Hart Energy Special Report

Energy ESG: Investing in Our Future

An in-depth report on the state of ESG initiatives in oil and gas. This Energy ESG special report produces a clear picture of ESG today. Learn more

Brought to you by

From completions to cutting flaring, sustainable oil production for a lesser environmental impact has become a necessity for satisfying investors and optimizing operations. Putting the technology in place to make a new kind of drilling operation is a technological dance requiring several partners.

In this CEO roundtable discussion, technology providers talk about the path toward sustainable production. Experts include: Eyal Aronoff, CEO of Pioneer Energy; Jason Roe, CEO and president of EcoVapor; Jonathan Rogers, CEO of Locus Bio-Energy Solutions; and Tracy Scott Turner, CEO of CP Energy Services | Sand Commander.

HART ENERGY: We know the pressure to fight climate change is increasing. What are some of the key trends that you believe are driving this surge for the need for new technologies and solutions to reduce emissions?

ROE: It’s a good question. There are a few direct trends that you see going on. One is a real active push for not only transparency, but also granularity in emissions reporting. And so, what you see is a demand from operators to understand what the problem is. Then, as I heard someone say, once you have the realization, you get driven into action.

We’ve been talking about the energy transition and emissions management strategies for several years now. I think we’ve been going through a phase of understanding and to a real phase of action, which has been really good to see.

HART ENERGY: Are you seeing any reluctance from producers to adopt new technologies? And if so, how are you overcoming that?

ROGERS: No reluctance. But I think there’s a ‘show me’ mentality, which is understandable. I will say if you take an average well, which takes $7 million to complete, people don’t want to experiment with that. So we’re lucky that we’ve got over 300 case histories, and we can demonstrate now through the laboratory tests that we do, that we can get a great correlation with the results we get in the lab and the results we get in the field.

We’ve got some of the biggest household name operators in the Bakken, where we are actively testing and piloting our technology.

We believe that we have an extremely high confidence rate of producing better results. So we’re not getting pushback. In fact, we’ve been recognized by Northeast Oil & Gas awards for an emerging new green technology…so, this is not something that is being seen as something novel or even risky. It’s just, obviously, people want to see data.

HART ENERGY: Many businesses are coming out and pledging for net-zero emissions by 2050. And that list just continues to grow. But do you think this goal is realistic, and what is the path forward for net-zero emissions?

ARONOFF: We are all…trying to see where we should put our resources as companies [and] as service providers to the industry. Where is the innovation coming from, and where do we fit in the overall picture?

In 1988, Time magazine came up with this cover article on the death of IBM. Because in 1988, mini computers started to show up. Personal computers started to become something that would happen in every person’s house…And here we are, 33 years later, and IBM is still with us. So if you think about 2050, oil is still going to be with us.

What does it really mean to be netzero? It means we have to find a way to minimize Scope 1 emissions, which is our own emissions. Then, we have Scope 2, which is usage emissions that we add on top that we also have to find a way to minimize and offset. And then Scope 3, which is the use of the products in cars and in trucks and so on. We heard about carbon sequestration. So there’s going to be a whole range of solutions. But I think the industry is going to first be judged by how reactive it is to the first challenge, which is Scope 1 emissions.

HART ENERGY: How are you aligning your operations to make sure you’re satisfying investors and meeting ESG goals?

ARONOFF: If you just do your calculations of emissions for EPA, this does not reflect your true emissions. The industry right now is just trying to figure out what’s the accounting method. What are they required to report? What are they required to measure? And is there going to be any penalty that they already are beyond what they said that they would be? And that’s a challenge. But then beyond that, I think it’s going to be deploying solutions, deploying technology that will be able to move toward lesser emissions and more production.

ROE: I would second a lot of what he said. I think what’s interesting that you see going on right now is really about the monitoring side of the equation, and there’s a great reconciliation going on, if you will, which is what we are reporting versus what we are actually measuring. The more monitoring you have, whether it be satellite, whether it be fixed wing, whether it be drone, whether it be ground-based—that reconciliation is going to be interesting to watch. And then the second part of that is what do you do about it? And so, when they get down to that level, I think that’s where you’re really starting to see an active push into mitigation techniques by operators.

“One thing that’s going to be interesting to observe in the coming years is how carbon reduction is incentivized, whether it’s via tax credits, whether it’s by carbon offsets [or] whether it’s via responsibly sourced gas.”—Jason Roe, EcoVapor

HART ENERGY: What are some of the biggest challenges that your companies are addressing right now specifically in the area of emissions?

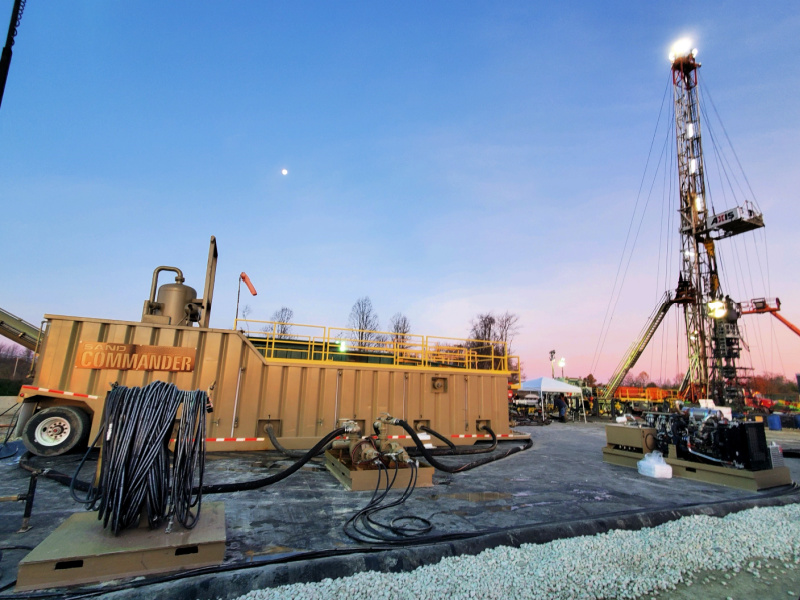

TURNER: Every company really wants to save money. They want to be environmentally sensitive, and they want to do things safely. When we structured and invented the Sand Commander concept, our whole point was we were able to go to them and say, ‘We are going to save you money [and] we’re going to make your processes more safe,’ which is incredibly important, particularly for me coming from a well-controlled blowout pressure control background. And we will be able to allow you to check the ESG boxes. Now, during our initial conversations, people were like, ‘Yeah, this ESG. What’s it all about?’

Well, if you look at the records of ESG, it was first being talked about in 2006. It’s not a new concept. And that’s why we’ve been able to advance very quickly.

HART ENERGY: We talked about new technologies to reduce emissions, but what really is the future of carbon management to reduce emissions? What are some key trends that will dominate this area over the next few years?

ROE: One thing that’s going to be interesting to observe in the coming years is how carbon reduction is incentivized, whether it’s via tax credits, whether it’s by carbon offsets [or] whether it’s via responsibly sourced gas.

And as you can imagine, as that gets put into practice, there’s a trickle-down effect in the fact that, if I really want to have differentiated gas, I need to be able to demonstrate that and to be able to certify that.

I need to prove that I’m going above and beyond what is regulated to be able to actually call myself a responsible producer. And then, if you really are going to be able to demonstrate and prove these offsets and be able to incentivize the operators to reduce their emissions, I think that’s going to be groundbreaking in terms of how you see behavioral change in the industry.

As technology providers in the space, it’s obviously a very exciting opportunity for us.

“The industry right now is just trying to figure out what’s the accounting method. What are they required to report? What are they required to measure? And is there going to be any penalty...? And that’s a challenge.” —Eyal Aronoff, Pioneer Energy

ROGERS: We’ve seen evidence today that [shale producers are] flaring methane gas, the most troublesome greenhouse gas, and I won’t say that’s the easiest fix, but surely the lowest hanging fruit. One of the things that we don’t look at is, if you think about the shale industry, how much do we actually extract? We are only recovering about 10% to12%, maybe 14% original oil in place.

So I think we’ve got to do more with less, and we’ve got to find ways that every time we do a frac, every time we complete a well, we look at a total lifetime of that well. At the moment now, as you’re probably aware, it’s very much divided up among the company. Both of the groups, the ones who are doing the completion and the production—are very much driven by the cost and how to reduce that cost.

And I think we’re moving toward a more joined up way and total life of the asset. And I think we’ve got technologies that can get a higher initial production from that well. And then, by intervening where the chemistry, say every two years, we could probably get 50% more of that original oil in place out of that well.

HART ENERGY: Jason, would you like to share your thoughts on what progress has been made so far? Where do we stand?

ROE: You hear a lot of the industry talk about the first 80%—this 80:20 rule— and focusing on the super emitters and the big problems before getting to the tail as you will. The trends that you’re going to start seeing are…OK, so these are the super-emitting moments: we identify them, we mitigate them, we repair them and we continue to prevent them. But then over time, you’re going to have to start thinking more holistically about how you’re going to manage the problem. It can’t just be, ‘Hey, I’m going to prevent a massive emissive event.’

And so, as people start to focus more and more on the totality of their operation, they’re going to look more and more at these life-of-asset type applications.

How can I actually transition to an operation where I’m going to design this into what we do? And so, as an example, what we’re doing at EcoVapor is we’re really focusing on this kind of a life-of-wealth solution that we can offer to clients, which is, we know initial production comes with its own emissions profile.

We know that first while you go through that kind of decline curve, there are still larger emissions in the beginning, but we have to have the life-of-well solution where we can have the smaller production volumes also being accounted for.

Editor’s note: This roundtable discussion, originally conducted at Hart Energy’s Carbon Management Forum at DUG Permian Basin + Eagle Ford, has been edited for clarity. Click here to see the complete video of the roundtable presentation.

Recommended Reading

Fire Closes Atlas Energy’s Kermit, Texas Mining Facility

2024-04-15 - Atlas Energy Solutions said no injuries were reported and the closing of the mine would not affect services to the company’s Permian Basin customers.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.

Exclusive: Scepter CEO: Methane Emissions Detection Saves on Cost

2024-04-08 - Methane emissions detection saves on cost and "can pay for itself," Scepter CEO Phillip Father says in this Hart Energy exclusive interview.

Majority of Recent CO2 Emissions Linked to 57 Producers - Report

2024-04-03 - The world's top three CO2-emitting companies in the period were state-owned oil firm Saudi Aramco, Russia's state-owned energy giant Gazprom and state-owned producer Coal India, the report said.