The energy transition is progressing with news this week of a multimillion-dollar investment in a battery technology center and a $144 million acquisition by a major manufacturer of electric vehicles (EVs) and fuel cells.

Two multiclient studies are also shedding light on geothermal resources and lithium brine opportunities. Meanwhile, companies are putting hydrogen plans into action as one gears up to trial hydrogen production and two others seal a deal to build a green hydrogen plant.

Here’s a look at some of this week’s renewable energy news.

Batteries

Nikola Acquires Romeo Power

Nikola Corp. is bringing battery pack engineering and production in-house with its acquisition of California-based Romeo Power Inc. in an all-stock transition.

The energy storage technology company, which provides electrification solutions for commercial vehicles, was valued at about $144 million. It’s focused on designing and manufacturing lithium-ion battery modules.

“With control over the essential battery pack technologies and manufacturing process, we believe we will be able to accelerate the development of our electrification platform and better serve our customers,” Nikola CEO Mark Russell said Aug. 1.

The transaction is expected to result in an annual cost savings of up to $350 million by 2026 and lower non-cell related battery pack costs by 30%-40% by year-end 2023, Nikola said. The company plans to name Romeo’s Cypress California facility as Nikola’s Battery Center of Excellence.

Subject to the tender by Romeo’s stockholders of shares representing a majority of the outstanding Romeo common stock and customary closing conditions, including regulatory approval, the transaction is expected to close by the end of October, the release said.

BP Targets Battery Technology with New Center

Aiming to advance battery technology for new applications, BP Plc said it plans to invest about $60 million in a new EV battery testing center and analytical laboratory in the U.K. by year-end 2024.

“This additional investment will help accelerate the transition to EVs by developing solutions to help decarbonize the transport sector,” said Louise Kingham, BP’s U.K. head of country, said in a news release. “This is another example of our ambitious plans to do more, and go faster.”

The company said it aims to advance development of battery technology, engineering and fluid technology for applications that include EVs, charging and data centers.

Switzerland’s New Hydro Plant Packs Battery Power

Switzerland is adding a much-needed cog in the wheel to its energy supply with an underground hydropower plant that says it has capacity to store enough electricity to charge 400,000 car batteries simultaneously.

Developers of the $2.3 billion Nant de Drance plant in the canton of Valais, which came online in July, say the facility operates like a giant battery.

Its six turbines tucked in a cavern 600 m below ground between the Emosson and Vieux Emosson reservoirs have capacity of 900 MW, making it one of the most powerful pumped storage plants in Europe.

During peak demand, Nant de Drance produces electricity from hydropower. But when output from sources such as wind and solar exceeds demand, the plant stores the surplus electricity by pumping water into the higher Vieux Emosson reservoir.

“In doing so, there are losses like any storage, but the yield is very good. We have about 80% efficiency over the complete cycle,” director Alain Sauthier told Reuters on a tour this week.

The plant, which has taken 14 years to build, will be officially opened next month.

Geothermal

Ormat Agrees to Pause Construction at Nevada Plant

After winning a legal challenge that would have prevented construction of a Nevada geothermal power plant, Ormat Nevada Inc. has agreed to postpone development of the project to allow federal authorities to evaluate risks to an endangered toad, court documents show.

The Center for Biological Diversity and the Fallon Paiute-Shoshone Tribe had argued in an appeal that a Nevada federal court erred in its decision to block construction of the Dixie Meadows Geothermal Utilization Project for only 90 days. The groups jointly alleged violation of the National Environmental Policy Act, Religious Freedom Restoration Act and the Administrative Procedure Act.

However, the Ninth Circuit refused to block construction of the geothermal power plant on Aug. 1, saying the district court did not apply the law incorrectly.

However, the same day, a joint stipulation on scheduling order was filed, stating the parties agreed to pause the project to allow the U.S. Fish and Wildlife Service to evaluate the project’s alleged impacts to the endangered Dixie Valley toad. Ormat agreed to temporarily halt construction until the FWS issues a biological opinion for the project, or until Dec. 31, whichever is sooner, court documents showed.

The project, located on federal land adjacent to the Dixie Meadows hot springs, has already been approved by the U.S. Bureau of Land Management.

CGG Licenses Multiclient Geothermal Studies

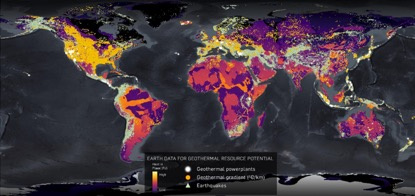

A geothermal resource assessment conducted by CGG SA has been licensed to an undisclosed energy company in the U.S., according to a news release.

A lithium brine screening study, also launched by CGG, was also licensed to the same company.

“The two studies, backed by industry prefunding before this license, provide accurate and unique independent tools to discover, assess and compare geothermal resource and lithium brine opportunities and the scale of their potential,” the company said in a news release. “They are the latest additions to CGG’s new suite of science-based GeoVerse TM modules specifically designed to support the energy transition.

Hydrogen

New Fortress to Build 120 MW Green Hydrogen Plant on Gulf Coast

New Fortress Energy Inc. entered an agreement for the construction of a 120-MW green hydrogen plant with Plug Power Inc., a press release announced on Aug. 4.

The plant, located in Jefferson County, Texas, near Beaumont, Texas, is expected to be the largest green hydrogen plant in North America.

Plug Power will produce its proton exchange membrane electrolysis technology and more than 50 tons of green hydrogen per day at the facility, which the company said is scalable to nearly 500 MW with the additional infrastructure.

“Amid an increasingly favorable U.S. policy environment for hydrogen, we are focused on scalable solutions that have a real impact on decarbonization and believe we are uniquely positioned to be an early mover in this vast and rapidly evolving market,” New Fortress chairman and CEO Wes Edens said in the release.

Within proximity to industrial end-users, the project site will allow it to access power and logistics such as rail, marine and existing pipelines spanning the Texas and Louisiana Gulf Coast region.

“Plug’s decarbonization goals and NFE’s [New Fortress Energy] energy transition goals are strongly aligned, and our partnership has strengthened at a pivotal time for the green hydrogen industry,” Plug CEO Andy Marsh said in the release.

Pertamina Unit Plans Hydrogen Production Trial in 2023

A unit of Indonesian state oil and gas company PT Pertamina aims to start a trial of hydrogen energy production next year as it seeks to expand its clean energy portfolio, a company official said on Aug. 3.

The company is currently preparing its geothermal plant in Ulubelu on Sumatra island to produce 100 kilograms of hydrogen per day for the trial, Fuadi Nasution, a vice president at Pertamina’s renewable energy unit said in an industry webinar.

Fuadi said Pertamina anticipates a surge in demand for hydrogen power by 2025-2030 and hopes it can start commercial production for hydrogen by 2025.

Pertamina has talked to a number of potential offtakers for the hydrogen output, which include buyers from Japan and South Korea, Fuadi added.

RNG

Brightmark RNG Delivers First RNG at Athena

First renewable natural gas has been delivered at Brightmark RNG Holdings’ Athena project in South Dakota.

Plans are for the RNG—generated by methane from manure from the Boadwine Farms, Pioneer Dairy and Mooody Dairy in Minnehaha County, South Dakota—to be injected into the local interstate pipeline system statewide, according to a news release.

“As agriculture and technology continue to advance and evolve, it has become apparent now more than ever that these two industries need to work hand in hand for the sake of our environment and those that inhabit it,” Lynn Boadwine, owner of the three farms, said in the release.

The dairy renewable project is expected to produce more than 55 million gallons of manure annually, according to Brightmark.

Brightmark RNG Holdings is a joint venture partnership between Chevron and Brightmark LLC.

Solar

GameChange Increases US Manufacturing Capacity

Connecticut-based GameChange Solar is increasing its capacity in the U.S. with a new 6-GW solar tracker factory.

The addition will bump the company’s U.S. tracker tube capacity to 14 GW, GameChange said in a news release Aug. 4.

“As our customers grow their business, GameChange is committed to continue to grow our substantial USA manufacturing base to allow for fast deliveries and flexibility in our supply chain,” GameChange Chief Commercial Officer Derick Botha said in the statement.

The 6-GW tracker tube line will start operations in the Midwest in February 2023.

EDP Renovaveis Buys 70% of Kronos Solar Projects

Portugal’s EDP Renovaveis (EDPR) has bought 70% of Kronos Solar Projects for about $256 million to help boost its growth in Europe, EDPR said.

German company Kronos has 9.4 GW of solar projects in different stages of development in Germany, France, the Netherlands and the U.K., EDPR said.

Germany represents close to 50% of the acquired solar development portfolio.

EDPR, which is the wind and solar unit of EDP-Energias de Portugal, said the deal allows it to expand its presence to 12 markets in Europe, which it said represents more than 90% of expected solar capacity additions in the European Union until 2030.

Miguel Stilwell d'Andrade, CEO of EDP and EDPR, said the deal gives the business a foothold in Germany and the Netherlands while strengthening its position in France and the U.K.

“We have great expectations in regards to Germany in particular as it is a key market in Europe with reinforced renewable growth targets,” he said in a statement.

The acquisition also creates opportunities to expand in wind power, hydrogen and energy storage technologies, the company added.

Wind

Cerulean Winds, Ping Petroleum Plan Wind-powered Oil Rig

Renewables developer Cerluean Winds and Ping Petroleum UK have signed an agreement to create an offshore oil facility powered by wind energy in Britain, the companies said on Aug. 2.

Under the agreement, the production unit at Ping Petroleum’s Avalon site in the U.K.’s North Sea will be powered by a floating offshore wind turbine that will be connected via a cable to a floating production and storage vessel.

It will remove up to 20,000 tonnes of carbon dioxide emissions a year, equivalent to taking more than 4,000 cars off the road, Cerluean Winds said in a statement.

Ping Petroleum UK acquired a 100% stake in the Avalon site in August 2021, with production expected to begin in 2025. The field has a total estimated recovery of 23 million barrels of oil.

The development concept plans have been approved by the North Sea Transition Authority (NTSA), and a field development plan will be submitted later this year.

Hart Energy staff and Reuters contributed to this article.

Recommended Reading

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.

Paisie: Crude Prices Rising Faster Than Expected

2024-04-19 - Supply cuts by OPEC+, tensions in Ukraine and Gaza drive the increases.

Report: Freeport LNG Hits Sixth Day of Dwindling Gas Consumption

2024-04-17 - With Freeport LNG operating at a fraction of its full capacity, natural gas futures have fallen following a short rally the week before.

Permian NatGas Hits 15-month Low as Negative Prices Linger

2024-04-16 - Prices at the Waha Hub in West Texas closed at negative $2.99/MMBtu on April 15, its lowest since December 2022.

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.