A drilling rig is shown in the Eagle Ford Shale. (Source: NeonLight/Shutterstock.com)

EOG Resources Inc. is betting on high-quality rock in the Gulf Coast Basin and its growing premium inventory to help create value as the oil and gas sector moves through challenging times.

“Our newest play, Dorado, is a prime example,” EOG CEO Bill Thomas said during an earnings call Nov. 6. “It’s great rock in a great location and that’s a resource you can’t buy through M&A.”

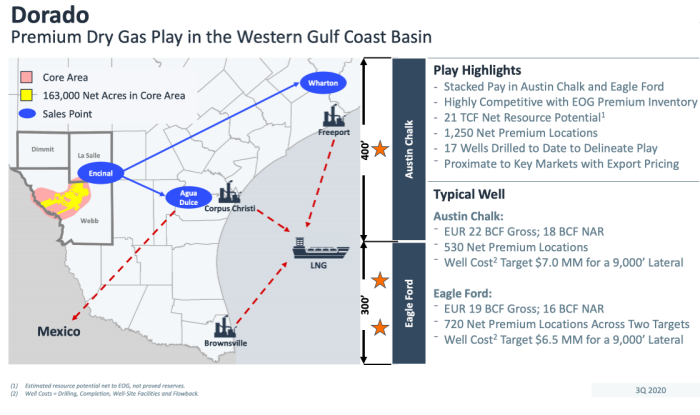

The Houston-headquartered company believes the Dorado natural gas play has an estimated net resource potential of 21 Tcf in 700 ft of stacked pay in the Austin Chalk and Eagle Ford Shale formations.

Word of the massive resource potential came Nov. 5, along with news on EOG’s third-quarter earnings. It followed an exploration drive that identified the Austin Chalk formation’s potential as an oil play in 2016. EOG said it has drilled 17 wells in Dorado since January 2019. Those wells included five targeting the Austin Chalk and 12 wells targeting the Upper and Lower Eagle Ford.

“We paused our drilling activity during 2020 to evaluate both the production results and the significant amount of technical data we collected from cores, petrophysical logs and 3D seismic surveys,” said Ken Boedeker, executive vice president of E&P for EOG. “This data, including a year’s worth of production history from our drilled wells, has generated a robust reservoir model, giving us confidence in our resource estimates and projections for well performance. We are leveraging our proprietary knowledge built from prior plays to move quickly down the cost curve with our initial development.“

RELATED

- Two Eagle Ford Wells, One Austin Chalk Well Completed at Webb County, Texas, Drillpad

- Austin Chalk Discovery Reported by EOG Resources in Webb County, Texas

Dorado is one of the lowest-cost natural gas plays in the U.S. and one of the largest, according to EOG.

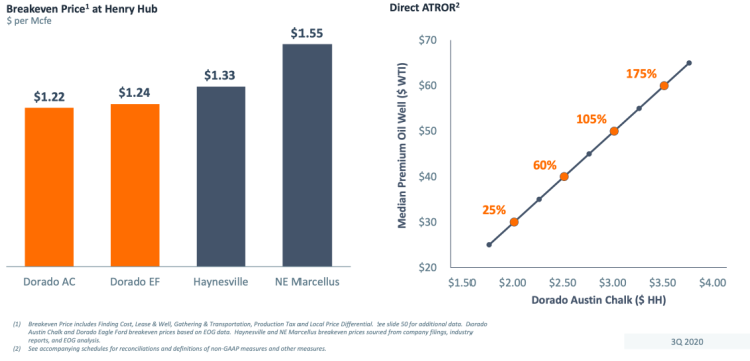

The Dorado Austin Chalk has a Henry Hub breakeven price of $1.22 per Mcfe, while the Dorado Eagle Ford has a breakeven price of $1.24. This compares to $1.33 in the Haynesville and $1.55 in Northeast Marcellus, EOG said in a company presentation.

The company’s premium-tailored strategy, rolled out in 2016, focuses on wells capable of earning at least 30% direct after-tax rate of return at $40 crude oil and $2.50 natural gas prices.

Any kind of play that has such economics is worth pursuing for EOG, company executives say.

“We’re not particular on the commodity, whether it’s gas or oil or even a combo play,” Thomas told analysts on the call. He, however, noted that he believes gas has a prominent role in the future energy supply adding, “there’s no doubt about that.”

Thomas said Dorado competes with EOG’s premium oil assets, elevated by the Austin Chalk’s high-quality rock.

“It upgrades our portfolio,” he said. “It gives us more exposure to gas going forward. It gives us a lot of optionality in the future to switch capital between types of plays as commodity prices, you know, might vary a little bit. But all of it is based on our premium price deck: $40 oil and $2.50 flat gas. And this one will certainly generate super high returns at $2.50 gas.”

The unveiling of the dry gas play, which grew the company’s premium portfolio by nearly 10%, appeared to be well-received by some analysts.

“While some may yawn at a new gas play, with a super low-cost structure and stronger pricing located near several natural gas markets with options for LNG and pipeline export pricing, the play competes for capital and is superior to the Haynesville and Northeast Marcellus,” Gabriele Sorbara, senior equity analyst for Siebert Williams Shank & Co., LLC, said in a note.

Though it is too early for EOG to say how much volume it plans to produce from the gas play in 2021, the company said it envisions a 15-well program next year with some gas production early in the year.

Initial development will target the Austin Chalk formation, where additional costs have been allocated due to anticipated tougher drilling conditions. Drilling will then move to the Eagle Ford Formation, where Boedeker said the company expects lower D&C costs to follow.

“The Eagle Ford utilizes a lower cost wellbore design optimized to a more forgiving drilling environment compared to the Austin Chalk,” Boedeker said on the call. “In addition, we can leverage water and gas gathering infrastructure put in place for the Austin Chalk. We will evaluate the capital allocation to the South Texas gas play each year based on market conditions.”

The targeted well cost in the Austin Chalk is $7 million, while the targeted cost for an Eagle Ford well is $6.5 million. The costs, which include D&C, wellsite facilities and flowback, in both formations are for 9,000-ft laterals.

EOG estimates finding cost of 39 cents per Mcf in the Austin Chalk and 41 cents in the Eagle Ford for Dorado.

The company divested the rest of its “noncore, sub-premium” Marcellus Shale position in the third quarter, with proceeds of about $130 million, to fund most of Dorado’s development costs for 2021.

“Combined with EOG’s low operating costs and advantage market position located close to a number of major sales hubs in South Texas, access to pipelines to Mexico and several LNG export terminals, Dorado is in an ideal position to supply low cost natural gas into new markets with long term growth potential,” Boedeker said. “Dorado is dry gas with close proximity to multiple markets. Therefore, we expect Dorado’s gas will have a lower carbon footprint than most other onshore gas plays in the U.S.,” utilizing the expertise of the company’s recently formed Sustainable Power Group.

So far, 1,250 net premium drilling locations have been identified across EOG’s 163,000 net acre position in the play’s core, the company said. The addition bumped its core inventory to 11,500 net locations.

“Perhaps for the first time in our history, every one of our eight areas has significant potential for premium plays—plays that, if successful, will add to the top of our inventory, not the bottom,” Thomas said.

In the U.S., EOG also has assets in the Permian, Williston, Powder River, D-J and Anadarko basins among other areas.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.