(Source: HartEnergy.com; Luftikus, Incomible/Shutterstock.com)

A growing China ravenous for electricity poses an immense opportunity for global natural gas producers, with the U.S. Energy Information Administration (EIA) projecting a 4.9% annual growth rate in consumption in the country between 2019 and 2050.

The EIA released its International Energy Outlook 2020 on Oct. 14, focusing on how market conditions would affect the high-growth regions of Asia, India and Africa.

Asia will account for half of the world’s energy consumption by 2050, and the region will more than double its electricity generation. How power generation feedstock is chosen will be governed mostly by price but also by government policy and capital costs, the outlook said, with natural gas consumption growth showing resilience even when competing against low prices for renewable sources.

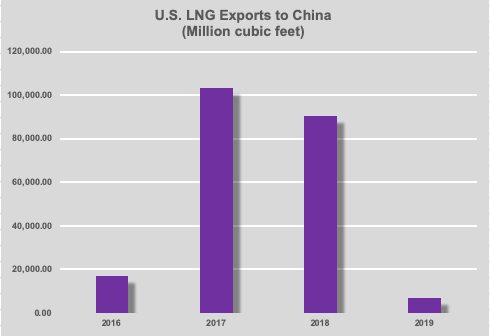

U.S. LNG exports to China soared from 2016 to 2017 but fell dramatically in 2019 as a result of the Trump administration’s trade war.

“Regardless of renewable costs, the annual growth rate of natural gas generation, in the six cases with reference and high natural gas prices, stays relatively similar to the Comparative Reference case, ranging from 3.9% to 5.5% from 2019 to 2050,” the report says. “In the low natural gas price cases, the annual growth of natural gas generation increases to a range of 7.2% to 8.1% during the same period.”

Those low gas prices would limit additional power generation from renewables unless those costs are low, as well. For example, if natural gas prices are as expected and renewable prices are higher, the annual growth rate of gas generation capacity to 2050 is 6.2%, while solar and wind are each 4.9%.

But even if the scenario shows high natural gas prices with the comparative reference case for renewables, gas-fired generation is still projected to increase by 4.7%. In this scenario, solar would increase by 7.1% and wind by 3.1%.

The loser in all these China-based scenarios is coal, which would see its generating capacity increase by an average 0.4% from 2019 to 2050—even with higher natural gas prices. Coal’s actual electricity generation, however, would decrease by 0.4% annually. This projection is based in part on the Chinese government’s stated policies to reduce coal generation and encourage competition among gas, wind and solar generation.

In a scenario in which natural gas and renewables are low-cost sources of energy, coal’s share of China’s electricity generation market falls to 22% in 2050. In 2019, coal provided 66% of China’s electricity output, down from 81% in 2007.

Sun vs. Wind

In its World Energy Outlook 2020, released Oct. 13, the International Energy Agency (IEA) viewed renewables, particularly solar, as energy champions while slower energy demand growth dampens the outlook for oil and gas, compared to pre-COVID pandemic trends. Supportive policies by many governments and maturing technologies are enabling cheap access to capital, the IEA said.

“Solar [photovoltaic] is now consistently cheaper than new coal- or gas-fired power plants in most countries, and solar projects now offer some of the lowest cost electricity ever seen,” the IEA report said.

In the case of China, the EIA outlook mostly agrees, noting that the combination of solar and wind surpasses coal by 2050. In the low-cost renewable scenario, solar and wind account for up to half of China’s electricity generation by 2050. If gas prices are high and renewable costs are low, solar grows at an 8.2% annual rate from 2019 to 2050.

However, when renewable costs are high, solar suffers in comparison with wind power because it is the newer technology. When natural gas and renewable costs are high, solar capital costs are disproportionately high, the EIA’s outlook says, which allows wind generation to increase by 60%.

Recommended Reading

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

US Drillers Add Oil, Gas Rigs for Third Time in Four Weeks

2024-02-09 - Despite this week's rig increase, Baker Hughes said the total count was still down 138 rigs, or 18%, below this time last year.