EnCap’s move to include renewables is not an abandonment of oil and gas though, notes EnCap Managing Partner Doug Swanson. (Source: Hart Energy/Shutterstock.com)

EnCap Investments LP, a private-equity firm with a decades-long history of investing in oil and gas, is now adding renewables to its portfolio.

The Houston-based firm said Sept. 23 it formed an “energy transition” team to pursue opportunities created by the global transition to a lower-carbon energy system. Investment targets range from solar and wind generation to battery storage systems.

EnCap’s announcement comes at a time of growing demand for the industry to take climate change action. Similarly, on Sept. 23, a group of 13 major oil companies, that included U.S.-based Exxon Mobil Corp., Chevron Corp. and Occidental Petroleum Corp., charted out a plan to promote carbon-capture investments.

Since 1988, EnCap Investments has been the leading provider of venture capital to the independent sector of the U.S. energy industry. The firm has raised 21 institutional investment funds totaling roughly $37 billion and currently manages capital on behalf of more than 350 U.S. and international investors.

EnCap’s move to include renewables is not an abandonment of oil and gas though, notes EnCap Managing Partner Doug Swanson.

“Fossil fuels will continue to play an essential role in meeting global energy demand in the coming decades,” Swanson said in a statement. “However, renewable energy sources are poised for rapid growth.”

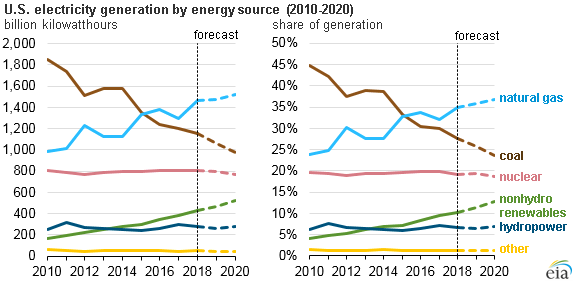

Renewables are projected to be the fastest-growing source of electricity generation in North America, according to a report by the U.S. Energy Information Administration (EIA) earlier this year. In particular, the EIA expects non-hydroelectric renewable energy resources such as solar and wind to grow at a faster rate than any other sources of U.S. electricity generation for at least the next two years.

Even with the growth from renewable energy sources, the EIA said fossil fuels will still provide most of the electricity generated in the U.S. for the next two decades. Coal and nuclear combined currently generate 47% of U.S. electricity.

Over the next two decades, U.S. electricity generation from nuclear and coal is projected to decline to 14% from 47%. Meanwhile, renewable sources of U.S. electricity are projected to grow to 37% from 18%, EnCap said on its website citing Bloomberg.

Swanson added that EnCap sees this transition toward renewables and away from coal and nuclear as an opportunity.

“Similar to our move into the midstream space 10 years ago, we believe the market dynamics in renewables will present very exciting investment opportunities for our firm,” he said.

To date, EnCap has invested roughly $22 billion in more than 240 different upstream companies. In 2008, the firm also began investing in the midstream space through the creation of EnCap Flatrock Midstream in partnership with Flatrock Energy Advisors LLC.

EnCap’s energy transition team will be led by Jim Hughes, Tim Rebhorn, Shawn Cumberland and Kellie Metcalf, all four of which worked together at Prisma Energy LLC and other firms before joining Encap. Prisma Energy is a Houston-based venture capital firm focused on providing integrated energy storage and finance solutions for application in utility, industrial and commercial markets in North America.

Recommended Reading

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.