An oil and gas field survey boat moves ahead. (Source: Sad Agus / Shutterstock.com)

A trade group for energy geoscience companies that scope the seabed for energy infrastructure and exploration sites released on Aug. 11 guidance for estimating and reporting greenhouse gas emissions (GHG) for the sector.

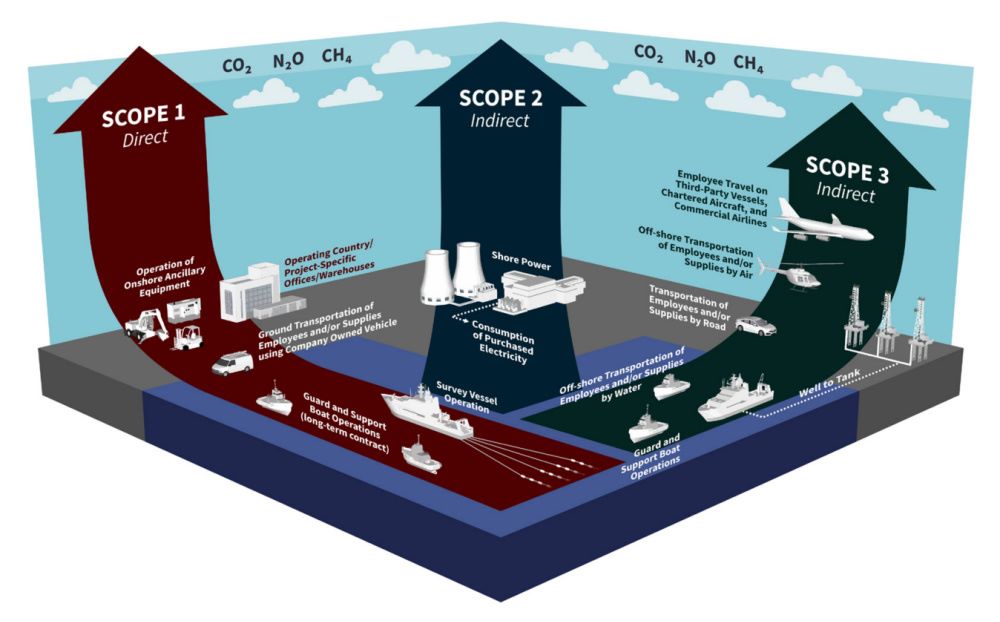

The EnerGeo Alliance guidance for member companies addresses Scope 1, 2 and 3 emissions and accounts for global emissions initiatives such as the 2015 Paris Agreement and the World Resources Institute and World Business Council for Sustainable Development’s Greenhouse Gas Protocols. The effort also aims to avoid the double reporting of emissions among companies reporting on different scopes.

“Our goal is to fuel a continuous cycle of improvement and excellence in health, safety, environment and ESG performance,” EnerGeo Alliance President Nikki Martin said during a media briefing. She later added, “The guidance enables voluntary collection, accounting and reporting of emissions in a manner that is transparent and consistent and provides the necessary data to measure and reduce emissions throughout the entire value chain.”

The guidance for marine geoscience survey contractors and survey operators was released as the world aims to lower emissions to slow global warming, keeping global temperature increases below 2 C. Balancing energy demand needs with emissions reduction goals has become a focus for stakeholders in the sector.

For the energy geoscience sector, GHG emissions mostly come from fuels used in vessels and helicopters needed to perform operations and transport workers.

Martin explained that the guidance addresses sources by scope associated with marine geoscience survey operations.

“Scope 1 addresses direct emissions. This includes survey vessel operations, guard and support boat operations, operation of onshore ancillary equipment and includes project specific onshore processing, offices and warehouses,” she said. “Scope 2 addresses indirect emissions from electricity consumed by the company during the course of the operation, and Scope 3 addresses emissions that are the consequence of the activities of the company but occur from sources not owned or controlled by the company.”

In addition to CO2 and methane, the alliance gives guidance on the calculating and reporting of nitrogen oxides.

Scope 1 and 2 reporting is required at a minimum based on the GHG Protocol Corporate Standard. EnerGeo’s optional guidance on Scope 3 emissions covers emissions from activities such as employee travel on third-party vessels, chartered aircraft and commercial airlines; guard and support boat operations; and offshore transportation of employees and/or supplies by air or water.

“We set boundaries based on the significance of the emissions from each operation and to ensure that double reporting of emissions is avoided,” Martin said. “One company reports Scope 1, while another reports Scope 3, avoiding double reporting of Scope 1.”

TGS CEO and EnerGeo chairman Kristian Johansen said he believes the guidance will promote consistency and facilitate lower emissions in the industry, which is critical.

“Our member companies had numerous objectives for reporting, including transparency, and our commitment to EGS for public stakeholders and shareholders, and supporting our partners and clients’ net zero goals,” he said. “The more standardized and transparent they are, the easier it is to assess and be better able to track the carbon footprint of industry activities.

EnerGeo also plans to develop onshore energy geoscience emissions guidance.”

Recommended Reading

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

US EPA Expected to Drop Hydrogen from Power Plant Rule, Sources Say

2024-04-22 - The move reflects skepticism within the U.S. government that the technology will develop quickly enough to become a significant tool to decarbonize the electricity industry.

For Sale? Trans Mountain Pipeline Tentatively on the Market

2024-04-22 - Politics and tariffs may delay ownership transfer of the Trans Mountain Pipeline, which the Canadian government spent CA$34 billion to build.

TotalEnergies to Acquire Remaining 50% of SapuraOMV

2024-04-22 - TotalEnergies is acquiring the remaining 50% interest of upstream gas operator SapuraOMV, bringing the French company's tab to more than $1.4 billion.

TotalEnergies Cements Oman Partnership with Marsa LNG Project

2024-04-22 - Marsa LNG is expected to start production by first quarter 2028 with TotalEnergies holding 80% interest in the project and Oman National Oil Co. holding 20%.