Workers on a rig within Encana’s position in the Duvernay, where the Calgary, Alberta-based company added assets through its acquisition of Newfield Exploration that closed earlier this year. (Source: Encana Corp.)

Encana Corp. is selling off its Arkoma Basin position as the Calgary, Alberta-based company continues to digest the slew of assets it acquired earlier this year from its multibillion-dollar deal for U.S. independent Newfield Exploration Co.

An undisclosed company agreed to buy the Arkoma assets, comprising roughly 140,000 net acres of leasehold in Oklahoma, Encana said in a July 8 release. Production from the assets is currently about 77 million cubic feet equivalent per day, 98% of which is natural gas. (Editor’s note: BMO Capital Markets listed NextEra Energy Inc. as the buyer in its weekly A&D market monitor on July 15.)

Encana said it will receive $165 million cash from the Arkoma exit, which is in line with estimates made by analysts with Tudor, Pickering, Holt & Co. (TPH) in a research note on July 8. The TPH analysts also noted that the Arkoma sale represents the second of Newfield’s legacy assets to go.

In early June, Encana said it will exit its China operations through an agreement with its partner the Chinese National Offshore Oil Corp. (CNOOC). The company had acquired the assets comprised of a production sharing contract offshore China from Newfield, which had been active in the South China Sea since 2005.

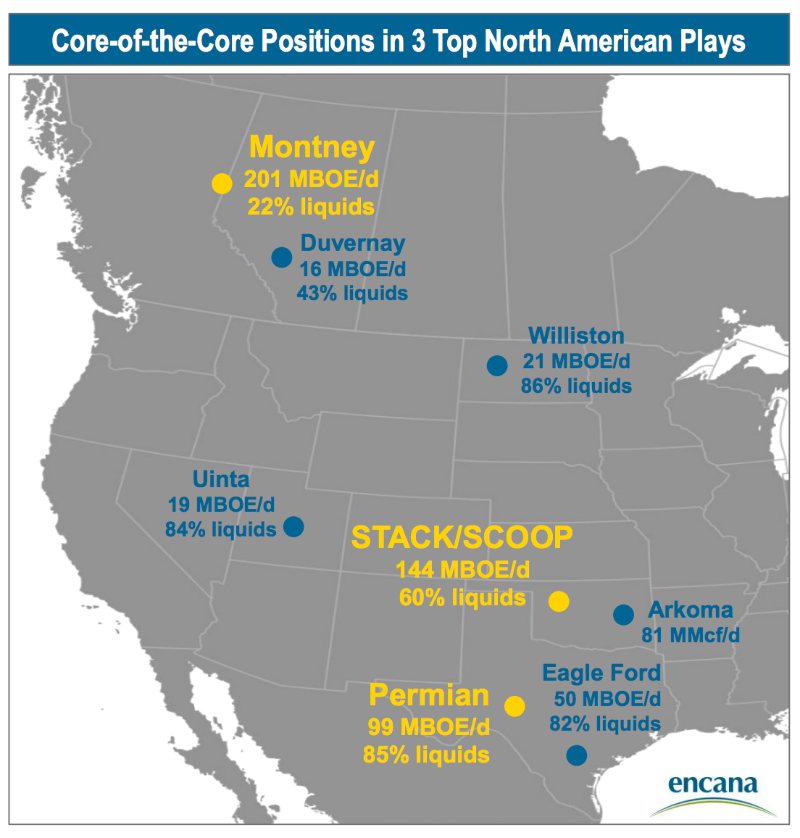

in the Anadarko Basin, Arkoma Basin, Uinta Basin

and Williston Basin. (Source: Encana Corp.

November 2018 Investor Presentation)

Encana’s purchase of Newfield that closed in February also included positions in the Uinta and Williston basins but most notably within the Stack and Scoop shale plays of the Anadarko Basin.

According to the company website, Encana’s core growth assets are the Anadarko, Permian Basin and Montney.

“Pre-deal leverage looks manageable [at TPH estimates 1.7x year-end 2020 ND/EBITDA] at current strip, and further improvement could come if the noncore Uinta and Williston are similarly monetized [TPH estimates about $1.4 billion to $1.5 billion], but we remain sidelined pending longer-term operational results from the Midcon,” TPH analysts wrote of Encana’s Arkoma sale.

Proceeds from the Arkoma sale will be directed to the company’s balance sheet, according to Doug Suttles, Encana’s president and CEO.

“Along with our recently announced agreement to exit China, this transaction shows our commitment to realize value from noncore assets,” Suttles said in a statement on July 8.

Encana expects to close the sale in third-quarter 2019. CIBC Griffis & Small provided advisory services to Encana for the transaction. Davis, Graham & Stubbs LLP was the company’s external legal counsel.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.