Hinds Howard is a portfolio manager at CBRE Investment Management where he evaluates listed energy infrastructure and transportation companies in North America and coordinates research of listed transportation companies globally. He is based in Wayne, Pennsylvania.

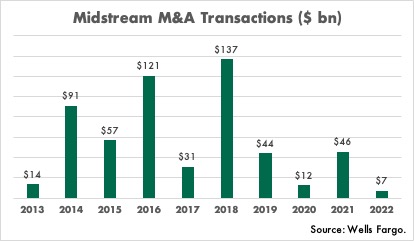

In my column from the March issue of Oil and Gas Investor, I laid out the current state of the midstream sector in business school terms, with a trend towards fewer companies with greater scale and bigger competitive moats than in the past. This time, I want to talk about how that happened and the implications for midstream from here. Every year investors ask the question: Is this the year midstream consolidation happens? The funny thing is that in hindsight, for most years since 2014, the answer has been yes.

How did we get here?

The sector has undergone an incredible amount of consolidation and rationalization, fully reversing the incredible expansion of the number of companies in the midstream space in the decade prior to 2015. Through mostly related-party M&A and incentive distribution rights (IDRs) elimination transactions, we have cleaned up the mess that the sector put itself in with 75 IPOs from 2005 to 2015.

The era of contraction began in late 2014 with the simplification transactions by Kinder Morgan that eliminated Kinder Morgan Energy Partners and El Paso Pipeline Partners. Several other simplification deals followed in 2015 and 2016 as the MLP space moved to eliminate the burden of IDRs. There were also several third-party M&A transactions, like Enbridge’s massive purchase of Spectra Energy and MPLX’s acquisition of MarkWest Energy Partners.

Consolidation peaked in 2018, with more than 20 transactions for overall value of approximately $137 billion, with $135 billion of those mergers being between related parties. Highlights from that year included the roll up of Enbridge Energy Partners, Spectra Energy Partners, Williams Partners, Energy Transfer Partners and Boardwalk Pipeline Partners, among many others. Around 20 of the 50 consolidation deals from 2015 to 2019 were “simplifications” that eliminated IDRs and stepped up tax basis for corporate acquirers. Rationales for other M&A seemed to be related to growing footprints, expanding into other geographies or new lines of business (like MPLX expanding into Marcellus gas processing with MWE).

Our current state

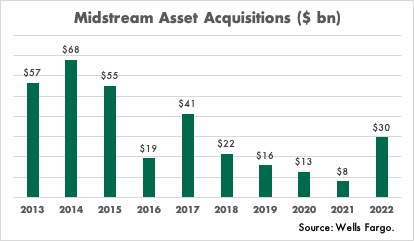

2022 saw the pace of consolidation slow, but those were replaced by asset acquisitions that accelerated to around $30 billion, the highest dollar value since 2017. This transition makes sense, because IDRs have been cleaned up, balance sheets have been shored up and opportunities to grow “organically” through building new assets are scarcer. That environment is the perfect set up for $1 billion+ “bolt-on” acquisitions like those announced by Enterprise (Navitas), Williams (Trace) and Targa (Lucid) in 2022. Expect similar transactions to continue in 2023 because the dynamics remain in place.

Asset acquisitions should lead to the remaining publicly traded midstream companies growing stronger, gaining more scale and ultimately gaining more stability due to reduced competitive dynamics over time. For producer customers, that could mean higher rates on third party infrastructure, which could lead to more producers opting to build their own infrastructure.

Valuations for asset acquisitions averaged 9.1x in 2022, recovering to around the long-term average after a dip down to 7.5x in 2020, but not back up to the heady double digit forward EBITDA multiples we saw back in the early 2010s when shale growth and low cost of capital permeated the space. Valuations should continue to be fairly reasonable given the current (lower) growth outlook and limited pool of potential buyers.

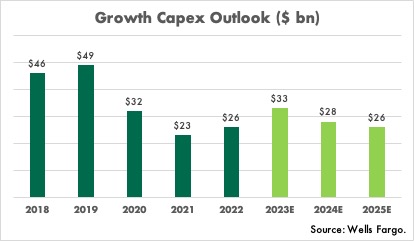

Organic growth has also slowed due to the push for midstream operators to be more disciplined with spending of late. Midstream operators are less willing to build infrastructure that’s only partially contracted, less willing to bet on production growth filling up that infrastructure over time. Investors are also less likely to respond well to aggressive spending. Asset acquisitions have been tolerated by investors, especially when the acquired assets are contiguous to existing footprints, where potential synergies and downstream benefits can be realized.

Where is infrastructure still needed?

There are still pockets of infrastructure constraints in North America that will lead to new infrastructure. Gas processing and new gas pipelines are needed every few years to move Permian Basin gas to the Gulf Coast. Production growth in the Permian should continue to drive development of NGL infrastructure. LNG export facilities are being built, which should continue over the next decade. In the Bakken, additional gas pipeline and NGL pipeline capacity may be needed in the next few years. Big dollars are being spent in Canada to complete massive gas and oil pipeline projects that have been under development for years. The combination of all of the above should see growth capital for midstream increase in 2023 versus the last few years of capital discipline.

But overall, opportunities for investment are fewer and the scale is generally smaller than prior to 2020. There is also little interest from midstream companies (and from their investors) to build large scale pipeline projects, especially given the huge cost increases and permitting challenges we’ve see with projects like the Mountain Valley Pipeline.

In summary, this next era will be characterized by less new infrastructure, less big M&A, higher utilization and more bolt-on acquisitions, all of which should lead to lower debt, higher free cash flow and more resilience for midstream.

Recommended Reading

Equinor Resumes Helicopter Flights on NCS Following Fatal Accident

2024-03-01 - Operator also announced it is expanding its helicopter fleet by 15 through contracts with Bell and Leonardo, with the first two helicopters slated for delivery in about a year.

CAPP Forecasts $40.6B in Canadian Upstream Capex in 2024

2024-02-27 - The number is slightly over the estimated 2023 capex spend; CAPP cites uncertain emissions policy as a factor in investment decisions.

Air Liquide to Add CO2 Recycling at Plant in Germany

2024-02-08 - In a supply agreement, Air Liquide and Dow plan to add a new CO2 recycling solution to two air separation units and one partial oxidation plant.

Coalition Launches Decarbonization Program in Major US Cities, Counties

2024-04-11 - A national coalition will start decarbonization efforts in nine U.S. cities and counties following a federal award of $20 billion “green bank” grants.

Fire Closes Atlas Energy’s Kermit, Texas Mining Facility

2024-04-15 - Atlas Energy Solutions said no injuries were reported and the closing of the mine would not affect services to the company’s Permian Basin customers.