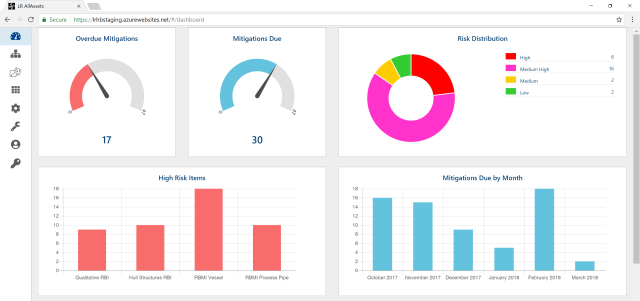

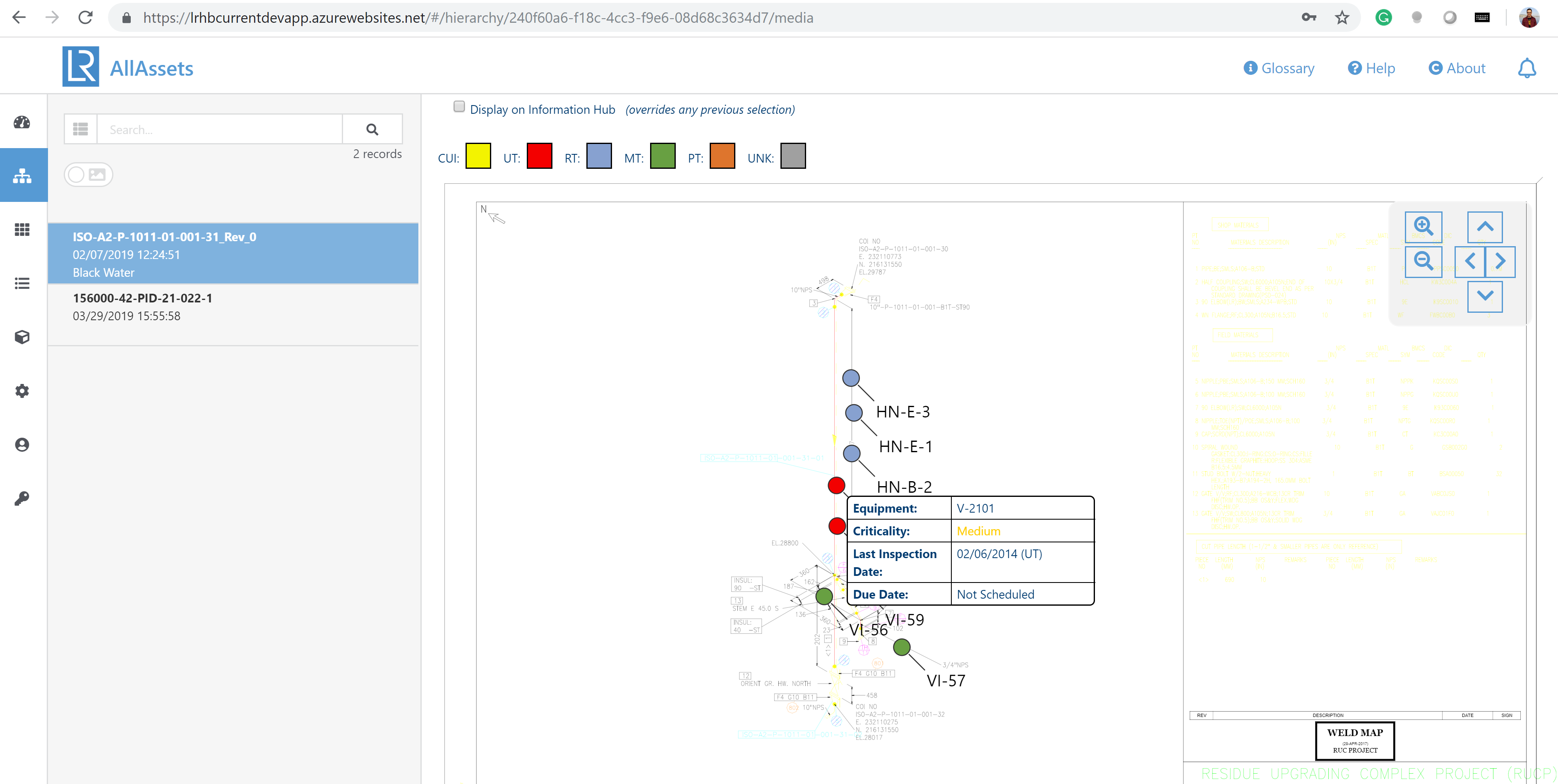

LR’s AllAssets asset performance management software is designed to help users mitigate operational risk and respond to production challenges. The dashboard displays the most important key performance indicators. (Source: Lloyd’s Register)

[Editor's note: This story originally appeared in the January 2020 edition of E&P. Subscribe to the magazine here.]

Managing risk has been a constant in the oil and gas sector since the very first wells were drilled. The nature of that risk has changed over time as a result of new technologies and standards, evolving regulation and greater public awareness. Yet, the dire consequences of risk management failure remain top of mind for responsible operators.

As managing risk becomes more complex, the tools and methodologies used also have changed. New tools offer E&P operators improved means of managing the essential risk question: ensuring productivity while maintaining stringent HSE standards. They also provide what Lloyd’s Register (LR) calls Surety of Insight—the confidence that operators need to address the various commercial, economic and operational pressures they face.

Digital, data and demographics

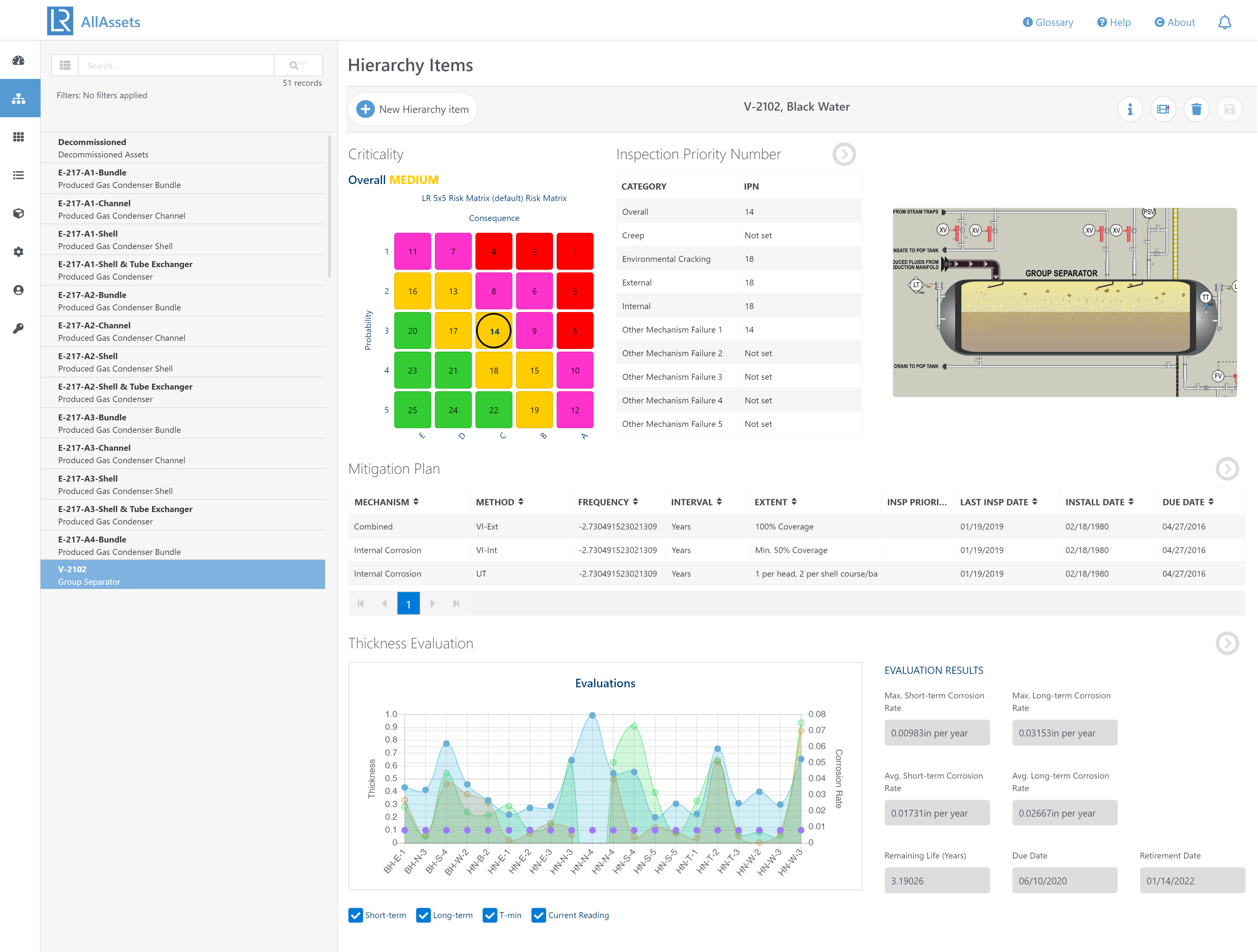

The increasing deployment of digital technologies in oil and gas also is reflected in the growing use of digital platforms to mitigate operational risk. The immediate advantage is that they replace much of the manual processing associated with using spreadsheets and similar tools. Their greater impact, however, comes from their ability to gather an extraordinary range of data, crunch it together and provide previously obscured insight into asset risk and performance.

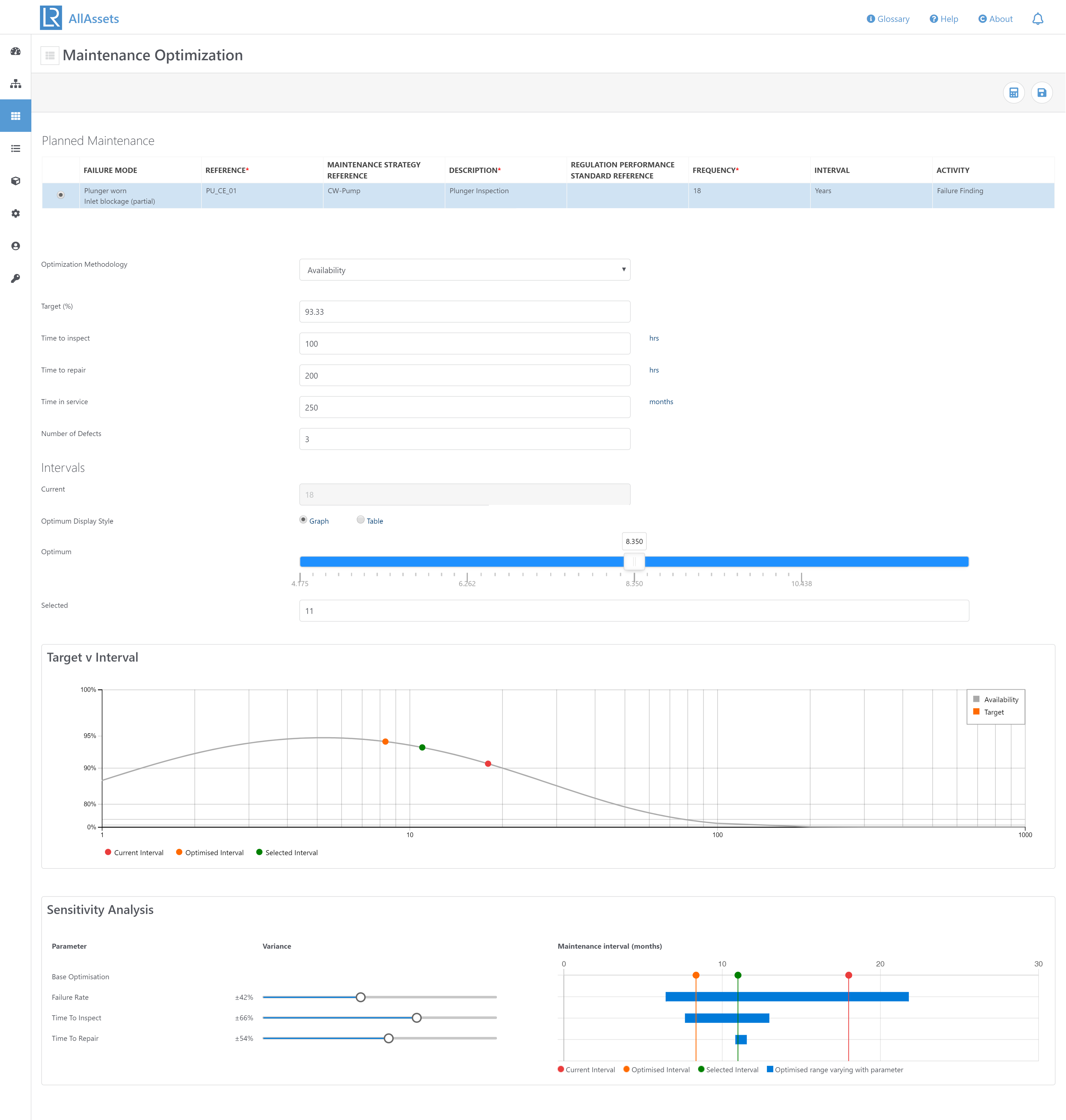

This comprehensive view of asset and plant performance makes it much easier for operators to spot potential business interruptions. This enables informed decisions that improve asset uptime and significantly reduce equipment failure inspection and maintenance costs. When coupled with advanced analytics that offers predictive capabilities, it supports a far more effective preventative maintenance program.

This is the first layer of advantage that an effective digital platform strategy gives operators—the ability to capture unprecedented amounts of asset and performance data. The second layer is their ability to harness the knowledge, experience and context that lives in the company and its people. This layer is becoming an almost existential issue.

LR estimates that between 60% and 80% of the best maintenance and operations staff will retire within five years—leaving behind a large knowledge gap. Filling that gap is an operational imperative. When combined with the asset data and failure analysis that are locked up in spreadsheets, it creates the next level of powerful insight for improving performance and safety.

An advantage comes from the collation of all these information sources (e.g., anecdotes, experience, data and algorithms) that empowers operators and asset owners and enables them to share information. In addition, role-based dashboards ensure that it is not just data that are liberated; people are freed from organizational silos that previously have hindered attempts to improve asset performance.

Confidence, collaboration and commerce

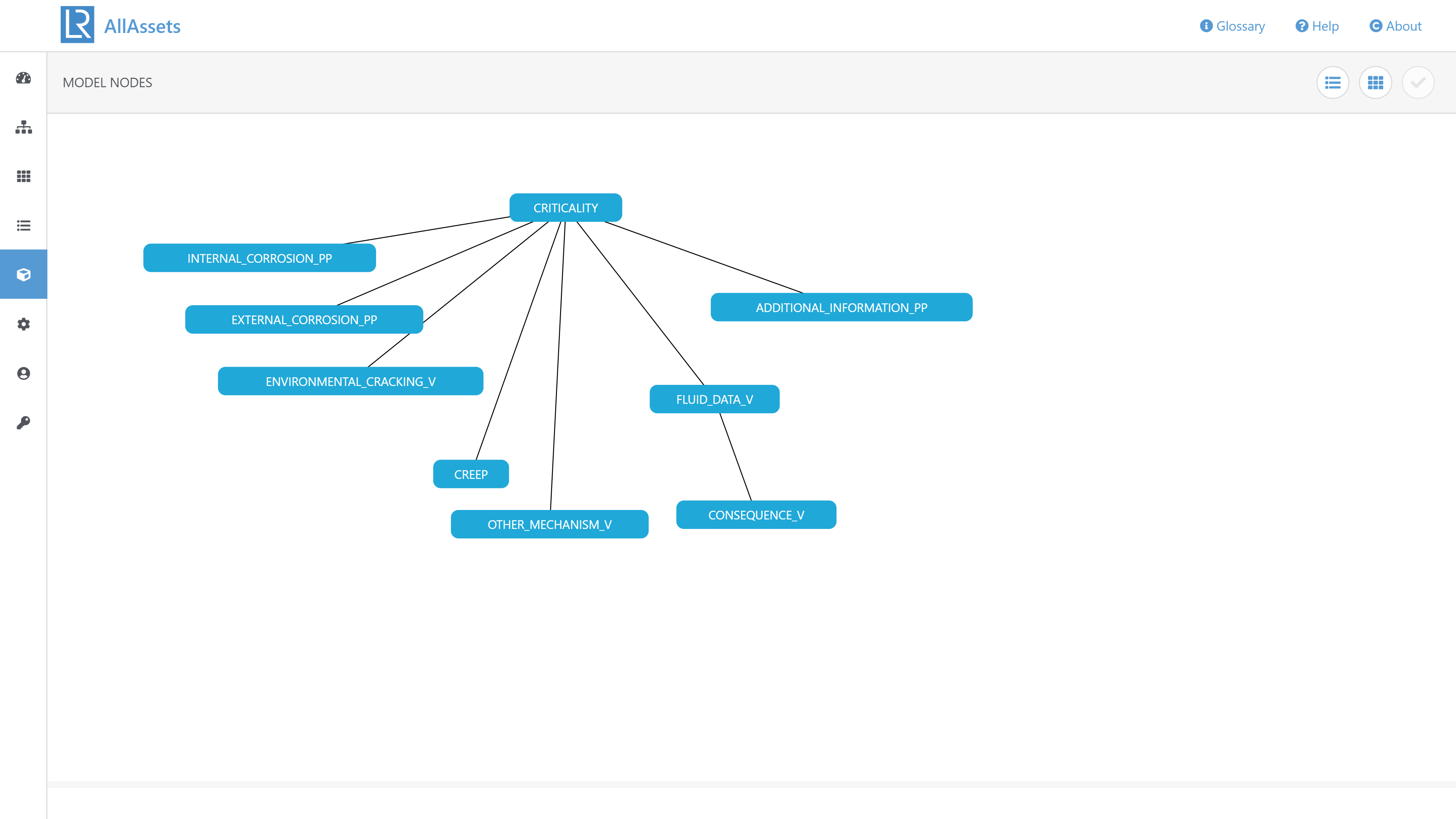

Distinguishing between these platforms can be difficult, particularly as vendors often promote the same features. However, looking deeper at the total cost of ownership gives a better indication of budgetary implications and effectiveness. Tools that cannot adapt to the organization will undoubtedly cost more. This is particularly true when it comes to adjusting risk models in line with changes in asset profiles.

There is a third layer to digital platforms to be considered: the expertise and experience of the developers and providers. This third layer creates significant additional advantages and is a crucial factor in platform selection.

Dependence on third-party tools implies dependence on its provider—a risky proposition where the user’s risk management strategies are, in part, reliant on the capabilities of an outside party. This can create a confidence gap, whereby operators are reluctant to use the platform to its full extent, thus compromising functionality and their investment. Alternatively, the platform can create a false sense of security where risk is not fully understood or mitigated. Neither position advances asset performance or commercial success.

Confidence and assurance are the watchwords of risk management and should be the guiding principles of platform selection. For a digital tool to truly deliver, it has to offer Surety of Insight. This is the security and conviction that comes from deploying an asset-performance management platform that is developed and delivered by experts who can draw on decades of knowledge and experience. With such a platform, surety comes baked in.

In practice, this means working in close partnership with a developer that is immersed in risk management for hazardous industries as well as in oil and gas. It means finding a platform provider that can turn broad risk management principles into detailed, customized tactics. It means working with experts who can share insights from other hazardous industries. It also means working with the developer to bring in the most appropriate building blocks of captured expertise and associated

models for the owner’s or operator’s requirements.

Understanding competition

Critically, it also means working with a provider that understands where risk management delivers competitive advantage and where it is best served by collaboration and cooperation.

As E&P assets become more complex amalgamations of physical engineering, automation and data, identifying dependent actions and calculating the consequent risks become equally more complicated. The role of risk management in improving performance can be considered a legitimate area for competition. There is certainly a commercial advantage to be had from improved maintenance schedules, extending asset life cycles and safely enhancing production output.

However, the role of risk management in maintaining HSE standards and minimizing threats to life is an area that is greatly improved by a more cooperative approach. A breach or a blowout damages a well operator’s people, finances and reputation as well as hurts the industry, dragging down partners and suppliers in its wake. No one wins.

There is an ethical dimension to risk management that goes beyond the immediate concerns of an individual business. The choice of platform and provider should not be dictated by technical nuts and bolts alone but through wider consideration of the provider, its capabilities and its contribution to the industry.

A platform developer that pools expertise, shares the lessons learned from each implementation and continually applies those lessons to every iteration of its platform can provide that ethical dimension without compromising commercial concerns. Any business that takes risk management seriously has to demonstrate that to its people, its shareholders, its regulators and its industry peers. It has to prove that it has Surety of Insight—not just today or on the day of inspection but in every single hour of operation.

(All images courtesy of Lloyd's Register)

Recommended Reading

Cheniere Energy Declares Quarterly Cash Dividend, Distribution

2024-01-26 - Cheniere’s quarterly cash dividend is payable on Feb. 23 to shareholders of record by Feb. 6.

Marathon Petroleum Sets 2024 Capex at $1.25 Billion

2024-01-30 - Marathon Petroleum Corp. eyes standalone capex at $1.25 billion in 2024, down 10% compared to $1.4 billion in 2023 as it focuses on cost reduction and margin enhancement projects.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.