The Powder River Basin continues to capture the attention of oil and gas companies. (Source: Jim Parkin/Shutterstock.com)

Houston-based EOG Resources Inc., among the largest oil producers in the South Texas Eagle Ford and a longtime player in the Permian Basin, is getting “big wells for low cost” in an area a company executive said was once described as the “Delaware Basin of the North.”

Speaking during the J.P. Morgan Energy Conference in New York on June 18, Kenneth W. Boedeker, executive vice president of E&P for EOG, highlighted the company’s Powder River Basin assets alongside its other major shale developments in the U.S.

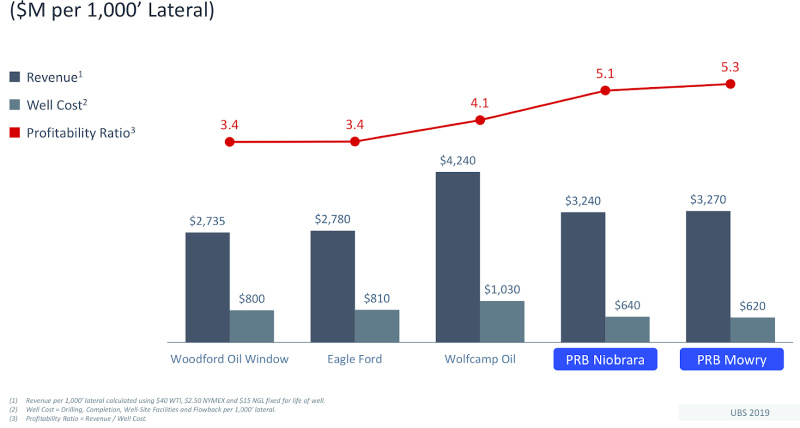

“The Niobrara and Mowry [shale formations] have some of the highest profitability ratio [oil and gas revenue divided by well cost] of any of our premium inventory,” Boedeker said.

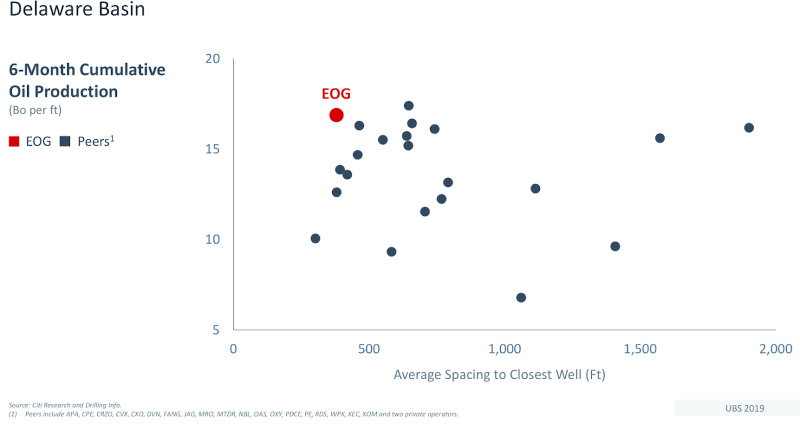

The company’s results in the Powder River are the product of years spent curating spacing and stimulation designs, among other efforts, to get the most out of reservoirs, while bringing down costs.

RELATED: EOG Targets High-return Growth

RELATED: DUG Rockies: Powder River Basin Projects Strong Outlook

Boedeker described the Powder River Basin, which has 4,800 ft of stacked pay, as a target-rich environment. The company puts its estimated net resource potential in the basin’s Mowry Shale, Niobrara Shale and Turner Sand at about 2,275 million barrels of oil equivalent combined.

The Powder River Basin continues to capture the attention of oil and gas companies looking to add value. The basin, which is also known for its coal supply, lies partly in southeast Montana but the Wyoming section has seen the most oil and gas activity. Large independents such as Anadarko Petroleum Corp., Chesapeake Energy Corp. and Devon Energy Corp. have joined privately-held players that include Anschutz Exploration Corp. and Ballard Petroleum Holdings LLC.

Since entering the basin about 10 years ago, EOG has identified about 1,600 premium drilling locations, more than half of which are in the Mowry. These are wells EOG believes is capable of delivering a minimum 30% direct after-tax rate or return.

“This ended up being a significant premium inventory addition to us and the majority of what brought this into premium inventory was the improvements that we made in both costs and stimulation technology,” Boedeker said of the Powder. “We used to refer to this as the Delaware Basin of the North.”

Most of the focus has been on EOG’s acreage in the southern part of the play; however, he said the company sees potential on acreage in the north. Plans are to carry out testing here in the near future, he added.

EOG is also adding to its Powder River Basin infrastructure.

“One of the keys in the Powder River Basin is to get additional water, gas and oil infrastructure in place, and … we’re delineating some other areas in the play,” Boedeker said.

No additional details were provided on this front, nor on exploration underway in the Louisiana Austin Chalk—another area that has attracted industry attention lately. The company typically doesn’t comment on its exploration plays until it reaches “premium status.”

“But we can say that that there are additional exploration plays going on in that area,” he said.

EOG’s exploration strategy focuses on acreage that is more attractive than its current premium inventory.

“It has to have the potential, first of all, to actually be accretive and move to the front part of our inventory,” he said. “Secondly, we look in basins that really have a low cost of entry as well as some existing infrastructure just because that helps your capital efficiency.”

The company plans to run an average of two drilling rigs and about 40 completions in the Powder in 2019. In fourth-quarter 2018, EOG reported gross initial 30-day average production of 2,050 boe/d from two Mowry wells with lateral lengths of about 9,200 ft.

Focus turned to the Turner—located between the Niobrara and Mowry—in first-quarter 2019. EOG reported gross initial 30-day average production of 1,450 boe/d from five Turner wells during the quarter. The average lateral length was about 9,800 ft.

While the basin appears to have solidified its premium position in EOG’s portfolio, work also continues in the Eagle Ford Shale plus the Delaware Basin where Boedeker said some companies are “poking around and testing” in the basin’s neighboring Northwest Shelf area. “As we get anything material we’ll bring that up,” he said.

EOG has about 163,000 acres on the Northwest Shelf and about 416,000 in the Delaware, where the company is currently developing the Wolfcamp zones.

In the Eagle Ford, EOG is looking at its western acreage for future growth, Boedeker said, having already made production strides on the high growth eastern side.

“That area has great rock quality, good fluid properties, and it’s fairly structurally complex,” he said of East Eagle Ford. “If we look at the western area, that area is less structurally complex, doesn’t have quite as good a rock quality but it also has good fluid properties. … Over the last several years we’ve worked on increasing the capital efficiency both in the east and the west, and I’m happy to report that we’ve been able to reduce both of them substantially.”

EOG’s 2019 game plan aims for double-digit returns and growth at $50 oil. The company doesn’t plan to increase its capital budget of $6.3 billion, which targets 12%-16% oil growth in the U.S. with about 740 completions, if oil prices rise.

Any free cash flow generated will go toward high-return premium drilling, dividend growth, debt reduction, value-accretive share repurchases and bolt-on acquisition opportunities.

“We don’t see any expensive M&A corporate acquisitions,” Boedeker added.

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

Triangle Energy, JV Set to Drill in North Perth Basin

2024-04-18 - The Booth-1 prospect is planned to be the first well in the joint venture’s —Triangle Energy, Strike Energy and New Zealand Oil and Gas — upcoming drilling campaign.

PGS, TGS Merger Clears Norwegian Authorities, UK Still Reviewing

2024-04-17 - Energy data companies PGS and TGS said their merger has received approval by Norwegian authorities and remains under review by the U.K. Competition Market Authority.

Energy Systems Group, PacificWest Solutions to Merge

2024-04-17 - Energy Systems Group and PacificWest Solutions are expanding their infrastructure and energy services offerings with the merger of the two companies.