The current level of U.S. gas rigs marks a 48% increase compared to the 112 rigs in operation on Jan. 31, 2020 when the U.S. Health Department initially declared a public health emergency related to COVID-19, the EIA said. Pictured, pump jack and oil storage tanks in the Permian Basin. (Source: Shutterstock.com)

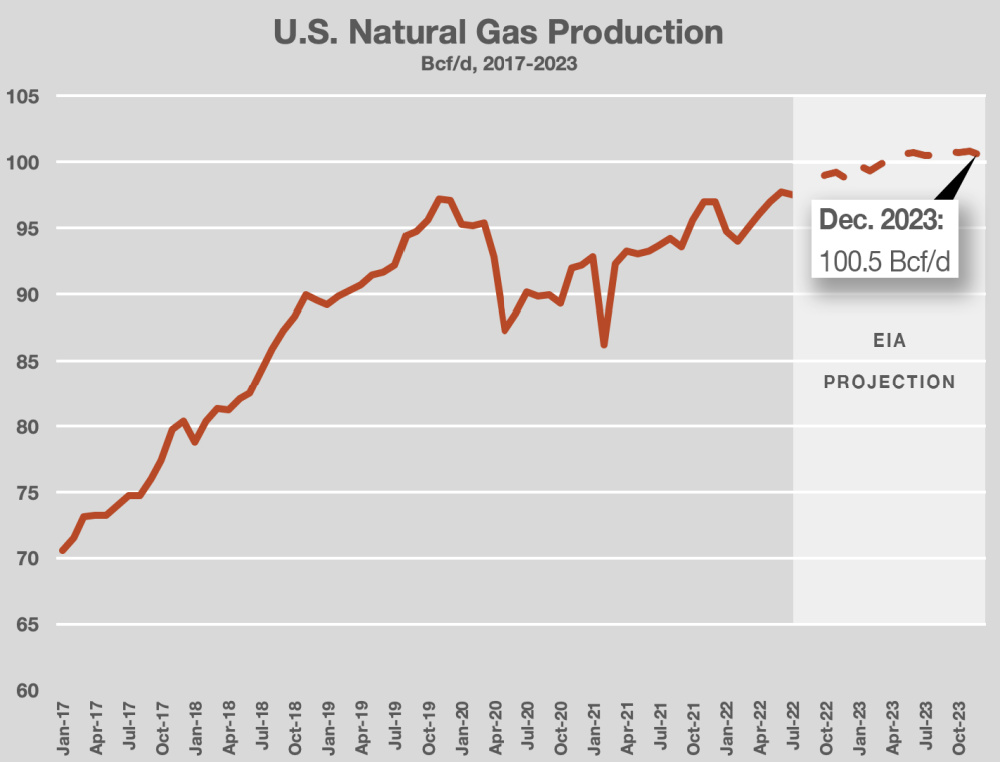

Average dry natural gas production in the U.S. is forecast to rise 3% by the end of 2023 as U.S. producers continue to boost the number of gas rigs in operation, according to the Energy Information Administration.

U.S. dry gas production is expected to average 100.5 Bcf/d in December 2023 compared to 97.6 Bcf/d in August 2022, the U.S. agency announced Sept.15 in a statement on its website. Production is forecast to average 99 Bcf/d in fourth-quarter 2022, up from 94.6 Bcf/d in first-quarter 2022.

Growth in dry gas production to date and further increases will be driven by U.S. producers looking to take advantage of higher domestic prices. Meanwhile, exporters continue to eye robust gas prices in Europe amid heightened demand for U.S. LNG exports as the EU seeks alternative energy sources other than Russia after its military invasion in Ukraine.

As of Sept. 9 there were 166 gas rigs operating in the U.S., according to Baker Hughes Co.

The current level of U.S. gas rigs marks a 48% increase compared to the 112 rigs in operation on Jan. 31, 2020 when the U.S. Health Department initially declared a public health emergency related to COVID-19, the EIA said. The number of gas rigs in operation reached a low of 68 rigs on July 24, 2020, the lowest level recorded by Baker Hughes data, which dates back to 1987.

Key U.S. Gas Regions

The bulk of onshore U.S. gas production is concentrated in Haynesville Shale which spans Texas and New Mexico, the Appalachian Basin located across Pennsylvania and West Virginia and the Permian Basin located in West Texas and southeastern New Mexico, according to the EIA.

The number of rigs in operation in Haynesville rose over 50% between January and August. In the Appalachia region, there were 48 gas rigs in operation at the end of July, just short of the 51 operating at the start of the pandemic.

In the Permian Basin where most gas production is associated with oil producing wells, producers continue to “respond to fluctuations in the crude oil price when planning their rig deployment,” the EIA said. Oil rigs in the region have been rising from lows seen in 2020 but are still 15% lower than the pre-pandemic tally of 406 rigs reported on Jan. 31, 2020.

EIA Gas Forecasts

The EIA is forecasting U.S. gas consumption will average 86.6 Bcf/d in 2022, up 3.6 Bcf/d compared to 2021 due to rising demand across all consuming sectors. Consumption is forecast to decline by 1.9 Bcf/d in 2023 “because of declines in consumption in the industrial and electric power sectors,” according to the forecast revealed on Sept. 7 in the EIA’s Short-term Energy Outlook.

U.S. gas inventories ended August at 2.7 Tcf, 12% below the five-year average. The EIA forecast U.S. gas inventories will finalize the April to October injection season with over 3.4 Tcf, which would be 7% below the five-year average.

RELATED:

Freeport LNG Not to Reach Full Capacity until March 2023

Finally, U.S. LNG exports, which have been rising amid robust demand in Europe as well as in Asia, are forecast to average 11.7 Bcf/d in fourth-quarter 2022, up 1.7 Bcf/d compared to third-quarter 2022. LNG exports from the U.S> are forecast to average 12.3 Bcf/d in 2023, according to the EIA.

Recommended Reading

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.

Bobby Tudor on Capital Access and Oil, Gas Participation in the Energy Transition

2024-04-05 - Bobby Tudor, the founder and CEO of Artemis Energy Partners, says while public companies are generating cash, private equity firms in the upstream business are facing more difficulties raising new funds, in this Hart Energy Exclusive interview.

Air Liquide Eyes More Investments as Backlog Grows to $4.8B

2024-02-22 - Air Liquide reported a net profit of €3.08 billion ($US3.33 billion) for 2023, up more than 11% compared to 2022.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.