Oil producer EnQuest Plc agreed to buy Suncor Energy Inc.’s 27% stake in the Golden Eagle fields in the U.K. North Sea for $325 million, roughly equivalent to its market cap, on the back of a planned debt refinancing and equity raise, it said on Feb. 4.

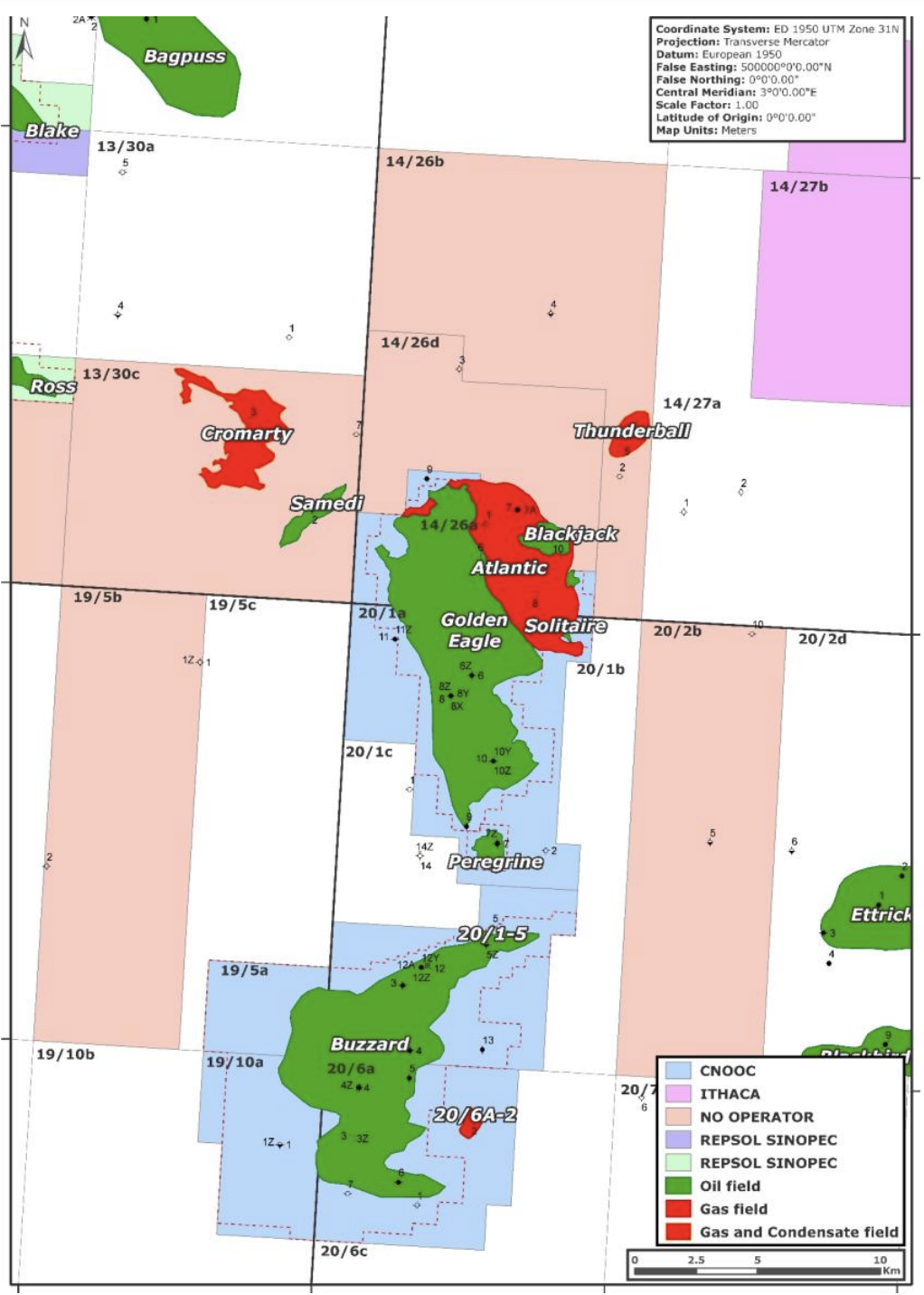

The company, which has net debt of around $1.3 billion, said the deal would add around 10,000 boe/d to its output and $100 million in net present value, meaning the difference between projected earnings and costs. The Golden Eagle development area comprises the producing Golden Eagle, Peregrine and Solitaire fields.

Golden Eagle, operated by Chinese-owned oil and gas firm CNOOC, would earn EnQuest around $13 million a month, CFO Jonathan Swinney said.

The transaction includes additional contingent consideration tied to future oil prices of up to $50 million payable in the second half of 2023. As part of the agreement EnQuest can also deduct money earned between January and the closing of the deal, expected by the end of the third quarter pending EnQuest reaching a refinancing package with its banks, from the purchase price.

EnQuest has accumulated so-called tax losses in Britain amounting to around $3 billion, which it can offset against future profits, making additional production an attractive tax proposition.

Shareholder approval for the acquisition is required, but CEO Amjad Bseisu, who also owns around 11% of the group according to Refinitiv data, has underwritten the planned $50 million equity raise underpinning the deal.

The North Sea-focused oil producer expects average net group production this year to be between 46,000 and 52,000 boe/d, lower than the 2020 output of 59,116 boe/d.

EnQuest shares were down 6% in afternoon trading at 12.9 pence.

Recommended Reading

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

Green Swan Seeks US Financing for Global Decarbonization Projects

2024-02-21 - Green Swan, an investment platform seeking to provide capital to countries signed on to the Paris Agreement, is courting U.S. investors to fund decarbonization projects in countries including Iran and Venezuela, its executives told Hart Energy.

Mitsubishi Makes Investment in MidOcean Energy LNG

2024-04-02 - MidOcean said Mitsubishi’s investment will help push a competitive long-term LNG growth platform for the company.

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Shell’s CEO Sawan Says Confidence in US LNG is Slipping

2024-02-05 - Issues related to Venture Global LNG’s contract commitments and U.S. President Joe Biden’s recent decision to pause approvals of new U.S. liquefaction plants have raised questions about the reliability of the American LNG sector, according to Shell CEO Wael Sawan.