, the global economy is also coming to terms with the scale of the pandemic. While the impact on oil markets was swift and dramatic, the gas and LNG sectors have also been hit hard by coronavirus.

Even before the coronavirus pandemic, oil price crash and ensuing economic upheaval, 2020 was already shaping up to be one of oversupply for global gas markets. Last year was a record year for new capacity additions, with nearly 40 MMtonnes of supply added in 2019— supply that was poised to put downward pressure on prices in 2020.

The events of early 2020 are impacting the gas market this year. The impact on gas demand was immediate as countries around the world went into lockdown. However, as restrictions loosen, demand is already showing signs of recovery.

RELATED:

Analysis Shows Natural Gas Primed for Bigger-than-expected Spike

The macroeconomic environment will continue to shape the trajectory of gas demand. If containment measures prove to be successful and the economy has a sharp recovery through the second half of 2020, demand will be resilient. While some demand is forever lost in 2020, global gas demand will follow a parallel growth path to the pre-coronavirus view. High growth markets recover more quickly than established markets where demand losses, particularly in the industrial sector, will be structural.

LNG

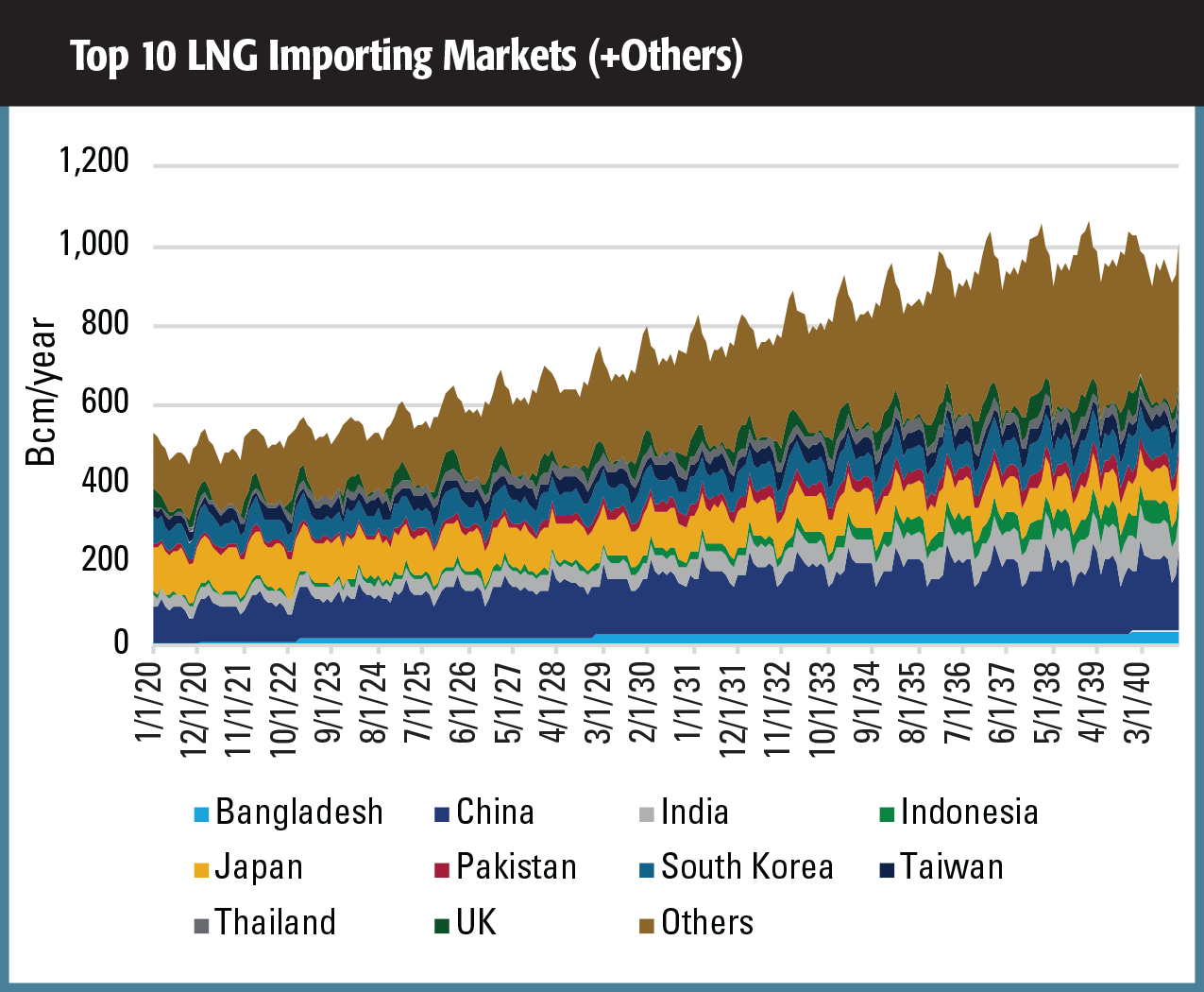

LNG demand is even more resilient through this period. Prolonged low prices allow LNG to outcompete more expensive pipeline contracts in growing markets like China, where the reduction to the LNG import forecast only reflects one-third of the reduction to the gas demand forecast through the early 2020s.

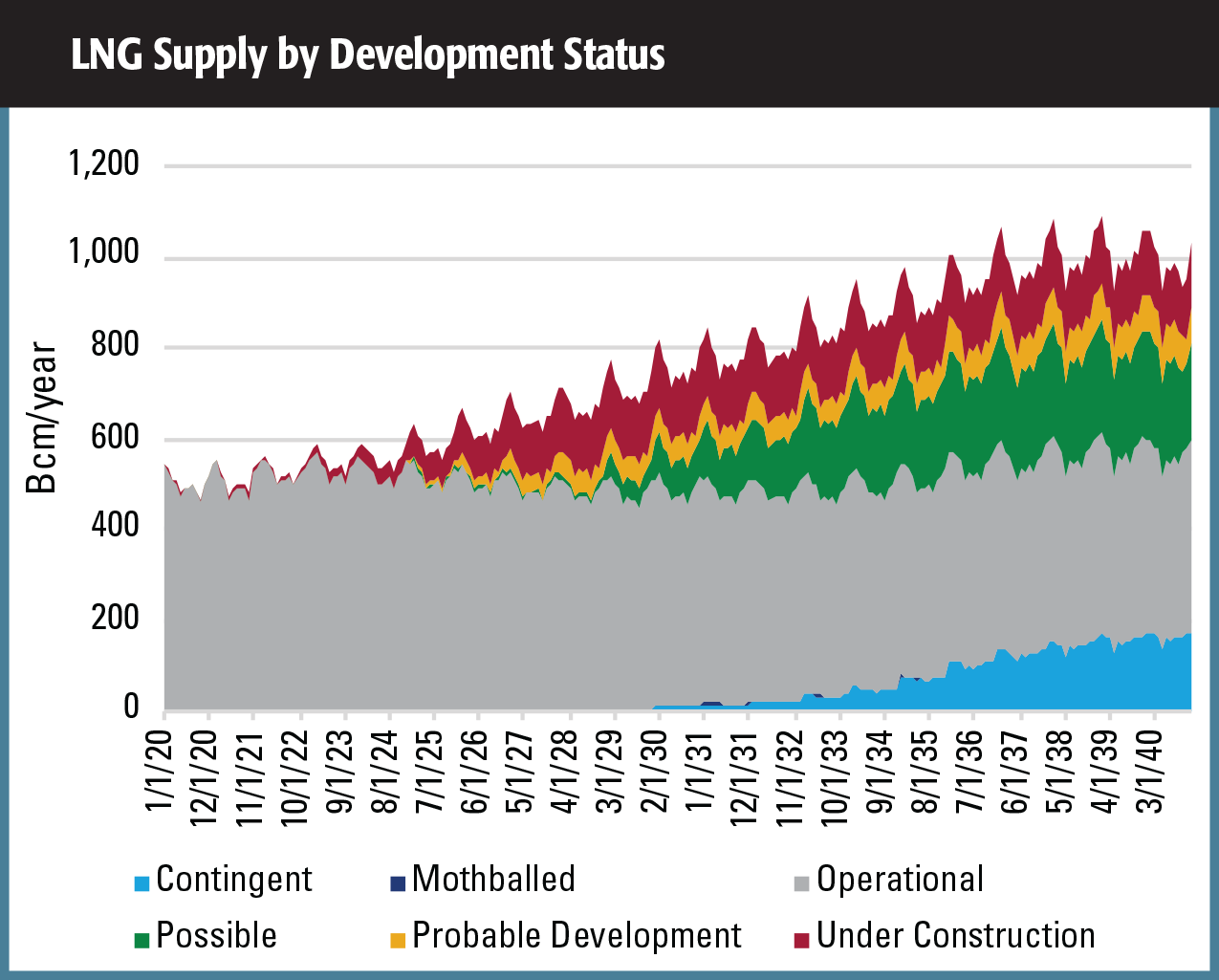

But the events of 2020 will have a longer-lasting impact to supply. LNG projects under construction are suffering up to 12-month coronavirus-related construction delays, which reduce the supply compared to the pre-coronavirus view by 10 MMtonnes per annum (mtpa) in 2025.

Furthermore, the current economic environment has halted supply-side investments. With long development times, decisions not to spend in the upstream over the coming months will impact supply for the coming years. Compared to the pre-coronavirus view, supply from existing LNG facilities is reduced by about 5 mtpa through 2024 due to reduced or deferred upstream investment.

The investment discipline theme transcends the industry as corporate producers across the globe—including in short-cycle unconventionals—will approach a recovering market with caution by spending less, even when presented with the same economic incentives. On 15% rate of return opportunities, Wood Mackenzie estimates U.S. producers are generally drilling 6% fewer wells than they would have last year.

With the final investment decision (FID) momentum from 2019 now all but lost, Wood Mackenzie’s view is that near-term LNG FIDs will be limited to strategic decisions made by the lowest-cost resource holders and smaller projects, which are already advanced in contract negotiations.

Wood Mackenzie expects Qatar to invest through the cycle, bringing on four megatrains (32 mtpa) starting in 2025. Based on contracting progress and commercial momentum, Wood Mackenzie expects FIDs over the next two years at Costa Azul, Corpus Christi Stage 3, Woodfibre and Obskiy LNG, adding 13 mtpa by 2027. Wood Mackenzie also expects continued investment upstream to backfill major facilities in Australia and Malaysia.

While strategic investments like Qatar’s North Field expansion adds a large volume to the market, they only defer the need for new supply development and do not eliminate it completely. Wood Mackenzie forecasts a growing gap between LNG demand and supply by 2030.

Using Wood Mackenzie’s Global Gas Model Next Generation, it forecasts further probable and possible pre-FID supply is needed to meet this growing demand. Combining Wood Mackenzie’s commercial intelligence, cost of supply analysis and model optimization, it determined the new supplies are needed from low-cost West African projects in 2028; U.S. expansion trains, Mozambique and PNG are needed in 2029; and major new projects in Qatar and the U.S. are needed in 2030.

Energy Transition

Demand growth continues in the face of the energy transition as companies and governments alike focus on reducing emissions. Through the 2020s, gas and LNG demand growth continues as gas substitutes for higher emitting fuels, namely coal, in the power and industrial sectors around the world.

However, this trend does not continue through the 2030s. Gas demand in these markets will reach its peak and begin to decline as zero emission technologies displace gas.

In developing markets, though, gas demand will continue to increase as total energy demand increases. And when this increase in gas demand is combined with declining domestic production and regional pipeline imports, demand for LNG imports in South and Southeast Asia will grow even faster—with emerging markets jumping to the top importers list.

A key risk to this view is related to the potential for a second coronavirus outbreak and therefore the pace of economic and gas demand recovery. Wood Mackenzie’s view is predicated upon the effectiveness of current containment measures and ensuing economic and demand recovery from the second half of 2020.

But Wood Mackenzie acknowledges things could develop differently, providing downside risk to the gas demand view in the medium term.

In the longer term, the forecast becomes increasingly sensitive to the view of the energy transition. Europe’s Green Deal policy is the most aggressive in terms of targeting emissions reductions, and other markets could follow with policies of their own as well.

At the same time, companies through the gas value chain, from producers to transporters to consumers, are becoming more conscious of greener alternatives to the traditional way of doing business, often referring to shareholder pressure.

Further policies or changes to corporate strategies could create the way for an accelerated energy transition. A more carbon-conscious world would impact demand as well as supply development and market prices.

Recommended Reading

Eversource to Sell Sunrise Wind Stake to Ørsted

2024-04-19 - Eversource Energy said it will provide service to Ørsted and remain contracted to lead the onshore construction of Sunrise following the closing of the transaction.

Exclusive: Building Battery Value Chain is "Vital" to Energy Transition

2024-04-18 - Srini Godavarthy, the CEO of Li-Metal, breaks down the importance of scaling up battery production in North America and the traditional process of producing lithium anodes, in this Hart Energy Exclusive interview.

High Interest Rates a Headwind for the Energy Transition

2024-04-18 - Persistent high interest rates will make transitioning to a net zero global economy much harder and more costly, according to Wood Mackenzie Head of Economics Peter Martin.

Scotland Ditches 2030 Climate Target to Cut Emissions by 75%

2024-04-18 - Scotland was constrained by cuts to the capital funding it receives from the British government and an overall weakening of climate ambition by British Prime Minister Rishi Sunak, said Mairi McAllan, the net zero secretary for Scotland's devolved government.

Exclusive: Mitsubishi Power Plans Hydrogen for the Long Haul

2024-04-17 - Mitsubishi Power is looking at a "realistic timeline" as the company scales projects centered around the "versatile molecule," Kai Guo, the vice president of hydrogen infrastructure development for Mitsubishi Power, told Hart Energy's Jordan Blum at CERAWeek by S&P Global.