Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Energy transition-related acquisitions made headlines this week as the energy sector made moves in renewable natural gas and solar power and electrical infrastructure analysis.

This came as the U.S. government unveiled goals to boost floating wind, announcing it plans to hold a lease sale offshore California by year’s end.

Development continued on the hydrogen front with Siemens and Shell partnering to advance the technology. Plus, CGG said it and the University of Edinburgh will study subsurface storage of hydrogen in depleted gas fields.

Geothermal also appears to be heating up as Criterion Energy Partners works with Chesapeake Energy.

Here’s a look at some of this week’s renewable energy news.

Batteries

Graphex, ReCharge Partner to Boost Graphite for Batteries

Natural graphite processor Graphex Technologies LLC has teamed up with critical mineral provider ReCharge Global Corp. to jointly pursue opportunities to supply critical graphite anode materials to the global EV industry, according to a Sept. 13 news release.

The two have entered a non-binding memorandum of understanding aimed at streamlining and localizing the supply chain. “The intent of the MOU is to evaluate joint venture opportunities to strategically locate, construct, and operate mid-stream graphite processing facilities throughout the world to support the global electrification of mobility,” the release stated.

The companies plan to leverage their design, equipment sourcing, financing, plant operations and technology expertise as well as established relationships with stakeholders and companies in the automotive and battery industries.

“Together, we can provide the mine-to-battery stability and localization of supply that is needed to meet the soaring demand for the batteries that will power the electric future of transportation,” David Batstone, founder and managing director of ReCharge, said in the release. “Partnering with Graphex will be a force multiplier in this effort.”

Initial focus will be in Australia, where U.S.-headquartered Graphex said the critical mineral mining and processing momentum is accelerating quickly. Properties and/or rights to properties have already been secured by ReCharge in Australia, according to the release. Additional upstream and downstream opportunities are being explored in Europe and North America.

Compass Minerals Picks Lithium Extraction Technology to Supply Ford, Others

Compass Minerals International Inc. said on Sept. 14 it will use a lithium extraction technology developed by EnergySource Minerals LLC to produce the electric vehicle battery metal for Ford Motor Co. and others.

Washington has been pressing for U.S. companies to find greener ways to boost domestic production of battery metals and lessen the country’s reliance on China.

Compass chose EnergySource’s direct lithium extraction (DLE) technology over four rivals and plans to use it alongside existing evaporation ponds to remove the battery metal from Utah’s Great Salt Lake.

Compass said it spent more than two years studying EnergySource’s technology and is confident it can begin producing 10,000 tonnes of lithium annually by 2025.

“This is the right technology for this resource,” Compass executive Ryan Bartlett told Reuters.

Compass also on Sept. 14 said it would sell shares worth $252 million to Koch Industries Inc and use proceeds to fund its lithium project. Compass has lithium supply deals with Ford and LG Energy Solution Ltd.

The partnership is the first technology license by privately held EnergySource, which counts oilfield giant Schlumberger NV SLB.N and mining investment firm TechMet as investors. EnergySource technology relies on an adsorbent that separates lithium from impurities in brine.

EnergySource is developing its own DLE project in California’s Salton Sea, but warned in June that a recently enacted state lithium tax could force it to invest elsewhere.

Eric Spomer, EnergySource’s chief executive, said the Compass partnership was not linked to the California tax, but added: “There are a lot of brine resources in North America.”

Biofuels/Sustainable Aviation Fuels

Alder Fuels, Directional Aviation to Pilot Transparency Tool

Clean tech developer Alder Fuels has landed financial investment from Directional Aviation, a private aviation investment firm, to scale up sustainable aviation fuel, a news release said Sept. 15.

The two companies are plan to pilot a pioneering blockchain-powered transparency tool to document the production life cycle and industry adoption of low-carbon SAF, the release said. The tool aims to assist with transparency in documenting compliance with regulations.

“4AIR and Alder will align the use of blockchain technology tools to account for all the emission claims from the use of the SAF,” the release said.

Alder also announced that Flexjet will be the first business aviation offtake partner using SAF from Alder Greencrude.

In other news, Alder Fuels has formed an R&D partnership with the National Renewable Energy Laboratory, looking to develop pathways to produce large quantities of SAF for future commercial use at airports across the country.

“Climate alarm bells are ringing every day around the globe,” Zia Abdullah, NREL biomass laboratory program manager, said in a statement. “This agreement is a bold step towards swiftly slashing the carbon impact of aviation in less than a decade.”

Geothermal

Chesapeake, Criterion Form Geothermal Partnership

Geothermal energy-focused Criterion Energy Partners said it has formed a strategic partnership with Chesapeake Energy Corp. to help advance the company’s plans to develop geothermal energy.

According to the Sept. 15 news release, the partnership includes investment by Chesapeake for an initial test well, bringing its expertise in subsurface evaluation and drilling and completions.

“Our partnership with Chesapeake will help unlock geothermal energy technology for new markets and customers that are increasingly demanding always-on renewable energy,” Criterion’s CEO Danny Rehg said.

The company’s recently acquired 10,000 acre lease near Department of Energy’s Pleasant Bayou project, which proved feasibility of a large geothermal resource along the Texas Gulf Coast.

Hydrogen

CGG, University of Edinburgh Study Storing Hydrogen in Depleted Gas Fields

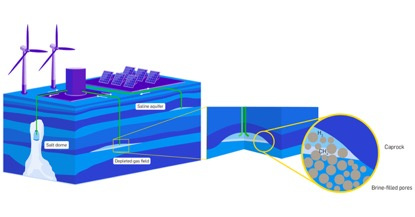

Geoscience firm CGG has teamed up with the University of Edinburg to study the subsurface storage of hydrogen in depleted gas fields, the company said Sept. 16.

The two will “model the heterogeneity of subsurface geological reservoirs to ascertain the most favorable potential sites for hydrogen storage and whether alternative cushion gases, such as CO2, can be used to reduce the operational storage and recovery costs of hydrogen,” the release said.

The storage option has the potential to make low-carbon hydrogen energy storage feasible on a terawatt-hour scale, CGG said, enabling continuous green hydrogen generation and use.

“We are keen to leverage our long-standing expertise in subsurface storage evaluation, reservoir modelling, engineering, instrumentation and monitoring to support the global effort to better understand the role that hydrogen can play in the future energy mix required to meet net-zero targets,” Dave Priestley, vice president of energy transition and environment for CGG said in the release.

Engie to Build Renewable Hydrogen Plant in Western Australia

Engie said on Sept. 16. it will go ahead with plans to build a green hydrogen plant in Western Australia to feed an ammonia facility owned by Norway’s Yara International as the French firm looks to expand rapidly in green hydrogen.

The project will use energy from solar panels and a small battery energy storage system at Yara’s site to power a 10-MW electrolyzer and make 640 tonnes of hydrogen per year, the companies and the government said in separate statements.

Construction on the A$87 million ($58 million) Yuri project is due to start in November with first production expected in 2024, Engie said.

In a separate news release, Technip Energies said a consortium it leads with Monford Group was awarded an engineering, procurement, construction and commissioning contract for the project in Western Australia’s Pilbara region. Technip Energies will manage the overall project and EPC for the electrolysis plant, while Monford Group will handle project construction and the PV farm engineering, procurement, commissioning and start up, according to the release.

Mitsui & Co. Ltd. also has agreed to acquire a 28% stake in Yuri, subject to the satisfaction of certain conditions under its investment agreement.

Africa’s First Hydrogen Power Plant Seen Producing Electricity in 2024

French independent power producer HDF Energy expects its green hydrogen power plant in Namibia, Africa’s first, to start producing electricity by 2024, a senior company executive said Sept. 12.

Once operational, the 3.1 billion Namibian dollar (US $181.25 million) Swakopmund project will supply clean electricity power, 24 hours a day all-year round, boosting electricity supply in the southern African nation that imports around 40% of its power from neighboring South Africa.

Namibia, one of the world’s sunniest and least densely populated countries, wants to harness its vast potential for solar and wind energy to produce green hydrogen and position the country as a renewable energy hub in Africa.

The project will see 85 megawatts (MW) of solar panels powering electrolyzers to produce hydrogen that can be stored.

“Yearly we can produce 142 gigawatt hours, enough for 142,000 inhabitants and that is conservative,” said Nicolas Lecomte, HDF Energy director for southern Africa.

HDF Energy is also eyeing new projects across Africa and other parts of the world.

“Soon after southern Africa you will see HDF developing projects in east Africa,” Lecomte told Reuters.

Siemens, Shell Form Hydrogen, Energy Transition Pact

Shell Global Solutions and Siemens Smart Infrastructure plan to collaborate on advancing low-carbon energy, including green hydrogen, Siemens said in a news release Sept. 15.

As part of an agreement, “Siemens and Shell will create solutions that increase energy efficiency and generate sustainable power, consisting of, but not limited to, digitalization, efficient networks, and the production, distribution, and application of green hydrogen,” the release stated.

Shell intends to supply Siemens with low-carbon products, including biofuels, to reduce its emissions.

The two companies have worked together on several projects since 2010. A key milestone to advance green hydrogen is Shell’s recently announced Holland Hydrogen 1 (HH1) project on the Maasvlakte in Rotterdam. Using electricity generated by wind turbines, the facility will have a capacity of 200 MW and 60 tons of hydrogen per day, becoming one of the world’s largest green hydrogen production plants.

Siemens’ Electrification and Automation serves as the power distribution and substation automation supplier and will be involved in plant operations when it goes online in 2025, according to the release.

Solar

Enverus Adds Solar Power with Acquisition of Spain’s RatedPower

Energy analytics firm Enverus has acquired Madrid-based RatedPower, expanding its footprint in the solar power and electrical infrastructure analysis, feasibility, design and engineering segment, the firm said Sept. 14.

Enverus CEO Jeff Hughes called RatedPower an automation, efficiency and digitalization trailblazer in the solar market.

“Our common denominator is truth in data, strategic planning and optimizing efficiencies,” Hughes said in a statement. “As of today, we have taken a major leap forward in adding to our solar planning capabilities enabling us to strategically advise customers where and how to design their plants to maximize production.”

The acquisition follows Enverus’ March 2021 purchase of Denver-based Energy Acuity, which provides information and intelligence on the renewable power and clean energy markets. The Austin, Texas-based SaaS company’s latest acquisition broadens its geographical reach internationally, growing its current base of 440 power market participants mostly in North America.

Wind

DOE Launches Floating Offshore Wind Initiative Starting along West Coast

The U.S. Department of Energy launched another Energy Earthshot Initiative, this time taking aim at floating offshore wind—initially along the West Coast.

Targeting deep water, the initiative seeks to lower the cost of floating offshore wind energy by at least 70% to $45 per megawatt hour by 2035 to jumpstart development, the Biden administration announced Sept. 15. The goal is to deploy 15 gigawatts (GW), enough to power about 5 million homes, within about 13 years.

The move is part of the administration’s clean energy ambitions that include deploying 30 GW of offshore wind by 2030. It’s an effort to combat climate change and slow global warming.

The latest initiative could unlock opportunities offshore states such as Oregon and California, where the Bureau of Ocean Energy Management (BOEM) also announced Sept. 15 a floating wind lease auction will be held by year-end 2022.

Iberdrola Sells 49% Wind Farm Stake to EIP

Spanish power company Iberdrola IBE.MC said on Sept. 14 it had agreed to sell to Swiss investment fund Energy Infrastructure Partners (EIP) a 49% stake in a German offshore wind farm for 700 million euros (US$700 million).

The sale of the Wikinger wind farm will have no impact on Iberdrola’s financial results in 2022, said the company, Europe's largest utility, in a statement.

Wikinger is off the island of Rugen and is part of 1,258 megawatts of offshore wind capacity that Iberdrola has in operation. Iberdrola calculates it will invest around 30 billion euros worldwide in turbines planted off windy coastlines by 2030.

The statement confirmed a Reuters report issued on Sept. 13.

EIP, which manages more than 4 billion Swiss francs ($4.17 billion) in assets, is investing in renewable assets in Europe.

EIP and Credit Agricole Assurances reached an agreement in June to jointly buy a 25% stake in Spain’s Repsol renewables unit.

Iberdrola's deal comes amid soaring energy prices in Europe, with the European Commission considering capping at 180 euros per megawatt (MW) hour the price at which wind, solar and nuclear plants can sell electricity.

Iberdrola is selling stakes in its wind developments to help finance its 150 billion euro 2020-2030 investment plan, mostly devoted to renewables and power grids. It sold 40% of a British development to Macquarie's Green Investment Group in 2019.

Reuters contributed to this article.

Recommended Reading

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.