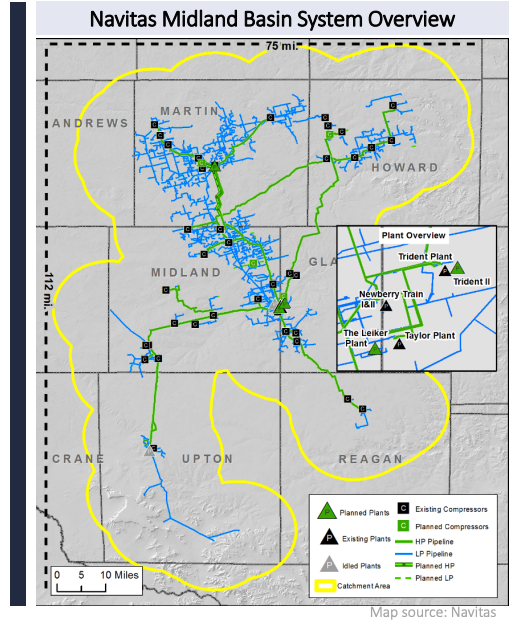

Navitas Midstream’s assets in the Midland Basin include approximately 1,750 miles of pipelines and over 1 Bcf/d of cryogenic natural gas processing capacity with the completion of the Leiker plant expected in first-quarter 2022. Pictured is the construction of the Navitas gas gathering system located in Glasscock, Howard, Martin, Midland, Reagan and Upton counties, Texas. (Source: Navitas Midstream Partners LLC)

Enterprise Products Partners LP agreed on Jan. 10 to acquire Navitas Midstream Partners LLC in a debt-free transaction for $3.25 billion in cash consideration, marking Enterprise’s “surprise” entrance into the Midland Basin.

Backed by Warburg Pincus LLC, Navitas provides natural gas gathering, treating and processing services in the core of the Midland Basin of the Permian. Enterprise’s agreement to acquire the privately held company comes as a surprise, according to analysts with Tudor, Pickering, Holt & Co. (TPH), given Enterprise’s recent capital discussions and messaged preference for downstream.

“While the relatively inexpensive portfolio cost should help mitigate initial market concern, implied DCF yield comes at only a slight premium to standalone EPD metrics and increasing exposure to the wellhead without a clear readthrough to NGL logistics is tough to reconcile with messaged strategy,” the TPH analysts wrote in a research note.

“Notably, there is little discussion of incremental downstream volumes to EPD’s pipeline, fractionation and export business as a result of the deal which will be a key market question to justify expanding wellhead exposure,” the TPH analysts added.

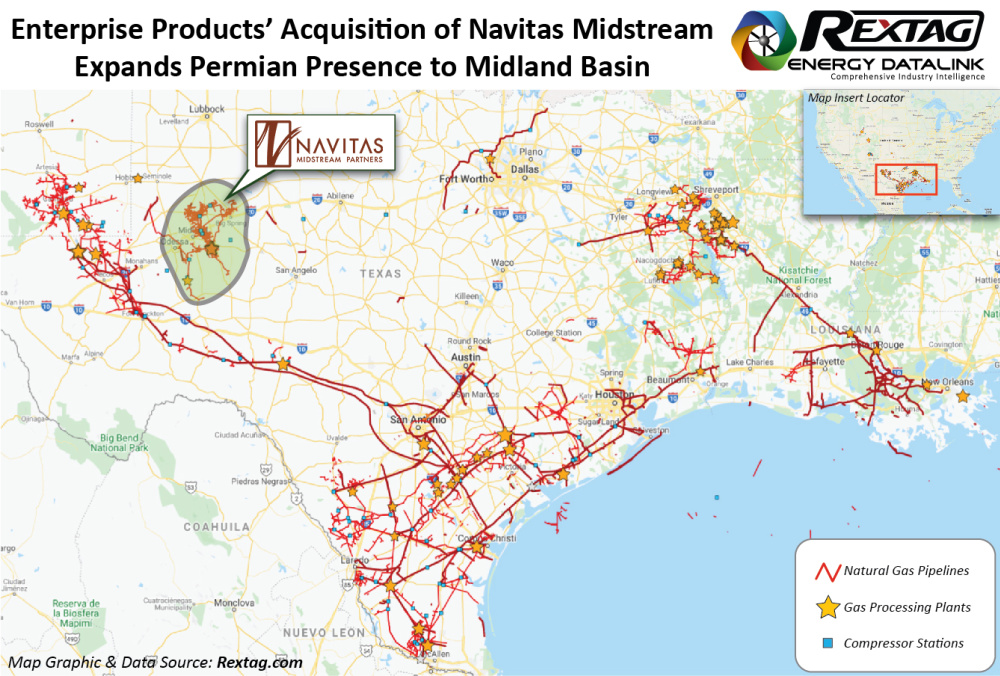

Data courtesy of Rextag. For more information about Rextag and to see the data for yourself, connect with Tyler Reitmeier at treitmeier@hartenergy.com.

Navitas Midstream’s assets in the Midland Basin include approximately 1,750 miles of pipelines and over 1 Bcf/d of cryogenic natural gas processing capacity with the completion of the Leiker plant, which is expected in first-quarter 2022.

Other than downstream pipelines, Enterprise Co-CEO A. J. “Jim” Teague said the company does not have a natural gas or NGL presence in the Midland Basin.

“The Navitas management team has developed a premier system in the heart of the Midland Basin. ... This acquisition will give us an entry point into the basin,” Teague commented in the release.

Based in The Woodlands, Texas, Navitas was formed in 2014 by an experienced management team in conjunction with Warburg Pincus. Founders R. Bruce Northcutt, Bryan Neskora and Jim Wade previously built Copano Energy LLC into a $5 billion enterprise before its sale to Kinder Morgan in 2013.

“We are excited to contribute our unique Midland Basin system to Enterprise, one of the premier midstream operators,” commented Northcutt, who serves as CEO of Navitas, in a separate company release.

“We have succeeded in our goal of creating a unique company that provides critical infrastructure to meet the needs of our Midland Basin producers,” he continued. “We would like to thank our customers for trusting Navitas to develop a system that would meet the needs of their rapid volume growth, and we know they will be in good hands with a company the scale of Enterprise.”

The Navitas system is anchored by long-term contracts and acreage dedications with a diverse group of over 40 independent and publicly owned producers. The system is also supported by fee-based contracts that provide additional revenues based on commodity prices.

“We believe this acquisition will be immediately accretive to distributable cash flow per unit,” commented Randy Fowler, co-CEO and CFO of Enterprise’s general partner, in the company release.

Navitas Midstream provides visibility to future growth with up to 10,000 drilling locations, or over 15 years of drilling inventory based on current rig counts, on the dedicated acreage, according to the release. Based on the current outlook for commodity prices in 2023, which would be Enterprise’s first full year of ownership, Fowler said the company forecasts distributable cash flow accretion will be in the range of $0.18 to $0.22 per unit as a result of the Navitas acquisition.

“This investment will provide Enterprise with an attractive return on capital and support additional capital returns to our limited partners through distribution growth and buybacks of common units,” Fowler added.

The transaction—the largest acquisition of a private gas gathering and processing business, according to Warburg Managing Director John Rowan—is expected to be completed in first-quarter 2022. Enterprise plans to fund the acquisition using cash on hand and borrowings under the partnership’s existing commercial paper and bank credit facilities.

Jefferies LLC was financial adviser to Navitas in connection with the transaction, and Kirkland & Ellis served as the company’s legal adviser.

Recommended Reading

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Summit Midstream Launches Double E Pipeline Open Season

2024-04-02 - The Double E pipeline is set to deliver gas to the Waha Hub before the Matterhorn Express pipeline provides sorely needed takeaway capacity, an analyst said.

FERC Approves ONEOK Pipeline Segment Connecting Permian to Mexico

2024-02-16 - ONEOK’s Saguaro Connector Pipeline will transport U.S. gas to Mexico Pacific’s Saguaro LNG project.

Enbridge Announces $500MM Investment in Gulf Coast Facilities

2024-03-06 - Enbridge’s 2024 budget will go primarily towards crude export and storage, advancing plans that see continued growth in power generated by natural gas.

Midstream Operators See Strong NGL Performance in Q4

2024-02-20 - Export demand drives a record fourth quarter as companies including Enterprise Products Partners, MPLX and Williams look to expand in the NGL market.