(Source: Hart Energy; image of drilling rig in Haima, Oman by Shutterstock.com)

EOG Resources Inc. is staking claims in Oman as it looks to broaden its operations in a lower cost theater of operations that the Houston-based E&P believes are necessary for profitability.

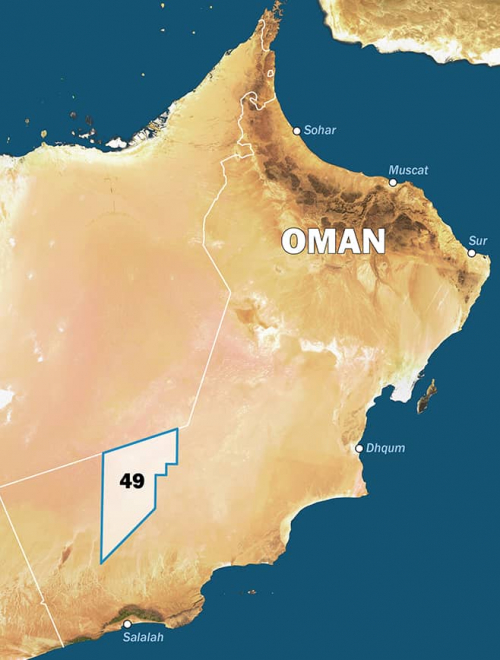

Swedish oil company Tethys Oil AB recently said it entered into a farm-out agreement with a subsidiary of EOG to obtain 50% interest in the exploration and production sharing agreement that covers Block 49 onshore Oman. The expansive block covers roughly 3.8 million acres. The agreement with Tethys, announced in November, comes in addition to a separate third-quarter 2020 acquisition by EOG.

The agreement, which requires government approval, gives EOG the option to assume operatorship of the block and increase its interest to 85% for any operation related to unconventional hydrocarbon resources.

“We are excited to partner with Tethys to evaluate an oil-rich basin for both conventional and unconventional potential,” William R. “Bill” Thomas, chairman and CEO of EOG, said in a new release. “This agreement expands EOG’s footprint in Oman which also includes Block 36 and provides us with an attractive opportunity to explore a basin with significant potential upside for the company.”

Fellow U.S.-based shale producer Occidental Petroleum Corp. also recently announced an acquisition to grow its Middle East footprint with an agreement with United Arab Emirates’ Abu Dhabi National Oil Co.

The deal between EOG and Tethys comes as Tethys was preparing to spud a well, the Thameen-1, in mid-December, about three years after first acquiring rights in the block. Tethys will continue as operator for the first exploration period.

The agreement gives EOG access to the data from several thousand linear kilometers of 2D seismic grids, two recently acquired 2D and 3D seismic surveys, nine exploration wells and additional geotechnical studies and reports.

In consideration for the 50% interest and access to data, EOG will refund all costs incurred on the Block and fund the Thameen-1 exploration well, up to a combined amount of $15 million in U.S. currency.

On a Nov. 6 earnings call, Ezra Y. Yacob, EOG’s executive vice president for exploration and production, said the company had entered Oman in the third quarter with the acquisition of 4.6 million net acres in Block 36.

“Block 36 is in the southwest portion of the country. It's located in the Rub Al Khali basin, which is a well-known hydrocarbon-bearing basin,” Yacob said, according to a Seeking Alpha transcript.

“We've been looking really outside the U.S. for the right opportunity to apply our expertise in tight oil development and we view Oman [as] really offering that,” he said.

The country offers low geopolitical risk and access to competitively priced oilfield services and equipment that EOG management says will be required to make tight oil successful.

“As part of the agreement, we plan to drill two test wells in the next two years to evaluate the potential of the acreage,” Yacob said. “We're very excited about the low-cost of entry in Oman and the option to evaluate a basin with significant potential upside.”

The agreement with Tethys was not mentioned on the call.

Recommended Reading

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.

Mexico Pacific Appoints New CEO Bairstow

2024-04-15 - Sarah Bairstow joined Mexico Pacific Ltd. in 2019 and is assuming the CEO role following Ivan Van der Walt’s resignation.

Global Partners Declares Cash Distribution for Series B Preferred Units

2024-04-15 - Global Partners LP announced a quarterly cash dividend on its 9.5% fixed-rate Series B preferred units

W&T Offshore Adds John D. Buchanan to Board

2024-04-12 - W&T Offshore’s appointment of John D. Buchanan brings the number of company directors to six.