Major energy companies are teaming up to develop hydrogen hubs and carbon capture projects in the U.S. as work progresses on a hydrogen and ammonia production project in Australia.

The efforts continue as several solar projects began operations, including in California and Malaysia, and developers successfully convert woody biomass feedstock into high quality syngas for sustainable aviation fuel.

Here’s a look at some of this week’s renewable energy news.

Batteries

EV Battery Maker SK On Raises $1.5 Billion in Expansion Push

South Korea’s SK On has raised about 2 trillion won (US$1.51 billion) from private equity firms, pushing the electric vehicle (EV) battery maker’s valuation to around 20 trillion won as it works to expand production abroad, local media reported Aug. 19.

The battery unit of energy group SK Innovation Co. Ltd. has been in talks with a local private equity consortium which includes EastBridge Partners, Korea Investment Partners and Stella Investment, the Korea Economic Daily Newspaper said, citing unidentified investment banking sources.

SK On has been talking to global private equity firms, including Carlyle Group Inc. and BlackRock Inc., but talks have stalled due to the market impact of war in Ukraine and interest rate hikes, the newspaper said.

Geothermal

US Offers Up To $44 Million to Scale Up EGS

The U.S. Department of Energy (DOE) said this week up to $44 million is being offered for projects to develop and test innovative enhanced geothermal systems (EGS).

The funding, available via the DOE’s Frontier Observatory for Research in Geothermal Energy field lab, aims to scale up deployment of geothermal systems in the U.S. Up to 17 awards will be given.

Proposals are sought in the areas of seismicity monitoring protocols, novel reservoir stimulation techniques, experiments on EGS heat extraction efficiency, materials to sustain flow pathways in EGS reservoirs, and tools that can withstand high temperatures while isolating zones within the wellbore, the release said.

Hydrogen

Equinor, Shell, US Steel Team for Hydrogen, CCUS Hub

Equinor US Holdings Inc., Shell US Gas & Power LLC and U.S. Steel Corp. will collaborate on a clean energy hub in the U.S. focused on hydrogen production and utilization along with carbon capture, utilization and storage, according to an Aug. 16 news release.

The hub would be located in the Ohio, Pennsylvania and West Virginia region.

“Establishing a low carbon hub in this region could have a profound impact on both the climate and the economy, creating sustainable jobs that will support families for many years to come,” Grete Tveit, senior vice president for Equinor Low Carbon Solutions, said in the statement. “For 14 years we have been engaged and investing in this region, and our significant equity gas production in the Appalachia region has proved to be an important low carbon asset in our portfolio.”

Shell and Equinor plan to jointly apply for hub funding from the DOE, while U.S. Steel’s role in the project could include being a customer, supplier, partner or potential funding participant, the release said.

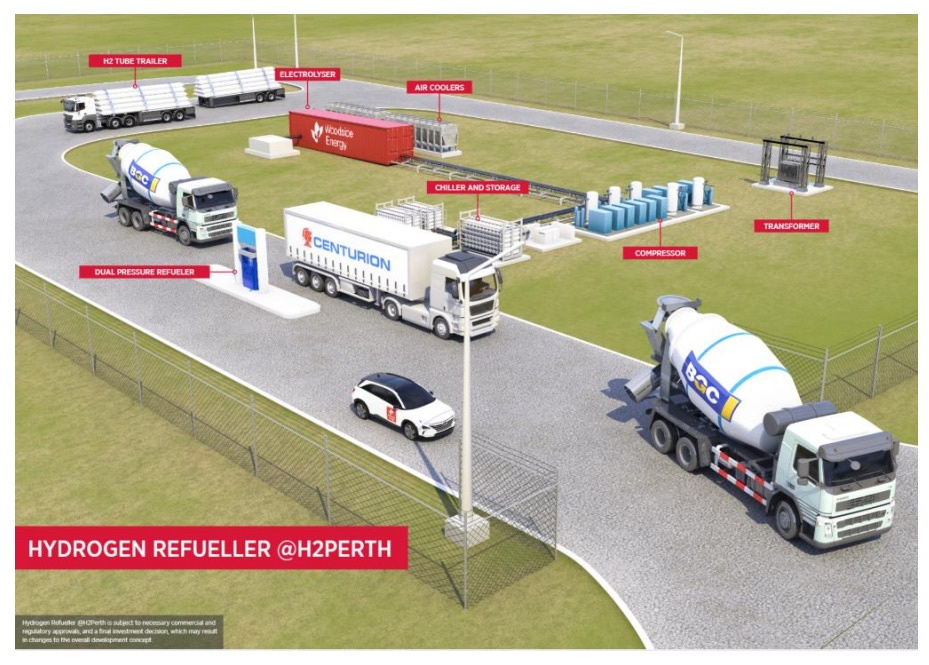

Woodside, Partners Pursue Hydrogen Fueling Project

Woodside, BGC and Centurion are moving forward with plans to develop a proposed self-contained hydrogen production, storage and refueling station.

The project, called Hydrogen Refueller @H2Perth, would be located adjacent to Woodside’s proposed H2Perth hydrogen and ammonia production facility in Western Australia. “The proposal targets delivery of hydrogen fuel at a globally competitive price of A$11 per kilo and subsidizes a number of large hydrogen fuel cell electric vehicles,” the company said in a news release.

Hydrogen would be produced using a 2-megawatt (MW) electrolyzer sourced with electricity from the South West Interconnected System. Plans are to initial produce 235 kilograms per day (kg/d) of hydrogen, but the facility would have potential to scale up to 800 kg/d.

Woodside said it has signed conditional, non-binding offtake memorandums of understanding stating its intentions to supply hydrogen from the project to BGC and Centurion. BGC intends to purchase and operate up to 10 hydrogen concrete agitator trucks, while Centurion intends to purchase and operate two hydrogen prime movers, the release said.

McDermott Lands Pre-FEED Contract for H2Perth

Woodside Energy has tapped McDermott to carry out pre-FEED work for the proposed H2Perth hydrogen and ammonia production project in Western Australia, according to a news release.

Plans are to produce hydrogen via electrolysis technologies and natural gas reforming. Carbon emissions would be abated or offset.

The engineering company said it plans to carry out work for the phased development from its office in Perth and its engineering center in The Netherlands.

Developers aim to produce at the facility up to 1,500 tonnes per day of hydrogen for export in the form of liquid hydrogen and ammonia.

RNG, Biofuels

Frontline, Red Rock Convert Biomass for SAF Production

Technology that gasifies residual woody biomass feedstock into high quality syngas for production of sustainable aviation fuel (SAF) and renewable diesel has been successfully tested by Red Rock Biofuels and Frontline BioEnergy, according to a news release.

The companies said Aug. 18 the technology was tested on Red Rock’s feedstock and used Frontline’s patented TarFreeGas and PMFreeGas technologies. The tests, carried out at Frontline’s headquarters in Nevada, Iowa, “demonstrated TarFreeGas gasifier production of high-quality syngas with excellent tar conversion, as well as PMFreeGas removal of char and ash from the syngas.”

The resulting syngas is suitable for further processing into SAF and renewable diesel, the release said.

“These tests mark a significant milestone toward the commercial deployment of biomass-to-drop-in fuels projects,” Frontline BioEnergy CEO Jerod Smeenk said.

Archaea, Énergir Sign 20-Year Renewable Natural Gas Agreement

RNG producer Archaea Energy Inc. is expanding its commercial partnership with Énergir LP by entering a new long-term RNG purchase and sale agreement, the company said Aug. 15.

This is the second long-term commercial agreement between Archaea and Énergir, the largest natural gas distribution company in Quebec.

Under the agreement, which is subject to regulatory approval by the Quebec Régie de l’énergie, Énergir expects to purchase 2.15 million gigajoules (approximately 2.04 million MMBtu) of RNG generated by Archaea annually from its portfolio of RNG production facilities for a fixed fee for a period of 20 years. Subject to regulatory approval, the agreement is expected to begin in October 2023.

RNG produced by Archaea for this expanded long-term partnership is expected to be a key contributor toward Énergir’s interim target of delivering 2% of its total annual natural gas volumes using RNG by 2023, with a longer-term target of 5% by 2025.

“We continue to see natural gas utilities, such as Énergir, as first-movers in the voluntary RNG market who are looking to RNG as a primary method of decarbonization in response to regulatory and existential mandates,” Archaea’s Co-founder and CFO Brian McCarthy said.

Liberty Closes Sandhill Advanced Biofuels Acquisition

Algonquin Power & Utilities Corp. (AQN) has entered the non-regulated RNG market with subsidiary Liberty (RNG) LLC’s completion of the Sandhill Advanced Biofuels acquisition.

Sandhill is a developer of RNG anaerobic digestion projects on dairy farms with four projects in Wisconsin, according to a news release. Two of the four projects are operational. The other two are expected online next year. Combined, the projects—which sequester methane from dairy operations—will produce about 500 MMbtu/day of RNG.

The completion marks Liberty’s first investment in non-regulated RNG, the company said Aug. 16.

“More and more, our corporate customers are demanding renewable energy sources to fuel their operations,” AQN Chief Development Officer Jeff Norman, said in an Aug. 16 news release. “In conjunction with our investments in wind, solar and hydro, RNG will help us expand our renewables capabilities, and get us closer to meeting our net-zero goals.”

Solar

EDF Renewables Cranks Up Palen Solar Operations

The 620-MW Palen Solar site has become fully operational in California, EDF Renewables North America said Aug. 17.

The site consists of four solar PV projects: Maverick 1, 4, 6 and 7. It also includes 200 MWh of battery energy storage in Riverside County, part of a Bureau of Land Management-designated Solar Energy Zone and Development Focus Area.

“The renewable energy industry has experienced significant volatility over the past years battling both unprecedented pandemic and supply chain constraints,” Benoit Rigal, senior vice president of implementation and projects management for EDF Renewables North America, said in a release. “We are excited to now have all four projects operating at full capacity and to contribute to California’s climate goal to reduce greenhouse gas emissions to 40% below 1990 levels by 2030.”

Engie Starts Operations at Malaysian SolarPower Project

French energy firm Engie said on Aug. 16 it has started commercial operations at its Kerian solar power project in Malaysia, the company’s first such plant in Southeast Asia.

The project, located in Perak state, has a capacity of 100 MW, or 136.44 megawatts-peak (MWp), Engie said in a statement.

Kerian Solar, named after the special-purpose company formed by a joint venture between ENGIE and TTL Energy Sdn Bhd, has entered into a 21-year power purchase agreement (PPA) with Malaysia’s state utilities company Tenaga Nasional Berhad, Engie said.

The project will contribute to Engie’s plans to install 50 gigawatts of renewable energy capacity globally by 2025, said Thierry Kalfon, managing director, ENGIE Renewables for Australia and Southeast Asia.

BP Solar JV Expanding in Australia with Two Projects

Solar developer Lightsource bp is set to reach financial close later this year on two new solar farms in Australia for a total cost of $560 million, the company half-owned by BP Plc said Aug. 16.

The Wellington North project in New South Wales and smaller Wunghnu project in Victoria, would give it five projects operating or under construction, with a combined capacity of more than 1 gigawatt (GW), Lightsource bp said.

That would make the company Australia’s biggest solar developer by capacity, it said.

Australia’s new Labor government is looking to slash carbon emissions by 43% from 2005 levels and have 82% of power generated by renewable energy by 2030.

“We see the acceleration of renewables happening more rapidly than previously anticipated,” said Adam Pegg, Lightsource bp Australia and New Zealand managing director, in a statement.

Australia is expected to make a “significant contribution” to the company’s global target of 25 GW of solar power by 2025, Pegg said.

EnBW Sells Minority Stake in 597 MW German Solar Portfolio

German utility EnBW has sold a 49.9% stake in a 597 MW solar power portfolio to local insurance firm ALH Group, reflecting rising deal activity across the renewables sector in light of higher valuations.

The companies decided not to disclose the purchase price for the portfolio, which covers 16 solar farms spread across Germany that produce enough energy to supply more than 200,000 three-person households.

“Selling minority stakes on the basis of investment models is part of EnBW’s renewable energy business model. We plan to invest the sale proceeds in new growth projects in the renewable energy and grids segments,” EnBW CFO Thomas Kusterer said.

“This is more important now than ever before, because every megawatt-hour from renewables makes Germany a little less dependent on fossil fuels.”

EnBW will continue to manage, service and maintain the solar farms.

Last month, Denmark’s Ørsted bought Ostwind, a German developer, owner and operator of onshore wind and solar projects in Germany and France, in a deal that valued the firm at $704 million.

Ostwind has 152 MW in operation and under construction, about 526 MW in advanced development and a further 1 gigawatt in its development pipeline.

Wind

Technip Energies, Partner Land Gray Whale 3 FEED Contract

TotalEnergies and Corio Generation have selected a Technip Energies-led consortium to perform FEED work for their Ulsan Gray Whale 3 wind farm project offshore South Korea, according to news released Aug. 17.

Working with Subsea 7 and Samkang M&T, TechnipEnergies will provide engineering for floater, mooring and interarray cable. The project includes Technip’s in-house floater technology INO15, a three-column semisubmersible floater.

Gray Whale 3, one of three wind farms being developed off Ulsan, South Korea, will be a 504-MW floating wind farm.

Innergex Marks Milestone with 30-year PPA at Boswell Springs

Berkshire Hathaway subsidiary PacifiCorp and Innergex Renewable Energy Inc. have sealed a long-term power purchase agreement (PPA) for electricity produced from the Boswell Springs wind project in Wyoming.

The 30-year, 320-MW PPA marks a milestone for the wind project, which is expected to begin commercial operations in fourth-quarter 2024.

“The contract will provide Innergex with long-term revenue certainty with a high quality, well-capitalized utility,” Innergex CEO Michel Letellier said in the release. “Once constructed, Boswell Springs promises to contribute to improving our payout ratio and to make a significant contribution to the decarbonization targets of the western states, where Innergex sees growing opportunities.”

The $544 million wind project is among the expected beneficiaries of the U.S. production tax credits. Operating cash flows from the company could reach about $22.6 million annually. Innergex said. The Canada-based company’s assets include 40 hydroelectric facilities, 35 wind farms, eight solar farms and one battery energy storage facility.

Hart Energy staff and Reuters contributed to this article.

Recommended Reading

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

PGS, TGS Merger Clears Norwegian Authorities, UK Still Reviewing

2024-04-17 - Energy data companies PGS and TGS said their merger has received approval by Norwegian authorities and remains under review by the U.K. Competition Market Authority.

Energy Systems Group, PacificWest Solutions to Merge

2024-04-17 - Energy Systems Group and PacificWest Solutions are expanding their infrastructure and energy services offerings with the merger of the two companies.

Chevron, Exxon in Dispute Over Hess Stake in Guyana Oil Block

2024-02-27 - Chevron’s $53 billion deal to buy Hess’ interests in the Stabroek Block offshore Guyana could be derailed as Exxon, CNOOC say they have first rights of refusal on the block’s interests.