The giant Beehive prospect, located in roughly 40 m water depth, is one of the largest undrilled hydrocarbon prospects in Australia. (Source: Shutterstock.com)

EOG Resources Inc., one of the largest oil and gas producers in the U.S. headquartered in Houston, is making its debut in ‘the land Down Under’ through the acquisition in a giant oil prospect off the northern coast of Australia.

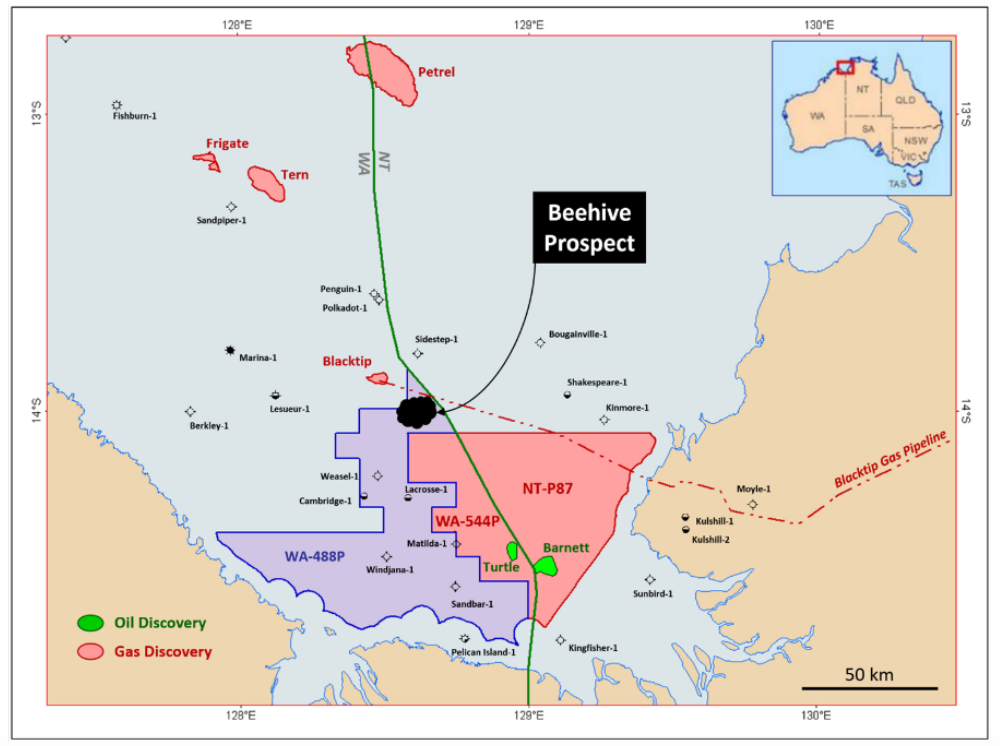

In a company release, Melbourne, Australia-based Melbana Energy Ltd. said it had entered into an agreement to sell its WA-488-P permit containing the giant Beehive prospect in the Petrel sub-basin to a subsidiary of EOG Resources for $22.5 million. The Petral sub-basin is a shallow-water area of the Timor Sea southwest of Darwin.

EOG, which under the terms of the deal will acquire a 100% interest in the WA-488-P permit, intends to drill an exploration well targeting the Beehive prospect in 2022, according to the Melbana company release.

“We are very pleased to have reached this agreement with a company of the caliber of EOG and look forward with great enthusiasm to the drilling of the first exploration well into the exciting Beehive Prospect,” Melbana Energy’s executive chairman, Andrew Purcell, said in a statement.

The WA-488-P permit includes an approximately 700 square km 3D survey and an extensive amount of 2D seismic coverage. EOG agreed to an upfront payment of $7.5 million plus $15 million in contingent and production-linked payments for the acquisition.

The giant Beehive prospect, located in roughly 40 m water depth and one of the largest undrilled hydrocarbon prospects in Australia, is a 180 sq km isolated carbonate build up of Carboniferous age with 400 m of mapped vertical relief and a crest at 4,100 m, according to Melbana’s website.

An independent expert appointed by Melbana has estimated the prospective resource of the Beehive prospect to be 416 million boe.

Last November, Melbana was awarded WA-544-P and NT/P87, permits adjacent to WA-488-P which the company retained full ownership of as part of its deal with EOG. The adjacent permits contain the undeveloped Turtle and Barnett oil discoveries, which Melbana plans to leverage learnings from the Beehive prospect to determine whether the discovers can be upgraded.

According to Purcell, the sale of the WA-488-P permit to an experienced and well-resourced party such as EOG Resources delivers upfront cash and an interest in any future production without exposure to the cost of appraising and developing a discovery.

“This transaction allows Melbana to retain significant exposure to the upside of a potential Beehive discovery without being exposed to the costs of offshore appraisal and development, which can be expensive and challenging for a junior oil and gas company,” he continued in his statement.

“The testing of this new and exciting play type in Australia, responsible for some of the world’s largest hydrocarbon discoveries, is what all the years of effort have been for and we are heartened that such an experienced and well-resourced company as EOG, known for being ahead of the curve when it comes to identifying new areas, will be responsible for the final stage of this journey,” he added.

The $5 million contingent payments included in the transaction are subject to EOG making certain future elections with regards to the permit following completion of the exploration well. Meanwhile, the production linked payments of $10 million are for each 25 million boe produced, in the event of a commercial discovery, the company release said.

Moyes & Co., an oil and gas upstream advisory firm, helped with the transaction.

Recommended Reading

Exxon, Chevron Tapping Permian for Output Growth in ‘24

2024-02-02 - Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Permian E&P Midway Energy Partners Secures Backing from Post Oak

2024-02-09 - Midway Energy Partners will look to acquire and exploit opportunities in the Permian Basin with backing from Post Oak Energy Capital.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.