Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Several large battery plants and storage projects are forthcoming as Chinese battery company Gotion High Tech, Michigan-based startup Our Next Energy and Equinor announced separate projects this week.

This comes as energy tech giant Schlumberger teams up with water solutions provider Gradiant, looking to maximize recovery of lithium.

There was also movement in the renewable natural gas (RNG), hydrogen, solar and wind sectors as news of more partnerships and planned production facilities and projects were made public.

Here’s a look at some of this week’s renewable energy news.

Batteries

Equinor Reaches FID for Battery Storage Project in England

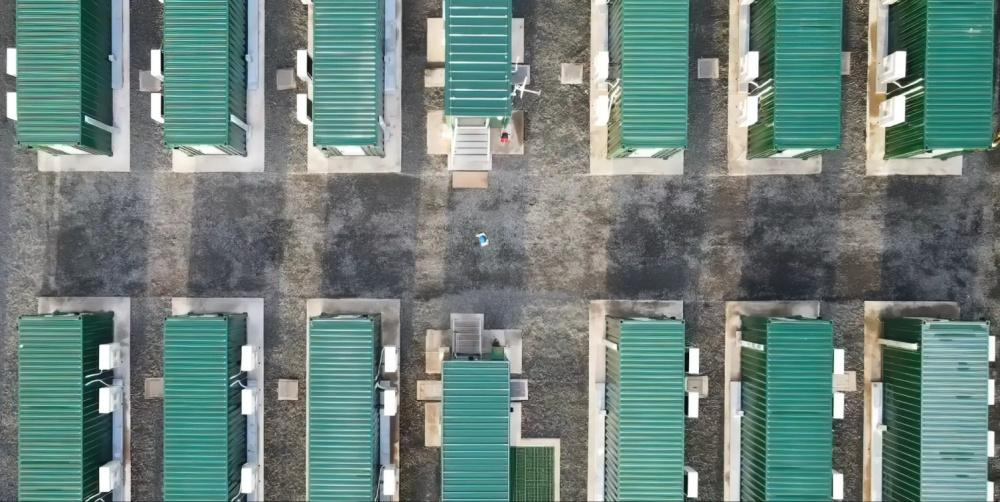

Equinor has sanctioned its first commercial battery storage project, aiming to manage power intermittency and balance supply and demand, the company said Oct. 3.

Construction of the 25-megawatt (MW) Blandford Road project in southern England will begin in January 2023 and is expected to become operation in third-quarter 2023, Equinor said.

The project, which will utilize CATL lithium-ion battery racks and connect to the SSE distribution network, marks the first from Equinor’s partnership with Noriker Power Ltd. The energy company acquired a 45% ownership share in Noriker in December 2021.

“We expect to sanction up to three battery storage projects in the country during the next 6-9 months,” Ingrid Fossgard-Moser, vice president for energy storage development within renewables at Equinor, said in a news release. “A portfolio of flexible storage assets will broaden and diversify Equinor’s energy offerings in the U.K. and strengthen our role as a reliable supplier of energy.”

Grupotec Renewable Ltd. will provide engineering, procurement and construction for the Blandford Road project, while Noriker will manage and develop the project, Equinor said.

The final investment decision came as the company accelerates investments in renewables and low-carbon markets. The company said battery storage can help “solve intermittency challenges and aid in the security of supply” in the U.K., where the government wants 95% of its electricity to be low carbon by 2030.

EV battery Makers Gotion, ONE Plan New Michigan Plants

Chinese battery company Gotion High Tech and Michigan-based startup Our Next Energy (ONE) will open separate, new electric-vehicle (EV) battery plants worth a combined $4 billion in Michigan, Governor Gretchen Whitmer announced Oct. 5.

Gotion’s $2.36 billion plant will create 2,350 jobs in Big Rapids, Michigan. The facility is expected to produce up to 150,000 tons of cathode material and 50,000 tons of anode material a year.

ONE’s $1.6 billion plant will create 2,100 jobs in Van Buren Township, starting in late 2024, the company said. ONE aims to develop a full battery-making complex, from raw material refining through manufacturing and assembly of cells and packs, with production capacity reaching 20 gigawatt-hours by late 2027, enough to supply about 200,000 EVs a year.

Michigan will provide about $715 million in financial incentives for the Gotion facility and $237 million for the ONE facility.

Gotion, a publicly traded company in China also known as Guoxuan High Tech Co., is partly owned by German automaker Volkswagen AG. German automaker BMW is an investor in ONE.

Chuck Thelen, vice president of Gotion Global, said in a statement the company is “dedicated to bringing world-class lithium battery production to North America and delivering high-quality products to our customers in a timely fashion.”

ONE founder and CEO Mujeeb Ijaz said the company is building a raw materials supply chain that initially will rely on overseas sources, with the goal of on-shoring more of those materials each year as it develops North American sources.

Massachusetts startup 6K Energy is partnering with ONE to integrate material refining into the Michigan complex. DTE Energy Co. will provide renewable energy to the plant and will partner with ONE to build a utility-scale energy storage system that will be tied to and help stabilize the local power grid.

Schlumberger, Gradiant Enter Lithium Technology Pact

Schlumberger is partnering water solutions provider Gradiant to maximize recovery of lithium, a crucial ingredient in batteries.

The partnership announced Oct. 5 targets sustainable production of battery-grade lithium compounds with Gradiant technology. The technology, which is used to concentrate the lithium solution and generate fresh water, has been integrated into Schlumberger’s NeoLith Energy direct lithium extraction and production flowsheet, a news release stated.

“The technology enables high levels of lithium concentration in a fraction of the time required by conventional methods, while also reducing carbon emissions, energy consumption, and capital costs when compared to thermal-based technologies,” Schlumberger said in the release. “This technology integration can be applied into new lithium mineral extraction and production sites, opening opportunities to untapped lithium production regions, as well as existing lithium production operations.”

The partnership is expected to help the lithium industry meet rising demand for the mineral.

Biofuels/RNG

Chevron, CalBio Build On Dairy Biomethane Fuel Partnership

Chevron Corp. and California Bioenergy LLC (CalBio) are teaming up again to produce and market diary biomethane as an RNG transportation fuel in California.

The energy major said Oct. 6 that subsidiary Chevron USA Inc. is jointly investing with CalBio in their second holding company, CalBioGas Hilmar LLC. Initial funding will be used to build infrastructure for dairy biomethane projects in California’s Merced County.

“This project brings together support from many groups, including seven California Dairy farmers, who are national leaders in milk and cheese production; Chevron, one of California’s largest energy companies; and grant funding from the California Department of Food and Agriculture,” Neil Black, president of CalBio, said in a news release. “The strong support from these partners will help California with its emission reduction targets.”

As part of the agreement, Chevron will fund up to seven digesters and one central upgrading facility for a cluster of dairy farms, while CalBio will bring its technology and expertise to help dairy farmers build digesters and methane capture projects, according to a news release.

When the projects are completed in 2023, Chevron said it will take all of the RNG produced to California’s vehicle fuels market.

“The investment underscores our commitment to produce 40,000 MMBTU/d of RNG by 2030 and grow the lower carbon businesses that we believe will be a bigger part of the future,” said Andy Walz, president of Americas Fuels & Lubricants for Chevron.

Lightning Renewables to Develop RNG Facility in Tennessee

Lightning Renewables LLC, the joint venture company of Republic Services and Archaea Energy, plans to develop an RNG facility at the Middle Point Landfill in Tennessee’s Rutherford County, according to an Oct. 4 news release.

“Combined with significant investments we have made in the landfill gas system to control the potential for off-site odor, this project will further propel gas collection at the site,” Jamey Amick, Area President of Republic Services, said in the release. “We know how important sustainability is to this community, and we are delighted to bring this innovative solution to Rutherford County and middle Tennessee.”

The gas-to-RNG project is expected to move Republic Services closer to its sustainability goal to beneficially reuse 50% more biogas by 20030.

The project is part of the JV’s plan to develop 39 new RNG projects at Republic Services-operated or owned landfills.

Hydrogen

New York Becomes Site for Air Products Hydrogen Production Facility

Hydrogen producer Air Products will invest about $500 million to build, own and operate a green hydrogen production facility in Massena, New York, the company said Oct. 6.

Liquid hydrogen distribution and dispensing operations are also planned for the 35-metric-ton-per-day facility where commercial operations are expected to begin in 2026-2027.

“Air Products has determined that the market demand warrants the investment in the project, assuming the receipt of certain local and state incentives, as well as any benefits from the Inflation Reduction Act (IRA), and which are anticipated in the current project budget,” the company said in the release.

In addition, the company said it evaluating the feasibility of establishing a hydrogen fueling station network in the Northeast.

Air Products said it expects to sell liquid hydrogen produced at the facility to New York’s mobility market and other potential northeast industrial markets.

“If all the hydrogen is used for the heavy-duty truck market, future climate benefits over the project’s lifetime would include avoiding more than six million tonnes of CO₂, which is equivalent to the emissions from over 600 million gallons of diesel used in heavy-duty trucks,” the release stated.

Fortescue, Tree Energy to Develop Green Hydrogen Import Facility in Germany

Fortescue Metals Group said on Oct. 5 it would more than double the planned capital spending in its green power arm this fiscal year to invest in a hydrogen import facility, with Germany’s Tree Energy Solutions (TES).

The world’s fourth largest iron ore producer said the partnership will help supply 300,000 tonnes of green hydrogen in the initial phase, with a financial investment decision targeted for 2023. The first delivery of hydrogen into the terminal is expected to take place in 2026.

Fortescue will invest 130 million euros (US$129.75 million), of which 30 million euros will be in TES and the rest in the facility in Wilhelmshaven, Germany.

The investment will be funded by previously unutilized capital commitments, Fortescue said. It added that the anticipated capital expenditure by Fortescue Future Industries (FFI) in fiscal 2023 is now $230 million, up from $100 million.

Solar

TC Energy Gears Up For Its First Solar Project in Canada

Energy infrastructure company TC Energy is entering the solar space in Canada, where it will spend $146 million to build its first utility-scale solar project in the country, the company said Oct. 4.

Located near Aldersyde, Alberta, the 81-MW project—called Saddlebrook—is expected to generate enough electricity to power 20,000 homes. Initial work will include installing solar panels on the company’s property in the local industrial park. Construction for the entire project is scheduled for completion in 2023.

“This investment bolsters our ability to deliver low-carbon solutions for our customers and underscores our commitment to add renewable energy to the local electricity grid,” Corey Hessen, executive vice president and president of Power & Energy Solutions for TC Energy.

The move is another step in TC Energy’s ambitions to lower its greenhouse gas emissions intensity by 30% by 2030 and reach net-zero emissions by 2050.

The company’s low-carbon energy efforts have included acquiring more than 400 MW of renewable power via power purchase agreements (PPA) in Alberta in the past 24 months. Among these are 74 MW of solar energy at Claresholm Solar, a joint venture between Capstone Infrastructure Corp. and Denmark-headquartered Obton, and 20 MW of solar energy at Elemental Energy’s East Strathmore Solar.

OMV Petrom Teams Up to Build Four Solar Energy Parks in Romania

Romanian oil and gas firm OMV Petrom said on Oct. 3 it will team up with state-owned lignite power producer CE Oltenia to build four photovoltaic parks that should provide electricity to the national power grid from 2024.

The plan will cost around 400 million euros (US$391.76 million), mostly from European Union funds, and the parks will have a combined installed capacity of around 450 MW, said Petrom, which is majority-controlled by Austria’s OMV.

Romania has committed to phasing out coal by 2032 and replacing it with gas, nuclear and renewable energy.

The new parks, which will be built on the sites of former mining operations operated by CE Oltenia in southern Romania, will boost the country’s installed solar energy capacity by a third from around 1.4 gigawatts (GW) currently, OMV Petrom board member Franck Neel said.

The EU’s modernization fund—a program under the European Green Deal which supports 10 lower-income member states in upgrading their energy systems—will provide 70% of the funds for the project and the two companies will provide the rest.

Romania had planned to restructure CE Oltenia by 2026 and replace its old capacity with solar power and gas, although Energy Minister Virgil Popescu has said the current energy crisis could push back the deadlines.

OMV Petrom aims to build over 1 GW of renewable power by 2030, including through partnerships.

Wind

EDP Renewables Begins Construction at Indiana Crossroads II

EDP Renewables North America has started construction at its 202-MW Indiana Crossroads II Wind Farms, the company said Oct. 4, paving the way to powering the equivalent of more than 54,000 average homes annually.

The nearly $380 million wind farm is one of several that EDPR has either under construction or operational in White County, Indiana. Indiana Crossroads II is expected to go online in 2023 with a power purchase agreement already executed with NiSource Inc. subsidiary Northern Indiana Public Service Co.

“Wind and White County go hand-in-hand, and EDP Renewables is proud to be a part of this clean energy movement, with Indiana Crossroads II representing our soon-to-be seventh operational wind farm in the area,” said Tom LoTurco, executive vice president of EDP Renewables North America’s Eastern Region and Canada and government affairs. “Our partnership with White County and Indiana residents is an example of how communities can flourish with renewable energy development.”

Indiana Crossroads II will consist off 42 Nordex N155 4.8-MW wind turbines.

The company said it has 1,400 MW of installed capacity in Indiana. Its other wind facilities include six phases of the Meadow Lake and two phases of the Headwaters Wind Farm.

Reuters and Hart Energy staff contributed to this article.

Recommended Reading

Mexico Pacific Appoints New CEO Bairstow

2024-04-15 - Sarah Bairstow joined Mexico Pacific Ltd. in 2019 and is assuming the CEO role following Ivan Van der Walt’s resignation.

Global Partners Declares Cash Distribution for Series B Preferred Units

2024-04-15 - Global Partners LP announced a quarterly cash dividend on its 9.5% fixed-rate Series B preferred units

W&T Offshore Adds John D. Buchanan to Board

2024-04-12 - W&T Offshore’s appointment of John D. Buchanan brings the number of company directors to six.

73-year Wildcatter Herbert Hunt, 95, Passes Away

2024-04-12 - Industry leader Herbert Hunt was instrumental in dual-lateral development, opening the North Sea to oil and gas development and discovering Libya’s Sarir Field.

Riley Permian Announces Quarterly Dividend

2024-04-11 - Riley Exploration Permian’s dividend is payable May 9 to stockholders of record by April 25.