Offshore wind developers agreed to pump a few more billion dollars into the sector this week.

Germany-based EnBW announced it will proceed with the 960-megawatt (MW) He Dreiht wind farm offshore in the North Sea. The $2.6 billion project is the company’s largest offshore wind development.

Japan’s top utility company, JERA, is adding offshore wind farms in Belgium to its portfolio, having said it will acquire Belgium-based Parkwind offshore wind energy producer for $1.7 billion.

Plus, leases have been awarded to companies pursuing offshore wind projects to supply power mainly to oil and gas platforms in the North Sea.

Here’s a look at some of this week’s other renewable energy news.

Hydrogen

Wärtsilä Marks Win Running Engine on Hydrogen Blend Fuel

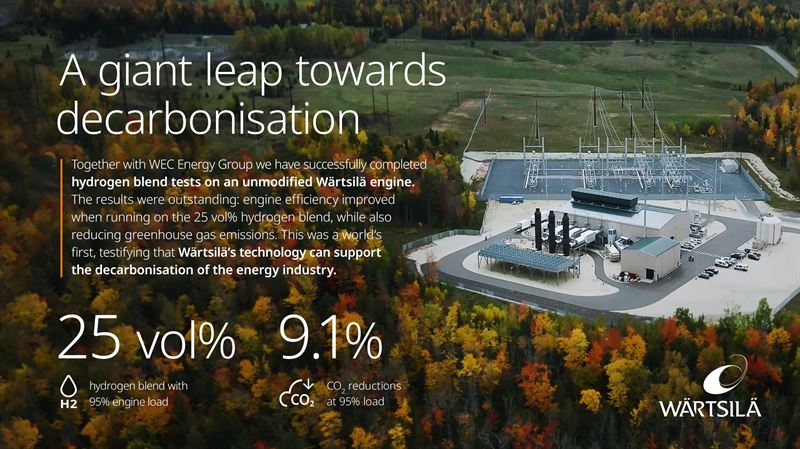

Technology group Wärtsilä of Finland and U.S.-headquartered WEC Energy Group said on March 23 they have successfully run a Wärtsilä engine on 25% volume hydrogen-blended fuel, marking a world’s first.

“These tests provide clear evidence that Wärtsilä’s engine technology can deliver future-proof power solutions that make a huge contribution towards decarbonized operations,” said Wärtsilä Energy COO Anja Frada. “The results of the testing with a hydrogen/natural gas blended fuel mix have been outstanding.”

Working with the Electric Power Research Institute, the tests were conducted in October 2022 on an unmodified Wärtsilä 50SG engine at WEC Energy Group’s 55 MW A.J. Mihm power plant in Michigan. As part of the test, the engine continued to supply power to the grid.

“During three days of continuous testing, the capability of the engine to co-fire hydrogen blends was successfully demonstrated, showing clear improvements in engine efficiency and reduced greenhouse gas emissions, while staying compliant with NOx [nitrogen oxide] emissions,” the company said. “A 95% engine load was achieved with the 25 vol% H2 blend,” verifying the engine’s fuel flexibility without impacting efficiency.

Additional testing proved a 17% volume H2 blend with a 100% engine load was attainable, Wärtsilä said.

The company called the accomplishment “the largest commercially operated flexible balancing engine ever to run on a hydrogen fuel blend, representing therefore a world-first achievement.”

Frada said Wärtsilä expects to have an engine and power plant concept for operating with pure hydrogen available by 2026.

DNV, Petrojet Form Green Hydrogen Pact

DNV and EPC contractor Petrojet have signed an agreement to support green hydrogen projects in Egypt, according to a news release.

As part of the memorandum of understanding, DNV will seek areas to lend its technical expertise in design verification and project assurance. The agreement also covers renewable power generation and energy storage projects, technical studies for natural gas and hydrogen/natural gas blend infrastructure and other technical services for CO2 or low-carbon hydrogen projects, the release states.

“Egypt has great potential for the cost-effective production of low-carbon hydrogen and its derivatives, and is at a geographic nexus,” said Hisham El-Grawany, DNV’s regional manager for Egypt and North Africa. “Our energy transition research shows that the region is set to become a key global supplier in the emerging global hydrogen market, and is expected to be the main exporter of pure hydrogen to Europe.”

Netherlands Aims to Construct 500-MW Offshore Green Hydrogen Facility

The Dutch government on March 20 said that it aims to build a large production facility to convert wind power into hydrogen in the North Sea.

The facility will have the capacity to produce 500 MW of green hydrogen per year and is expected to become operational in 2031.

The project marks the first time the Netherlands will produce hydrogen at sea on a large scale. The Dutch government aims to have the capacity to produce 4 gigawatt (GW) of hydrogen from renewable energy sources at onshore facilities by 2030.

The new hydrogen plant will be connected to an offshore wind farm off the coast of the northern province of Groningen, where the hydrogen could be transported to land by using an existing natural gas pipeline.

Solar

Standard Solar Grows Portfolio with Acquisition

Community solar player Standard Solar has expanded in the U.S. Northeast with the acquisition of a 21-MW solar project portfolio.

The Maryland-based Brookfield Renewable Energy company said on March 22 it acquired 21 MW of solar projects in New York and Massachusetts from New Leaf Energy.

The projects are:

- Copicut in Freetown, Massachusetts. The project will have more than 12 MW of solar and 22 megawatt-hours (MWh) of storage. It is designed to produce 17,924 MWh of energy annually upon completion

- Main Street Newbury in Byfield, Massachusetts. Thee nearly 3-MW system is expected to annually produce 3,571 MWh of clean energy.

- Saunders Settlement project in Sanborn, New York. With more than 6 MW, the system is will produce about 8,861 MWh annually, Standard Solar said in the release.

“Meeting the growing demand across the country for community solar is critical to growing an equitable clean energy economy,” said Harry Benson, director of business development for Standard Solar. “These projects go a long way toward increasing affordable energy in the Northeast.”

Foss & Co, Birch Creek Partner on Tax Equity Investment

Birch Creek Energy and Foss & Co. have closed a tax equity partnership for about $130 million of investment for the 258-megawatt direct current (MWdc) Project Beech solar project in Texas, according to a March 21 news release.

“We are proud to be partnering with Birch Creek for the first time on this project,” said Bryen Alperin, managing director, Foss & Company. “This is our largest project to-date, and we could not be more excited to be partnering on this project with well-respected developers and lenders. We look forward to continuing to grow this partnership.”

Located in Pecos County, Texas, the project is expected to prevent 425,000 metric tons of CO2 emissions from being produced each year, the release stated.

UK’s Foresight Solar Acquires Solar Development Projects in Spain

Britain’s Foresight Solar Fund Ltd. said on March 23 it has acquired 467 MW of solar photovoltaic projects under development in Spain.

The fund said it secured the rights to six solar sites under development called “Project Lynx” from renewable energy company Grupo Cuerva and another Spanish renewables developer.

The solar sites are located in the south and east of Spain. Two of the sites have sought grid connections and one of those has already secured grid access with the potential to be ready to build in 2024.

The financial details of the deal were not disclosed, but Foresight said it made “a modest down payment” at the closing of the deal.

Additional payments will depend on the projects reaching certain milestones in the coming years, such as securing grid connections and reaching ready-to-build status. However, there is no guarantee that all projects will proceed, the fund said.

Spain aims to install 39 GW of solar photovoltaic capacity by 2030.

BP Weighs Buying Control of Solar Power JV Lightsource BP

BP is considering buying the remaining 50% stake in Lightsource BP (LSBP), its solar power joint venture, as part of the British giant’s drive to build up its renewable energy capacity, three industry and company sources said.

The internal talks come after CEO Bernard Looney last month slowed down BP’s shift away from oil and gas, but still vowed to increase spending on renewables and low-carbon fuels by up to $8 billion by 2030, or about $1 billion per year.

BP acquired in 2017 a 43% stake in Lightsource for $200 million and increased its interest to 50% two years later.

A deal would value LSBP’s current portfolio around $2 billion, although the final price tag could be significantly higher depending on the valuation of its long-term business, two of the sources said.

Wind

Havfram Wind Lands Contract for Ørsted’s Hornsea 3

Havfram Wind has been tapped to install turbines at Ørsted’s Hornsea 3 offshore windfarm in the North Sea, according to a March 21 news release.

The wind turbine installer said on March 21 it will use its newly built NG20000X jackup wind turbine installation vessels (WTIV) with a 3.250-ton crane for the project, which includes up to 231 wind turbines. Installation is expected in fall 2026.

“The different construction phases of the Hornsea offshore wind development zone all represent record-breaking wind projects,” said Havfram Wind CEO Even Larsen. “The contribution of Havfram Wind to one of these giant projects proves our growing position in the market and the trust given to us by Ørsted.”

Hornsea 3 will have a capacity of 2,852 MW and be capable of producing enough renewable electricity to power more than 3 million U.K. homes, the release stated.

The contract marks Ørsted’s first with Havfram Wind.

“We now look forward to working together even more closely, sharing our combined knowledge and expertise to ensure the safe and high-quality delivery of the project,” said Patrick Harnett, Ørsted’s vice president for execution programs.

Ørsted is targeting 30 GW installed offshore wind capacity by 2030.

EnBW Reaches FID for $2.6 Billion He Dreiht Wind Farm in North Sea

Germany-based EnBW said on March 23 it will proceed with the subsidy-free 960-MW He Dreiht wind farm offshore in the North Sea — the company’s largest offshore wind development.

The investment cost for the project is about US$2.6 billion (€2.4 billion), the company said.

“The final investment decision for the construction of our He Dreiht offshore wind farm is an important milestone in accelerating the energy transition,” said EnBW CEO Andreas Schell. “Long planning horizons and extensive preparatory work in the offshore wind industry require a high degree of foresight, expertise and readiness to make decisions and invest. This is another big step towards a carbon-free energy future.”

A consortium of Allianz Capital Partners, AIP and Norges Bank Investment Management acquired a 49.9% stake in the project. An additional €600 million in long-term funding secured by EnBW from the European Investment Bank is also helping to finance the project.

The wind farm is expected to be one of the largest in Europe when it becomes operational by year-end 2025, generating electricity for the equivalent of 1.1 million households, the company said.

So far, 335 MW worth of long-term power purchase agreements have been signed with Fraport, Evonik, Salzgitter and Bosch as talks continue with other companies, EnBW said.

Scotland’s Offshore Wind Winners Set to Cut North Sea Carbon Emissions

BP, TotalEnergies and U.K. renewable companies were among 13 awarded leases to develop offshore wind to supply power mainly to North Sea oil and gas platforms to lower the sector’s emissions, Crown Estate Scotland said March 24.

The 13 were chosen from 19 total bidders and awarded agreements to start offshore wind development work for a total initial investment of about $317.3 million.

Flotation Energy and Cerulean Winds, which are spending almost $117.3 million and $168.7 million respectively, are set to the biggest investors.

The Crown Estate is an independent commercial business that oversees the seabed around Britain. Through a leasing process called INTOG (Innovation and Targeted Oil and Gas), it aims to attract investment in innovative offshore wind projects in Scottish waters to help decarbonize North Sea operations.

The maximum capacity of all the projects that are awarded contracts to supply power to oil and gas installations is 5 GW, and 500 MW for smaller innovative projects, Crown Estate Scotland said.

Crown Estate Scotland will offer a seabed lease of 25 years to 50 years for these projects, it said.

JERA to Buy Belgium’s Top Offshore Wind Company for $1.7 Billion

Japan’s JERA, the country’s top utility, has agreed to buy Belgium-based Parkwind offshore wind energy producer for $1.7 billion as JERA expands in renewable power to meet decarbonization goals.

JERA, a joint venture between Tokyo Electric Power Company Holdings and Chubu Electric, adds Parkwind’s four offshore wind farms in Belgium to JERA’s offshore wind investments located in Taiwan and the United Kingdom.

Virya Energy, which agreed to sell Parkwind to JERA, would study a possibility to buy a minority stake in Parkwind’s Belgian wind farms, JERA said in a statement on March 22. The deal is to be closed later this year, pending approvals.

Parkwind currently runs 201 turbines off the coast of Belgium with a 771-MW capacity and ability to supply 800,000 households. The company has another 1.1 GW in development worldwide, including in Germany and Ireland.

JERA decided to sell its 44% stake in the Formosa 3 project off the central-western coast of Taiwan while keeping its exposure to the Formosa 1 and 2 projects, it told Reuters in March, and the buyer has not been disclosed.

Hart Energy staff and Reuters contributed to this article.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.