Israeli renewable energy platform Enlight Renewable Energy Ltd. will launch a roadshow for the IPO of 14 million ordinary shares in the U.S., the company announced in a press release on Feb. 6.

Enlight currently lists the shares under the ticker symbol "ENTL" on the Tel Aviv Stock Exchange but has applied to list the shares under the same symbol on the Nasdaq Stock Market. The last Tel Aviv closing price was NIS$71.73/share on Feb. 2.

Additionally, the company is expected to grant underwriters the option to purchase up to an additional 2.1 million ordinary shares within a 30-day period at the IPO price, the release stated.

J.P. Morgan, BofA Securities, Barclays, Credit Suisse, Wolfe | Nomura Alliance and HSBC are acting as book-running managers, with J.P. Morgan, BofA Securities and Barclays taking the lead. Roth Capital Partners is acting as co-manager for the offering.

With global solar, wind and energy storage operations, Enlight develops, finances, constructs, owns and operates utility-sale renewable energy projects.

Recommended Reading

From Satellites to Regulators, Everyone is Snooping on Oil, Gas

2024-04-10 - From methane taxes to an environmental group’s satellite trained on oil and gas emissions, producers face intense scrutiny, even if the watchers aren’t necessarily interested in solving the problem.

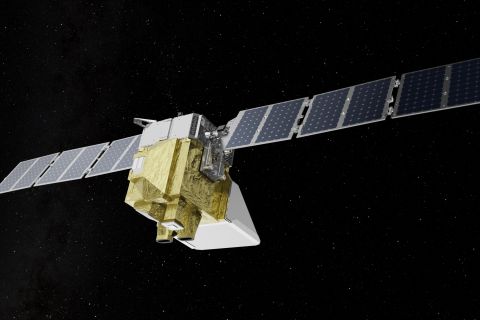

Markman: Is MethaneSAT Watching You? Yes.

2024-04-05 - EDF’s MethaneSAT is the first satellite devoted exclusively to methane and it is targeting the oil and gas space.

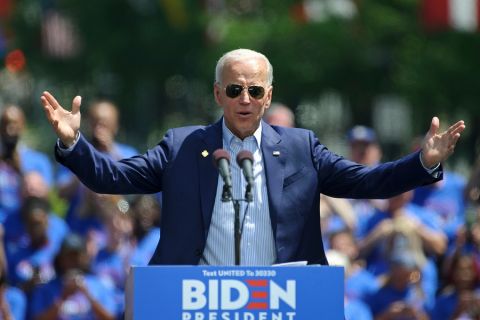

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

2024-03-13 - While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.

Tax Credit’s Silence on Blue Hydrogen Adds Uncertainty

2024-01-31 - Proposed rules for the 45V hydrogen production tax credit leave blue hydrogen up in the air, but producers planning to use natural gas with carbon capture and storage have options.

Hirs: SEC’s Enhanced Climate-related Disclosures Are Unnecessary—Even According to SEC

2024-03-15 - The SEC’s rationale for enhanced climate-disclosure rules is weak and contradictory, says Ed Hirs.