EnCap agreed to double its investment in Pegasus Resources, a mineral and royalty company focused primarily in the Permian Basin, bringing its total equity commitment to $600 million. (Source: Hart Energy/Shutterstock.com)

EnCap Investments LP is doubling down on oil and gas minerals and royalties with a second infusion of equity in Fort Worth-based Pegasus Resources LLC.

Pegasus, a mineral and royalty company focused primarily in the Permian Basin, said Feb. 11 it had secured the additional equity commitment from EnCap of $300 million, bringing EnCap’s total commitment in the company to $600 million.

The move by EnCap comes less than a week after the private-equity firm agreed to sell its stake in oil and natural gas minerals and royalties controlled through Phillips Energy Partners to Kimbell Royalty Partners LP (NYSE: KRP).

RELATED: Kimbell Royalty Partners Adds EnCap Assets In Multimillion-dollar Acquisition

The deal, which was a 100% equity transaction valued at about $151.3 million, follows a record-breaking year overall last year for deal making in the mineral and royalty space.

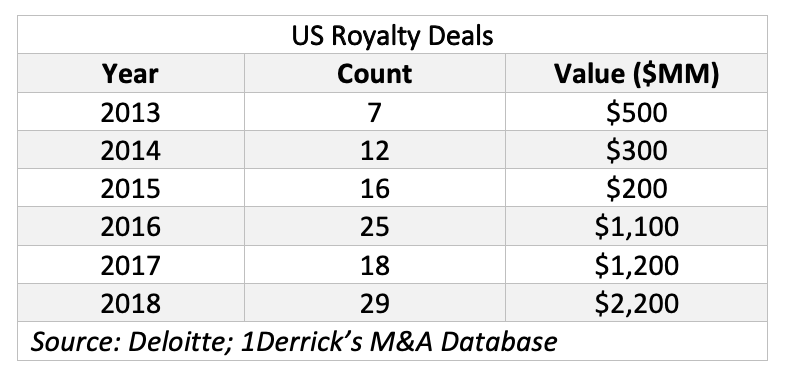

In 2018, royalty deal volume and value in the U.S. reached an all-time high of 29 deals worth $2.2 billion, according to a recent report by New York-based consulting firm Deloitte.

“Most of these deals either focused on the Permian or on a bundle of oil-heavy shale plays,” the Deloitte report said. “Furthermore, all the royalty deals in 2018 were for proven but undeveloped assets, implying that companies explored this tool to drive future growth and distributable cash flow per unit by minimizing the financial risk involved in operating the assets.”

Pegasus itself was formed in 2017 to acquire and manage mineral and royalty properties located in the core of established and rapidly emerging resource plays, primarily the Permian Basin.

Led by CEO George M. Young Jr., who has spent more than 35 years in the energy industry, Pegasus has spent the past year focusing on properties in the core of the Delaware and Midland sub-basins of the Permian.

In a statement, Young said his team is “pleased with the significant deal flow we continue to see and are confident in the mineral and royalty space as a whole.”

Young most recently served as CEO of Silverback Exploration LLC, a Delaware Basin-focused E&P that sold to Centennial Resource Development LLC for $855 million in late 2016.

At Pegasus, Young is joined by Will O. Rodgers, president and COO who most recently served as vice president of Collins and Young LLC and vice president of Wolf Exploration LLC, and CFO Lynn Frank, who most recently served as director of finance for Black Stone Minerals LP (NYSE: BSM).

The Pegasus management team has worked together successfully in various ventures for over a decade and represents decades of experience in land, geology and engineering, and has expanded its accounting and finance capabilities to manage its rapidly growing portfolio of producing properties, according to the company press release.

“Our goal at Pegasus has always been to create long-term value by building a portfolio of mineral and royalty interests with sustainable, multi-generational growth potential,” Young said. “EnCap has been an outstanding equity partner from the beginning and this additional capital allows us to continue to source best-in-class opportunities, under the premier operators, in the most prolific oil and gas basin in the world.”

Pegasus received an initial commitment of $300 million from EnCap in November 2017.

“This second infusion of equity is a testament to our confidence in the Pegasus team and their overall development strategy,” said EnCap Co-Founder and Managing Partner David Miller in a statement. “We look forward to continuing our successful partnership and being part of the Pegasus growth story.”

Additionally, Pegasus said it will continue its partnership with Tilden Capital LLC, according to the company release.

Tilden is an independent oil and gas investment company also based in Fort Worth. The firm has a long track record of successfully sourcing and closing mineral and royalty acquisitions across various basins, and specifically the Permian Basin, the release said.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.