(Source: Shutterstock.com)

Energy Transfer LP will acquire Lotus Midstream LLC in a $1.45 billion cash-and-stock deal, the company said on March 27. The deal includes thousands of miles of pipeline, gathering and storage in the Permian Basin and paves the way for a connecting crude oil pipeline project from Midland to Cushing, Oklahoma.

The purchase, from an affiliate of EnCap Flatrock Midstream (EFM), continues a rash of midstream deals worth billions of dollars that began late last year and continued to build momentum in January. The transactions have ranged from smaller bolt-on deals to multi-billion-dollar transactions such as Enterprise Products Partners’ acquisition of Navitas and Targa’s acquisition of Lucid Energy, Stacey Morris, head of energy research for VettaFi, told Hart Energy.

“Energy Transfer’s acquisition of Lotus is another example of a sizable acquisition of Permian assets, though this deal is different in that the assets are focused on crude gathering and transportation instead of natural gas,” Morris said.

Energy Transfer will pay $900 million in cash and approximately 44.5 million newly issued Energy Transfer common units.

“The financing mix is attractive, given the issuance of equity to the seller, so—not all cash, not going to raise leverage,” Hinds Howard, Principal and Portfolio Manager at CBRE Investment Management, told Hart Energy. “In general, this deal follows the trend we saw last year with large-scale bolt-on acquisitions for more than $1 billion by major midstream players. Navitas, Lucid, Trace all fit into the trend.”

RELATED

Abundant Cash Flow Fueled Batch of Midstream Deals as 2022 Ended

The transaction is expected to be immediately accretive to free cash flow and distributable cash flow per unit. Lotus Midstream cash flows are supported by fee-based revenues from fixed-fee contracts.

“The larger companies will continue to add assets in acquisitions, now that consolidation has happened and new project development isn’t needed or is too challenging to complete,” Howard said.

Morris echoed that, noting that opportunities will increase as private equity companies exit their investments.

“The Permian remains an attractive area for deal-making as midstream companies look to enhance their existing positions in the most prolific producing region in the U.S.,” she said. “With competition in the basin, growing footprints and enhanced connectivity to different markets can improve the offerings and transportation solutions that midstream companies can offer their customers.”

Deal Details

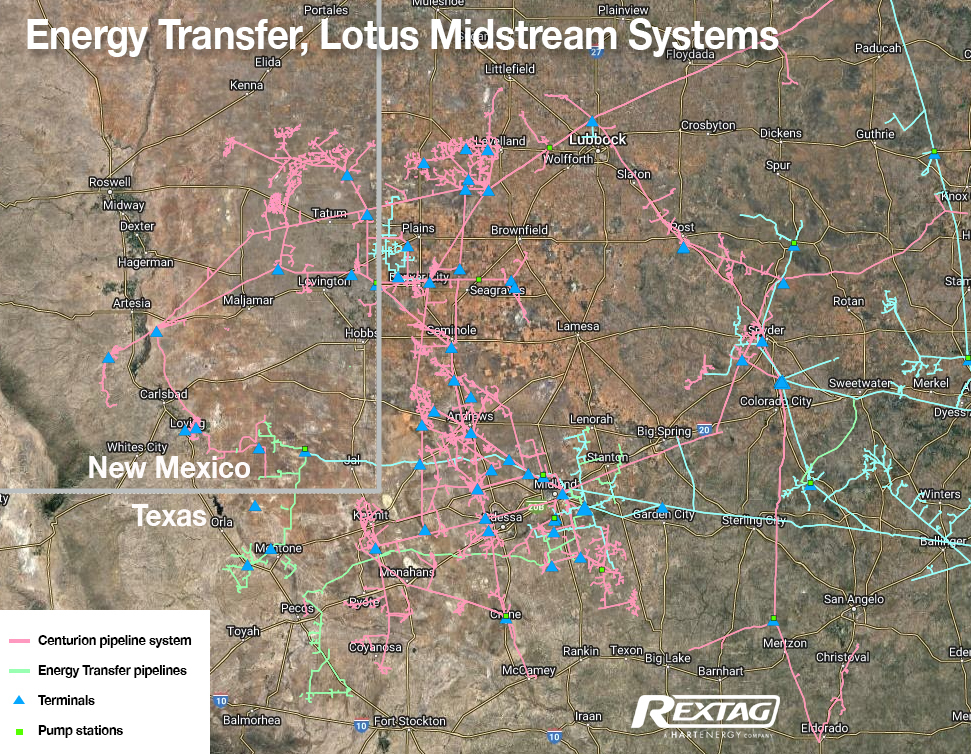

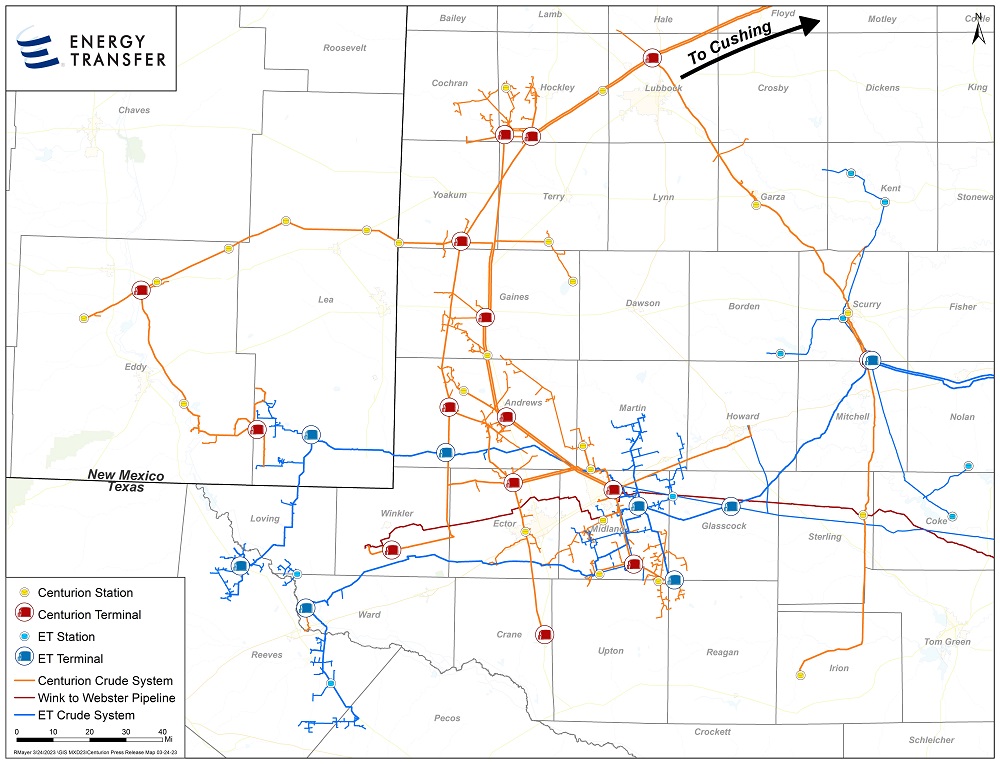

Energy Transfer’s acquisition, expected to close in the second quarter, includes Lotus Midstream’s Centurion Pipeline Company LLC—an integrated, crude midstream platform located in the Permian. Centurion Pipeline Co. provides a full suite of midstream services, including wellhead gathering, intra-basin transportation, terminalling and long-haul transportation services, according to Energy Transfer.

The system consists of approximately 3,000 active miles of pipeline and serves major production areas of the Permian with nearly 1.5 MMbbl/d of capacity. Lotus Midstream’s assets provide direct access to major hubs including Cushing, Midland, Colorado City, Wink and Crane. The system is anchored by large-cap producer customers with firm, long-term contracts and significant acreage dedications.

Lotus Midstream’s Midland Terminal offers 2 MMbbl/d of crude oil storage capacity and additional supply and demand connectivity. The acquisition also includes a 5% equity interest in the Wink to Webster Pipeline, a 650-mile pipeline system transporting more than 1 MMbbl/d of crude oil and condensate from the Permian Basin to the Gulf Coast.

Upon closing, Energy Transfer expects to begin construction on a 30-mile pipeline project that will allow Energy Transfer and its customers the ability to originate barrels from its Midland terminals for ultimate delivery to Cushing. This project is expected to be completed in first-quarter 2024.

J.P. Morgan Securities LLC and TD Securities are serving as financial advisers to Energy Transfer. Sidley Austin LLP is acting as Energy Transfer’s legal counsel on the transaction.

Jefferies is serving as financial adviser to Lotus Midstream, and Vinson & Elkins LLP is acting as Lotus Midstream’s legal counsel.

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.