Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Hart Energy Special Report

Energy ESG: Investing in Our Future

An in-depth report on the state of ESG initiatives in oil and gas. This Energy ESG special report produces a clear picture of ESG today. Learn more

Brought to you by

Get ready. Climate-related financial reporting is coming, and it is like no other financial reporting requirement before. It can be challenging to understand and implement. However, if approached in the right way, climate-related financial reporting can be both easy and valuable.

To get started, don’t treat the requirements as a chore, only to check the compliance box. Instead, lean into the reporting framework to find the value. The reporting framework drives good governance, strategic thinking, risk management and operations. If a commitment is made to get value from the climate-related financial reporting exercise, it can be rewarding for leaders and staff. Market and operational opportunities may surface that otherwise would have been missed.

SEC rules expected

Before year-end 2021, the U.S. Securities and Exchange Commission (SEC) is expected to issue rules requiring climate disclosure for public companies. But if you think you are in the clear because your company is not public, think again. The push behind these reporting requirements stems from the belief that to prevent a global climate financial crisis, climate-related financial reporting needs to become a baseline for all businesses so risks get identified, monitored and dealt with.

“As the key to real estate is location, location, location, the key to managing climate-related risks and opportunities is governance, governance, governance.”

Federal efforts are in motion for climate-related financial reporting to be considered in multiple government policies and programs for contracts, lending, underwriting and accounting standards. So if your business touches federal business loan programs, agribusiness incentives, deposit insurance, flood insurance or regulated financial products or services, climate-related financial reporting may be coming your way.

The SEC’s proposed rule is based on the Task Force for Climate-related Financial Disclosure’s (TCFD’s) 2016 recommendations. Financial professionals wrote the TCFD recommendations for a financial audience and are different from the SEC’s existing disclosure requirements in several ways. Including more emphasis on forward-looking analysis and statements, requirements to describe opportunities and not just risks, the inclusion of scenario analysis and non-financial metrics and targets with emissions reporting. The concepts in the TCFD recommendations can be difficult to understand. On top of that, most of the TCFD documents are written by a committee, and the documents read like they were.

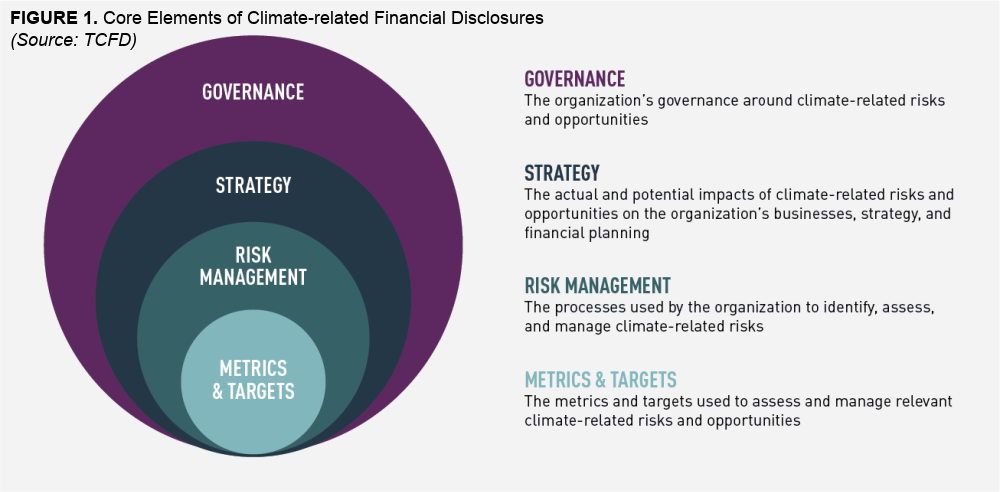

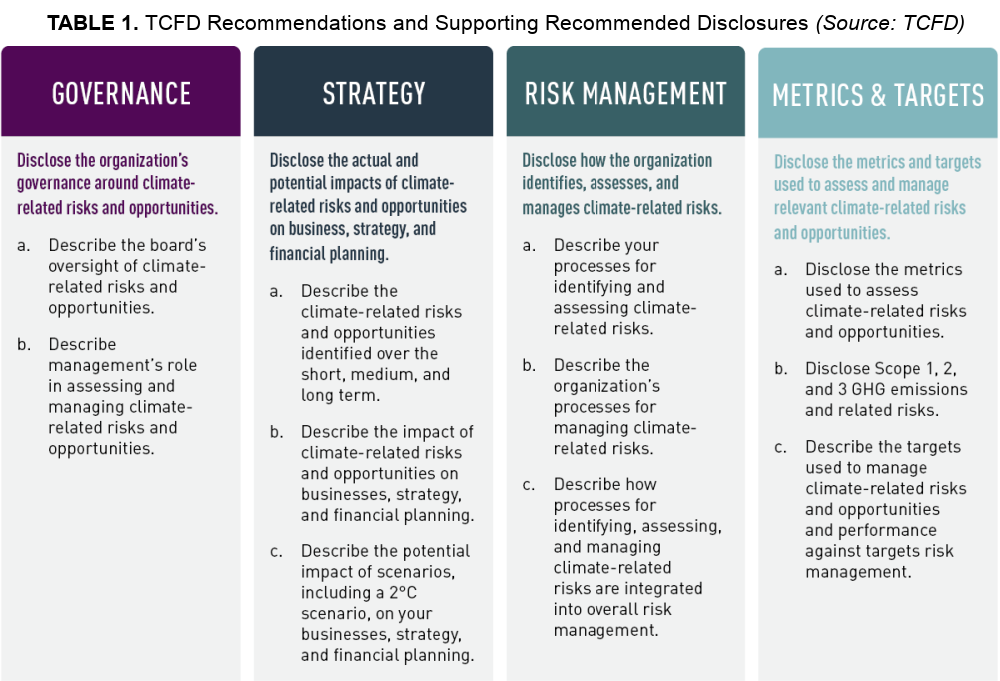

The challenge in implementing the TCFD’s recommendations is not a lack of guidance. Instead, part of the challenge is the abundance of information. In support of their recommendations, the TCFD published an annex, technical supplements, scenario-analysis guidance, a status report, a consultation document, webinars and other documents totaling thousands of pages. Much of the material is not clear, concise or easy to understand. Luckily, the TCFD summarizes the bulk of their recommendations in one picture and two tables (Figure 1, Table 1 and Table 2).

The four core areas of the TCFD’s recommendations are shown in Figure 1 and include governance, strategy, risk management, metrics and targets. Two important takeaways from this chart are the repeated use of the term “climate-related risks and opportunities,” and governance is the first and most prominent part of the graphic.

Governance

As the key to real estate is location, location, location, the key to managing climate-related risks and opportunities is governance, governance, governance.

Investors put a premium on board makeup and involvement. Board members are generally intelligent, accomplished, thoughtful and driven individuals. They are motivated to help their companies’ employees, customers and investors succeed. The act of preparing to present to a board on a topic makes leadership better understand and manage a topic. Board member questions can go a long way in getting an organization to systematically address risks and pursue opportunities.

Some questions to consider about your board include:

- Is your board talking about climate-related risks and opportunities?

- Are those discussions frequent?

- Are there members of your board who have expertise in climate-related topics?

- Has regular management reporting on climate-related topics been established?

- Does the board seek the opinions of third-party experts on climate topics?

- Are oversight responsibilities of climate-related risks and opportunities formalized in the board or committee bylaws or charter?

Identifying risks and opportunities and establishing governance for climate topics are important early steps, but there is more to the TCFD recommendations. Its recommended disclosures are summarized in Table 1.

Of the 11 items listed, nine start with the word “describe.” In other words, for those nine topics, the reporting is a narrative of the topic. Start that reporting by describing the topics using the 5 Ws—who, what, when, where and why.

For example, for the first topic, board oversight, is it the full board or a committee that oversees climate topics? What topics has the board reviewed? If management reports on climate topics, is there an established reporting cadence of quarterly, semi-annual or annual reporting for various topics? Are some of the topics covered in committee meetings and others with the full board? If topics are covered more or less frequently, why are some topics given higher priority over others? These types of questions can be asked and answered for each disclosure topic.

Climate-related risks and opportunities

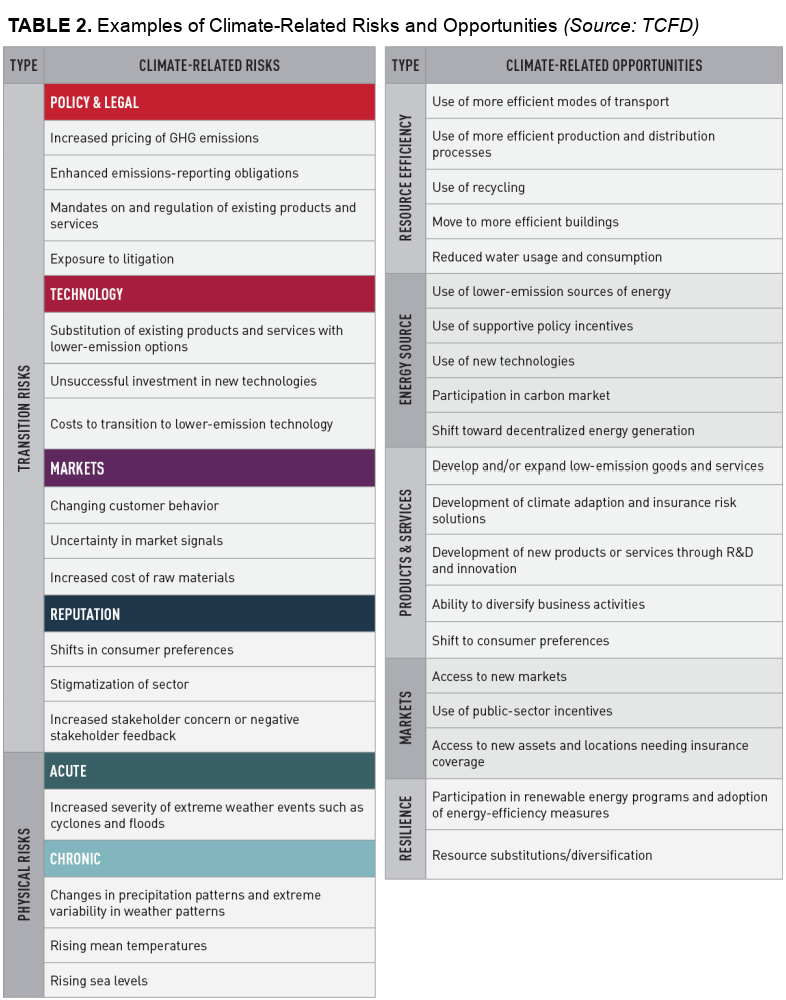

An essential early step is developing an understanding of what potential climate-related risks and opportunities there are for your business. The TCFD provides several examples in Table 2.

Notice that the climate-related risks are divided into two types: transition risks and physical risks.

Transition risks are “risks related to transition to a low-carbon economy,” which the TCFD breaks down into four categories: policy and legal, technology, markets and reputation. Examples of transition risks in these categories for an oil and gas company could include the potential for increased regulatory costs, increased costs for emissions control technologies, decreased demand for oil and gas and increased investor concern.

Physical risks are “physical impacts of climate change” and are categorized into acute risks (e.g., increased severity of extreme weather events) and chronic risks (e.g., changes in weather patterns).

On the other side, climate-related opportunities are divided into five types: resource efficiency, energy sources, products and services, markets and resilience. See Table 2 for examples of climate-related opportunities.

As a business develops its list of climate-related risks and opportunities, it should also think through the potential financial impacts of both (e.g., increased costs and revenues), ways to mitigate the risks (e.g., reduce emissions) and ways to capitalize on the opportunities (e.g., start a new business line).

Scenario analysis

The more challenging parts of climate-related financial disclosures are scenario analysis and emissions reporting. The scenario analysis is sometimes difficult because people can fall into the trap of focusing on—and it’s difficult not to—the parts of a scenario in which they disagree. Because the scenarios require significant assumptions, it’s easy to fixate on those assumptions and the holes in them.

Necessary but dubious assumptions include the development of technologies that don’t exist yet or costs and the effectiveness of technologies that are orders of magnitude better than today. Focusing on how unlikely the assumptions and outcomes are can sidetrack the value in the scenario analysis. One near absolute for scenarios is they are wrong. Move on. The value of scenario analysis is largely a tool for the development of business resilience. It’s exploring questions like, if the scenarios were to occur, what adjustments could we make in our business today, or in the future, to protect and grow our business? Does it make sense to make those adjustments today? Or what parameters in the environment and marketplace should be monitored to identify emerging risks and opportunities so they can be mitigated or pursued? What are the thresholds in those parameters that would trigger the business to act?

Emissions reporting

Emissions reporting is difficult because disclosing greenhouse-gas (GHG) emissions per the TCFD recommendations is different than emission reporting under environmental regulatory standards. Emission reporting infrastructure built for reporting to environmental agencies will likely require changes, sometimes significant, to meet climate-related financial reporting standards.

Currently, GHG emissions reporting for state and U.S. EPA purposes is generally done for Scope 1 emissions from individual facilities, and not entire companies, while excluding smaller emission sources, Scope 2 emissions and Scope 3 emissions. But GHG emissions reporting using the standards referenced by the TCFD has its own set of accounting rules that don’t exactly align with financial accounting rules, such as the concepts of operational versus financial control and market versus location-based Scope 2 emissions reporting. Additionally, while double counting in financial accounting is usually an error where a transaction is counted more than once, double counting is embedded in the GHG reporting standards. For example, one organization’s Scope 1 emissions may be Scope 2 for another, and an organization’s Scope 3 emissions could be another organization’s Scope 1 emissions, and so on.

The same reporting processes companies have established for financial reporting often need to be developed for emissions data reporting. Emissions reporting for environmental regulations generally has data verification processes that are not as robust as an organizations’ financial data controls established under Sarbanes-Oxley Act of 2002. A small percentage of companies have had their emissions data assured by a CPA firm, and many executives overseeing and signing off on climate financial reports should want a level of review equivalent to what they have for their financial accounting to check that their data are reasonable and accurate, timely and reliable, and consistent and comparable. Developing and documenting internal controls for data gathering and reporting processes likely need to be initiated to achieve financial reporting levels for checking accuracy and completeness.

Bottom line

Climate financial reporting requirements are coming. If you haven’t started yet, governance improvements can be the easiest, the most impactful and most appreciated by investors. If your board doesn’t have members qualified to assess climate-related risk and opportunities, help to get them educated. If your board hasn’t discussed the SEC’s statements and questions on climate-related financial disclosures, get it on your agenda. And commit to getting value from the exercise.

The thinking, discussions and analysis that go with climate financial reporting can, if approached the right way, lead to improvements in governance, strategic thinking, risk management and operations. Don’t expect to be perfect right out of the gate. To get ahead of the coming requirements, you just need to get started.

Dirk Cockrum is BKD’s ESG national practice leader and is based in the firm’s Houston office. He has more than 20 years of experience helping companies improve their ESG performance.

Editor’s note: This article is for general information purposes only and is not to be considered as legal advice. This information was written by qualified, experienced BKD professionals, but applying this information to your particular situation requires careful consideration of your specific facts and circumstances. Consult your BKD adviser or legal counsel before acting on any matter covered in this update.

Recommended Reading

Private Equity: Seeking ‘Scottie Pippen’ Plays, If Not Another Michael Jordan

2024-01-25 - The Permian’s Tier 1 acreage opportunities for startup E&Ps are dwindling. Investors are beginning to look elsewhere.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

In Shooting for the Stars, Kosmos’ Production Soars

2024-02-28 - Kosmos Energy’s fourth quarter continued the operational success seen in its third quarter earnings 2023 report.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.