Alleviated supply challenges helped push U.S. solar energy installations to a record 6.1 gigawatts (GW) during first-quarter 2023, up 47% from a year earlier, according to a joint report released this week by the Solar Energy Industries Association and Wood Mackenzie.

The growth came as delayed utility-scale solar projects came online and the Biden administration continued efforts to strengthen the sector with incentives, including those from the Inflation Reduction Act (IRA).

“Each segment had a record-setting first quarter, except for community solar, which faced interconnection and siting challenges in several key state markets,” the report states. “The residential segment set a first quarter record and would have likely set another overall quarterly record had it not been for intense rainstorms that hampered installation crews.”

Florida was the top solar market with 1.46 megawatts (MW) of utility-scale solar installed during the first quarter, according to the report. The amount installed was 72% more than the second-ranked California.

An improving supply chain contributed to U.S. utility-scale installations jumping 66%, compared to first-quarter 2022, as module shipments arrived.

“Importers are progressing on providing proper documentation to comply with the Uyghur Forced Labor Prevention Act (UFLPA). This has taken time,” the report states, “but U.S. Customs and Border Protection (CBP) is releasing increasingly more volumes of detained module shipments that meet the requirements for polysilicon sourcing. CBP has issued guidance documentation for importers that has helped modules using North American and European polysilicon move through customs more quickly.”

President Joe Biden last year issued waivers for duties on panels made in Cambodia, Malaysia, Thailand and Vietnam as U.S. suppliers worked to boost manufacturing. The action came amid a probe concerning circumvention of U.S. antidumping and countervailing duties. The Commerce Department investigation centered on Chinese polysilicon PV manufacturers that were possibly routing supply chains through nearby countries to skirt U.S. solar panel tariffs imposed during the Trump administration.

RELATED: Questions Remain after Latest Trade Policy Twist for Solar Sector

In May, Biden vetoed Congressional legislation that would have repealed the tariff exemptions on panels imported from Cambodia, Malaysia, Thailand and Vietnam, allowing time for domestic manufacturing of solar panels to ramp up.

The report pointed that overall installations were down, including for utility-scale solar, compared to fourth-quarter 2022; however, first quarters are typically slower than the end-of-the-year rush to install projects.

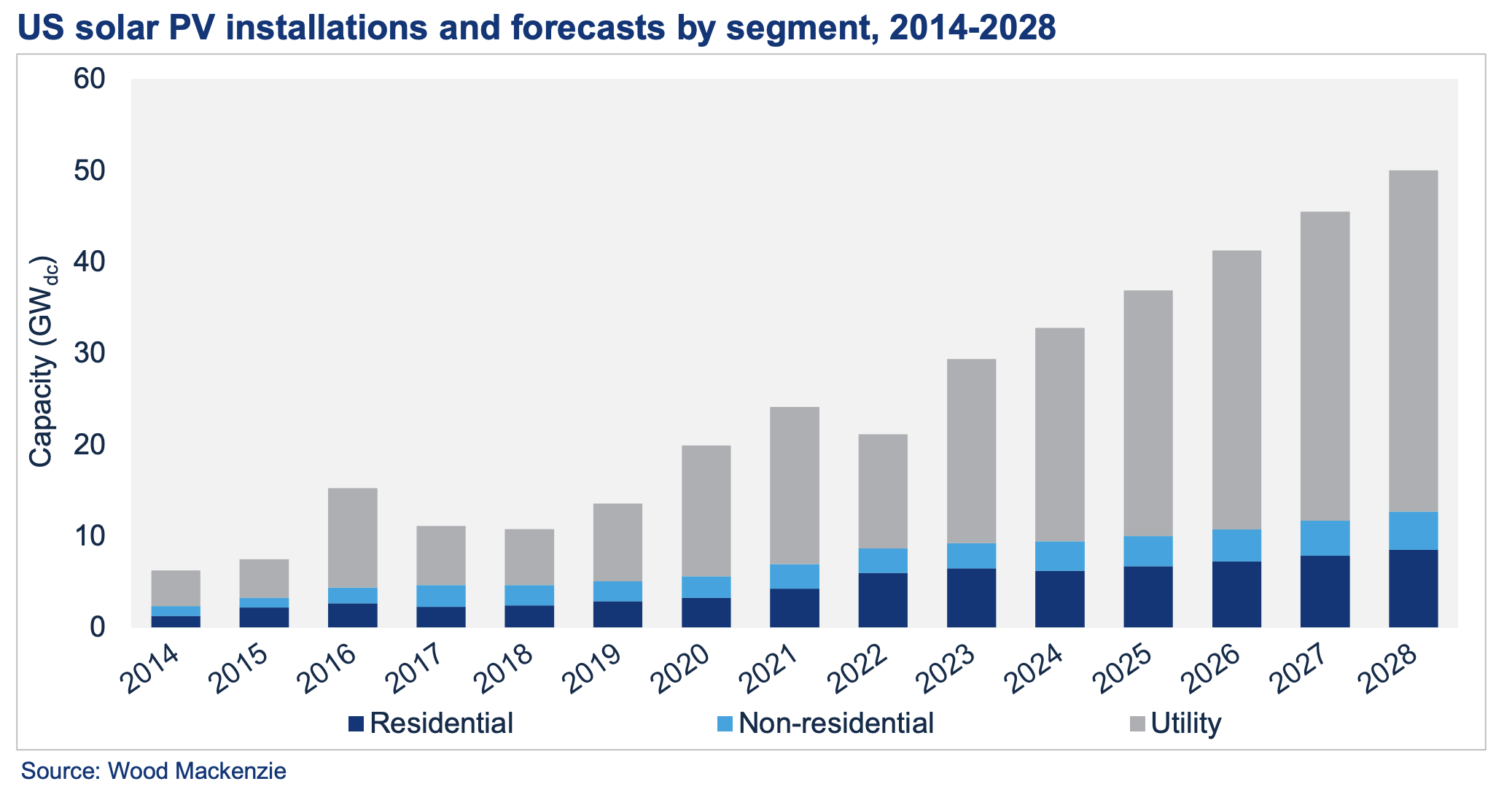

Wood Mackenzie forecasts installed solar capacity to rise to 378 GW by 2028, tripling in size.

Here’s a look at other renewable energy news.

RELATED: New Jersey Now Home to 17-acre Floating Solar Array

Energy Storage

Toyota Plans Auto Battery Lab at Michigan R&D Headquarters

Toyota Motor North America plans to build a $50 million lab facility to evaluate batteries for electric vehicles at its R&D headquarters in Michigan.

Focus will be on ensuring batteries meet performance, quality and durability requirements, the company said on June 8. Charging and connectivity to power sources and infrastructure will also be among the planned R&D activity.

“By adding these critical evaluation capabilities around automotive batteries, our team is positioned to better serve the needs of our customers, including Toyota Battery Manufacturing North Carolina and Toyota Motor Manufacturing Kentucky, the latter of which will soon be assembling the recently announced all-new, three-row, battery electric SUV,” said Shinichi Yasui, executive vice president of Toyota Motor North America, R&D.

The company said it will also work with other suppliers in North America to incorporate battery parts and materials produced locally to its products as the company aims to lower carbon emissions.

Livista Plans German Lithium Refinery for EV batteries

Livista Energy said on June 8 it plans a lithium refinery for electric vehicle (EV) batteries in Germany that should launch production in 2026 and has partnered with French oil and gas services provider Technip Energies to design the plant.

Luxembourg-based Livista said it initially aims to refine 40,000 tonnes of lithium annually at the plant, enough to supply batteries for around 850,000 EVs, with the potential to double capacity over time.

The European lithium refiner said that recycled lithium from batteries should make up 50% of the plant's capacity by 2030.

“The capacity of our plants to accept recycled battery materials will make us a key part of the circular economy and will support our customers in sourcing lithium directly in Europe,” Livista chief operating officer Jean-Marc Ichbia said in a statement.

Livista did not specify a location for the plant.

Technip will design the plant and prepare construction plans—including for a potential expansion—and design a second plant in another, undisclosed location, the two companies said. Technip will also provide a cost estimate for constructing the refinery.

Eneco to Build Battery Storage Plant in Belgium

Netherlands-based Eneco said June 7 it plans to build a 50-MW battery storage project in Wallonia, Belgium, aiming to balance the country’s electricity grid.

The battery energy storage system will include 53 Megapacks energy storage units from Tesla, the company said.

“In cooperation with Belgian high-voltage grid operator Elia, the battery ensures that the ever-increasing volumes of variable solar and wind energy can be deployed in an efficient way and keeps grid power in balance,” Eneco said in a news release.

The Tesla units can supply power to the grid for four hours, or 200 megawatt-hours (MWh).

The project is scheduled to begin operations by year-end 2024.

Hydrogen

Perenco Taps Bloom for Fuel Cells

U.K. oil producer Perenco plans to install 2.5 MW of Bloom Energy’s solid oxide fuel cells at the Wytch Farm oil field in western Europe, according to a June 7 news release, as the operator moves to further lower emissions.

Bloom said the agreement will make the first U.K. deployment of its fuel cell technology. The company plans to deliver the Bloom Energy Server platform in late 2023. The technology will be used to support Perenco’s baseload requirements, Bloom said.

“This is an important step that will demonstrate how our solid oxide fuel cell technology supports the resilience and sustainability goals of our energy-intensive clients,” said Tim Schweikert, senior managing director of international business development for Bloom.

The company describes its server platform as “a distributed generation platform that provides always-on power.”

Plug Power to Provide Hydrogen Fuel Cells to Energy Vault

Plug Power said June 7 it will supply 8 MW of hydrogen fuel cell stationary power to Energy Vault Holdings Inc., which aims to displace diesel generators to power a microgrid in California.

The hydrogen fuel cells will be used to provide backup power when the utility grid operator is required to shut off power to help prevent wildfires or during other emergencies, according to a news release.

Owned and operated by Energy Vault, the energy storage system located in Calistoga, California, will provide dispatchable power under a long-term tolling agreement with Pacific Gas and Electric Co. Construction of the system is scheduled to start in fourth-quarter 2023 with commercial operation beginning in third-quarter 2024.

“Our agreement with Energy Vault marks a huge step forward for hydrogen fuel cells in the microgrid market and represents the future of utility power back-up,” Plug CEO Andy Marsh said in the release. “Green hydrogen is uniquely positioned to solve the need for clean long-duration energy storage in at-risk communities like Calistoga that are susceptible to power interruptions.”

Polenergia Selects Hystar for 5-MW Electrolyzer

Norway-based electrolyzer company Hystar said June 7 that the company has signed its first commercial contract with Polish energy developer Polenergia for a 5-MW electrolyzer.

The electrolyzer, which is set for delivery in 2024 and includes a long-term maintenance contract, will be used for Polenergia’s H2HubNS project.

Located at Polenergia’s Nowa Sarzyna Cogeneration Plant in Poland, the project will produce green hydrogen for refueling stations, according to a news release.

RELATED:

Plucking Power From the Air: Ammonia Production Tested

TES Americas CEO: Electric Natural Gas Bigger Than Shale

Heliogen, City of Lancaster, Execute Green Hydrogen Production Contract

Japan to Invest $107 B in Hydrogen Supply Over 15 Years

Wind

TotalEnergies, Kazakhstan Sign PPA for $1.4 Billion Wind Project

Kazakhstan has signed its largest power purchase agreement to date with TotalEnergies—a 25-year agreement for the 1-GW Mirny onshore wind project, the energy company said June 9.

The $1.4 billion project, which will include a 600 MWh battery energy storage system and about 200 turbines, will be located in the Zhambyl region of north Kazakhstan. All electricity produced, enough for an estimated 1 million people, will be sold to Kazakhstan’s Financial Settlement Center of Renewable Energy.

TotalEnergies CEO Patrick Pouyanné said the project is a significant milestone for the company’s multi-energy strategy.

“As a global energy leader, TotalEnergies is proud to drive the energy transition in Kazakhstan through such an innovative project as Mirny,” said Pouyanné. “This wind and battery project will contribute to the supply and security of the Kazakh power grid.”

TotalEnergies said it is developing the wind project in partnership with National Wealth Fund Samruk-Kazyna and the National Company KazMunayGas. The project is expected to avoid about 3.5 million tons of CO2 emissions annually during the 25-year PPA.

Air Products Lines Up Turbines for Saudi Hydrogen Project

Air Products has tapped Envision Energy to supply 1.67 GW wind turbines for the hydrogen mega plant being developed by NEOM Green Hydrogen Co. in Saudi Arabia, according to a news release.

A joint venture company comprised of ACWA Power, Air Products and NEOM has a goal to produce 600 tonnes per day of hydrogen by year-end 2026. It plans to use a wind and solar power for the project.

Envision said its wind turbines will be installed for the project as part of the contract.

The $8.4 billion plant will produce hydrogen in the form of green ammonia, developers said. Air Products has an exclusive 30-year offtake agreement with NEOM Green Hydrogen for ammonia produced at the facility.

Orsted Expects to Take Final Decision on Hornsea This Year

(Reuters) Danish renewable energy company Orsted said on June 8 it expects to take a final investment decision (FID) on its planned Hornsea 3 offshore wind project in Britain this year.

Orsted warned in early March that the 2.8 GW project may not go ahead without more UK government support such as tax breaks.

At a capital markets day in London, Rasmus Errboe, CEO of Europe at Orsted, also said the company sees sufficient value creation in its planned Baltica 2 offshore wind project in Poland and expects to do cash-on-delivery in 2027.

However, it has decided to “reconfigure” the Baltica 3 project—potentially getting a bigger turbine and adding more capacity—as it has flexibility on the timeline of the project, he added.

RELATED: Constellation Breathing New Life Into Criterion Wind Project

Reuters contributed to this report.

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: Autonomous Drone Aims to Disrupt Subsea Inspection

2024-01-30 - The partners in the project are working to usher in a new era of inspection efficiencies.

Drilling Tech Rides a Wave

2024-01-30 - Can new designs, automation and aerospace inspiration boost drilling results?