Leasing activity is heating up in the U.S. geothermal sector as companies place millions of dollars in high bids for acreage in Nevada.

The sector also saw a major oilfield service player agree to lend its expertise to a geothermal company aiming to repurpose end-of-life oil and gas wells.

Meanwhile, the recently signed Inflation Reduction Act is already stimulating new investment, including in the solar sector where an operator of large grid-connected PV power plants has announced a planned $1.2 billion expansion.

Here’s a look at some of this week’s renewable energy news.

Batteries

Toyota Plans $2.5 Billion Expansion for North Carolina Facility

Toyota Motor Corp. said it will invest an additional $2.5 billion at its battery manufacturing facility in North Carolina to support electric vehicle battery production, adding 350 jobs.

The news, announced Aug. 31, follows the company’s decision last year to spend about $70 billion globally on electrification efforts as the world transitions to a low-carbon economy. The latest investment plans for the Toyota Battery Manufacturing North Carolina facility are part of a battery production commitment of up to $5.6 billion.

The North Carolina facility is scheduled to begin producing batteries for hybrid electric vehicles and battery electric vehicles in 2025, the company said.

“This plant will serve a central role in Toyota’s leadership toward a fully electrified future and will help us meet our goal of carbon neutrality in our vehicles and global operations by 2035,” Norm Bafunno, senior vice president of unit manufacturing and engineering at Toyota Motor North America, said in the release.

Geothermal

Nevada Lease Attracts Nearly $3 Million in High Bids

The U.S. Bureau of Land Management’s (BLM) geothermal lease sale for acreage on federal land in Nevada attracted more than 20 companies, which placed high bids totaling more than $2.98 million.

Companies placing high bids included Ormat Nevada Inc., Zanskar Geothermal & Minerals Inc., Aspect Holdings LLC, KDS Investments Holdings LLC, Chevron USA, Baseload Power US Holdings Inc., Riverside Minerals LLC, TLS Geothermics Corp., Sierra Pacific Power Co., RodaTherm Energy Corp., OM Geothermal LLC and Raser Power Systems LLC.

Of the 79 parcels offered during the Aug. 30 lease sale, 66 received bids from 22 registered bidders, according to the BLM. Bidding was intense for several parcels, including between Ormat, KDS and Zanskar for NV-2022-08-1839.

The sale’s average high bid per parcel $204,720.

The parcels cover more than 232,000 acres in Nevada, more than double the amount of land offered during the last competitive lease sale.

The October 2021 lease sale brought in about $1.45 million in high bids; however, only 32 parcels were offered covering more than 73,630 acres. That sale attracted 16 bidders.

The next competitive geothermal lease sale is tentatively scheduled for fall 2023.

Halliburton, CeraPhi Form Geothermal Partnership

CeraPhi Energy has tapped Halliburton for its geothermal engineering and project management support as part of an exclusive drilling and intervention agreement, CeraPhi said Aug. 30.

The agreement will initially focus on support CeraPhi’s opportunities to repurpose end-of-life oil and gas wells in the U.S. and the U.K.

“Scaling this opportunity is key to reducing cost and making geothermal energy the baseload energy of choice everywhere for everyone,” CeraPhi CEO Karl Farrow said in a news release.

While CeraPhi will concentrate on front-end resource modeling, Halliburton will focus on well engineering and development potential for CeraPhi’s patented CeraPhiWell technology, the company said.

The technology is described in a news release as a “closed loop downhole heat exchanger that draws up subsurface heat for different applications for scalable baseload energy.”

The companies plan to begin its first project in the U.K. by year-end.

Toshiba ESS, KenGen Team Up For Geothermal Power

Japan’s Toshiba Energy Systems & Solutions Corp. and Kenya Electricity Generating Co. have agreed to work together to advance geothermal energy in East African countries.

The two signed a memorandum of understanding for operations and maintenance services for geothermal power plants in developing countries, KenGen said in a news release.

“There is an ongoing survey to identify geothermal resources in the Great Rift Valley, a tectonic plate boundary running from north to south with immense geothermal potential,” KenGen said. “Both companies are delighted to cooperate in this opportunity and plan further business expansion.”

Hydrogen

Saudi’s Alfanar to Build $3.5 Billion Green Hydrogen Project in Egypt

Saudi Arabian company Alfanar said on Aug. 29 it has signed a memorandum of understanding to build a $3.5 billion green hydrogen project in Egypt.

The facility will produce 500,000 tonnes of green ammonia, which is used in agricultural fertilizers, from 100,000 tonnes of green hydrogen per year.

The project is among seven MoUs signed last week between Egypt and international companies, including Globeleq and Actis, to set up green hydrogen and ammonia production facilities in the Egyptian port of Ain Sokhna.

Alfanar builds power generation and transmission projects, including renewable power. It operates a 50 MW solar project in the Benban Solar Park in Egypt’s Aswan.

Keppel Reaches FID For $538 Million Hydrogen Plant in Singapore

Singapore conglomerate Keppel Corp. said on Aug. 30 it will build a $538 million hydrogen power plant, the country’s first such plant, in Jurong Island and has appointed a unit of Mitsubishi Heavy Industries to construct it.

Keppel has reached a final investment decision for the 600 MW Keppel Sakra Cogen Plant, which will initially run on natural gas but can transition to running fully on hydrogen.

Keppel has appointed a consortium that includes Mitsubishi Power Asia Pacific and Singapore’s Jurong Engineering to construct the plant. The Mitsubishi Heavy Industries unit will also provide maintenance services for the turbine.

Solar

First Solar Plans US Factory Expansion

Arizona-headquartered First Solar Inc. plans to invest up to $1.2 billion to build a new solar module manufacturing facility in the southeast U.S.., the company said Aug. 30.

The facility would be First Solar’s fourth, fully vertically integrated factory. With an annual capacity of 3.5 gigawatts DC (GWDC), the facility would begin operations in 2025 if required permits are secured and government incentives are received.

“In passing the Inflation Reduction Act of 2022, Congress and the Biden-Harris Administration has entrusted our industry with the responsibility of enabling America’s clean energy future and we must meet the moment in a manner that is both timely and sustainable,” First Solar CEO Mark Widmar said. “This investment is an important step towards achieving self-sufficiency in solar technology, which, in turn, supports America’s energy security ambitions, its deployment of solar at scale, and its ability to lead with innovation.”

The company said it also plans to spend $185 million to upgrade and expand its Northwest Ohio complex as well as expand capacity at its Perrysburg and Lake Township facilities and a third Ohio factory scheduled to be commissioned in first-half 2023. Combined, the planned expansions boost the company’s investment in Ohio to more than $3 billion, growing capacity to more than 7 GWDC by 2025.

The new investments are expected to add at least 850 new manufacturing jobs, bringing its employee count to more than 3,000 in the U.S. by 2025, the company said.

Ørsted Acquires its First Solar Project in Ireland

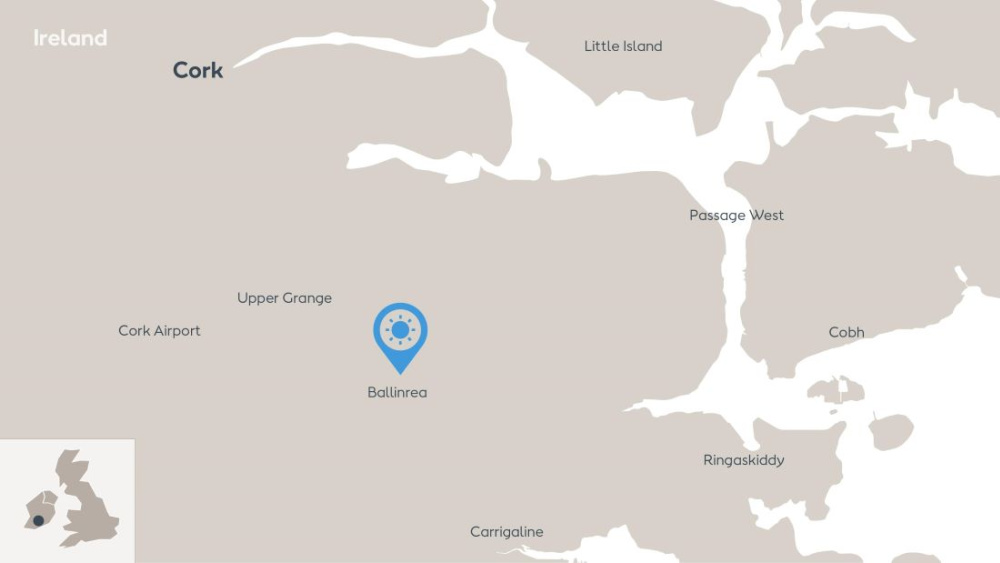

Ørsted has acquired renewable energy developer Terra Solar’s Ballinrea solar photovoltaics project Ireland, its first solar acquisition in the region, according to an Aug. 30 company press release.

The solar farm is anticipated to generate enough renewable energy to power up to 16,000 homes in the Cork, Ireland, area–equivalent to almost every new home to be built in Cork City between now and 2028, according to the release.

The 65 MW of power generated from the Ballinrea solar farm will add to Ørsted’s 1.3 GW of solar capacity, as well as its combined total of about 5 GW of capacity already in operation or under construction across its onshore wind, solar and storage holdings.

With this in mind, the company is aiming to reach a total of 17.5 GW of onshore capacity globally by 2030, as well as to comprise its global portfolio of a 50:50 wind and solar capacity mix by the same year.

“This project will make a meaningful contribution to Ireland’s national energy target of 80% renewable electricity by 2030 and to the Irish government’s new 5.5 GW solar target,” said Kieran White, Ørsted vice president of Europe onshore.

The project is expected to begin operations by 2025.

In addition to the acquisition from Terra Solar, Ørsted in July entered the French and German solar markets through the acquisition of onshore wind platform Ostwind. It also acquired Irish onshore wind platform Brookfield Renewable and entered separate partnerships with Glide Energy, Rolwind, ARBA Energías Renovables and Ereda to expand into the Spanish onshore business.

Wind

Mainland China Sees Growth in Floating Wind Capacity

Mainland China is forecast to have commissioned an estimated floating wind capacity of 477 MW by 2026 as the country fast-tracks development, according to a report released Aug. 31.

Today, the region ranks fifth globally with a wind capacity of 5.5 MW, Westwood Global Energy Group said in its report. Mainland China could have just over 13% of the world’s floating wind capacity in about four years as eight projects—mostly demonstrations—become operational. Half of the projects are located in the Guangdong province.

The mainland would still trail the U.K., estimated to have 25% of commissioned floating wind capacity by 2026; South Korea, 20%; Spain, 19%; and Italy, 14%.

It is possible for Mainland China to dominate the sector similar to fixed-bottom wind, according to Westwood analysts, noting the country has the world’s largest offshore wind market with an operational capacity of 25 GW.

“Floating wind developers in Mainland China consist of a variety of companies, including traditional offshore wind developers such as China Three Gorges Corporation and Longyuan Power,” Westwood said; “however, in the mix are oil and gas operator China National Offshore Oil Corporation (CNOOC) and supply chain giant China State Shipbuilding Corporation (CSSC).”

The floating wind projects, according to Westwood, include the 7.25MW CNOOC Deep Sea Floating, 6.2MW CSSC Fu Yao Floating Demo, 5.5MW CTG Yangxi Shapa Deepwater Floating Demo/Three Gorges Leader, 200MW Hainan PFS-1 Wanning Southeast, 4MW Longyuan Putian Nanri Island Floating Pilot, 15MW Nezzy 2 Demonstrator, 25MW Shanghai Deep & Far Sea Demonstration (Floating) and the 10MW Wenzhou Goldwind Floating Demo.

Dutch Wind Farm Blows Away Opposition as ‘New Millers’ Get Stake

Authorities in the Dutch city of Zeewolde have opened one of the country’s largest onshore wind farms after winning over residents often hostile to living next to turbines by allowing them to invest in the project.

The 320-MW park, enough to generate electricity for 300,000 households, is unusual in that most farmers and residents of the small community, 50 km (31 miles) east of Amsterdam, are shareholders.

In the Netherlands, opposition to onshore wind has been forceful as people have complained of noise problems and what they call “horizon pollution”—when wind turbines are visible on the famously flat Dutch countryside.

“People sometimes are not happy with the wind turbines,” said Regina de Groot, who owns a nearby organic farming company and invested in the project.

IKEA Stores Owner Buys 49% Stake in Swedish Wind Power Projects

Ingka Group, the owner of most IKEA stores worldwide, on Aug. 29 said it has agreed to buy a 49% stake in three wind development projects offshore Sweden from renewables development company OX2 for 58 million euros ($57.5 million).

Ingka Investments, the investment arm of Ingka Group, said in a statement the early-stage projects—two in the Baltic Sea and one off the southwest coast—have the potential to reach a total installed capacity of 9,000 MW.

“The projects have the potential to produce up to 38 TWh (terawatt-hours) combined, once operational, corresponding to more than 25% of the electricity consumed in Sweden 2021,” it said.

Ingka Group already produces more renewable energy than it consumes, having invested around 3 billion euros in wind and solar projects since 2009. It plans to reach 6.5 billion euros in investments by 2030 as part of efforts to increase the use of renewable energy across its supply chain. It owns 575 wind turbines, 20 solar parks and 935,000 solar panels on the roofs of IKEA stores and warehouses.

Hart Energy staff and Reuters contributed to this article.

Recommended Reading

Which Haynesville E&Ps Might Bid for Tellurian’s Upstream Assets?

2024-02-12 - As Haynesville E&Ps look to add scale and get ahead of growing LNG export capacity, Tellurian’s Louisiana assets are expected to fetch strong competition, according to Energy Advisors Group.

TotalEnergies to Acquire Remaining 50% of SapuraOMV

2024-04-22 - TotalEnergies is acquiring the remaining 50% interest of upstream gas operator SapuraOMV, bringing the French company's tab to more than $1.4 billion.

Tellurian Exploring Sale of Upstream Haynesville Shale Assets

2024-02-06 - Tellurian, which in November raised doubts about its ability to continue as a going concern, said cash from a divestiture would be used to pay off debt and finance the company’s Driftwood LNG project.

Ohio Oil, Appalachia Gas Plays Ripe for Consolidation

2024-04-09 - With buyers “starved” for top-tier natural gas assets, Appalachia could become a dealmaking hotspot in the coming years. Operators, analysts and investors are also closely watching what comes out of the ground in the Ohio Utica oil fairway.

Aethon Cuts Rigs but Wants More Western Haynesville Acreage

2024-03-31 - Private gas E&P Aethon Energy has drilled some screamers in its far western Haynesville Shale play—and the company wants to do more in the area.