Encana Corp. (NYSE: ECA) said Feb. 13 it completed its acquisition of U.S. shale producer Newfield Exploration Co. and now will proceed with a previously announced $1.25 billion share buyback program.

As part of the combination, Encana acquired all outstanding shares of Newfield common stock in an all-stock transaction valued at roughly $5.5 billion. In addition, the Calgary, Alberta-based company also assumed $2.2 billion of Newfield net debt.

The acquisition was a part of a $13 billion week of M&A activity among North American shale producers when it was announced late last year.

RELATED: Encana To Combine With Newfield Exploration In $5.5 Billion All-Stock Transaction

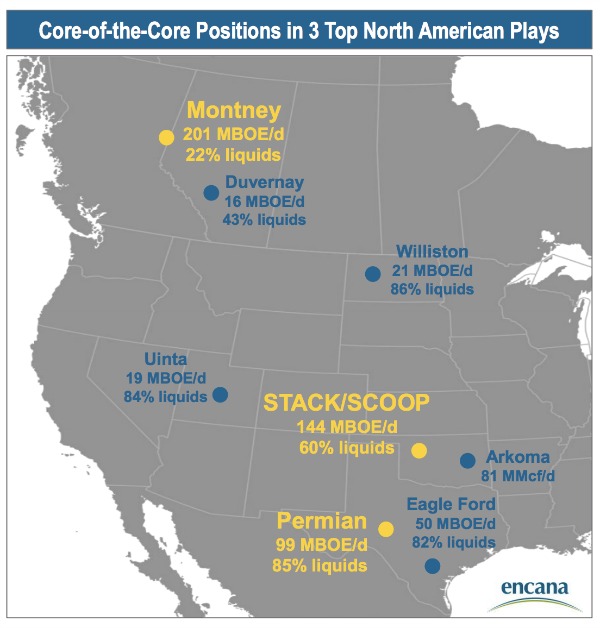

For Encana, the acquisition of Newfield, which analysts called Encana’s “boldest move yet,” will expand the company’s “core four” portfolio to include a key position in the oil-rich Stack and Scoop shale plays of the Anadarko Basin.

“This acquisition creates North America’s premier resource company with large-scale positions in the core of the Permian, Anadarko and Montney,” Doug Suttles, Encana’s president and CEO, said in a statement.

In November, Encana said it expected liquids production following the close of its combination with Newfield to contribute over 50% of total company production, driving continued margin expansion and returns. Additionally, the company also anticipates the combination to result in $250 million of annual synergies through greater scale, cube development and overhead savings.

“Our multi-basin portfolio provides tremendous investment optionality to deliver liquids growth and free cash flow to support the continued return of capital to shareholders,” Suttles said in the Feb. 13 statement.

With the close of the transaction, Steven W. Nance and Thomas G. Ricks, who both served as Newfield directors, will join the Encana board of directors.

Also, in addition to the $1.25 billion share buyback program, Encana plans to increase its dividend by 25%.

Credit Suisse and TD Securities acted as financial advisors to Encana and delivered opinions to Encana’s Board of Directors. Paul, Weiss, Rifkind, Wharton & Garrison LLP and Blake, Cassels & Graydon LLP acted as legal advisors to Encana.

J.P. Morgan Securities LLC provided a fairness opinion to Newfield’s board. J.P. Morgan and Goldman Sachs & Co. LLC served as Newfield’s financial advisers. Scotiabank served as a technical adviser to Newfield. In addition, Kirkland & Ellis LLP and Wachtell, Lipton, Rosen & Katz served as legal advisers.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.