Encana Corp. (NYSE: ECA) said Feb. 13 it completed its acquisition of U.S. shale producer Newfield Exploration Co. and now will proceed with a previously announced $1.25 billion share buyback program.

As part of the combination, Encana acquired all outstanding shares of Newfield common stock in an all-stock transaction valued at roughly $5.5 billion. In addition, the Calgary, Alberta-based company also assumed $2.2 billion of Newfield net debt.

The acquisition was a part of a $13 billion week of M&A activity among North American shale producers when it was announced late last year.

RELATED: Encana To Combine With Newfield Exploration In $5.5 Billion All-Stock Transaction

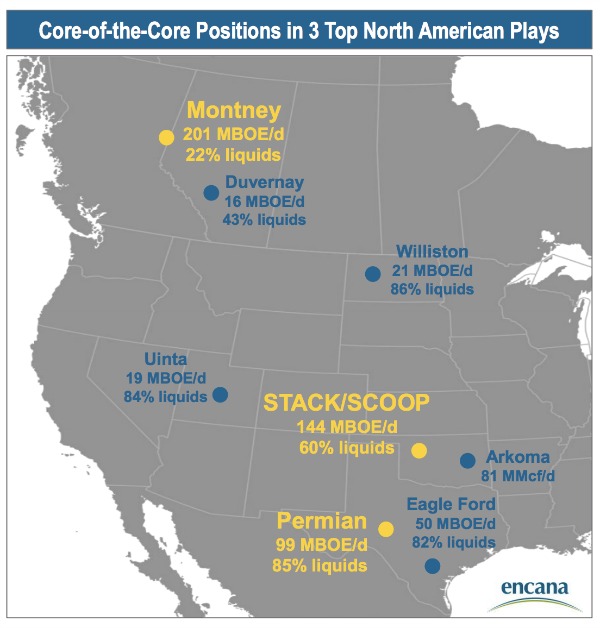

For Encana, the acquisition of Newfield, which analysts called Encana’s “boldest move yet,” will expand the company’s “core four” portfolio to include a key position in the oil-rich Stack and Scoop shale plays of the Anadarko Basin.

“This acquisition creates North America’s premier resource company with large-scale positions in the core of the Permian, Anadarko and Montney,” Doug Suttles, Encana’s president and CEO, said in a statement.

In November, Encana said it expected liquids production following the close of its combination with Newfield to contribute over 50% of total company production, driving continued margin expansion and returns. Additionally, the company also anticipates the combination to result in $250 million of annual synergies through greater scale, cube development and overhead savings.

“Our multi-basin portfolio provides tremendous investment optionality to deliver liquids growth and free cash flow to support the continued return of capital to shareholders,” Suttles said in the Feb. 13 statement.

With the close of the transaction, Steven W. Nance and Thomas G. Ricks, who both served as Newfield directors, will join the Encana board of directors.

Also, in addition to the $1.25 billion share buyback program, Encana plans to increase its dividend by 25%.

Credit Suisse and TD Securities acted as financial advisors to Encana and delivered opinions to Encana’s Board of Directors. Paul, Weiss, Rifkind, Wharton & Garrison LLP and Blake, Cassels & Graydon LLP acted as legal advisors to Encana.

J.P. Morgan Securities LLC provided a fairness opinion to Newfield’s board. J.P. Morgan and Goldman Sachs & Co. LLC served as Newfield’s financial advisers. Scotiabank served as a technical adviser to Newfield. In addition, Kirkland & Ellis LLP and Wachtell, Lipton, Rosen & Katz served as legal advisers.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.